The State has fallen

The Fiat Collapse

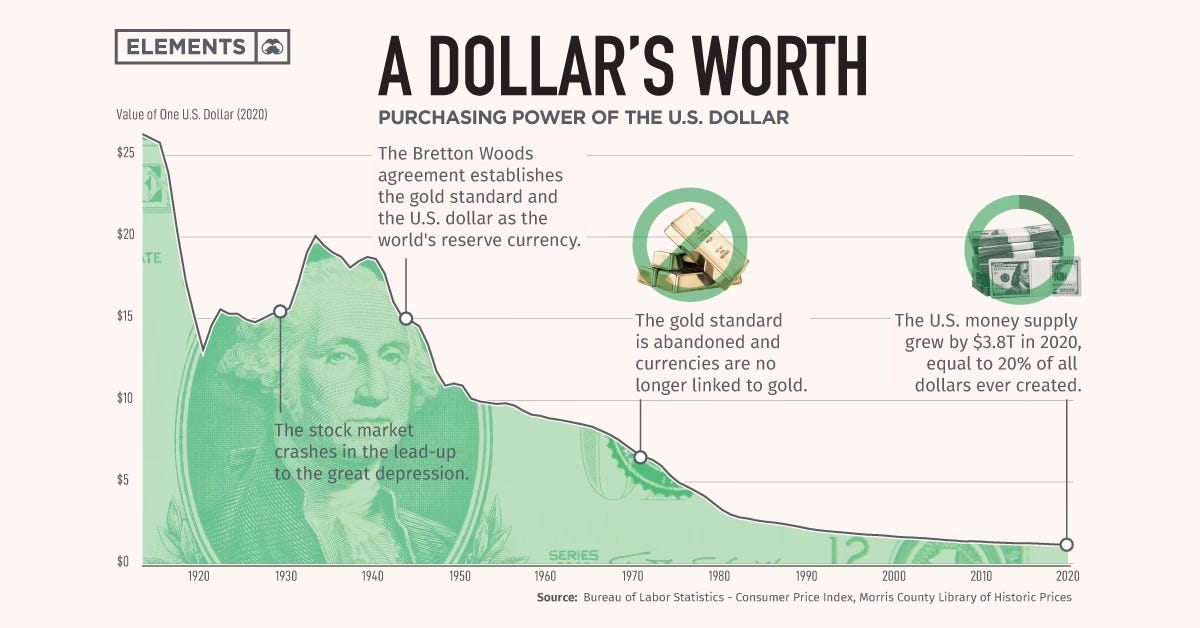

History proves, over a period of time, all fiat currency loses its value, and the US Dollar, like all fiat currencies, is on the brink of collapse. Digital assets (e.g. Cryptocurrency) are taking center stage in the financial world, presenting what might be one of the most profitable & lucrative investment opportunity of our time.

I will share my insights and bold predictions for cryptocurrency, explaining why these digital assets are likely among the best options for transforming your net worth over the next 12 months.

Let's explore how you can leverage these global challenges & unique opportunities to capitalize on the digital revolution.

Fiat currencies eventually fail due to their unlimited printing ability, causing inflation and loss of value as a medium of exchange. The USD is no different, with central banks creating liquidity to finance debts, leading to asset price surges and stagnant wages. This devalues the currency, with the USD losing over 25% of its purchasing power since 2020 and an estimated 99% since 1923.

Less than 3% of USD exists as physical money; 97% is digital. The USD has been the global reserve currency, offering economic advantages but also imposing constraints and systemic risks.

However, the BRICS nations are working on a new currency to challenge the USD's dominance, driven by geopolitical tensions and economic sanctions.

The solution lies in digital assets, such as cryptocurrency.

The Big 3

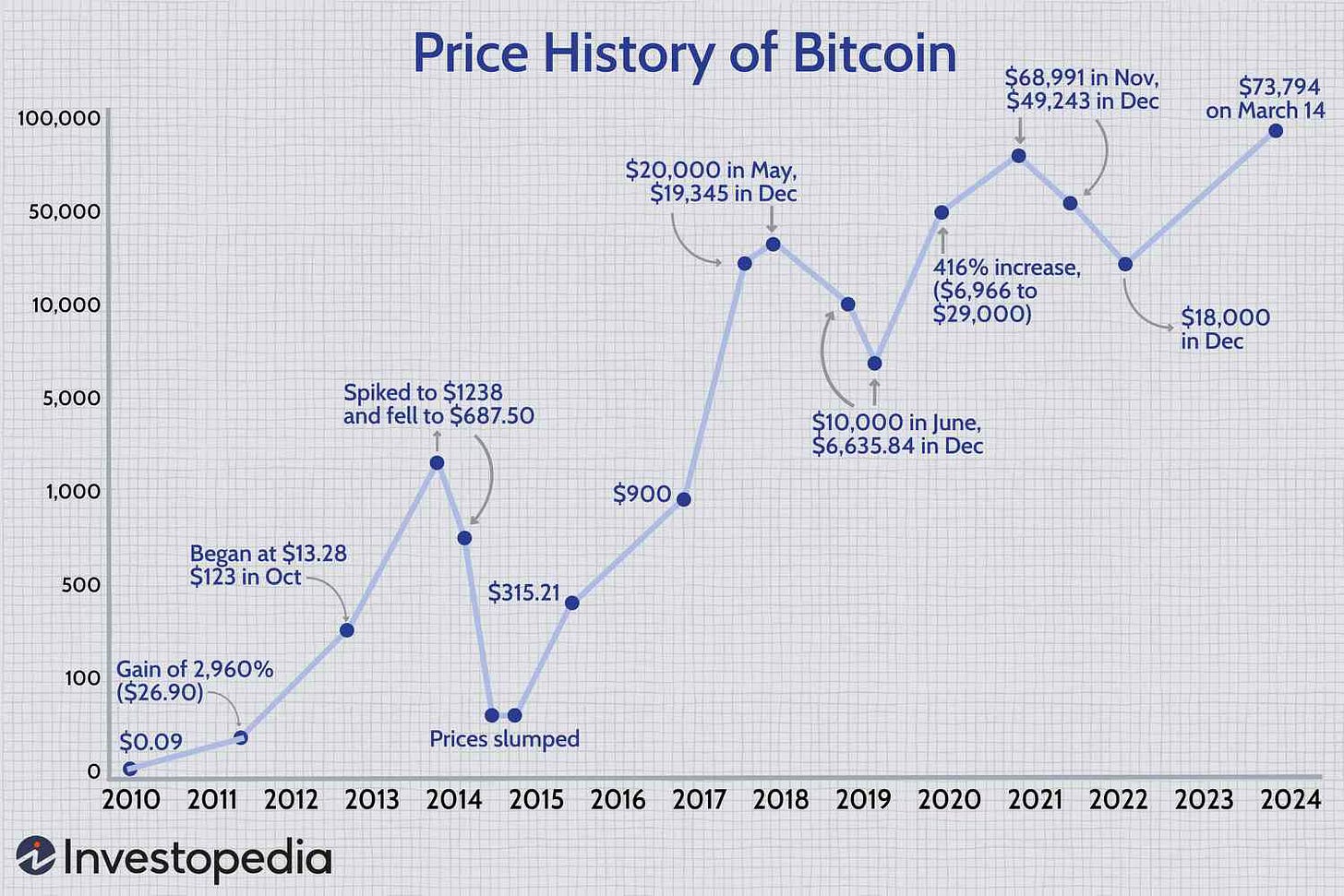

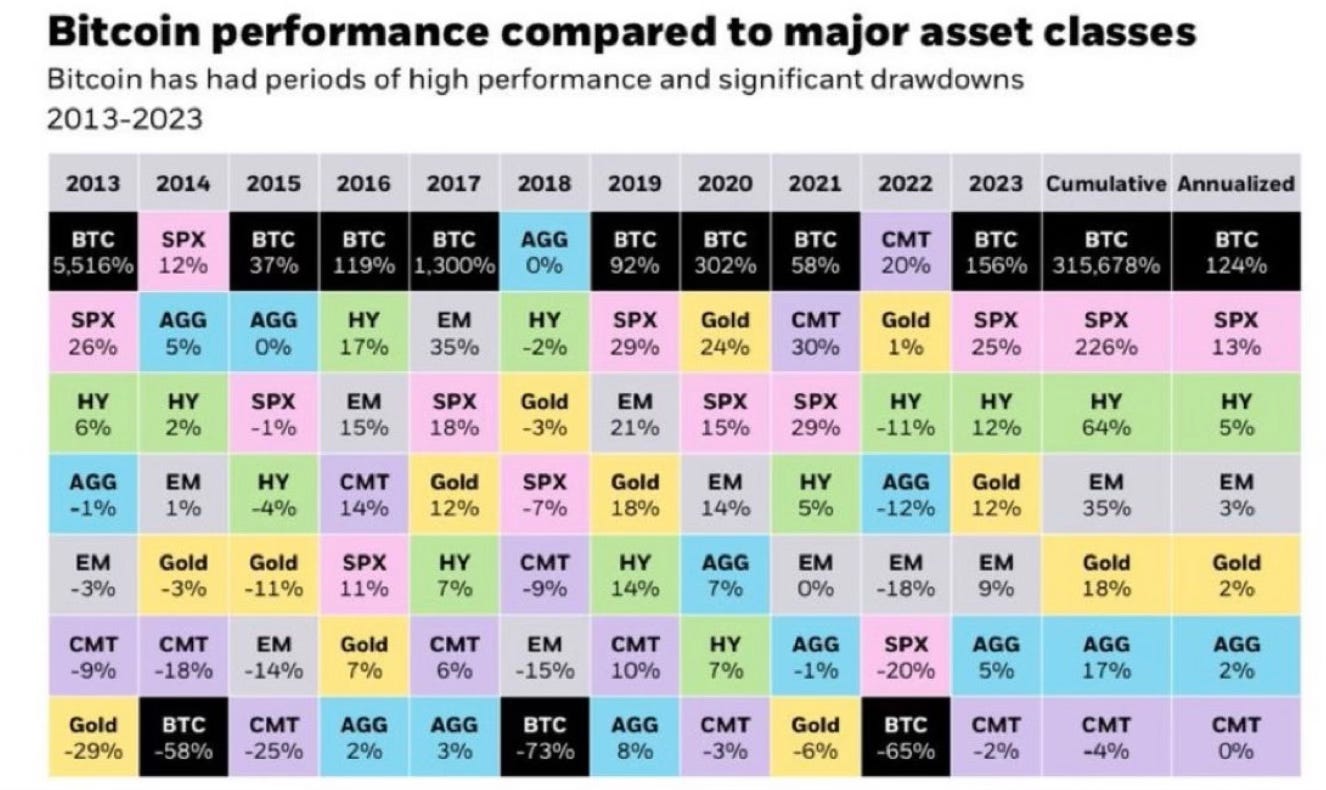

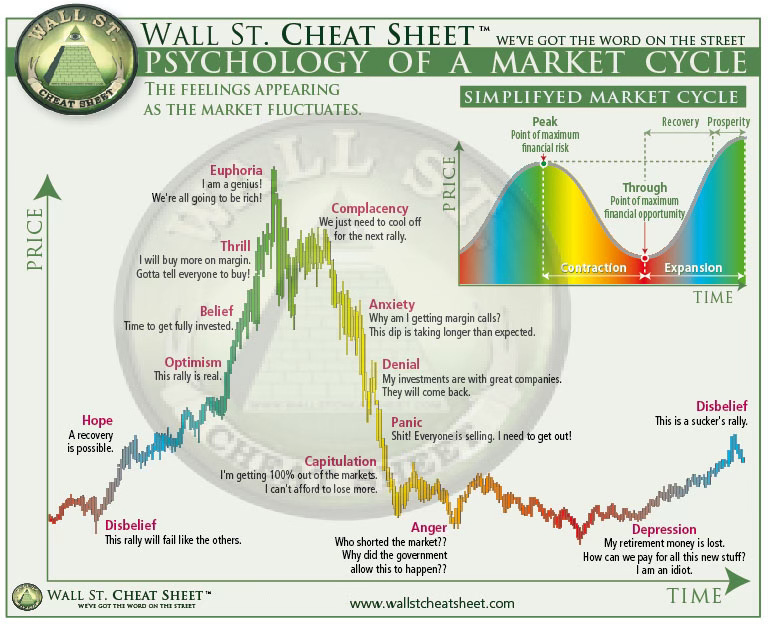

As we move deeper into the cryptocurrency bull run, it’s common to encounter headlines and online commentators, like myself, sharing their opinions, predictions about Bitcoin (BTC) & other alt-coins reaching new all-time highs.

1. Big Events

→ The Politics

→ Halving Cycle

2. Liquidity

→ Global Debt Cycle

→ Interest Rates

3. Adoption

→ Activity

→ Financial ‘Digital’ Revolution

The Politics

Despite his past criticisms, former President Trump has recently shown support for cryptocurrencies, seeing them as a strategic move amid his legal troubles. In contrast, US Senator - Elizabeth Warren has been a vocal critic of cryptocurrencies, consistently emphasizing the need for stringent regulatory frameworks to protect consumers and ensure financial stability.

Trump's recognition of the crypto community's strength contrasts with Yellen's critical stance.

Following Trump's pro-crypto statements, the SEC approved the first spot Ethereum (ETH) ETFs, shortly after approving Bitcoin ETFs.

This milestone allows investors to access Bitcoin and Ethereum through regulated products, potentially increasing their acceptance in traditional markets. Companies like Grayscale, Fidelity, and Bitwise have received approval to list their ETFs. This development coincides with the 2024 US Presidential election, aiming to attract middle-ground voters.

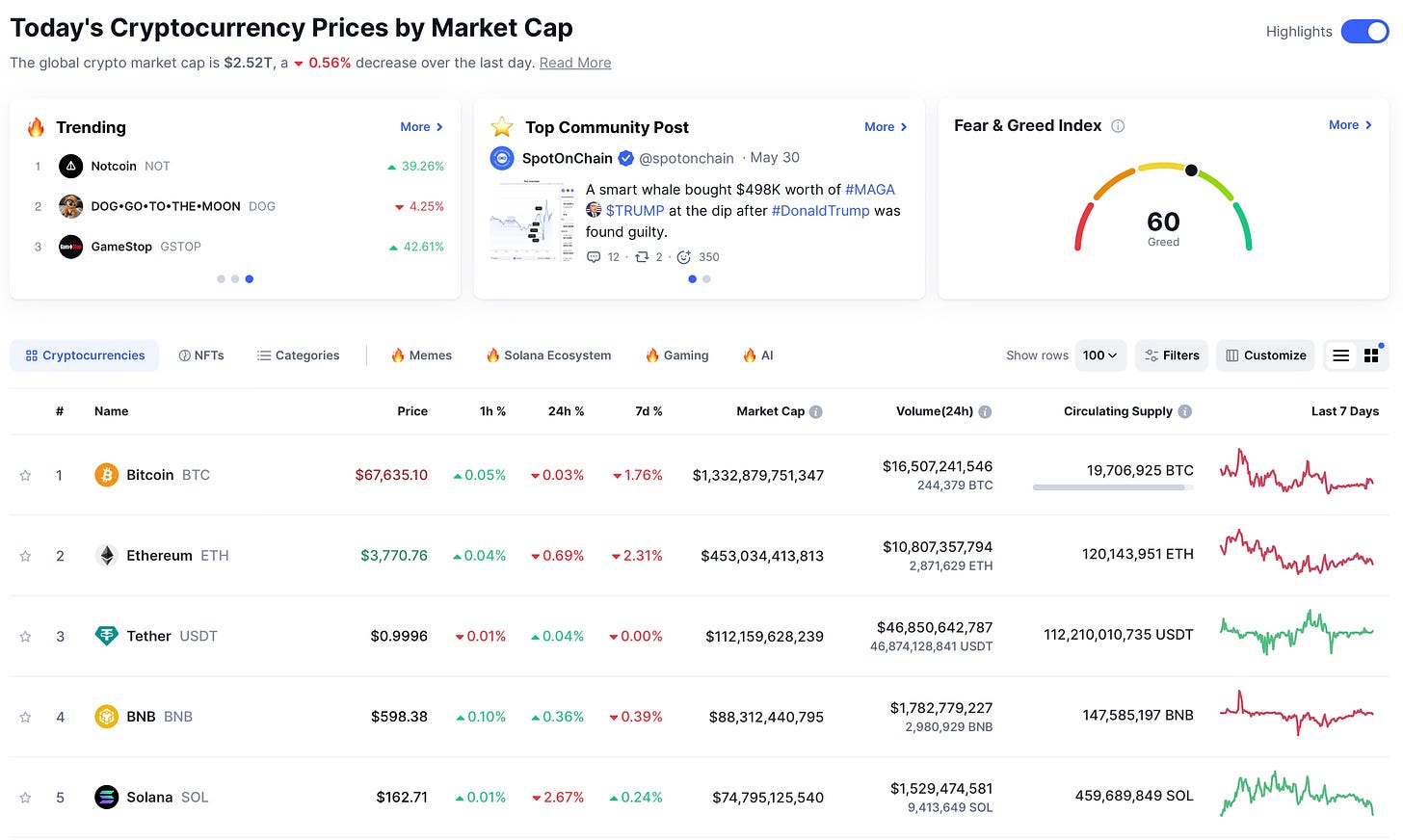

The Crypto Market Cap

The current total cryptocurrency market cap stands at ~$2.52 trillion, with BTC & ETH making up about $1.7 trillion. If analysts' predictions hold true, the ETF-approved funds could boost BTC and ETH prices by over 50%, pushing 1 BTC to over $100K and 1 ETH to above $5,500.

These approvals mark a major advancement for the crypto industry, expanding market access and potentially reshaping the financial landscape.

$10T market cap by EOY 2025 is not unlikely.

The Halving Cycle

Bitcoin has historically surged following its halving events:

On average, Bitcoin increases by ~427% from 30 days before to 180 days after a halving, driven by reduced supply and increased demand. The 4th halving cycle, combined with BTC ETF approvals, could push Bitcoin's price to at least $125,000 by the end of 2025.

Liquidity & Adoption

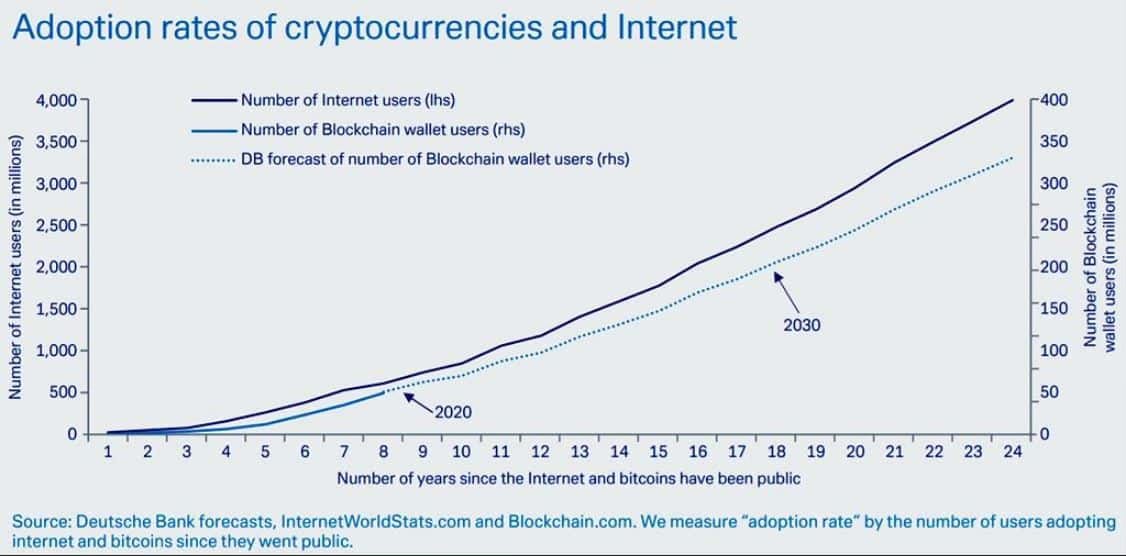

Aside from artificial intelligence, Cryptocurrency is the fastest & most adopted technology in human history.

The Coinbase exchange alone has over 100M accounts. Paying close attention to the wallet activity on the crypto exchanges is a great indicator for growth within the crypto markets.

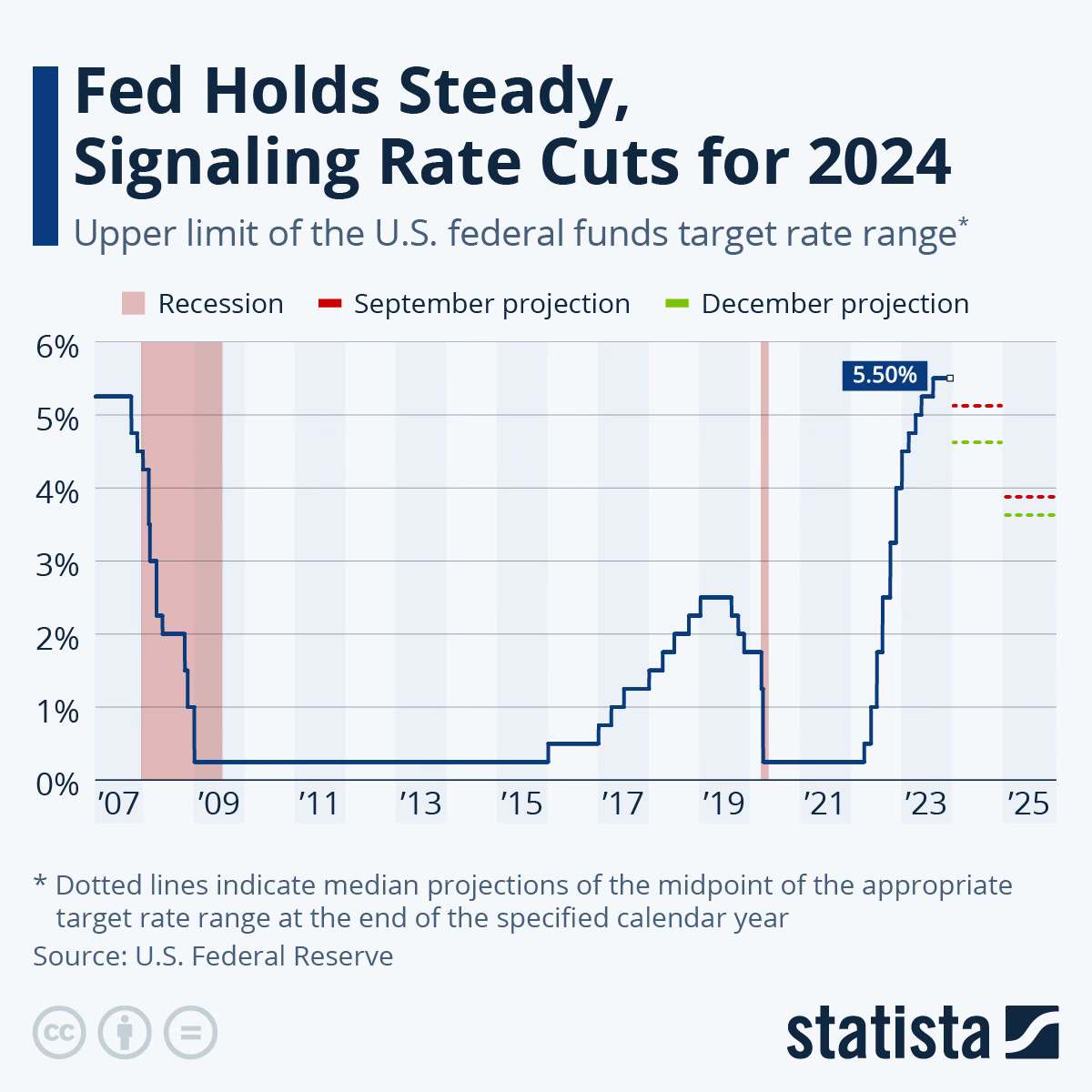

In 2022, the fastest rising interest rates over the past 30 years halted the previous crypto bull run and other asset classes.

Recently, the FEDs committed to drop interest rates in effort to incentivize consumers & institutions to stimulate the market by borrowing more credit (debt) and injecting it into assets.

Percentage of Net Worth Allocated to Crypto Assets

In my personal opinion, not financial advice, I believe the following percentage of one’s net worth into digital assets.

Minimal Risk → 1-5%

Medium Risk → 5-15%

High Risk → 15%+

Crypto Portfolio Allocation

BTC & ETH → 70%

→ It is quite obvious these two are going no where and if you can 2-4X your capital in the coming 6-18 months, rather conservatively, then it is a no brainer IMO.BTC: $125,000.00

ETH: $15,000.00

Mid-Cap → 25%

→ project/coins with market cap between $1 billion to $10 billion$SOL (Solana): $500

$KAS (Kaspa): $1

$AR (Arweave): $200

Small-Cap → 5%

→ project/coins with market cap less than $1 billion. Personally, I believe some allocation towards small-cap and meme coins can be a game changer, if profits are taken of course.

→ Here are some bold picks:$Brett on Base: $1.00 (5-10X)

$Andy on ETH: $0.10 (5-10X)

Ahh, meme coins, what a time to be alive.DO YOUR OWN RESEARCH - THIS IS NOT FINANCIAL ADVICE!

Price target predictions are projected by EOY 2025. You can find projects on CoinGecko or CoinMarketCap.

All in all, I believe “Tokenization” will be arguably the most innovative aspect of digital assets, meaning all Asset classes will become Digital.

Also, “Artificial Intelligence” and “Gaming” type projects will likely be a big contributor to this crypto bull run cycle.

Pay attention to ‘smart’ money, as they scoop up the 1st ever scarce asset in human history — Bitcoin.

You never go broke taking profits.

PS - if you enjoyed this, please share with someone you love and want to win in this crypto cycle. :)

Text Me your crypto picks!

+1 (614)-660-5921