Get Ready: Bitcoin's Next All-Time High

You have to slow down in order to speed up. 📈

Poppy's Bitcoin price prediction from a recent post is unfolding just like we thought it would, with prices ranging from a floor of about $95,000 to a breakthrough around $104,000.

It's all about knowing the rules of the crypto casino game so you can play your hand for the best shot at coming out ahead. 🎰

What’s next?

Today’s Agenda:

Bitcoin Next All-Time High: $120,000 (by March 31st)

Over $14 Billion Set to Flood the Crypto Market!?

⭐️ Bitcoin Price: $120,000

Risky prediction? Sure, but making bold calls based on solid data and countless hours of hard work is what excites Poppy. Being wrong is part of it, but the real deal is in having the courage to admit and pivot when needed, ego aside.

🔑 KEY FACTORS:

Treasury Moves: The Treasury's printing machine is likely to be on overdrive—$241 billion coming this February 3rd through an auction.

Oh, and the $DOGE advocate Elon Musk has overtaken the Treasury Department Payment System.

Market Factors:

Quantitative Easing: Jerome Powell is quietly kicking off quantitative easing.

Interest Rates: Expecting lower rates by mid-March at the next FOMC meeting, likely to depress the DXY and make Treasury bonds less attractive.

Global Politics: Trump’s trade war tariffs and China’s AI advances could continue to shake tech stocks, resulting in money flowing into higher upside assets: Bitcoin.

Central Bank & Institutional Interest: Major institutional funds are eyeing Bitcoin and alt coins, ready to invest billions at these key price and support levels.

It’s a gutsy forecast, but hey, that’s part of the fun. 🤩

🎲 Crypto Casino: How The Game Really Works 🎲

Sure, Bitcoin did briefly blow past that $104,000 breakthrough mark (hit nearly $110K), likely fueled by a string of positive developments, the latest being Jerome Powell's surprising positive support of central banks and financial institutions diving into digital assets like Bitcoin. Considering Jerome Powell’s historical negativity towards Bitcoin and crypto — this is insanely bullish, no doubt.

But let’s not lose sight of the bigger picture—the exchanges, the real 'house' in this crypto casino game. Whether it's crypto exchanges or a Vegas casino floor, the house always has the upper hand. For crypto, giants like Binance and Coinbase maintain significant power to sway Bitcoin prices and other cryptocurrencies by exploiting a classic pitfall: leverage.

These exchanges can peek at your cards; they see when users leverage bets that Bitcoin will rise (long) or fall (short).

Here's how it plays out: Exchanges boost liquidity by sending stablecoins like USDT or USDC to market makers such as Wintermute, which then strategically buy or sell Bitcoin (or other cryptocurrencies) to manipulate trading volume and price.

By pinpointing key liquidity levels, they can set price ceilings and floors, capturing profits at the expense of others (the over leveraged)—welcome to the zero-sum game of markets, much like any casino. → There is a winner and a loser.

If you're not up to speed with the rules or how they're stacked against you, it's easy to see why many view crypto as a gamble.

Don’t believe me? 🤷♂️

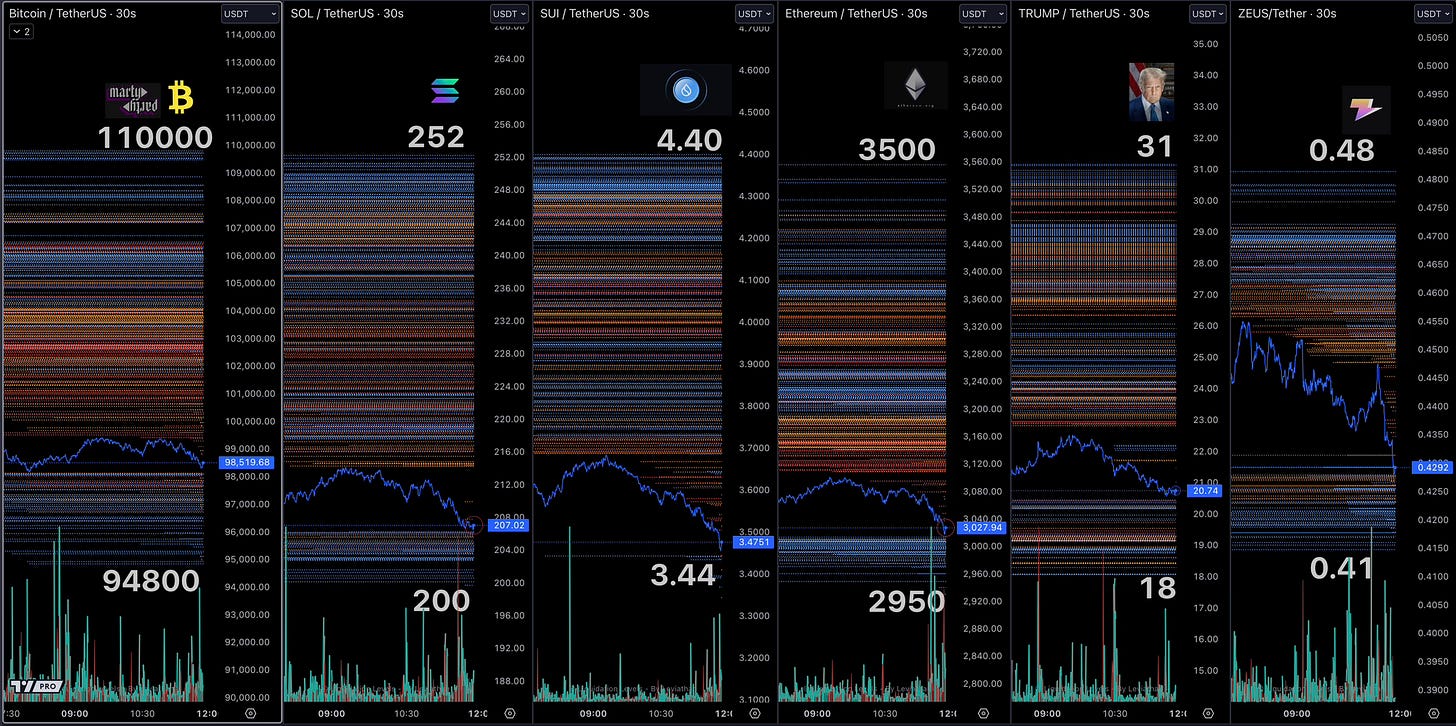

Poppy's calling a price dip this weekend, and it might stretch into early next week. He's spotted some key support levels that could be the last big sweep to flush out those over-leveraged positions. Looks like the exchanges are gearing up to snag more assets like Bitcoin, SOL, and ETH at sweeter prices.

👀 Keep an eye out for those better entry points, based on these liquidity levels!

Top 10 CEX (Centralized Exchanges) by Market Share 📊

Binance: 34.7%

Crypto.com: 11.2%

Upbit: 9.8%

Bybit: 8.9%

Gate.io: 6.8%

Coinbase: 6.5%

Bitget: 6.4%

OKX: 6.2%

MEXC Global: 6.1%

Huobi: 3.3%

🔒 How do you win with the cards stacked against you? Buy spot and move the asset (e.g Bitcoin) off the exchanges and onto a Hardware Wallet for self custody.

Here's the scoop: those weekend price dips aren't just random—they're usually manipulations by the big players to shake out longs and shorts. This $200 billion-a-day game won't change without some serious rules.

Traders wait for these drops, but that’s when the exchanges really play their hand, triggering reversals right when folks start to bail.

😬 Poppy said he is going to stop here… because who knows who’s monitoring his reports.

Interest Rates 📉 = Bitcoin Price 📈

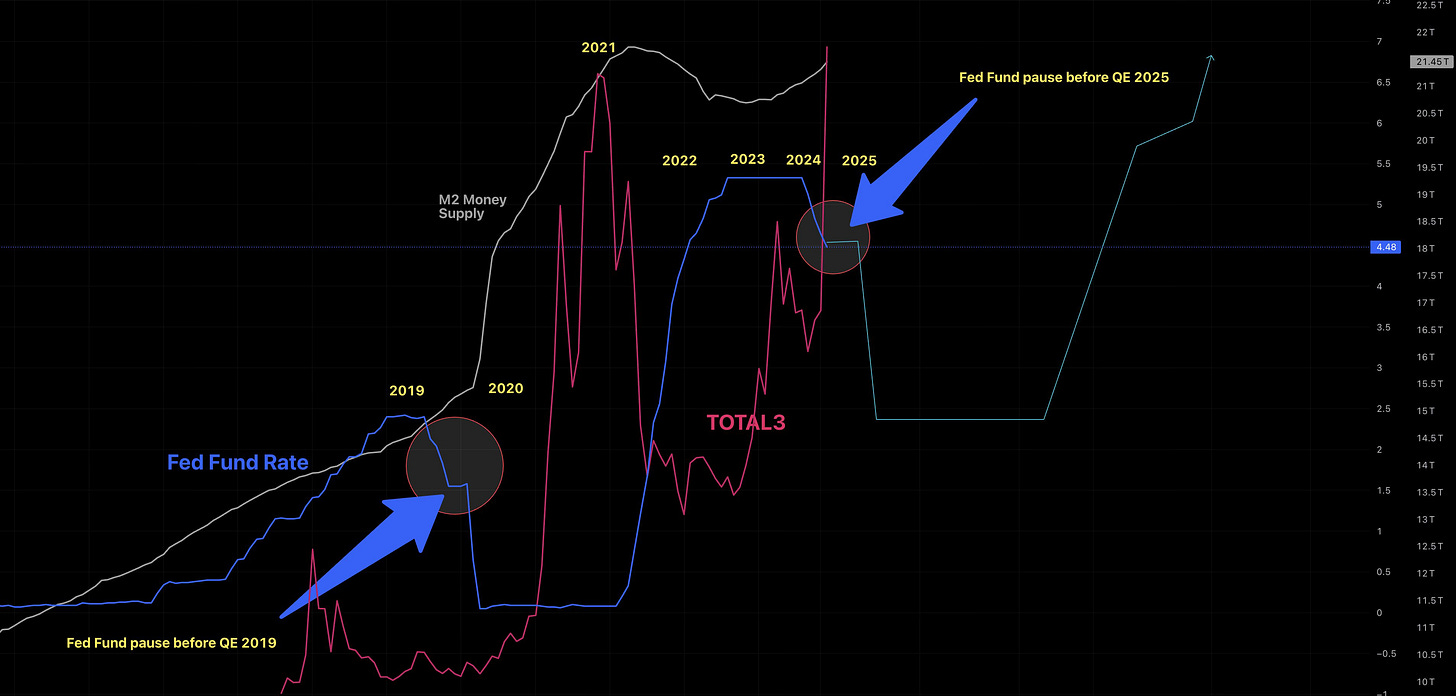

Just saw the Fed Funds Rate dip below its moving average, which usually means rates are headed down, historically from 2% to 0%. And guess what happens when the crypto Total 3 (which is crypto total market cap excluding BTC and ETH), crosses its moving average?

Yup, crypto tends to shoot up. 🚀

Need more proof? 🔎

Check out this chart tracking the Fed Fund Rate (in blue), Money Supply (in grey), and TOTAL3 for crypto (you guessed it, in crypto color). You'll see the trend lines take a pause and then—bam!—they show us exactly where things might be heading next. Keep your eyes peeled, because the trends are pointing to some interesting moves!

⬇️ Let's not forget, Bitcoin has outperformed every other asset class since it debuted post-2008 financial crash.

💰 Over $14 Billion Set to Flood the Crypto Market!? 💰

Just over two years since its dramatic collapse, FTX Trading has emerged from Chapter 11 bankruptcy and is gearing up for its initial creditor repayments.

The approved $14+ billion reorganization plan will see distributions starting within 60 days of January 3, 2025.

Here's what FTX creditors need to know:

Key Dates and Amounts:

January 3, 2025: Record date for the initial distribution.

February/March 2025: Distributions begin, with holders of convenience class claims under $50k receiving about $1.2 billion (119% of their claims) and those with claims over $50k sharing $10.5 billion.

Distribution Partners & Requirements:

FTX has appointed BitGo and Kraken as the managers for these distributions. Creditors are required to:

Complete Know Your Customer (KYC) procedures.

Fill out a W-8 Ben form for tax purposes.

Onboard with either BitGo or Kraken to facilitate the distribution process.

Steps to Ensure Smooth Processing:

To avoid any delays in receiving your distribution, make sure to complete all required documentation and onboarding steps through the FTX Debtors' Customer Portal. For more detailed information on how to file your claims and the necessary steps, visit FTX Claims Portal.

Now, it’s anyone’s guess whether all these distributions will pour back into the crypto markets, but we can expect a good chunk of it might. A lot of that is likely to go towards buying Bitcoin in a safer manner, like using a hardware wallet for self-custody.

And what great timing for these distributions, right? With all the recent upbeat news and solid economic data favoring crypto, it looks like Bitcoin's price could really get a boost—and hopefully, alt coins will ride that wave too! 📈

Bible Verse:

Proverbs 13:11 - "Wealth gained hastily will dwindle, but whoever gathers little by little will increase it."

Reflection:

In the context of the FTX saga and its impact on investors, this verse from Proverbs offers profound wisdom. The rapid ascent and subsequent collapse of FTX serve as a stark reminder of the risks associated with pursuing wealth through quick and speculative means. The verse cautions against the allure of fast gains, which can often be unstable and fleeting.

Reflecting on the FTX reorganization plan and the gradual repayment to creditors, we can see a parallel in the biblical advice of accumulating wealth slowly but steadily. The recovery process for FTX creditors, though painstaking, highlights the importance of diligence and patience in financial recovery and investment. It reminds us that building or rebuilding in a thoughtful and measured way tends to create a more stable and sustainable future.

This scenario encourages us to consider how we manage our own resources and make financial decisions. Are we seeking quick gains, or are we planning for long-term stability? As we reflect on this, let us strive to gather our resources little by little, ensuring a firmer foundation and a more secure future. This approach not only applies to financial dealings but to all aspects of life where enduring values and slow but steady efforts prevail over the fleeting and fast.

Oh yeah— and it's all about doing it with the right people! Sure, you can zip ahead quickly on your own, but you'll travel further with a solid support system of people. Though, if you're in tune with yourself and the higher power, sometimes that's all you need.

Take it from someone who’s been there—the wrong folks, which will always prioritize profits over people, instead of putting people first.

🐍 Keep the grass cut, and the snakes will show.

Need Help?

Fill out this quick form to inquire about my consulting services, and let's create a winning strategy to get you where you want to be.