The ₿est Risk vs Reward Investment

“It’s just ₿usiness”

Whether it’s your favorite NBA All-Star getting traded out of nowhere or an insurance company dropping tens of thousands of policies—at the end of the day, it’s just business. It all comes down to risk vs. reward.

Like it or not, being insured is usually required by law. The whole point? To protect against financial loss by transferring risk from an individual or business to an insurance provider—for a price, of course. Sounds a lot like Warren Buffett’s #1 rule of money & investing:

💰 Rule #1: Don’t lose money.

💰 Rule #2: See Rule #1.

At its core, the most important thing in life, business, and investing is protecting yourself—your assets, your investments, your future. Yet, despite paying some of the highest premiums in history, many people don’t even have the right coverage, leading to catastrophic financial losses in nearly every area of life:

🏥 Healthcare

🚗 Automobile

🏠 Housing

💼 Employment & Business Operations

✈️ Travel

🎓 Education

⚖️ Personal Liability

🌪️ Natural Disasters

💰 Retirement & Financial Planning

It’s kinda funny (but not actually funny) how insurance companies are arguably the most recession-proof businesses ever. Why?

📊 Data. Data. Data.

Insurance companies hold some of the most detailed databases in existence—allowing them to predict risk with precision and make highly profitable, data-driven decisions.

Take State Farm, for example—the largest insurance provider in California. Last year, they dropped thousands of policies after reassessing high-risk probabilities for natural disasters, regulatory concerns, and other unknown factors.

At the end of the day, insurance is a for-profit business. So can we really blame them?

That’s the big debate.

🐶 Poppy? He’s not too interested in that so-called “mutual” conversation. Instead, he’d rather help you understand how to actually use the system to protect yourself—because let’s be real:

Most people don’t realize their premium has a higher probability of being denied than they think. 😬

Today’s Agenda

🏛️ Insurance Companies: Revolutionizing Digital Assets & ₿itcoin⚡

🦅 U.S. Sovereign Wealth Fund 🇺🇸

🔥 The BTC Kimchi Premium: A Hidden Crypto Power Indicator 📊

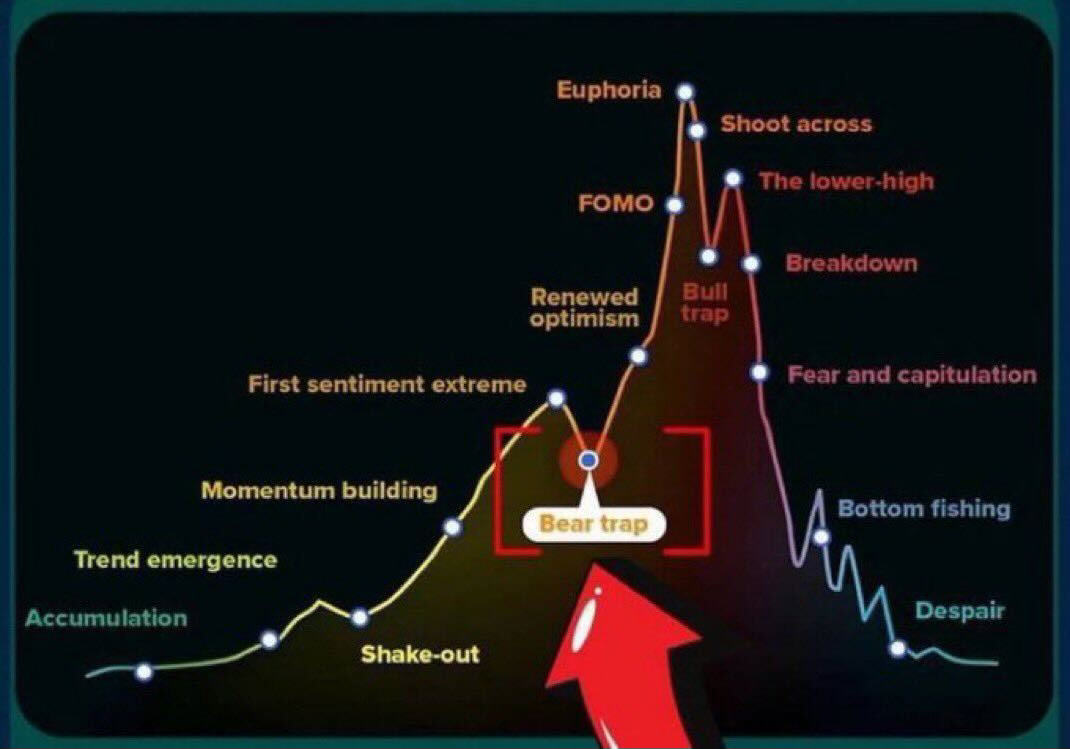

The long-anticipated "royal flush-out" is over (hopefully) —wiping out what is estimated to be over 700K traders and $8-10 billion in over leveraged positions. \

Easier said than done, but this game is all about being quick without rushing. Hindsight is 20/20, but it’s always a humble reminder: slow and steady wins—sometimes, slowing down to speed up is the best move. Hopefully, my recent posts helped you stay ahead of the storm!

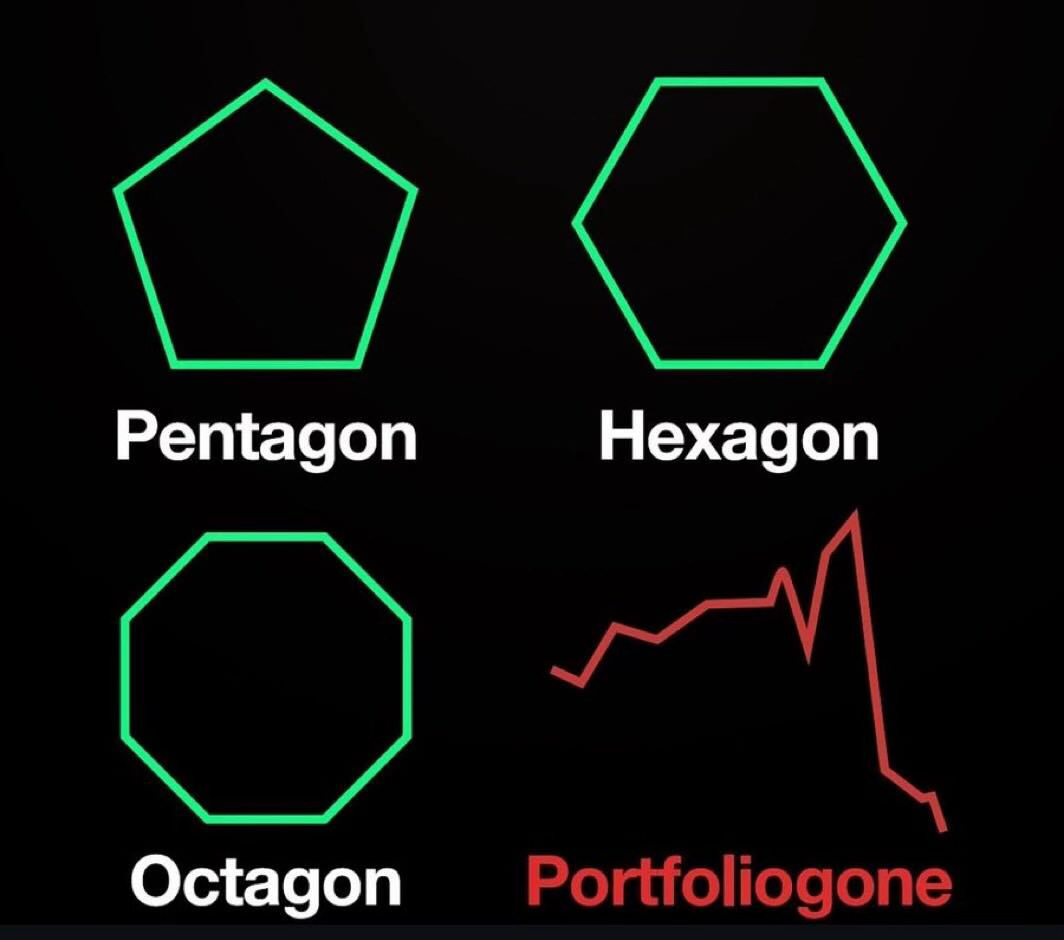

Overleveraging and greed? That’s how you get wrecked.

Poppy’s still ultra bullish—are you? 🚀🐶

🏛️ Insurance Companies: Revolutionizing Digital Assets & ₿itcoin⚡

A Game-Changing Hedge Against Risk

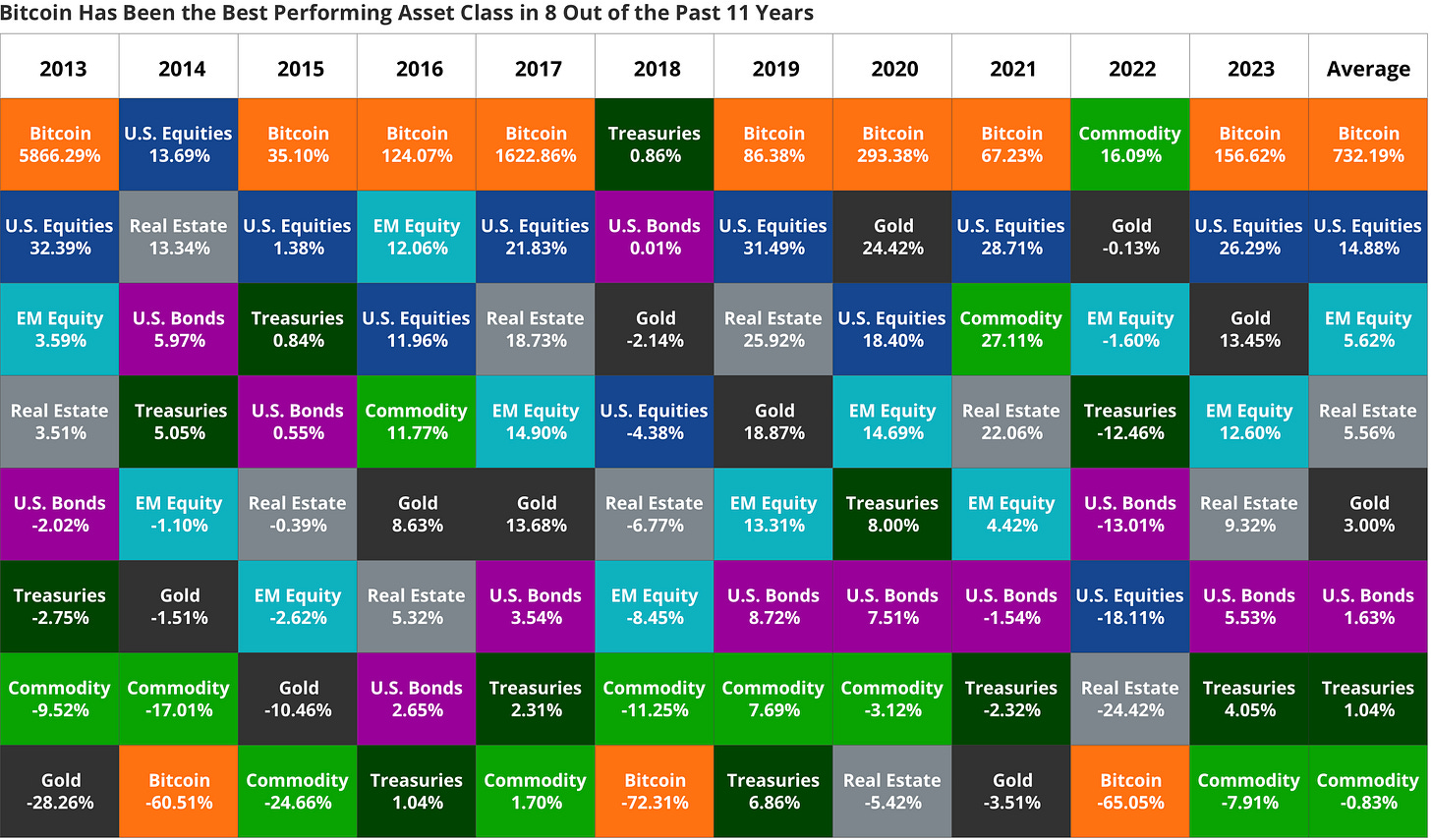

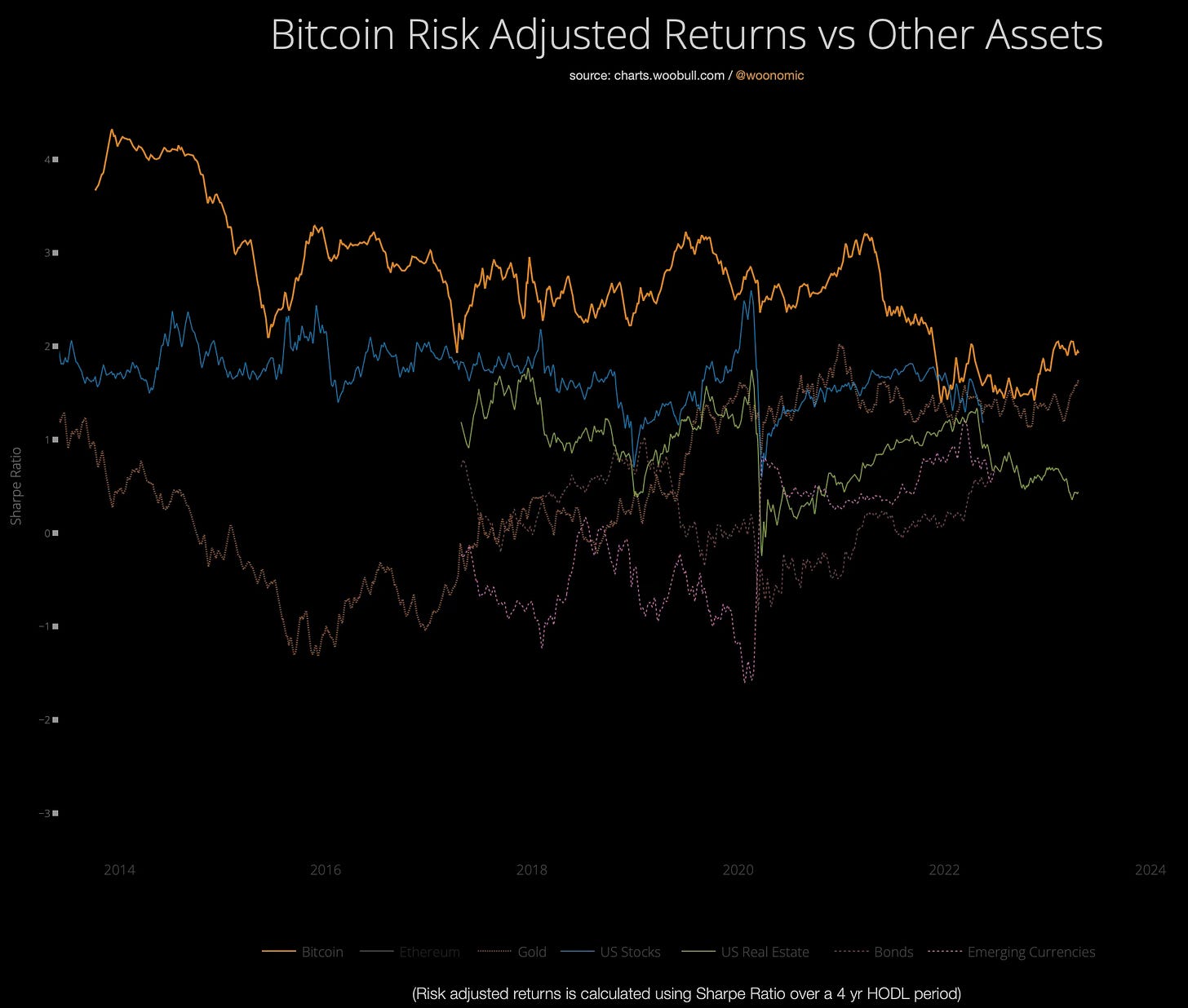

Insurance companies thrive on stability, managing billions in assets to ensure they can pay out future claims. Traditionally, they rely on bonds, real estate, and equities—but what if just 1-5% of their portfolios moved into Bitcoin?

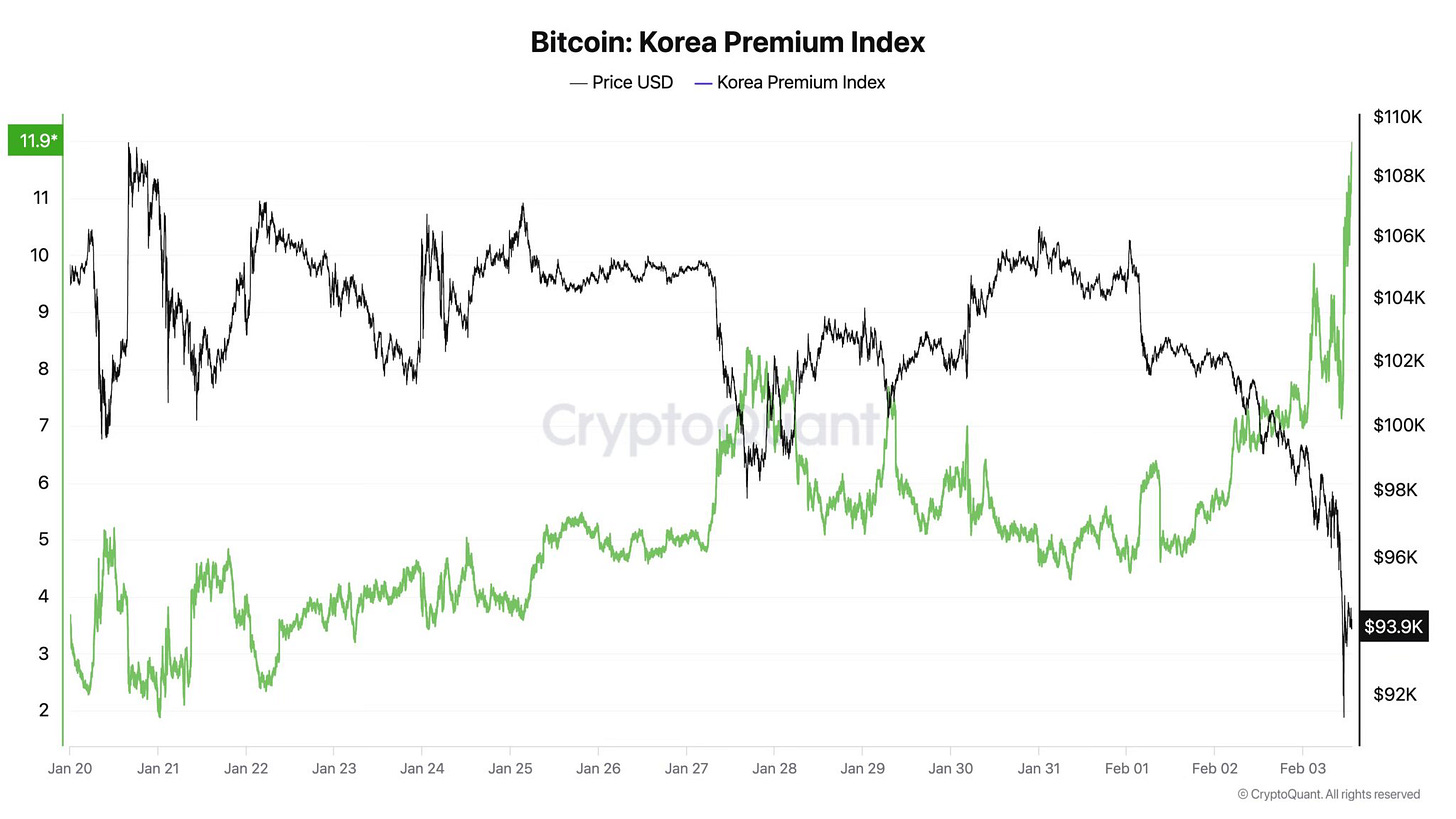

In this chart, a 4 year HODL period to run the Sharpe Ratio calculation, this seems a sensible choice as it is sufficient time to cover a full bear to bull cycle for Bitcoin.

🔹 Massive Influx of Capital → If major insurers allocated even a small percentage (1-5% or so) of their portfolios (trillions in total assets) into BTC, it would send billions—potentially trillions—into Bitcoin’s market cap, driving its price significantly higher.

🔹 Better Risk Management → Holding cash erodes value over time due to inflation, while traditional investments like bonds offer low returns. Bitcoin, with its historical outperformance and fixed supply, provides a hedge against devaluation and potential outsized returns over the long run. This allows providers to estimate and build

🔹 BTC as a Diversifier → Compared to stocks or other asset classes, Bitcoin has a low correlation at times, making it a valuable risk-adjusted asset in an insurer’s portfolio, especially when macro uncertainty spikes— even unexpected Black Swan events, global tensions and always expecting the unexpected!

📈 Big Players Are Already Moving → MassMutual, NYDIG, Liberty Mutual, and other insurance giants have started allocating into BTC, signaling a shift toward crypto adoption in institutional finance.

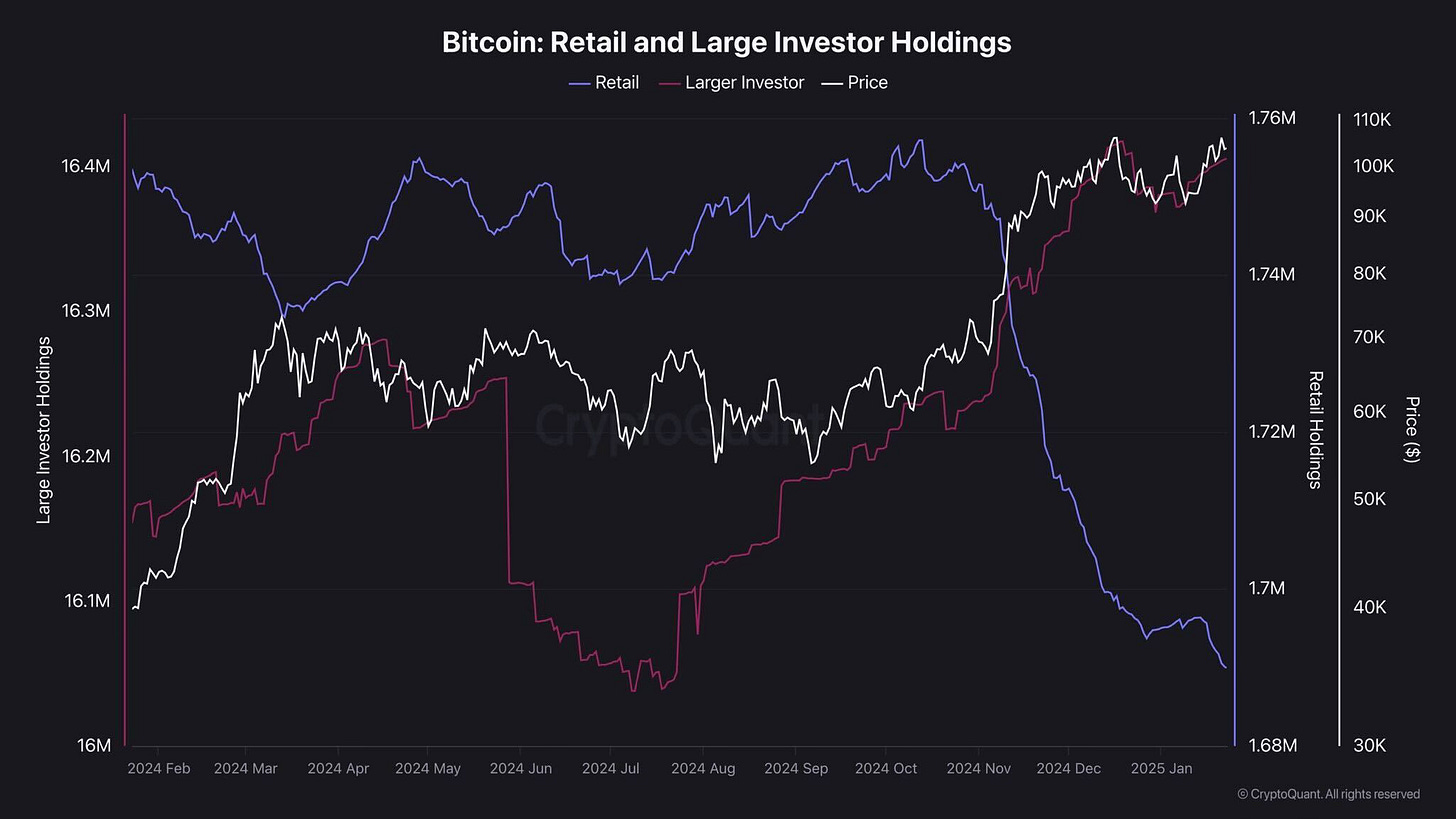

After this "royal flush-out", Poppy’s got a reminder for you—the next leg up isn’t retail, it’s the big dogs. 💰🏦

We’re talking central banks, ETFs, insurance giants, corporations, even governments—and guess what?

They’re already moving in… 👀

This is exactly when retail investors panic-sell at the bottom, while the big dogs—institutions, whales, and smart money—load up at a massive discount. 🐋

Same story, different cycle. Stay sharp, don’t get shaken out. 🚀

🦅 U.S. Sovereign Wealth Fund 🇺🇸

On February 3, 2025, President Donald Trump signed an executive order to establish the first-ever U.S. sovereign wealth fund.

Purpose and Objectives:

Wealth Generation: The fund aims to generate wealth for American citizens by investing in valuable national assets.

Fiscal Sustainability: It seeks to promote fiscal sustainability and lessen the tax burden on American families and small businesses.

Economic Security: The fund is designed to establish economic security for future generations and enhance U.S. economic and strategic leadership internationally.

Potential Funding Sources:

Tariff Proceeds: One proposed method to capitalize the fund includes using proceeds from tariffs.

Monetizing Government Assets: The fund may also monetize U.S. assets for national investments, such as infrastructure and medical research.

Potential Investments:

Acquisition of TikTok: President Trump mentioned TikTok as a potential first acquisition for the fund, with a possible divestment by China to avoid a 10% tariff.

Infrastructure and Medical Research: The fund is expected to invest in various sectors, including infrastructure and medical research, to create significant value and wealth.

Bitcoin & Digital Asset Reserve: President Trump clearly is an advocate of cryptocurrency with the recent launch of his $Trump memecoin.

Administration and Timeline:

Leadership: Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick are tasked with developing a plan for the fund's establishment.

Implementation Timeline: The plan for the fund is to be submitted to the President within 90 days of the executive order, with the fund expected to be operational within 12 months.

Found out more info → whitehouse.gov

🇰🇷 The BTC Kimchi Premium: A Hidden Crypto Power Indicator 📊

The Kimchi Premium is one of the most underrated yet powerful indicators in crypto—tracking how Bitcoin trades at a premium in South Korea compared to global markets.

Here’s why it matters:

🔹 What is it? → The Kimchi Premium is the price gap between BTC in South Korea vs. the rest of the world. When demand spikes, BTC can trade 5-20% higher in Korea!

📈 Why does it happen?

Strict capital controls → South Koreans can’t easily move large sums overseas, leading to local supply shortages.

High retail demand → Korea has a huge crypto culture, with aggressive retail traders piling in.

Regulatory bottlenecks → Limited ways to arbitrage the price difference keep the premium alive.

⚠️ Why is it important?

✅ Major bullish signal → When the Kimchi Premium surges, it shows big money is flowing into BTC.

✅ Retail hype detector → A high premium often signals euphoria & FOMO, while a drop can indicate a cool-off or bear market.

✅ Liquidity & adoption trends → It reflects how regional demand affects BTC’s global price action.

Sam Bankman-Fried (SBF) allegedly made his initial fortune—worth hundreds of millions (maybe billions)—by exploiting the Kimchi Premium through arbitrage trading.

How He Did It:

🔹 2017-2018: Bitcoin was trading 10-30% higher in South Korea than in the U.S. due to capital controls and high demand.

🔹 SBF saw the opportunity—buy BTC cheap in the U.S., sell it high in South Korea, and pocket the difference.

🔹 Daily profits? Up to $1M! 💰

🔹 Challenges: Moving money across borders was tricky due to South Korean regulations and capital restrictions.

This arbitrage strategy helped him launch Alameda Research, which later fueled FTX—the now-infamous crypto exchange that collapsed in 2022

🔥 Bottom Line: The Kimchi Premium isn’t just some weird price glitch—it’s a real-time signal for retail investor sentiment, liquidity trends, and where BTC could be headed next.

Keep an eye on it. 👀

Oh yeah—keep an eye out today for the Crypto Czar, David Sacks, who’s making some big announcements about the U.S. crypto agenda and kicks off at 2:30PM EST. Word on the street is that this could set the tone for policy moves that impact the entire industry!

🐶 Poppy’s also been hearing rumors & speculation…

Ondo Finance might have some big positive news on the way—potentially making it a solid crypto pick of the week.

Want to dive deeper?

🔹 Project Research: Ondo Finance

🔹 Market Data & Price Action: CoinMarketCap: ONDO

📖 Bible Verse:

"The prudent see danger and take refuge, but the simple keep going and pay the penalty." – Proverbs 22:3

Reflection:

Just like the Kimchi Premium signals where money is moving in Bitcoin, wisdom helps us spot trends and act accordingly in life. Whether in investing or faith, being aware, prepared, and discerning leads to better decisions. Instead of chasing hype or fear, seek understanding, patience, and strategy—that’s where true blessings come.