Taxes and inflation for the consumer.

On the left you hear: “TARIFFS ARE BAD!”

On the right you hear: “TARIFFS ARE GOOD!”

Just remember, if you are left wing or right wing — it’s the same bird!

America has specialized in a service-based economy, putting a lot of focus on sectors like tech, legal, and financial services. At the same time, we're big on importing labor-intensive products that fill our daily lives, from the food at our grocery store and tech gadgets we use to most of the cars we drive.

When it comes to tariffs, things get a bit tricky.

They can safeguard local industries but also drive up prices and can spark trade disputes and tensions amongst powerful companies, countries and customers. It’s tough to pin down whether they’re ultimately positive or negative, as it really depends on the context.

→ Here’s why tariffs are on the Trump table of negotiations:

They encourage local production.

They protect our domestic industries from foreign competitors who might undercut them on price.

They generate additional tax revenue, which can be beneficial for government funding.

💥 (and how can all of this explode the price of Bitcoin?) 🤯

Businesses importing products are the first to pay the imposed tariffs. They then face a decision: absorb the costs or pass them on to consumers like us. With tariff rates ranging from 10% to over 50%, more often than not, it's us—the consumers—who end up bearing the brunt through higher prices.

What does this mean for us? In the short term, it leads to higher inflation, affecting nearly everything we buy. This aligns with what appears to be Trump's intention with these tariffs.

So, could there be a silver lining?

Trump views tariffs as a strategic tool for negotiations, aiming to use them not only to manage power amongst other countries, but also to control import costs and incentivize domestic production. His approach includes easing regulations and reducing corporate taxes, or other unique loopholes, creating a more appealing environment for foreign companies to expand in the U.S. and encouraging local corporations to ramp up production.

The goal? Spur economic growth.

Whether you agree or disagree— Trump's tariffs could potentially boost U.S. production and job creation while raising more tax revenue from these very tariffs.

The challenge, however, lies in the timing.

It could take significant time for corporations to adjust or expand their operations, which could initially lead to increased inflation and higher costs for everyday goods.

With consumer debt at an all-time high, the question remains: how can we manage a projected increase in the cost of living?

Hopefully, we gain some further clarity on a few important factors sooner rather than later: federal income taxes (& other potential tax benefits), interest rates and the dollar printing machine.

Let’s not overlook the big picture:

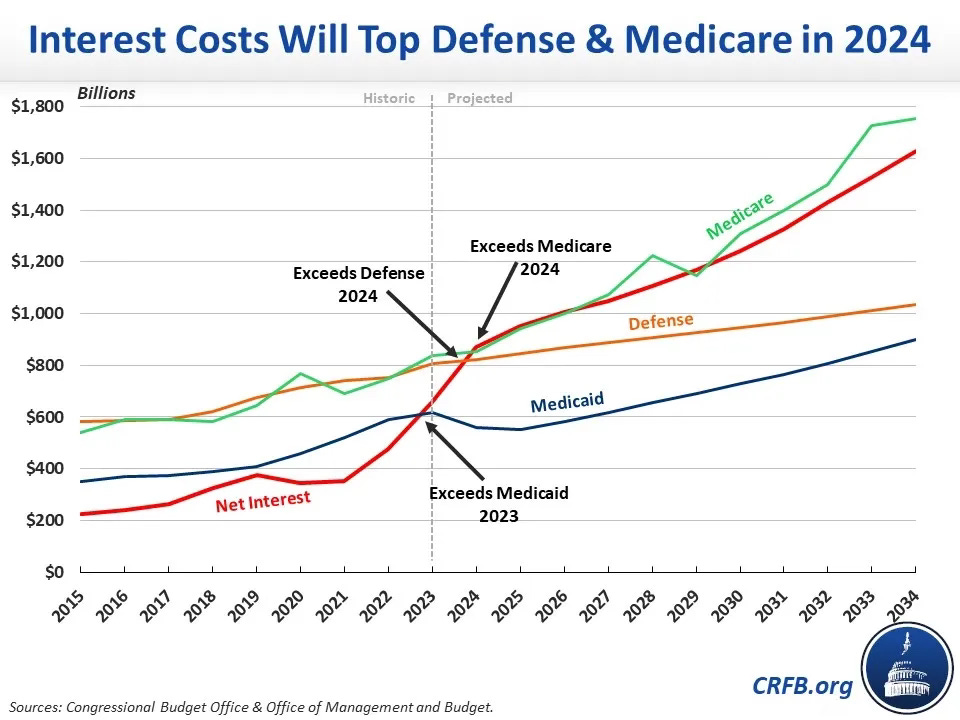

The United States is facing a major deficit dilemma.

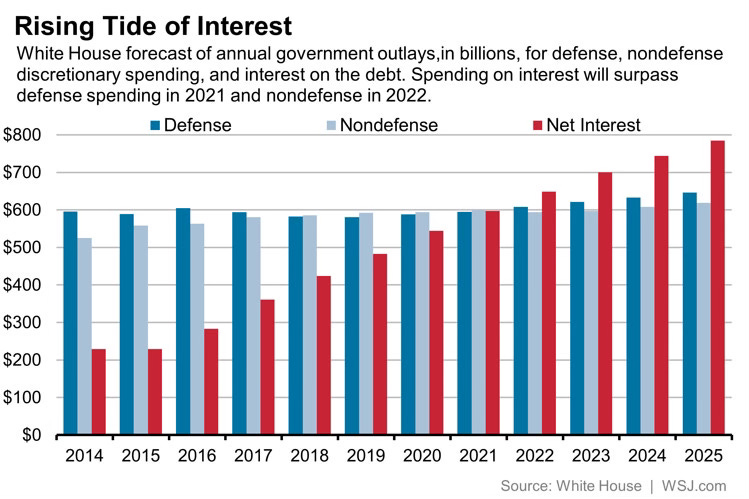

For the 1st time in history, the United States is paying more in interest debt than the defense budget.⬆️ Uh… that’s not good.

An interesting point to note is the first-time integration of the Department of Government Efficiency (DOGE), aimed at cutting down on unnecessary spending.

Could this, along with the implementation of tariffs, reductions in federal interest rates at the Fed’s next FOMC meeting in mid-March, and further incentives for both local and foreign companies to invest and expand in the U.S., pave the way for a new era of economic prosperity?

Maybe they do eliminate or at least reduce the Federal Income Tax or provide other lucrative loopholes.

After all, you can now pre-order a Trump watch and pay for it using Bitcoin or his meme Trump coin. Could this be a sign we could see no capital gains on transactions purchased using Bitcoin or crypto?

The stakes are high, and if you love sports like me, they always say that the best offense is a great defense. So, how can we allow interest to exceed the cost of protecting our country?

Time will reveal if the new administration can successfully navigate these rapid negotiations.

We’re also looking to see if Trump will intensify his post-game press conference type speeches urging the Fed and Jerome Powell to lower rates in their upcoming meeting to avoid government debt delinquency and encourage more economic-friendly borrowing conditions.

💰 And of course, there’s the controversial tactic of simultaneously printing more money.💰

While this approach could inevitably lead to higher inflation, it’s crucial to remember that the U.S. dollar still holds significant purchasing power compared to other currencies—a point that Trump has often highlighted as he advocates for devaluing the USD to increase economic liquidity, while reducing the country's deficit.

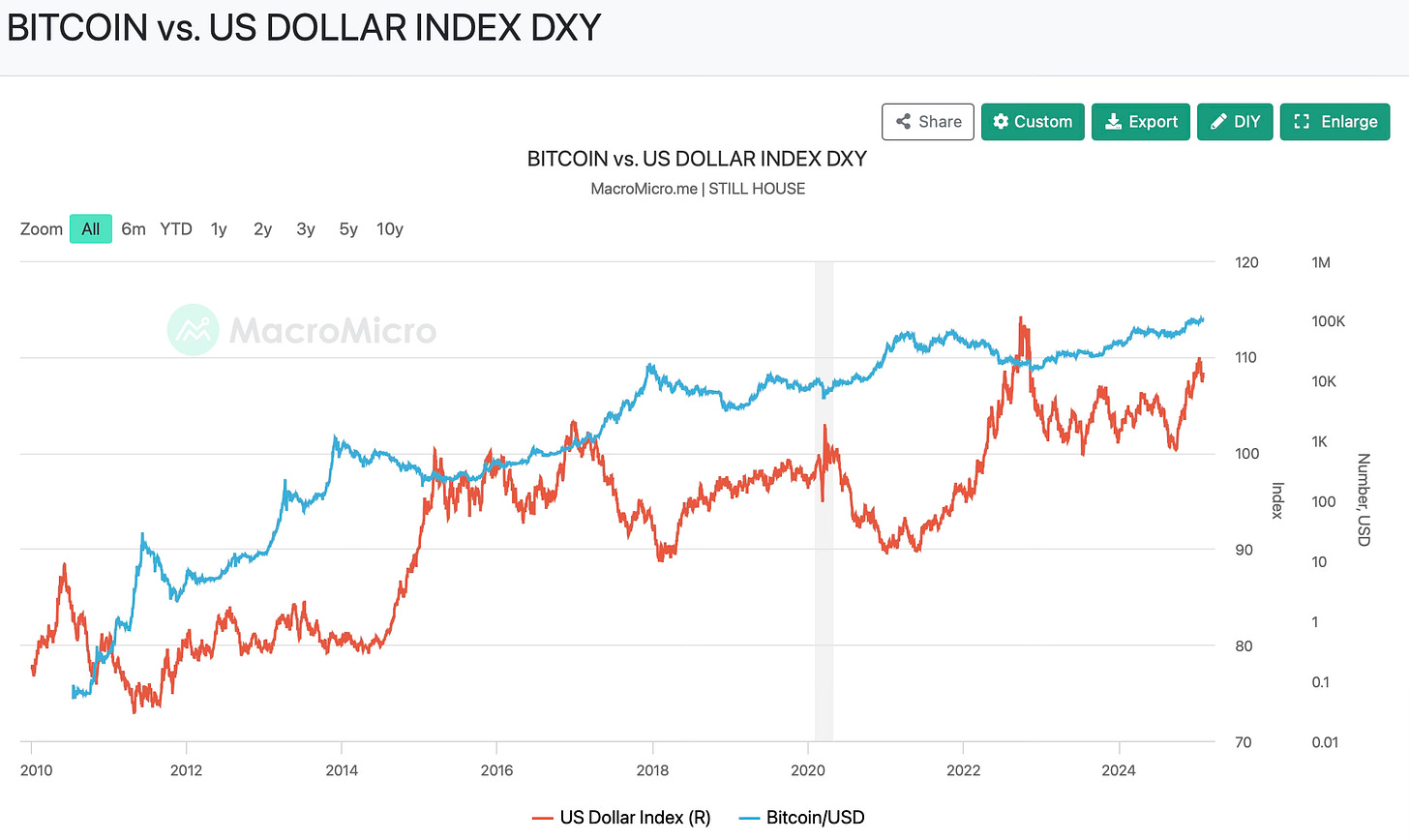

IMPORTANT: let’s not forget the inverse relationship between the USD Index (DXY) and Bitcoin.

As the dollar weakens, Bitcoin's price tends to surge—an interesting dynamic for investors and economists alike. 📈

Bible Verse:

Proverbs 11:1 "The LORD detests dishonest scales, but accurate weights find favor with him."

Reflection:

The verse from Proverbs emphasizes the importance of fairness and integrity in transactions, which can be thoughtfully applied to the concept of tariffs. In the context of international trade, tariffs are essentially a tool used to balance the scales of economic justice between nations. They can protect domestic industries from unfair competition or even create healthy competition, prevent the exploitation of cheaper labor markets abroad and so much more. However, if misused, tariffs can also lead to retaliation, increased consumer prices, and overall economic inefficiency.

Reflecting on this, tariffs, like the "scales" mentioned in Proverbs, must be employed justly and wisely.

After all, isn't achieving perfect balance and harmony what we're all striving for?

They should not serve as tools for greed or to unjustly favor one group over another but rather aim to foster fair play in international trade. This aligns with the biblical principle of integrity and honesty, suggesting that while tariffs can be necessary, they must be implemented in a way that maintains fairness and equity, reflecting the balance that God favors.