If it ain’t broke, don’t fix it.

Well… if it could be better, it might as well be broken.

💭 The Dream

Do you ever pause and ask yourself what you really want to do with your life?

For me—professionally—it’s always been clear: I want to help people understand the complex financial topics we were never taught in school (and if we were lucky, maybe picked up at home). Things like credit, investing, crypto, and money management. The stuff that quietly shapes your future whether you understand it or not.

It’s wild how we work day in and day out chasing money, yet most people don’t understand how it actually works—where it comes from, how to access more of it, or how to escape the financial traps we fall into.

And here’s the truth: most people don’t chase their dream because of one simple reason—money.

That’s it.

One day you look around and think, How the hell did I end up here?

Maybe it’s student loan debt.

Maybe it’s credit cards.

Maybe it’s bad partnerships.

Maybe it’s a job that drains your energy more than it pays your bills.

Or maybe things are good—or even great. But deep down, you know there’s more.

Sure, money isn’t everything.

But let’s be real—it impacts & influences almost everything & everyone.

And while it does take money to make money...

It doesn’t have to be your money.

Last week, a friend called me with a 🔥 question:

“Tyler, I’m finally ready to start my business. I’ll probably need around $50K to cover the first year—branding, marketing, ads, systems, all the stuff to get it off the ground. I have the cash… but should I really use it? What if the business doesn’t work out?”

Solid question. One I hear all the time.

And whether or not that’s you — maybe you’re not launching a business, or maybe yours is doing just fine — you might still feel like something’s off. Like you're capable of more, but something’s quietly blocking you from leveling up.

After years of wins, losses, and helping thousands of people navigate finances, credit, and business… here's the truth I’ve come to live by:

Most people don’t fail because of bad ideas or bad work ethic.

They fail because they run out of cash.

And cash flow is everything.

Yes, it takes money to make money.

But it doesn’t have to be your money.

We often throw time or money at problems, then wish & hope for the best.

But what if the answer is learning how to strategically use both?

Instead of burning through cash, she could secure a 0% APR funding: easily $50,000 to $200,000, depending on a few factors—to invest in professional marketing, branding, operations and overall launch.

As a consequence of securing and deploying this capital in a strategic and prudent manner, this automatically saves her time. And more importantly, this approach allows her focus on her core strength: delivering exceptional products, building loyal customers, scaling revenue & profits.

If the business thrives: She generates revenue to scale and can bring tasks in-house later, if it makes financial sense.

If it struggles: She has 12+ months at 0% interest, and I can guide her to extend the term, consolidate, or repay using the cash she preserved.

Key advantage: That cash could remain invested in assets like Bitcoin or stocks, potentially growing, while the business loan doesn’t impact her personal credit score.

📉 The Real Problem

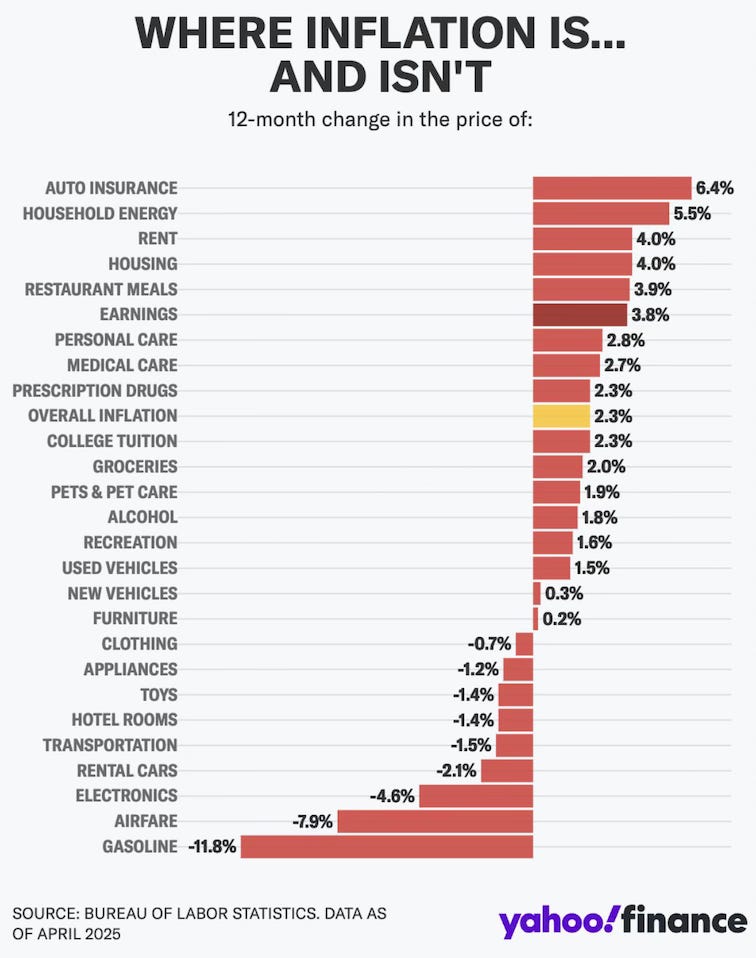

Let’s be real—this is why the funding conversation matters more than ever:

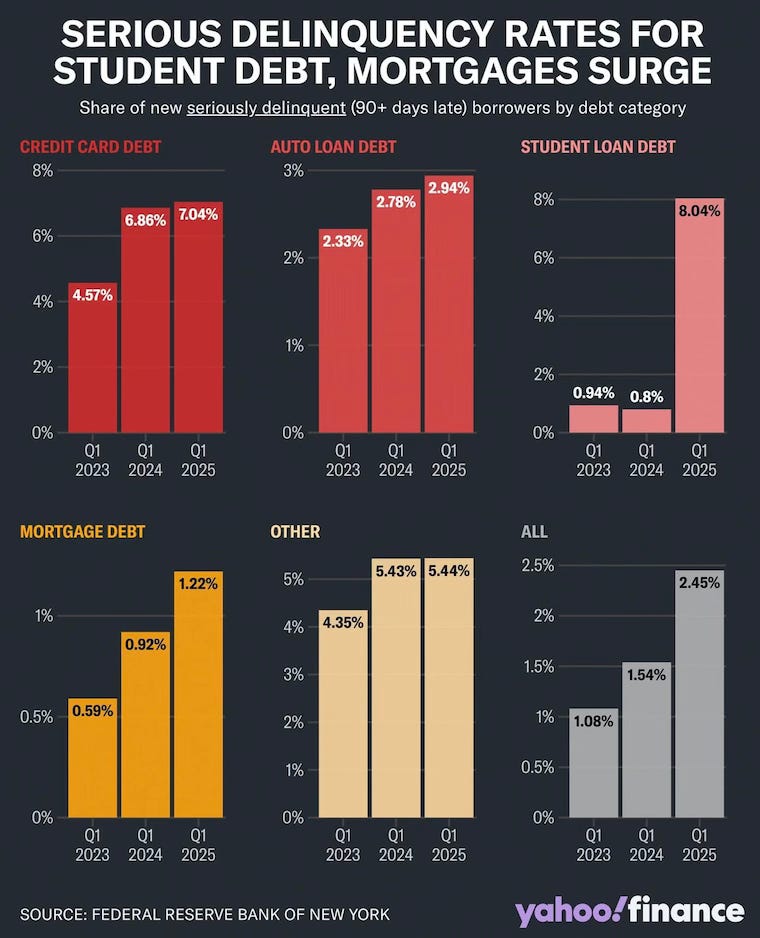

Consumer debt is at an all-time high (and no, the cost of living isn’t getting cheaper)

Student loans are hitting collections at a record pace (credit card, auto & mortgage loans are not slowing down either).

Most people and businesses are one surprise bill away from financial chaos.

And yet… the same outdated advice keeps getting recycled:

“Save more. Spend less. Never take on debt.”

Sure, that may have worked in the 1980s. But this isn’t your grandpa’s economy.

Let’s not be ignorant—discipline still matters. It always will. If you can’t consistently save money, then everything else I share below is irrelevant.

But the real issue? Most people (and business owners) are stuck in survival mode.

They’re living to work… instead of working to live.

🧬 It’s time to rewire your nervous system to reprogram your financial future.

🧠 The Better System

This philosophy isn’t for everyone. But it is for someone.

When my friend asked if she should use her cash to launch her business, my honest response (after dropping the usual financial disclaimer 😅) was simple:

“No, I wouldn’t use your cash.

Worst case? The business flops and you don’t generate enough revenue to pay back the 0% or low-interest funding.

So what? You’ve still got options.”

We can:

Strategically extend the 0% APR period

Consolidate or restructure the debt to then still pay it off in a creative approach

Or she can simply pay it off with the same cash she already had—which ideally was working harder elsewhere (like growing in Bitcoin, stocks, or other maybe other income-producing investments)

The upside? She gave herself a longer runway, more margin, and less risk—without burning through her savings or wrecking her personal credit.

🎯 Business Funding (Even for Beginners)

Crypto pioneers and financial experts love to point out how broken the U.S. financial system is—and they’re not wrong. But ironically, we’re living in one of the most opportunistic lending environments ever created.

📌 Major Benefits of Business Funding

From intro 0% APR options to high-limit business credit lines and other creative lending solutions, we have access to tens of thousands of lenders offering flexible, strategic capital.

🧾 No Personal Credit Reporting

Most business funding doesn’t report to personal credit bureaus, meaning your score stays protected—no matter how much you borrow.

📈 Higher Approval Odds & Limits

Even with a new LLC, lenders will fund you based on how your business is set up and based on having the right connections — after all it is relationship driven. In some cases and options, other factors are taken into consideration rather than just your FICO credit score.

🧰 Customizable for Any Person or Business

Whether you’re in eCommerce, consulting, real estate, coaching, or SaaS, real estate, etc. there’s funding that aligns with your unique situation & goals.

🔄 0% & Low-Interest Terms

Many lenders offer 0% interest for the first 12–18 months, giving you room to generate cash flow before hight interest repayment pressure begins. Worst case scenario, there are multiple ways to avoid the future higher interest due (if applicable).

💼 Liquidity Preservation

Why burn through your own cash when you can use OPM (other people’s money)? Save your reserves for investments like Bitcoin, stocks, growth initiatives or keep in your account as a safety net.

📊 Scalable to Your Vision

Access can start at $10K and scale up to $500K+ based on your structure, revenue, and collateral—not just your credit score. We share the full roadmap for you to become your own bank.

And that’s just the beginning. Business funding isn’t just for survival—it’s for expansion, momentum, and freedom.

🌐 The Digital Revolution

The financial system is evolving fast. FinTech, crypto, and digital lending are breaking down outdated constraints and opening up smarter, faster, and more flexible ways to access capital and build wealth.

Here’s what’s happening—and why it matters:

💸 1. Stablecoin Integration

Stablecoins (crypto pegged to the U.S. dollar) are going mainstream. With MoonPay x Mastercard leading the charge, global payments and lending through digital assets are becoming seamless.

Ideal for payments, savings, and borrowing

Crypto wallets are on track to replace traditional bank accounts

Regulation will accelerate adoption and trust

🏦 2. Tokenized Assets: Stocks, Real Estate & More

Tokenization is unlocking new funding models by turning assets into digital tokens.

Enables fractional ownership and borrowing without liquidation

Firms like BlackRock and Fidelity are already involved

Expect sports teams and private equity to tokenize ownership for investors and fans

📊 3. Crypto Lending: Flexible & Accessible

Platforms like Aave, Compound, and others allow you to borrow against crypto at competitive rates—no credit check needed.

Keep your crypto while accessing capital

Fast, global, and borderless

Institutional players are entering as regulation tightens

🌍 4. FinTech Lending: Smarter & Faster

Platforms like Upstart, Chime, and Funding Circle use AI to offer loans that are quicker, more personalized, and often cheaper than traditional banks.

Loans from $1K–$500K+ for personal or business use

Revenue-based financing, equipment loans, invoice factoring

Perfect for startups and growing businesses

🔐 The Shift & Strategy

Will crypto wallets replace banks?

With stablecoin regulation on the horizon and major platforms like Visa, PayPal, and MoonPay integrating crypto & stock functionality, digital wallets are quickly becoming the new financial hub.

Expect to see:

Tokenized income streams used as loan collateral

AI-powered lending replacing outdated FICO scores

Widespread adoption as digital wallets go mainstream

💡 Smart Funding Strategies

→ Consolidate & Pay off Debt

Swap 20% APR debt for lower interest—or even 0%—to free up cash flow and reduce financial pressure.

→ FinTech & Crypto

Borrow against crypto without selling your positions, or tap into modern digital lending platforms built to move faster and smarter than banks.

→ Personal & Business Funding

Access 0% APR credit lines, cash funding, collateral-backed loans, revenue-based financing, equipment loans, SBA options, and more—all tailored to your current situation and future goals.

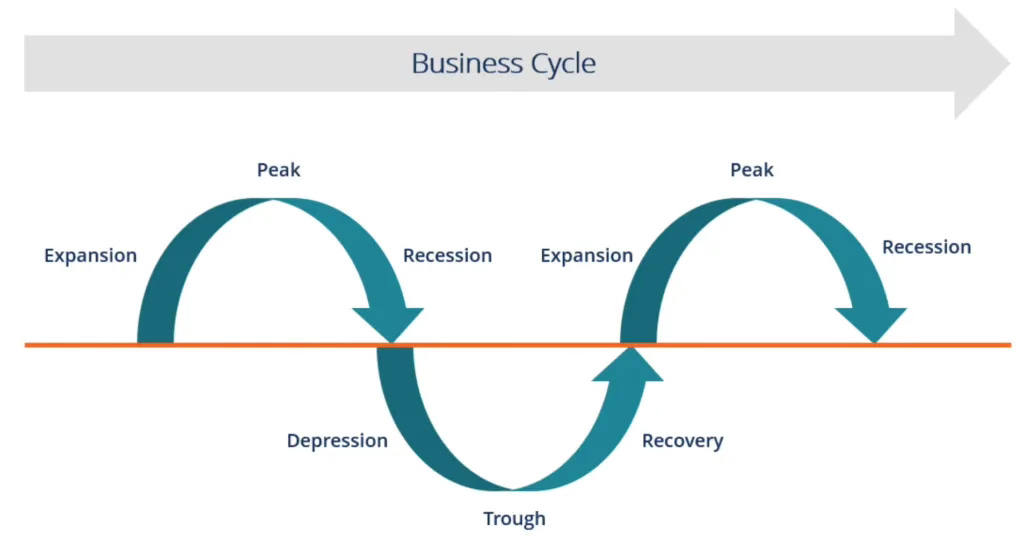

📈 The Business Cycle

Is the economy shifting? Honestly—no one knows for sure. But here’s what we do see:

🧊 Labor & housing market is softening

💸 Trillions are sidelined, ready to be printed (digitally) and deployed

🪙 Digital assets are surging—and beginning to decouple from traditional risk signals like U.S. Treasury bonds (which are holding strong—a sign investors expect continued volatility)

Here’s the bottom line:

Lenders still lend in a bad economic environment—just not to everyone.

They’re favoring those who are:

Creditworthy (strong scores, low utilization)

Cash + Collateral (clean books, structured entities, assets — even with bad credit)

Strategic (clear plan for capital deployment)

Relationships (it’s not what you know, but who you know — regardless of technology)

Creative funding is the edge.

If you're not funding your future…

You’re funding someone else’s.

🎯 Ready to Fund Your Future? Let’s Map It Out.

Whether you’re drowning in high-interest debt (or buried in student loans), sitting on untapped credit, or finally ready to launch the business you’ve been dreaming about—I’m here to help you build a real strategy and execute with confidence.

This isn’t a sales pitch.

It’s a Clarity Session—a focused consult designed to help you:

Understand where you stand personally, professionally, and financially

Identify what funding options you qualify for—or how to get there

Cut through the noise & move forward with clarity & precision

⚠️ Spots are limited—I only work with people I know I can help.

Let’s get you unstuck, uncapped, & unapologetically moving forward.

📖 Bible Verse

"By wisdom a house is built, and through understanding it is established; through knowledge its rooms are filled with rare and beautiful treasures." — Proverbs 24:3–4

Reflection: Just as a home requires vision, structure, and care, so does a life rooted in purpose and discipline. Wisdom lays the foundation, understanding keeps it strong, and knowledge—when applied with good stewardship—fills it with lasting abundance.

Bankers