The Crypto Casino: #1 Secret EXPOSED

Would you play Poker if you could see your opponents hand?

⬇️ your response:

Although there are some variables to consider—like the specific rules of the game, number of opponents, and overall skill level—the probability of winning each hand is often tilted in your favor if you know the cards.

Now, imagine this is what it’s like for exchanges holding funds for users in crypto. This applies to the major platforms. It’s important to understand how crypto leverage trading controls asset prices, in the past 24 hours or so:

~$307 billion was gambled on crypto in a single 24-hour period.

~$1 billion in liquidations occurred in just one day.

The futures market manipulates asset prices, and this applies to stocks as well. However, the key difference with crypto is transparency: we can see the movement of assets between entities on the blockchain.

Today’s Agenda

The Arm’s Race 💣

The #1 Crypto Secret Exposed 🤫

Poppy’s Market Predictions 🔮

→ The AI Arms Race 💣

Panic has officially entered the chat.

China’s AI startup, DeepSeek, has disrupted the game with a super cheap, high-performing AI model that’s giving Western leaders like ChatGPT a run for their money. This has seriously escalated the U.S.-China competition in AI, kicking off what feels like a full-blown "AI arms race."

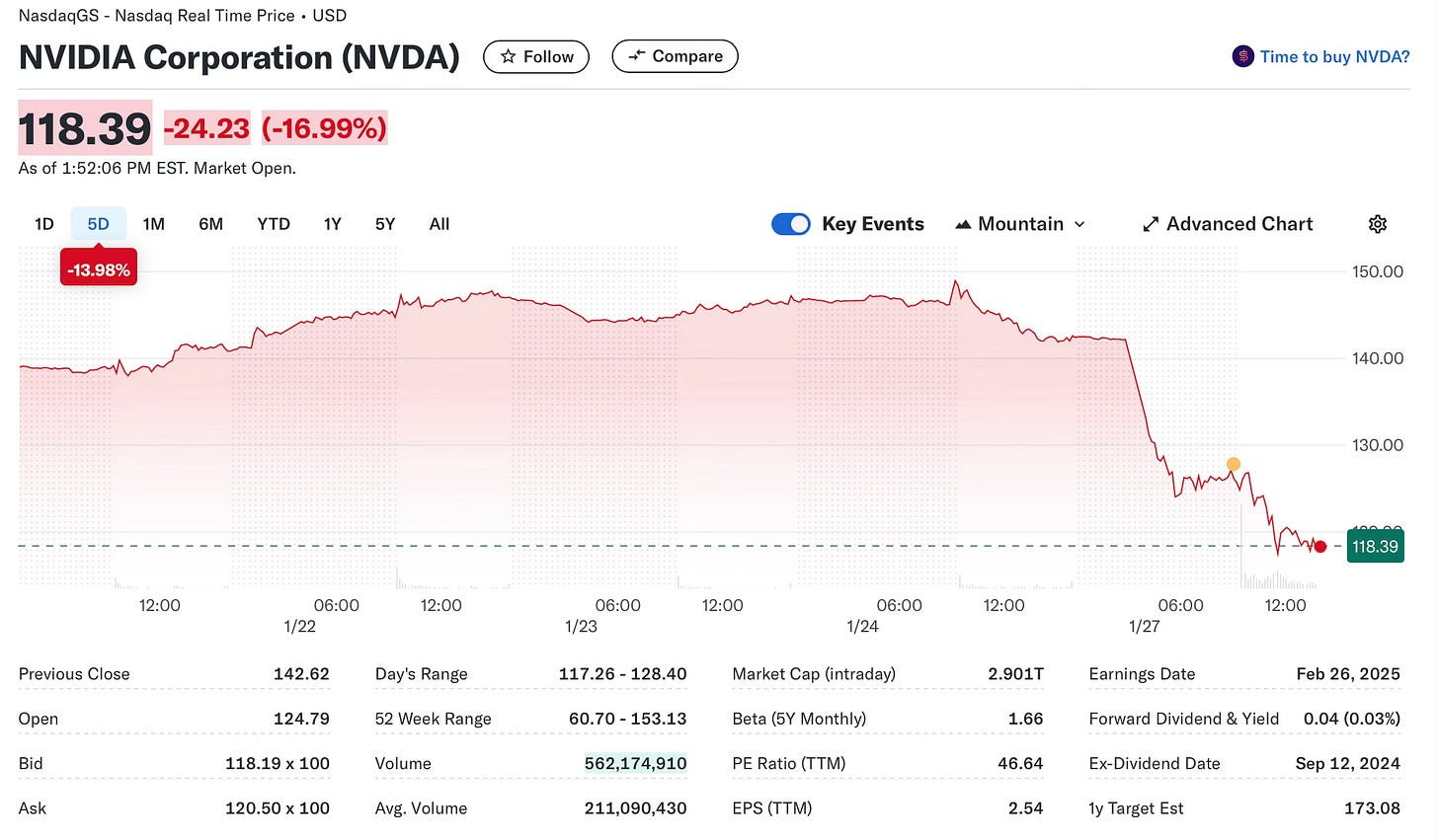

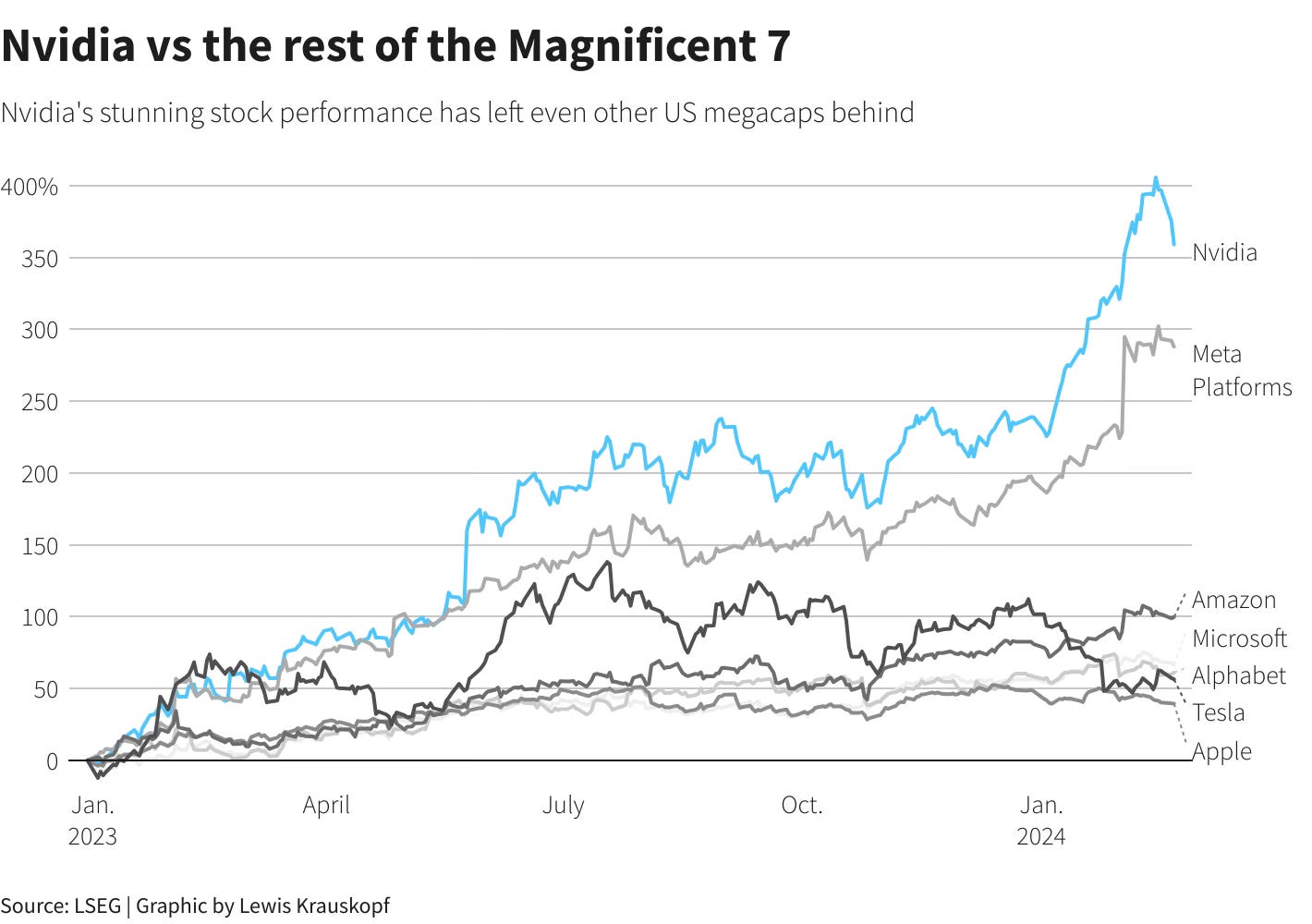

The ripple effects on U.S. markets were massive—tech stocks took a nosedive, with Nvidia hit particularly hard. Its stock plunged 18%, wiping billions off the market in just days. The pressure is now on for the U.S. to step up its AI game, with the government already pushing for more investments in infrastructure to stay competitive. The battle for AI dominance isn’t just heating up—it’s roaring.

This is especially significant given Nvidia’s central role in the "Magnificent 7" stocks, which have been a major driving force behind the S&P 500’s stellar performance in recent years. If Nvidia stumbles, the broader markets could feel it too.

Competition aside, the real questions are:

Is China misrepresenting the financials to fund and launch the DeepSeek project? What are the actual costs of maintaining and improving their model over time?

Could this be a strategic move by China to gain backdoor access to critical user information, especially as Trump appears to be in the final stages of negotiations in the U.S. to gain more control over data security and user privacy?

One of the most interesting aspects of DeepSeek is that it launched as open source. This means the code and technology are publicly available, allowing anyone—developers, researchers, or businesses—to use, study, or build upon it. Open sourcing can accelerate innovation globally, but it also raises concerns about how this technology might be used.

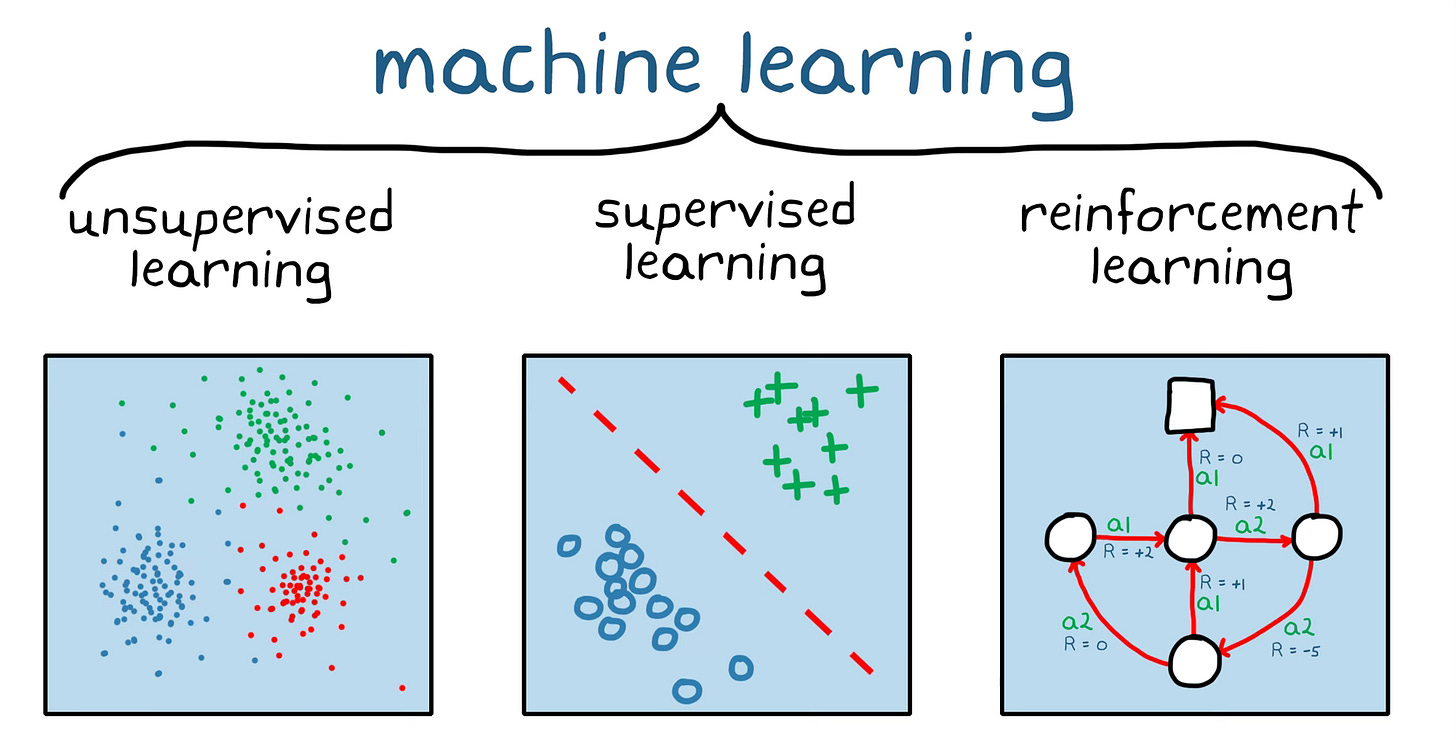

DeepSeek has also integrated reinforcement learning, a groundbreaking form of machine learning where the AI essentially teaches itself through trial and error, improving over time without human intervention. This is a game-changer because it takes AI closer to truly autonomous decision-making. In simple terms, think of it as the tech version of CGI’s evolution—bringing us a step closer to hyper-intelligent, self-improving systems that can adapt and innovate on their own.

At the end of the day, innovation and competition drive progress, but these advancements inevitably raise challenges and questions about their global impact and long-term implications.

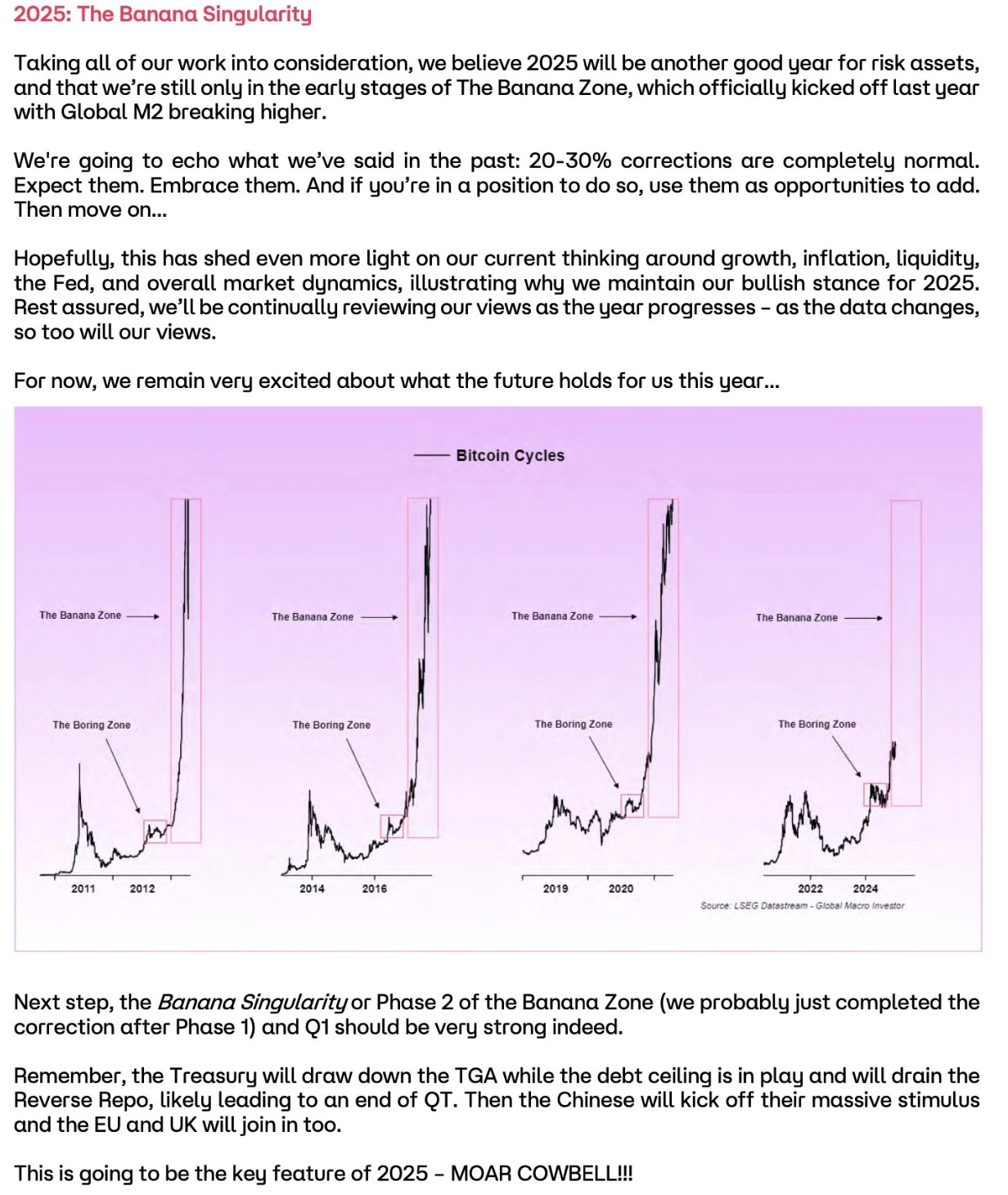

Poppy predicts that the current volatility in the stock market will likely lead to a significant flow of money moving out of traditional investments, S&P, NASDAQ, and the "Magnificent 7" stocks, and into Bitcoin and the broader crypto markets.

→ The #1 Crypto Secret Exposed 🤫

Let’s talk about the next Arms Race: Bitcoin

There are ~1,055,675.0 #Bitcoin left to be mined, forever.

To put this into perspective, Michael Saylor (Microstrategy) recently purchased 10,000 Bitcoin, which is roughly 22-23 days of supply from miners and they are not selling their positions. A true supply vs demand example of upward price action likely to be ahead. 📈

How Markets Truly Work (& Why Crypto is Unique)

⬇️ Let’s break this down step by step so it’s easy to understand how the markets, especially crypto, actually function. ⬇️

1️⃣ The Role of Market Makers (aka Market Manipulators)

Every market in the world operates using market makers—entities that create liquidity by buying and selling assets to keep prices moving. In crypto, the biggest player is WinterMute, a market maker often described as a "market manipulator."

Here’s how it works:

Exchanges, which essentially controls the entire crypto market, like Binance, Coinbase, or ByBit don’t sell directly from their own order books (doing this is illegal).

Instead, they send money or assets to a market maker (e.g., WinterMute) and instruct them to sell at a specific price on their exchange. This is legal.

This is how they legally influence and "move" prices.

Market Manipulation Happens in Broad Daylight:

With crypto, all of this is more transparent because we can see these actions on the blockchain, unlike traditional stock markets where these processes are hidden or deceptive.

2️⃣ How the Game is Played

Here’s the basic playbook:

The Exchange Sends Assets to Market Makers:

Market makers execute trades to manipulate the price, often causing massive price swings.

Liquidate Longs or Shorts:

When the price drops, it triggers liquidations for people in "long" positions (betting on prices to go up).

After trapping long positions, they reverse course, shooting prices back up to liquidate the "shorts" (betting prices will fall).

The Market Reacts Emotionally:

The fear of missing out (FOMO) or panic leads everyday investors to make impulsive decisions—buying high or selling low.

The exchanges profit from this chaos.

3️⃣ Why Crypto is Unique

What makes crypto different is blockchain transparency. Unlike traditional markets, where manipulation is hidden behind closed doors, you can see everything on-chain. For example, you can watch as exchanges send funds to market makers like WinterMute and trace their movements.

Yesterday alone, crypto exchanges made $1 billion in a single day by running this exact playbook—liquidating positions, reversing the trend, and profiting from the resulting liquidity.

4️⃣ The Zero-Sum Game of Markets

Markets are fundamentally a zero-sum game. For every winner, there’s a loser:

When someone buys, someone else sells.

When someone sells, someone else buys.

Institutions are working overtime to manipulate and influence the markets because retail investors (everyday people) are tightening their wallets. However, this may soon change as adoption rises and quantitative easing (money printing)kicks back in, potentially fueling one of the largest liquidity events in history.

♦️♠️ The Royal Flush Strategy: Beat the "Casino" ♥️♣️

So, how can you protect yourself and win the game? By thinking like a pro and following The Royal Flush Strategy:

Buy the Dumps (Flushes):

When the market crashes or flushes, buy the dip instead of panicking.

Move Assets to Self-Custody:

Use a hardware wallet (e.g., Ledger) to take your crypto off exchanges and secure it yourself. ⬆️ Click the link above to support Poppy and save!

Set Limit Orders for Re-Entry:

Have limit buy orders ready to scoop up assets during dips automatically. Once bought, move them back into your hardware wallet.

THIS IS HOW WE WIN → Take control of your assets by buying cryptocurrencies like BTC, ETH, and SOL, and then securely transferring them from exchanges to your own hardware wallet for self-custody. This strategy effectively "drains the swamp" of exchanges holding your assets.

Poppy’s “Market Mindset”

The crypto market (technically any market) is like a casino, and the house (exchanges) always tries to win. But with transparency on the blockchain and a solid strategy, you can avoid being manipulated and play the game of odds to your advantage.

With adoption climbing (e.g., more active wallet addresses and tools like Base Wallet), and the likelihood of governments ramping up money printing (quantitative easing), we are very likely to be on the cusp of one of the largest market opportunities ever.

The winners will be those who can see through the manipulation, stay calm, and play smart. As always, the market rewards patience and preparation.

🔮 Poppy’s Market Assessment & Prediction:

Gold: Stable.

NASDAQ: Down hard.

S&P 500: Down hard.

DXY (Dollar Index): Down hard.

Crypto: Recovering strongly (Bullish outlook).

The data speaks for itself—markets are emotional and reactive, but in crypto, at least we have the benefit of transparency.

🎲 Best Bet 🎲

Your best bet? Investing in yourself.

You don’t have to do it alone.

Fill out this quick form to inquire about my consulting services, and let's create a winning strategy to get you where you want to be.

Bible Verse

"The plans of the diligent lead to profit as surely as haste leads to poverty." – Proverbs 21:5

Reflection

In a world of AI arms races, market manipulation, and financial uncertainty, this verse reminds us to approach decisions with diligence and wisdom. While institutions may play games with markets, transparency and thoughtful action—like investing in yourself and securing your resources—lead to lasting success. Just as God calls us to be stewards of our blessings, we are reminded to act with discernment, patience, and trust in His provision, even in the face of chaos.