Trump: Pump or Dump in the Markets?

Weekly Market Insights: Stay Ahead of the Curve | [01/17/2025]

When you hit the panic button, it really shows where your weak spots are.

Poppy agrees that the same holds true for your portfolio. As fear creeps into the markets, the rush to sell off can be overwhelming. This natural reaction can make you doubt your own investments and let emotions—the main reason for financial wins or losses—push you to sell at low points rather than high.

Just like we talked about this past Monday, we were bracing for some likely rough waters this week. A lot of this is down to a few key things: the latest PPI and CPI reports, a strong USD that’s been boosting Treasury Yields, and the upcoming Trump inauguration.

So, what’s next?

Today's Agenda:

Trump Inauguration: Pump or Dump?

Dive into Poppy’s forecasts and strategies for Q1 2025. We're tackling the big question: what's next for the markets following the inauguration?

Poppy’s Portfolio: Top 10 Crypto Watchlist (Q1 2025)

Now's the ideal time for tweaks. Recent market swings might've shown some cracks in your strategy or mindset. Worried it's too late to adjust? Think again.

1. Trump Inauguration: Pump or Dump?

Love him or hate him, let's stick to the facts. Trump has consistently supported the cryptocurrency sector, appointing "crypto-friendly" advisors throughout his campaign and presidency. It boils down to two main factors: Regulation & Institutions.

There’s buzz from Poppy’s sources close to Trump’s administration that he plans to sign a crypto-focused executive order on his first day back in office. With Mr. Burns, oops! I mean, Gary Gensler stepping down as SEC Chairman, we can now expect clarity in crypto regulations moving forward.

In December 2024, Trump announced his pick for the next SEC head: Paul Atkins, a former commissioner known for his pro-business approach and current CEO of consulting firm Patomak Global Partners, a firm with ties to the financial and crypto industries.

Additionally, David Sacks, the new crypto czar, brings significant tech and venture capital experience to the table. His expertise could greatly influence favorable crypto regulations, potentially spurring significant industry growth.

So, what’s the verdict?

Poppy predicts a Trump Pump!

Institutions

Poppy assumes Trump will pressure the Feds & Jerome Powell to cut interest rates and start the money printing press.

Why?

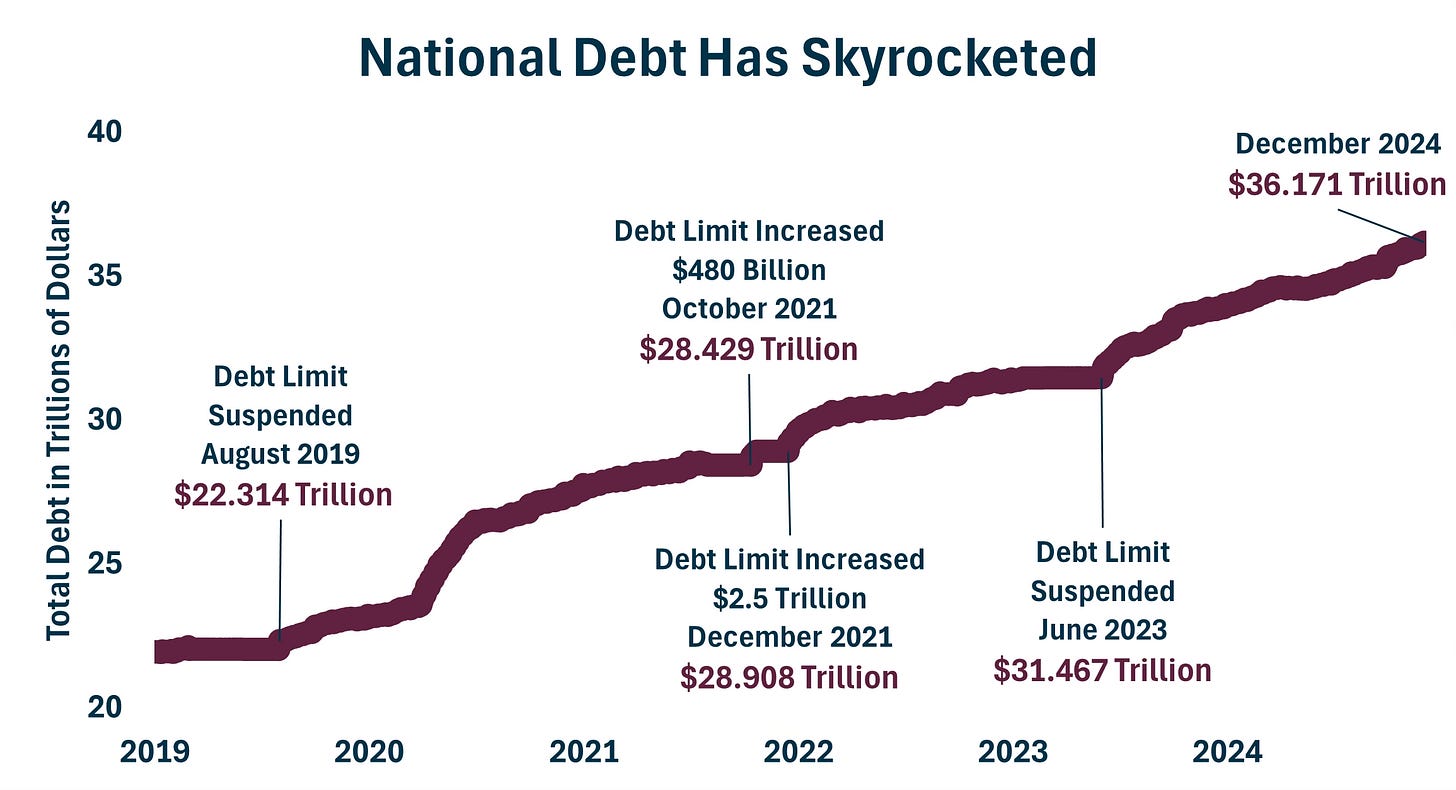

The U.S. has big debts maturing soon and if interest rates remain high, it could become nearly impossible to pay back or refinance this mountain of debt.

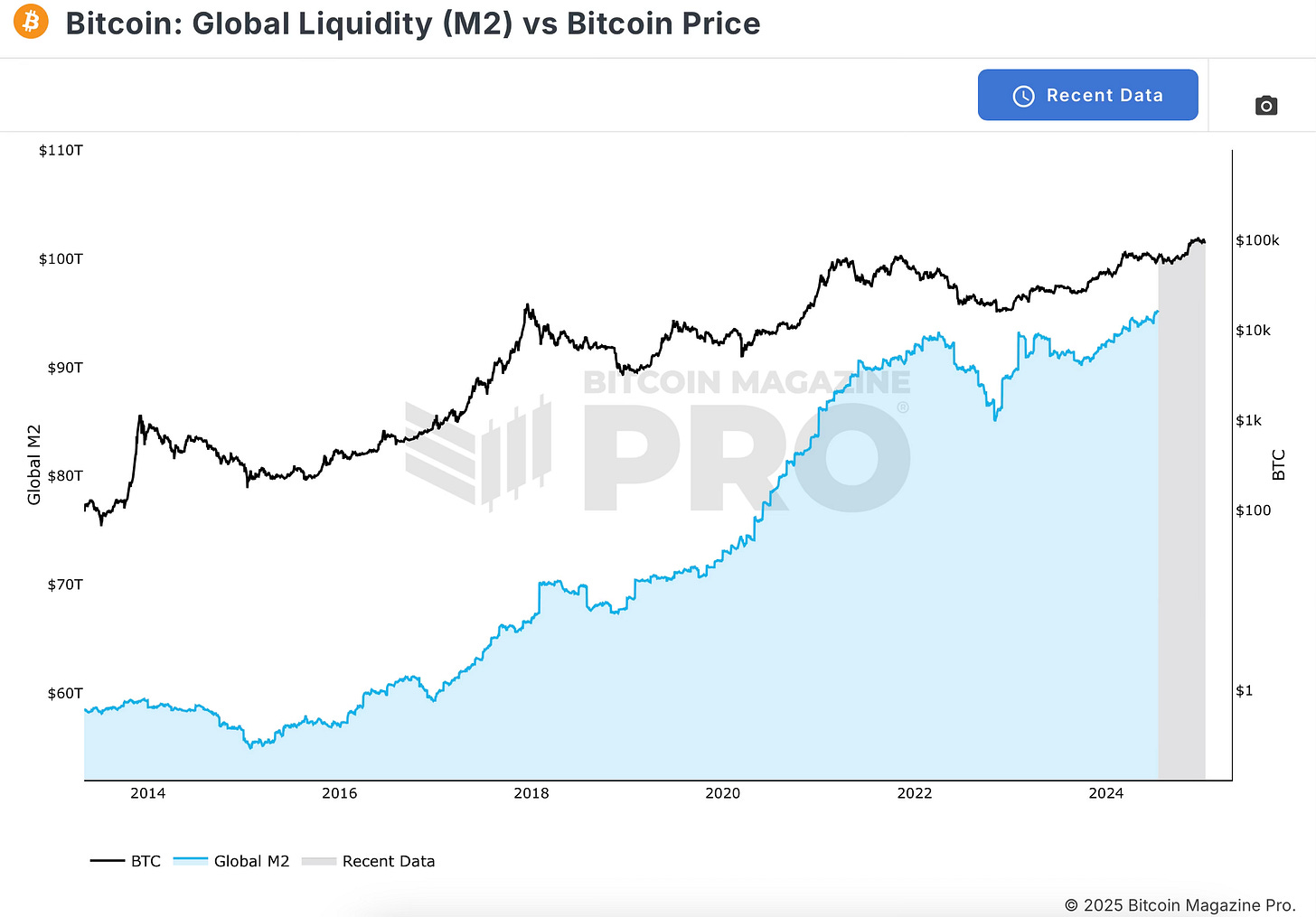

If the dollar stays strong along with higher-than-expected inflation CPI Report on Friday—ideally, we are at or below the 2.9% target—we could face a severe global liquidity crunch (M2).

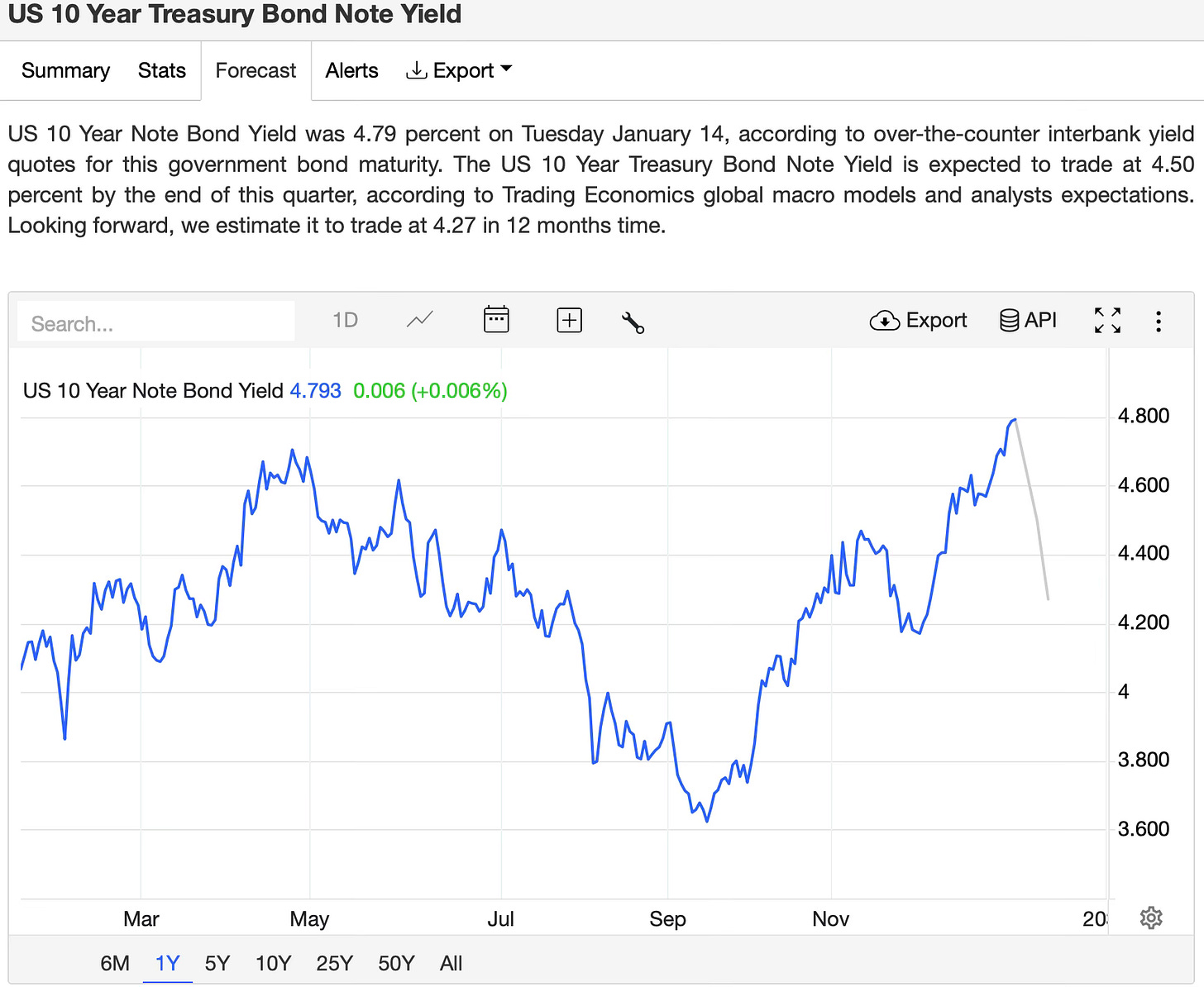

This scenario could deter money from moving into volatile type assets—Bitcoin and crypto, as people might prefer the safety of holding USD or Treasury Bills, which are yielding nearly 5%.

Although the US 10 Year Treasure Bond Note Yield remains strong, it is a matter of time for it to reverse, which reflects in the forecast below:

PRINT FOR THE PUMP, TRUMP!

Despite these hurdles, Poppy remains optimistic about crypto, predicting the total market cap will soar past $5 trillion by the end of Q1, currently just over $3 trillion.

More global liquidity = Higher BTC prices.

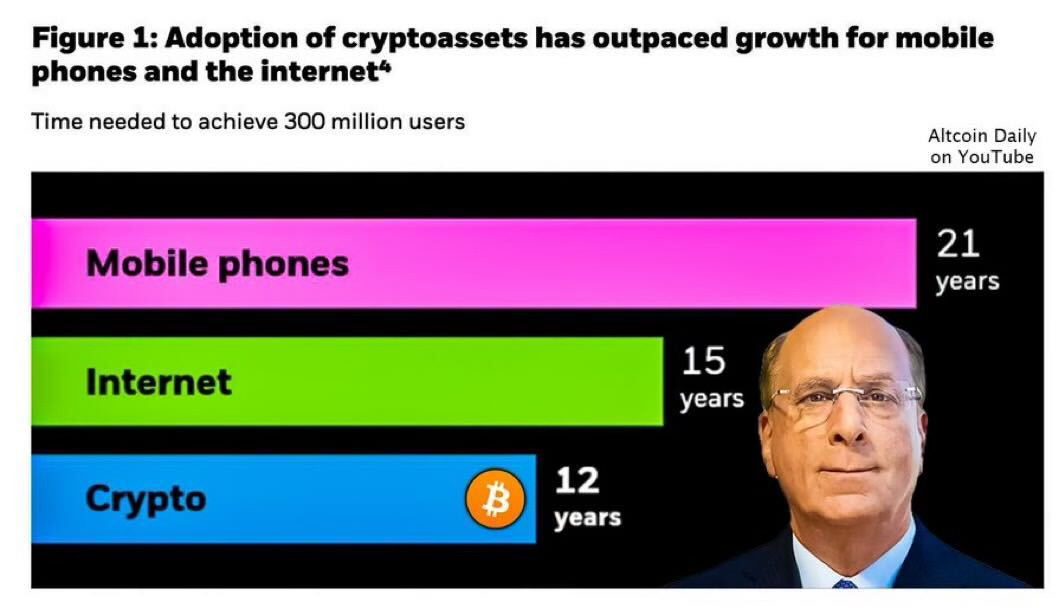

So, what's going to drive nearly double that capital into crypto? Big institutional money—that's what.

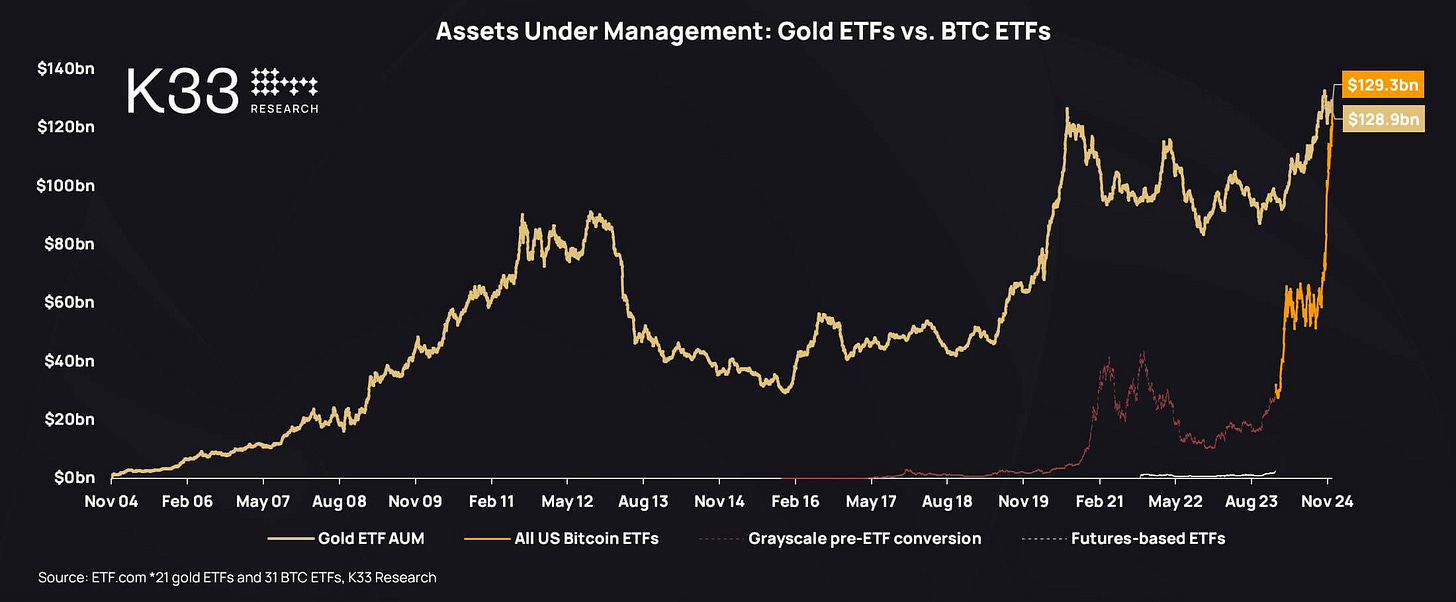

And speaking of significant moves, Bitcoin exchange-traded funds (ETFs) in the United States have now eclipsed gold ETFs in total assets, achieving this feat in less than a year of their launch.

The best time to invest was yesterday. The 2nd best time is now.

Poppy would not be shocked if additional ETFs are approved this year: SOL & XRP in particular.

How much can we anticipate to flood into crypto from institutional adoption in 2025 alone? Time will tell.

👑 America — the world capital for crypto & Bitcoin 👑

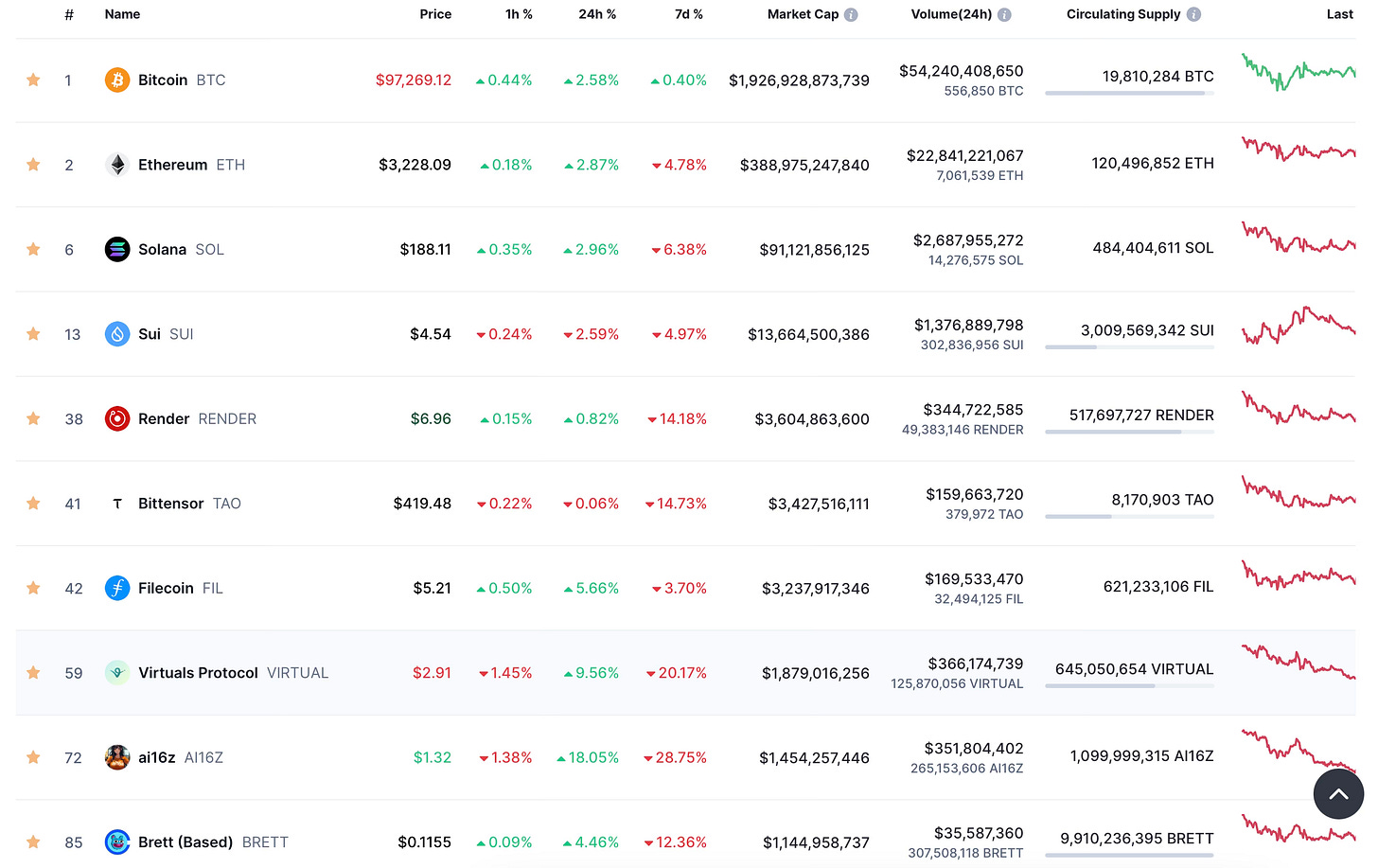

2. Poppy’s Portfolio: Top 10 Crypto Watchlist (Q1 2025)

🚀 Once we see ETH begin to outperform Bitcoin, expect alt coin season to begin!

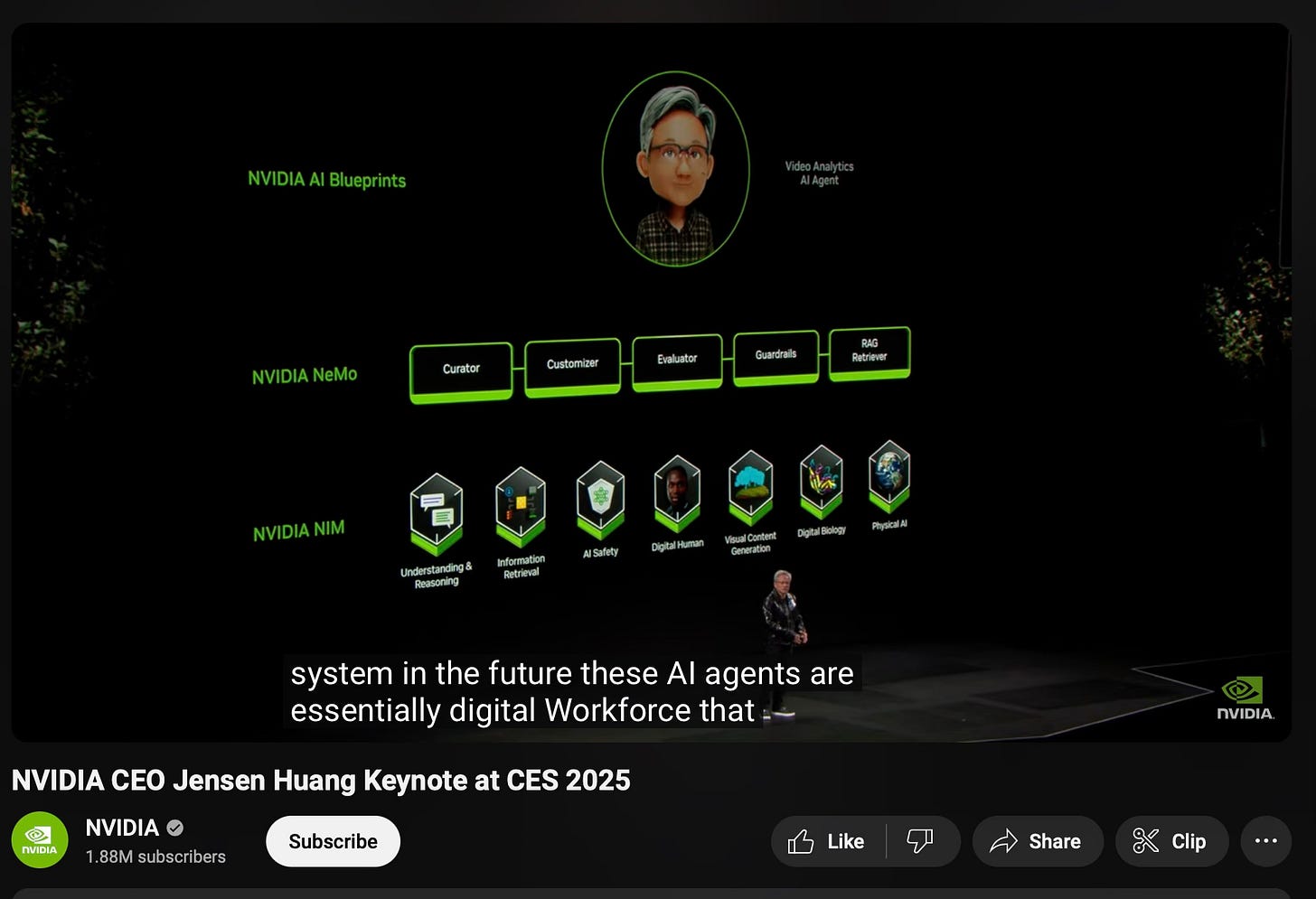

💡 Remember Poppy’s heads-up in previous Substack posts? His take hasn’t changed—the big story in crypto is all about Artificial Intelligence and AI Agents. If you missed it, [Click Here] to check out his earlier posts to see the full list of crypto AI Agent projects. Many of Poppy’s Pals have already seen their investments double or even triple in just a few weeks!

🎤 To back this up, at the CES 2025 keynote, Nvidia CEO Jensen Huang called AI Agents "a multi trillion-dollar opportunity."

Huang went on to claim these AI Agents will be working right alongside your human workforce.

[Click Here] to listen to the full keynote speech (~36 mins on AI agents)

Verse and Passage of the Week: "I have told you these things, so that in me you may have peace. In this world you will have trouble. But take heart! I have overcome the world." – John 16:33

Reflection: In the ebbs and flows of the financial markets, it's easy to feel overwhelmed by the waves of uncertainty and change. This week's verse reminds us that turbulence is a part of our world, yet it also reassures us of the enduring peace and victory we can find through faith. Just as the markets fluctuate, so do the circumstances of our lives. However, with each challenge comes an opportunity to strengthen our resilience and renew our hope. Let this message inspire you to remain focused and optimistic, no matter the market's motion.

Become Poppy’s Pal?

📚 Craving more? For less than the cost of your daily coffee run, you can access Poppy's full library of resources, guides and more.

This is just the beginning :)

→ Become Poppy’s Pal and dive deeper with us at The Poppy Report!