Have You Been Searching for a Financial Miracle?

Feeling stuck in the grind? Expenses climbing, progress slipping—it can feel like running on an endless treadmill, taking steps forward only to fall further behind. Even if you’re not living paycheck to paycheck, you might still find yourself wondering, Why am I not further ahead?

Here’s the truth: Bitcoin and cryptocurrency are rewriting the financial rulebook, and we’re officially in the midst of a Bull Run. Think it’s too late? It’s not. The best time to start was yesterday; the second best is today.

Soon, you’ll be explaining how to set up a Coinbase account at Thanksgiving while Aunt Linda asks, “Is doggy coin still a thing?” And if you’re feeling lost, don’t worry—I’ve got you covered. [Click Here] for a quick primer and start positioning yourself for the opportunities ahead.

Oh, and here’s how I know it’s go-time: My inbox is flooded with messages from people asking, “Should I buy Bitcoin now? What projects should I invest in?” Funny how everyone shows up when Bitcoin nears $100K but vanishes when it’s $10K. Don’t wait for the crowd—run your own race.

Being the go-to person for navigating these waters is both thrilling and weighty—it’s a mix of ego boost and responsibility. The market’s volatility demands clarity, patience, and strategy.

As Bitcoin dominates headlines, here are key factors to consider and how to prepare based on your goals and risk tolerance.

(Quick disclaimer: THIS IS NOT FINANCIAL ADVICE!)

Let’s dive in.

Major Recession?

Here’s the deal: You either understand this asset class, or you need to invest time learning until you do. Most people hesitate with Bitcoin or crypto not because it’s unworthy, but because they haven’t grasped its potential. Like anything in life, it takes investment—of time, money, or both.

Each generation gets its financial game-changer. For our parents and grandparents, it was affordable tuition, stable jobs, and employer-backed retirement plans. For us, it’s Bitcoin and cryptocurrency.

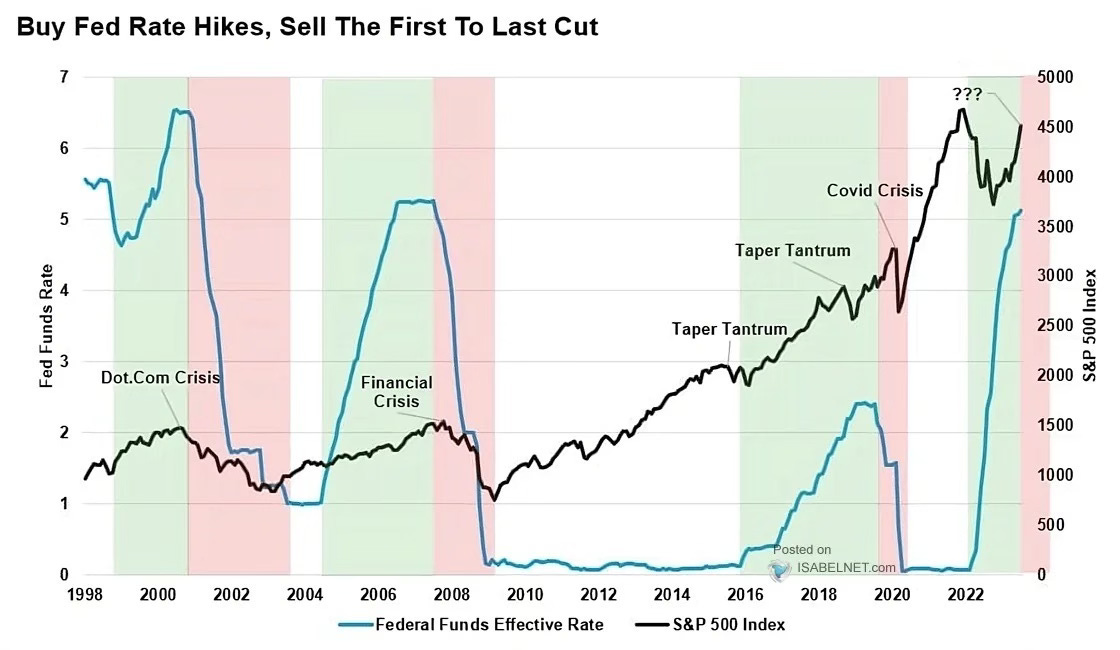

Historically, rate cuts by the Federal Reserve signal recessionary pressures, as seen during the dot-com bubble and financial crises. In today’s climate, these cuts not only stimulate markets but also fuel crypto cycles as investors seek higher-yielding alternatives. This presents a strategic opportunity to pull profits from stagnating assets like stocks or real estate and reallocate to emerging markets like crypto, where the potential for outsized returns aligns with the cyclical nature of monetary easing.

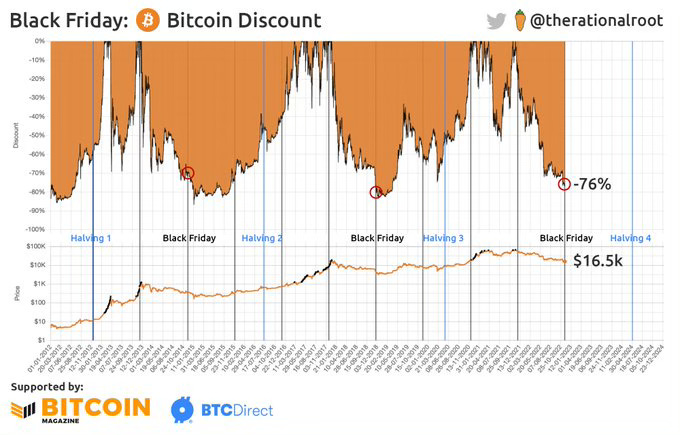

Black Friday Sale!

Although past performance does not guarantee future positive returns or price movements—Bitcoin’s bull run cycles have historically included corrections of 20-40%, with some exceeding 40%. In 2024, the largest correction so far was nearly 25% in the summer.

Based on the recent all-time high of $93,000, we might expect a correction to $65,000-$75,000, though I believe a milder pullback to $80,000-$85,000 is more likely—potentially setting the stage for Bitcoin to break $100,000.

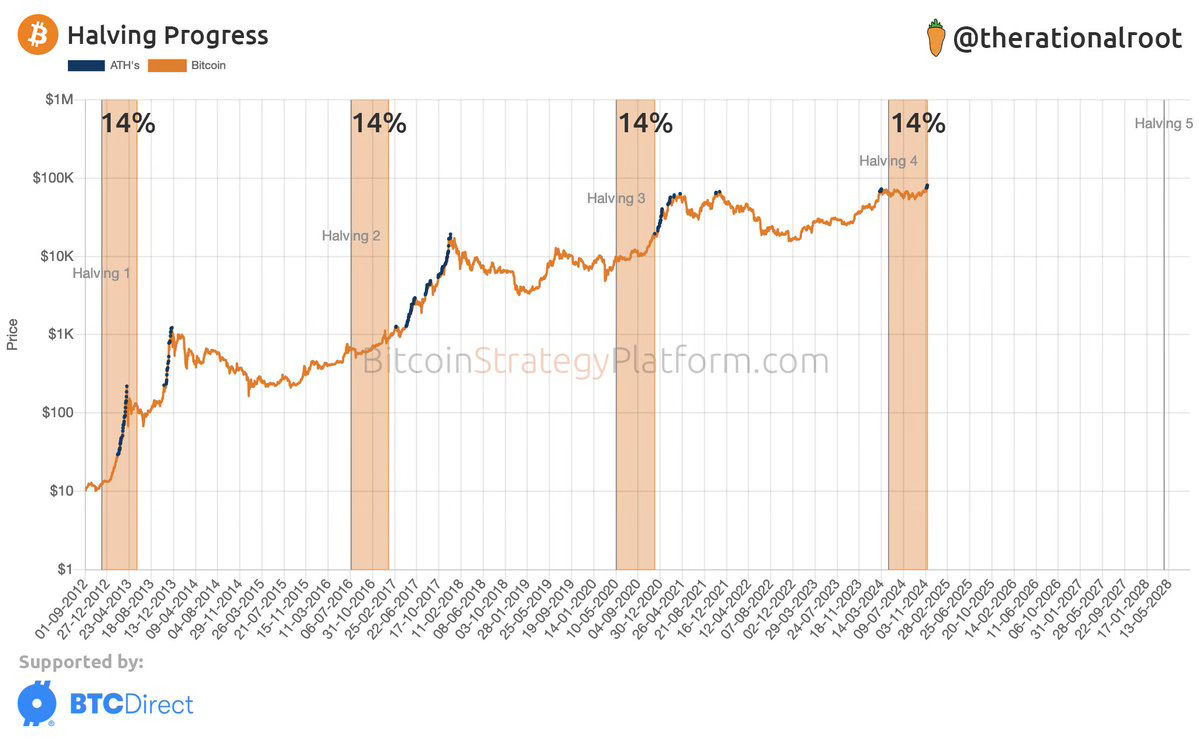

Remember, investing is about time in the market, not timing the market. A pattern worth noting is the "Bitcoin Black Friday Flash Sale," a recurring trend in bull run cycles.

Bitcoin’s bull run cycles often feature corrections following halving events, with a potential dip around Black Friday (November 29, 2024). While not guaranteed, this could be an opportunity for those feeling they’ve missed out to capitalize on temporary price drops.

Major corrections are natural in Bitcoin's trajectory, offering chances to accumulate and refine strategies, particularly for long-term investors. If a 2-3X upside doesn’t align with your risk tolerance or you still feel it’s too late, reassess your approach—sometimes diversifying or waiting can be just as strategic as taking action.

Alt Coin Season

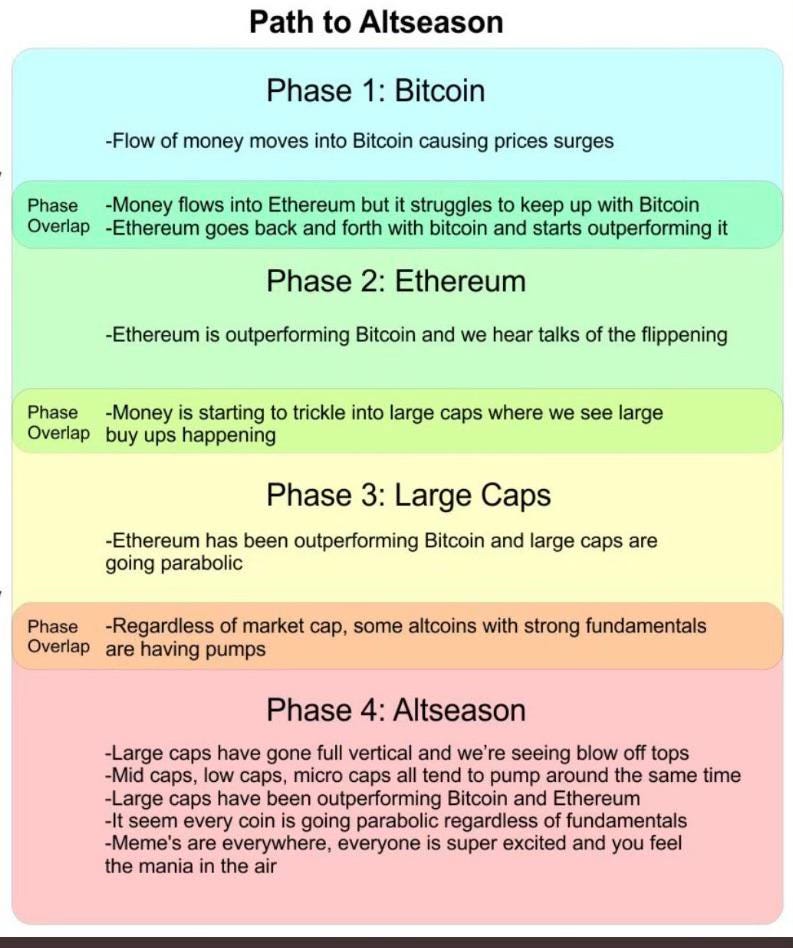

For those who feel like they’ve missed the boat or have a high-risk tolerance and seek the biggest bang for their buck, the upcoming altcoin season may be your golden opportunity. While I am an ardent advocate for accumulating as much Bitcoin as possible, the recent parabolic growth in Bitcoin has made one thing clear: the potential for exponential portfolio gains now lies in strategically positioning yourself in altcoins.

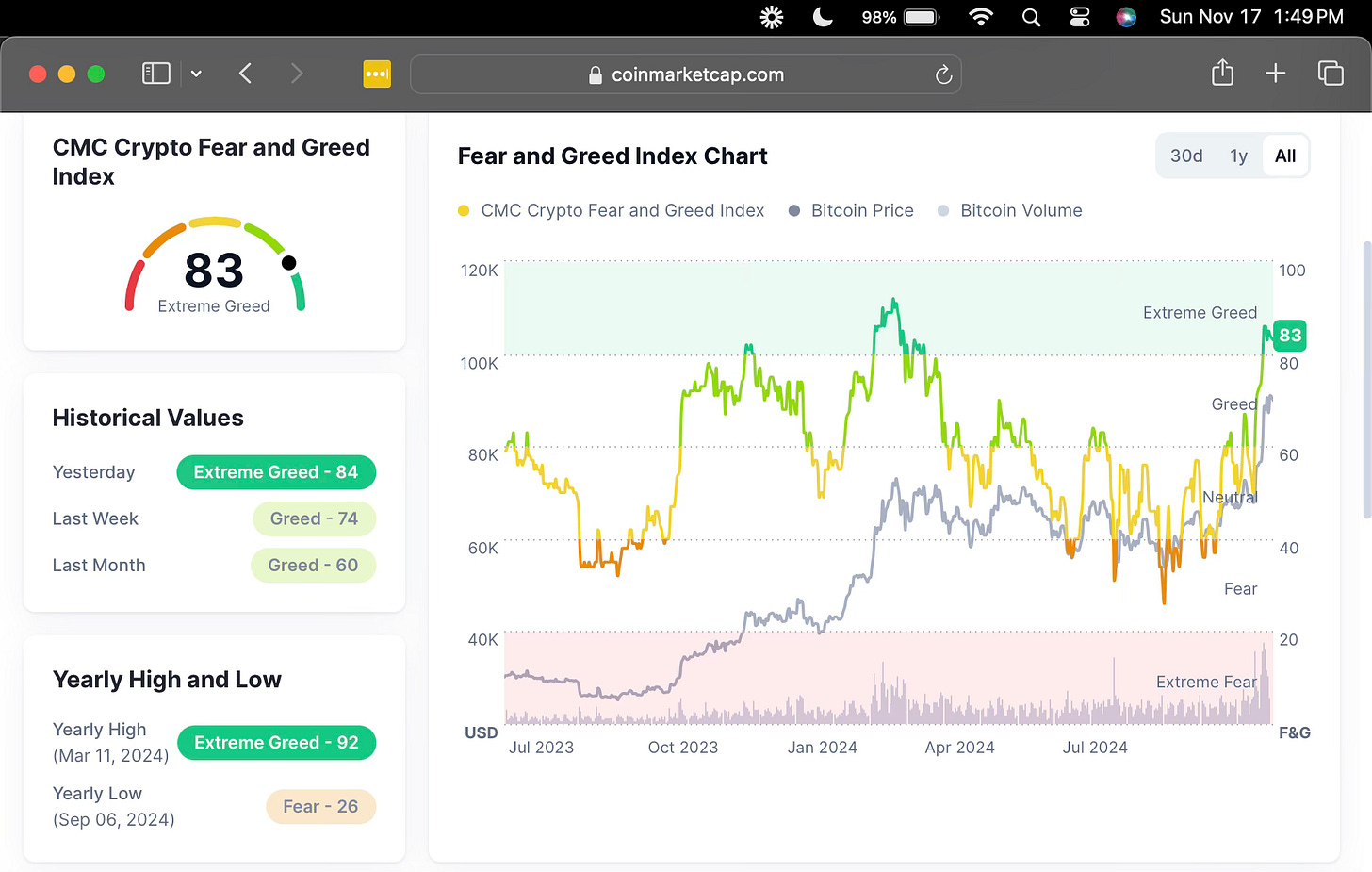

As with all things in life, many will overcomplicate their strategies or let emotions—fear, greed, and FOMO—cloud their judgment, often resulting in losses during critical market cycles. If there’s one strategy consistently proven to work, it’s tuning out the noise and making decisions based on market sentiment indicators like the infamous “Fear and Greed” index. Warren Buffett, one of the greatest investors of our generation (with Michael Saylor arguably not far behind), famously said: “Be fearful when others are greedy and greedy when others are fearful.”

So, where are we now?

Whether you choose to take profits and reinvest in Bitcoin during its price correction opportunities in this bull run, dollar-cost average through the next bear market, or diversify into other asset classes, the decision is yours to make.

Based on my analysis and the chart below, we are firmly in step #2 and quickly transitioning into steps #3 and #3a of this cycle—on the cusp of a significant Bitcoin price correction and the beginning of a parabolic altcoin rally. If history and logic hold true, this is the moment to position yourself for the explosive growth altcoins are poised to deliver. The only question is: will you capitalize on this opportunity, or let it slip away?

Jokes On You!

Meme coins in the crypto world are more than just humorous or culturally-driven tokens—they're a fascinating blend of community, utility (sometimes), and speculative frenzy. While they may have started as a joke, their explosive growth and loyal followings often create significant market value. For savvy investors, allocating 5-10% of a portfolio (or more, depending on your risk tolerance) into top-performing meme projects could be a strategic play in the current market.

Here’s why: The top 1-2 meme coins on any blockchain often derive value as a percentage of their network’s total market capitalization, reflecting their activity, transactions, and cultural relevance. Historically, we’ve seen these leading meme coins account for up to 10% of their network’s value during peak market cycles.

For example:

The #1 meme coin on a blockchain tends to hold 5-10% of its chain’s market cap.

The #2 meme coin typically carries about 50% of the value of the #1 meme, and each subsequent meme coin sees further dilution in value.

Furthermore, these coins are highly correlated to the success of their respective blockchains, often experiencing a 2-3X price multiplier in response to the network’s growth. This makes them not just a speculative play but also a way to ride the wave of a blockchain’s overall success.

For those with a high-risk tolerance and an appetite for potentially outsized gains, meme coins could offer an intriguing way to diversify your portfolio. After all, in a world where cultural relevance and viral trends meet blockchain technology, the "joke" might just be on anyone who overlooks the potential of memes in crypto.

Let’s face it—99% of cryptocurrency projects, particularly meme coins, are susceptible to rug pulls and scams. However, by understanding the key principles outlined above, you can strategically position yourself to capitalize on significant upside potential. This can be achieved without overexposing your liquidity or compromising your overall portfolio allocation, as long as it aligns with your goals, risk tolerance, and thorough research.

Numbers Don’t Lie

During the 2021 cryptocurrency bull run, several meme coins experienced remarkable growth, significantly outperforming many traditional assets. Here's an overview of the top-performing meme coins on their respective blockchain networks, their percentage growth during that period, and hypothetical returns on a $10,000 investment:

1. Dogecoin (DOGE) on the Bitcoin Blockchain:

Percentage Growth: Approximately 28,000% in 2021.

Hypothetical Investment Return: A $10,000 investment at the beginning of 2021 would have grown to about $2,800,000 by the peak of the bull run.

2. Shiba Inu (SHIB) on the Ethereum Blockchain:

Percentage Growth: Over 1,000,000% from its launch in August 2020 to its peak in October 2021.

Hypothetical Investment Return: A $10,000 investment at launch would have surged to over $100,000,000 at its peak.

3. SafeMoon (SAFEMOON) on the Binance Smart Chain:

Percentage Growth: Approximately 20,000% from its launch in March 2021 to its peak in April 2021.

Hypothetical Investment Return: A $10,000 investment at launch would have grown to about $2,000,000 at its peak.

4. Dogelon Mars (ELON) on the Ethereum Blockchain:

Percentage Growth: Approximately 3,780% from April 2021 to its peak in May 2021.

Hypothetical Investment Return: A $10,000 investment in April 2021 would have grown to about $388,000 at its peak.

5. Floki Inu (FLOKI) on the Ethereum and Binance Smart Chain:

Percentage Growth: Approximately 2,400% from its launch in June 2021 to its peak in November 2021.

Hypothetical Investment Return: A $10,000 investment at launch would have grown to about $250,000 at its peak.

Note: These figures represent peak values during the 2021 bull run. The cryptocurrency market is highly volatile, and such gains are not guaranteed in future cycles. Investors should conduct thorough research and consider their risk tolerance before investing in meme coins or any other cryptocurrencies.

Predicting The #1 Meme Coin: 2024-2025

Brett on Base

Here’s a compelling hypothetical scenario for Brett on the Base blockchain—my boldest prediction since the summer of 2024. Positioned as the #1 meme coin on Base, Brett stands out on a network powered by the influential Coinbase exchange.

*PS - If I am wrong, don’t get mad at me. Do your own research. But, if I am right, please tell me how I was right, my ego will appreciate it lol

Current Landscape:

Current Market Cap of Brett: ~$2 billion

Projected Market Cap: ~$50 billion (based on the projected growth of Base and Coinbase user adoption)

Rationale for Growth: Coinbase's vast user base and the trend of users allocating 5-10% of their portfolios into meme coins, particularly the top 1-2 on a blockchain.

Important Note:

A notable indicator of an impending bull run and accelerated growth in the cryptocurrency market is the surge in popularity of crypto trading applications. For instance, Coinbase has recently climbed to the top of the App Store's top finance category and most downloaded, reflecting increased retail interest in cryptocurrencies.

This trend suggests a growing mainstream adoption and enthusiasm for digital assets, often preceding significant market upswings.

Hypothetical Growth Analysis:

Current Value:

A $10,000 investment at Brett's current $2 billion market cap represents 0.0005% of the project.

Projected Value:

If Brett achieves a $50 billion market cap, that same $10,000 investment would grow 25x, resulting in:

$250,000 in returns.

Supporting Data:

Historically, the top meme coins on networks like Ethereum (Shiba Inu) and Binance Smart Chain (SafeMoon) have achieved valuations exceeding 10% of their network’s market cap during peak cycles.

If Brett mirrors this performance, its growth trajectory could align with Base’s ecosystem expansion, backed by Coinbase’s global adoption.

Why Brett Could Achieve This:

Coinbase’s Dominance: As arguably the most trusted and widely used exchange, Coinbase brings unparalleled credibility and access to Base. In fact, one of the best indicators confirming a Bull Run and more rapid growth is ahead is the fact Coinbase is the most downloaded app on the apple and google store front.

Base’s Ecosystem Growth: With Coinbase onboarding millions of new users annually, Base is poised to expand rapidly, making Brett an attractive entry point for speculative and mainstream investors alike.

Meme Coin Psychology: Meme coins thrive on community sentiment and viral appeal. Brett, as the #1 meme on Base, could capture a significant portion of user attention and portfolio allocation.

Key Considerations:

While this projection highlights the potential upside, investing in meme coins carries substantial risks due to their speculative nature and market volatility.

Diversify your portfolio, conduct thorough research, and ensure your investment aligns with your financial goals and risk tolerance.

Proverbs 21:5 (NIV):

"The plans of the diligent lead to profit as surely as haste leads to poverty."

This verse emphasizes the importance of diligence, planning, and patience—key principles for navigating the volatile and often speculative crypto markets. Whether it's understanding meme coins, strategizing portfolio allocations, or leveraging historical patterns to anticipate market movements, success in investing aligns with thoughtful and informed decision-making.

Diligence: Researching projects like Brett or understanding market cycles reflects careful planning rather than acting impulsively.

Avoiding Haste: Jumping into the market driven by FOMO (fear of missing out) often leads to losses, much like the verse warns against haste leading to poverty.

Strategic Gains: Allocating 5-10% to meme projects or taking advantage of corrections, as mentioned above, demonstrates a calculated approach, which aligns with the verse's principle of diligent planning leading to profit.

Faith can inspire discipline and remind us to stay grounded in long-term goals, trusting that with careful planning and wise action, growth—both financial and personal—can be achieved.

Disclaimer: THIS IS NOT FINANCIAL ADVICE!

Looking to crush your personal, professional, or financial goals? 📈

Whether it’s navigating the crypto markets or creating a solid game plan, I’m here to help! Reply to this Substack email or send me a DM on Instagram—I’d love to connect! 😊

Stay Blessed

— Tyler Bossetti