Will Private Equity bankrupt America?

The Next Big Short

🚨 Private equity firms are likened to a financial time bomb, echoing the 2008 housing collapse, now targeting profitable retail giants like Hooters, Joann’s, and Party City.

Private equity involves funds or investors buying shares in non-public companies, aiming to improve and grow these businesses for profit. This exclusive investment typically requires substantial capital and long-term commitment, mainly attracting institutional investors and wealthy individuals. Although everyday investors can join through specialized funds, these are generally riskier and demand higher investments compared to public stocks.

The 2008 crisis, portrayed in The Big Short, unfolded when banks mismanaged subprime mortgages into complex securities (CDOs), selling them as safe investments. These were backed by unstable home loans, and when homeowners defaulted, it triggered a financial disaster, erasing pensions and savings globally.

Is history about to repeat? 🤔

Big Daddy 🦉

Stay away from the frozen-food section…

Today, we’re seeing parallels to 2008 – but this time the ticking time-bomb is in the private equity (PE) and corporate debt world, not housing.

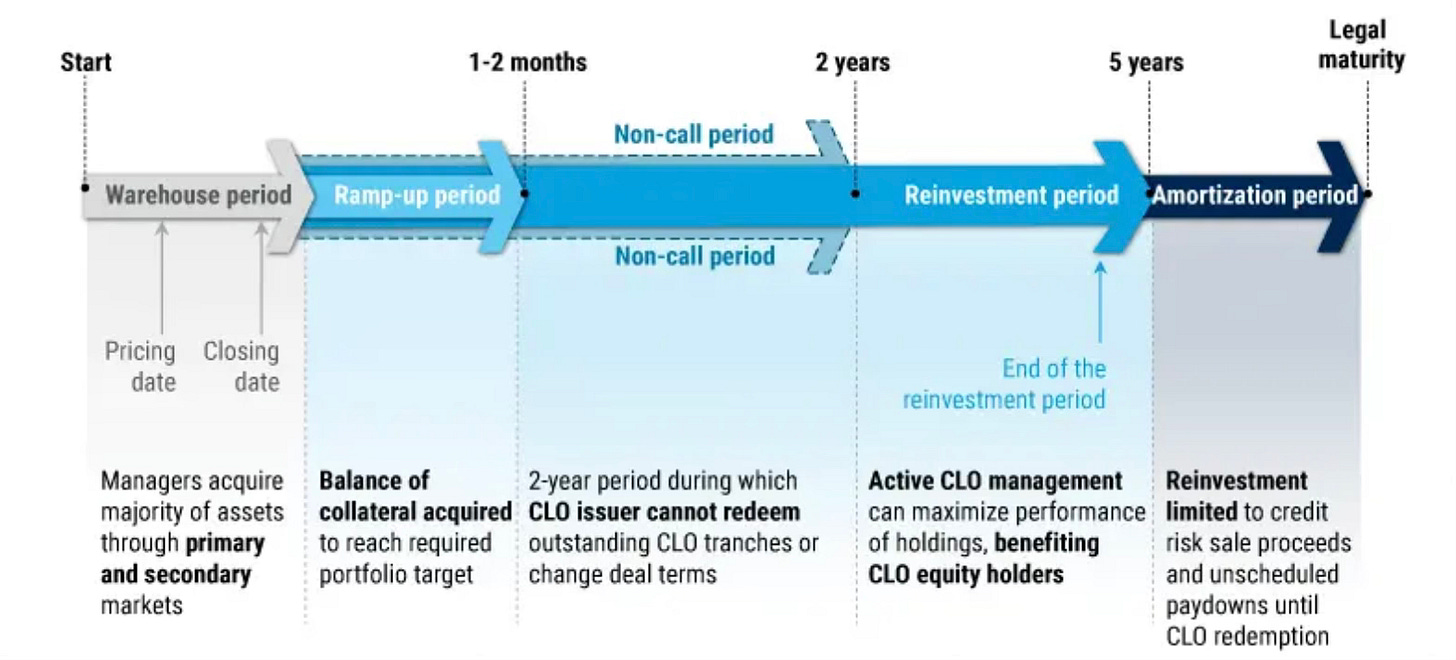

Instead of subprime mortgages, it’s floating-rate loans used to fund private equity buyouts of companies (often retail chains). Instead of CDOs, we have CLOs (Collateralized Loan Obligations) packing risky corporate loans into slices for investors.

Believe it or not… Hooters was profitable! Best known for their chicken wings (definitely not creepy men visiting the waitresses), the infamous restaurant chain was making money but got entangled in adjustable-rate loans. Rising interest rates pushed its financials to the brink, mirroring a broader trend affecting the entire retail sector.

In short, Wall Street has created a new “big short” scenario: PE firms loading up companies with adjustable debt, then repackaging that debt to sell to pensions and others, much like banks did with mortgages before 2008.

🌐 Impact & Horizon Outlook

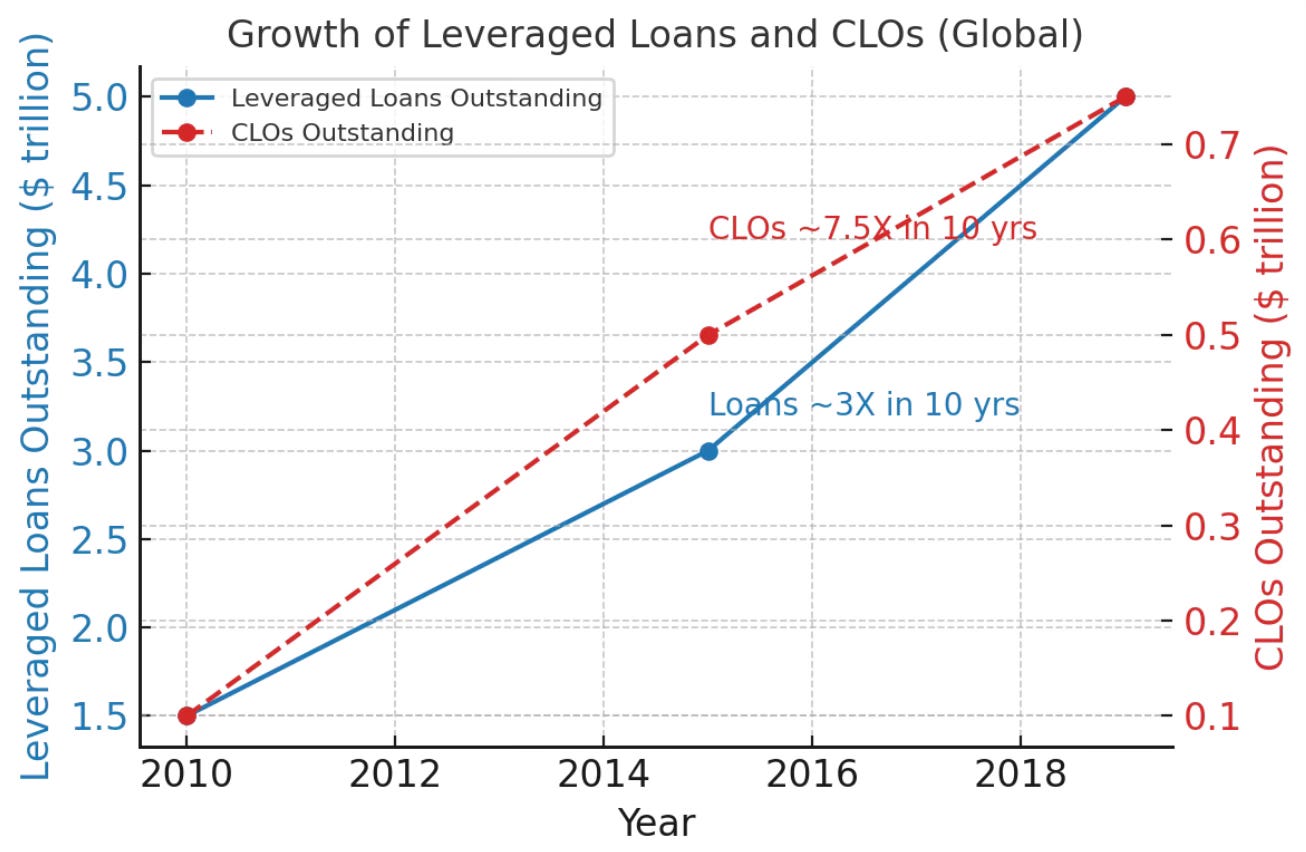

The CLO Time Bomb: Massive Debt Repackaging: Nearly $4 trillion in risky corporate debt is repackaged into Collateralized Loan Obligations (CLOs), reminding many of the CDOs of the 2008 crisis. These CLOs are being sold to unsuspecting pension funds across America, heightening the risk of a significant financial meltdown.

💰Cash-Flow Case Study: Joann’s Collapse: Despite 97% of Joann Fabrics' stores being profitable, the company was overwhelmed by debt, with interest rates that likely tripleed, pushing it into bankruptcy. This scenario allowed private equity firms to profit at the expense of employees and communities, much like the Toys R Us collapse.

📊 Market-Wide Retail Issues: Nationwide Struggles: Major retailers like Bed Bath & Beyond, J.Crew, Neiman Marcus, and Revlon, previously sustained by cheap debt, now face financial challenges as interest rates normalize. This highlights the failure of the "buy now, pay later" strategy employed by many private equity firms.

🚩 Regulatory Red Flags: In 2019, the SEC permitted pension funds to invest in riskier assets like CLOs. This decision could exacerbate the fallout during a financial downturn, potentially leading to a taxpayer-funded bailout reminiscent of 2008, but without stringent regulatory consequences.

Retirement Money at Risk?

⚠️ Default Wave: An uptick in defaults, as interest payments outstrip earnings, could push U.S. corporate default rates to unprecedented highs, destabilizing CLO investments.

💣 Pension Funds: If numerous companies default on their debts, CLO values could plummet, potentially sparking a severe pension fund crisis, risking retiree incomes & possibly necessitating painful cuts or taxpayer interventions.

🏬 Retail & Employment Fallout: The potential bankruptcies in the retail sector could lead to extensive job losses and store closures, impacting communities nationwide.

📉 Broader Credit Crunch: A collapse in the leveraged loan and CLO market could freeze credit for businesses, mirroring the credit freeze of the 2008 financial crisis.

🏦 Bailout Dilemma: The government might need to intervene as in 2008, risking moral hazards if bailouts are managed poorly.

🌐 Global Ripple Effects: U.S. financial instability could lead to international economic repercussions, affecting global markets and economies.

Bible Verse

Proverbs 22:7 (NIV) "The rich rule over the poor, and the borrower is slave to the lender."

Reflection: This verse reminds us of the dangers of excessive debt & the power dynamics it creates & controls. Bad/high interest debt is often times why most people are paycheck to paycheck— business & investments are no different.

Fascinating take on market cycles and economic shifts. History has a way of repeating itself—great insights on what to watch for!