The stage has been set, so let’s play a game.

The reason so many people get caught in the crosshairs of the IRS isn’t because they intentionally wanted to commit fraud, it’s often due to the law being deliberately vague.

Words like “willful,” “aiding,” or “causing” sound simple & straightforward, right? Not the case because legally, they’re wide open to interpretation. Let’s say if you signed a tax return or were considered ‘involved’ in preparing one at all, prosecutors can twist it into intent.

And if the IRS or DOJ wants to build a broader narrative — wire fraud, conspiracy, etc — they’ll stretch your negligence, delegation, or even the trust you had in your professionals into criminal liability.

It’s not a bug in the system. It’s the design of it.

Because in this system, the complexity is the weapon & you’re the easiest target.

You hire a tax professionals & many other licensed advisors & counsel.

You pay them hundreds of thousands of dollars to stay compliant.

They guide the filings, prepare the reports, sign off on the strategy.

& somehow, you’re the one who can still be at fault & end up with the felony charge.

There are over 80,000 pages of U.S. tax code — more than most people will read in a lifetime. But none of that complexity seems to protect you. Instead, its complexity seems to trap you in a web of plausible deniability... for everyone except the taxpayer.

“Our tax system is a disgrace to the human race.”

— Fred Goldberg, Former IRS Commissioner

Let this sink in:

The IRS Criminal Division has a 90%+ conviction rate once they open a case.

They don’t need to prove fraud — only that you should have known what someone else did “on your behalf” or “advise” you to do.

The more complex your finances, the easier it is for them to build a narrative around guilt.

This is not about tax mitigation or strategy anymore — this is about self-preservation in a system that’s weaponized ambiguity.

Now, as Trump’s One Big Beautiful Bill Act makes its way through Congress, the rules are shifting again — on paper, they say it’s about lower taxes and business growth. But underneath, there are new traps, vague language, and political incentives baked into every deduction.

Because the same people who write the laws, (usually) the same ones to break them... then come after you for the fine print.

Let’s break it down.

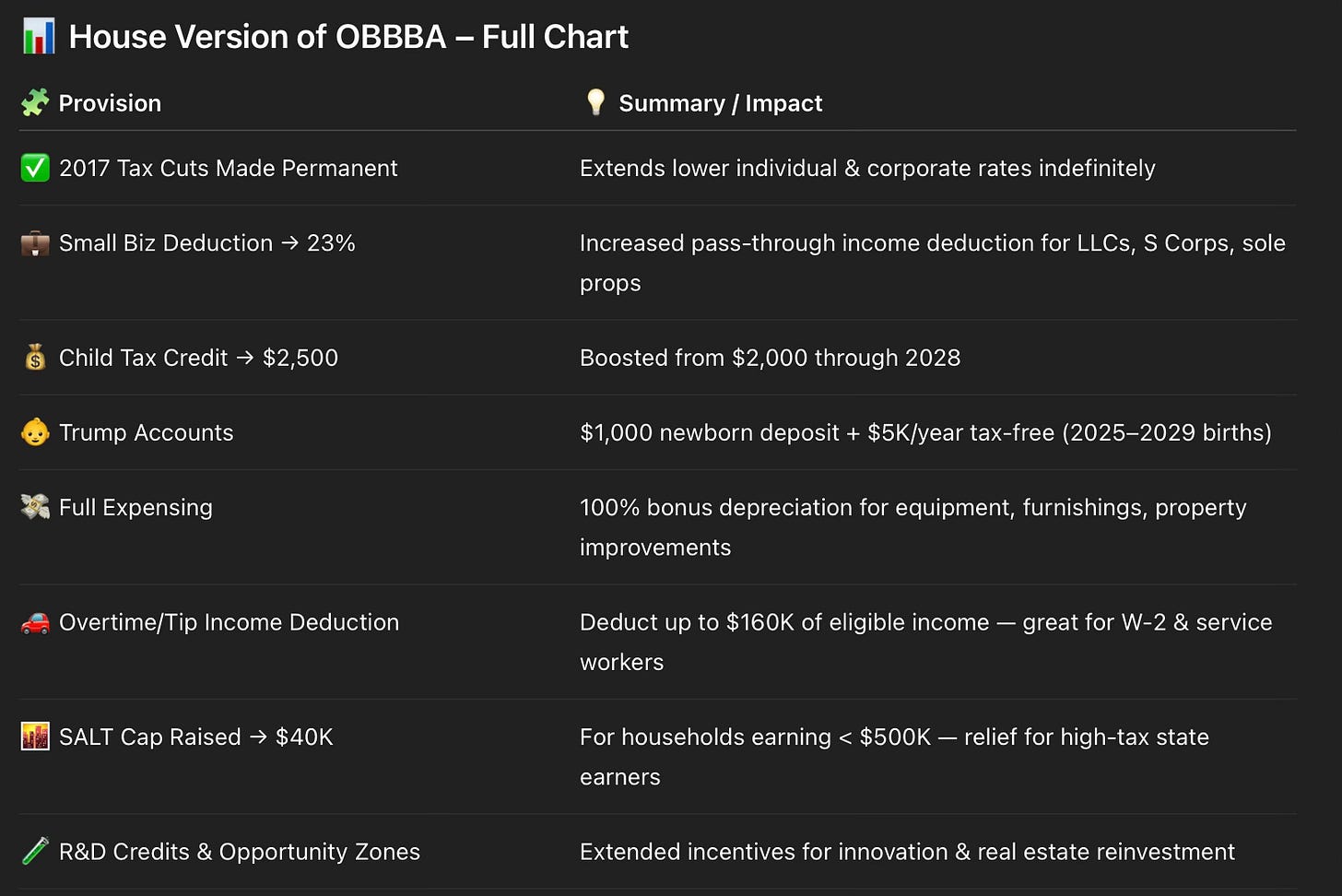

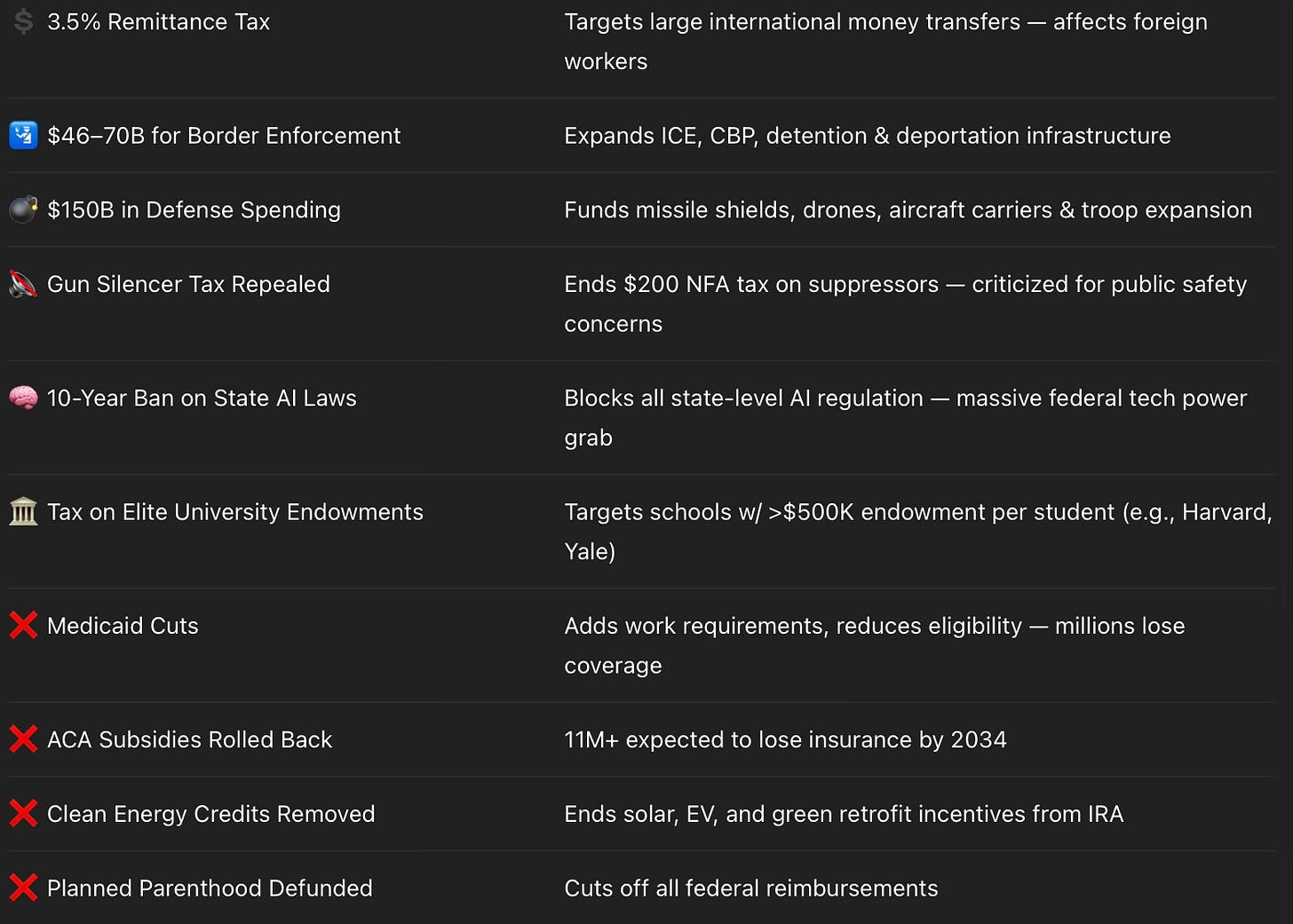

🧾 What’s in Trump’s Tax Bill (House Version)

The House passed OBBBA on May 22, 2025 → a blend of tax cuts, incentives, & rollbacks.

Here's the full breakdown:

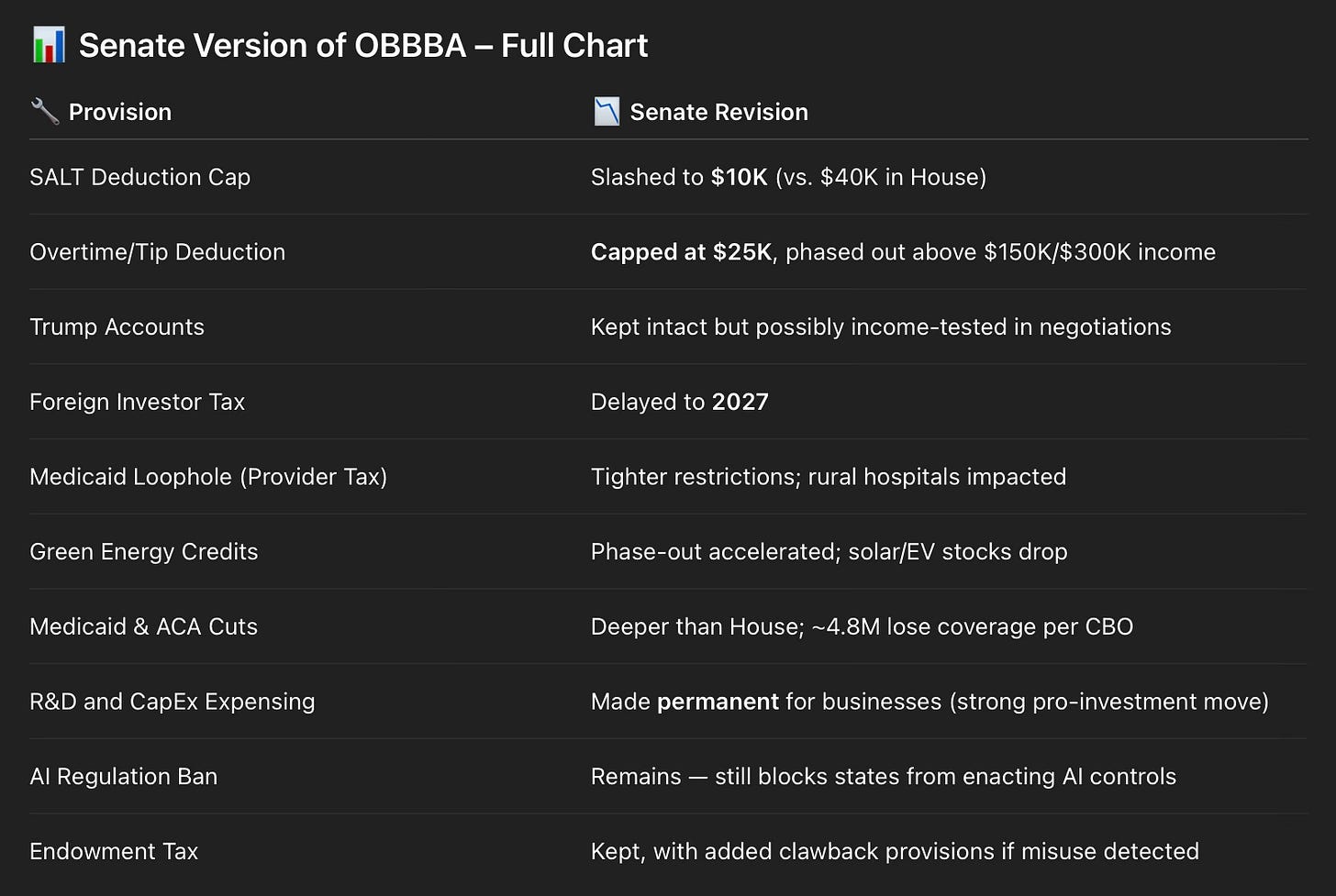

🏛 Senate Version — What's Changing?

The Senate released a more conservative, budget-conscious version on June 16 (as I am writing this).

Some provisions were walked back, others made more severe:

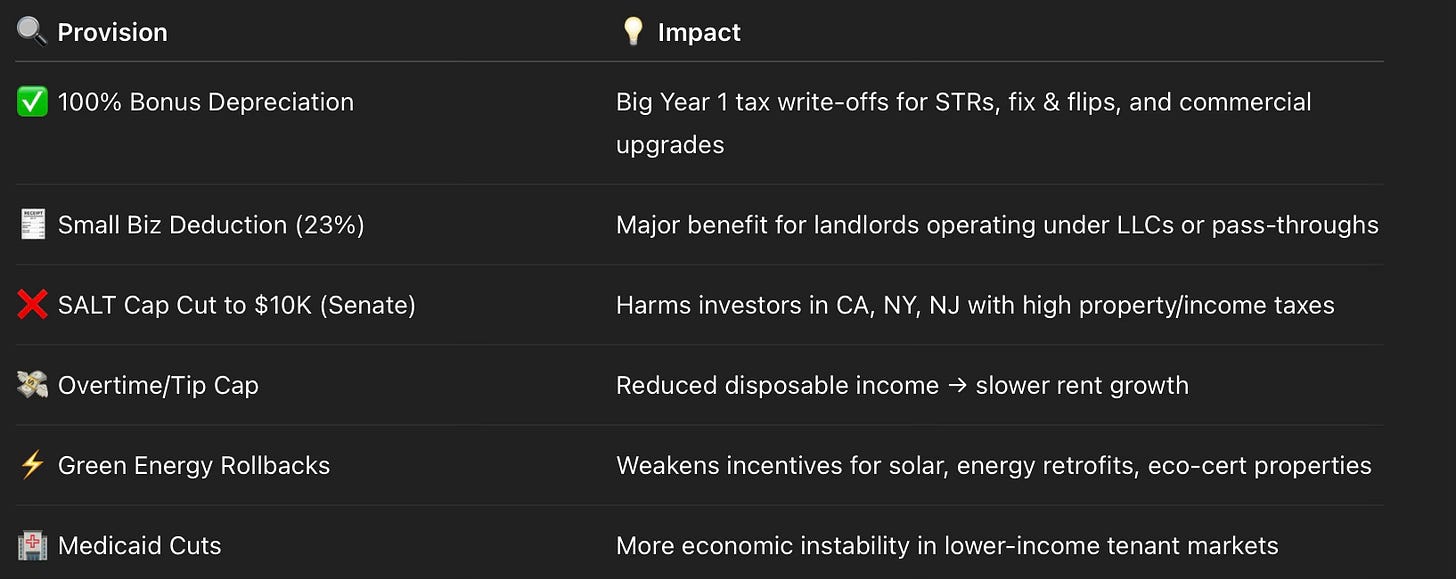

🏘️ Real Estate & Investor Summary

Trump’s bill is both generous & some could consider dangerous for investors. It offers large deductions, but paired with market volatility & social cuts that impact long-term demand.

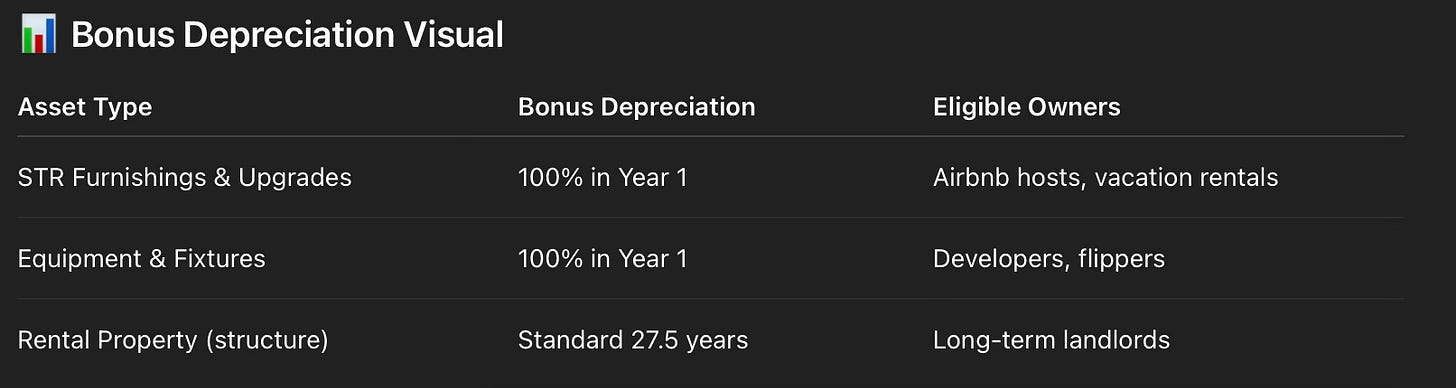

💰 Bonus Depreciation 💰

This was by far one of the most powerful tax advantages from Trump’s first term & under the new bill, it would be extended.

Let’s say you spend $50,000 on short-term rental (STR) upgrades (furnishings, appliances, HVAC, etc.) & operate under a Schedule C or LLC:

→ You can deduct the full $50,000 in Year 1

→ At a 37% tax bracket, that’s an immediate $18,500 in tax savings

This strategy is a game-changer for Airbnb operators & for those qualified under the IRS rules of filing as a real estate investing professional, along with some other unique scenarios.

Consult your own counsel silly 😉

What Gets Cut & Who Pays for It?

While the headlines focus on tax cuts & investment incentives, the reality underneath is far more sobering. To fund these benefits, the bill aggressively slashes key social programs, affecting millions of Americans in the process.

⚙️ Economic Engineering

This isn’t just tax policy, it feels like reengineering that shifts wealth up the ladder while removing critical safety nets at the bottom.

🚨 1 Final Alarm: AI Regulation Freeze

One of the most quietly dangerous provisions in this bill?

😳 It blocks all state-level regulation of AI for the next 10 years.

That means no matter how advanced, biased, or intrusive AI becomes — whether it’s used in:

Hiring decisions

Facial recognition

Mass surveillance

Predictive policing

Social credit-style scoring systems

Your state won’t be allowed to intervene.

Big Tech will have a full decade to innovate, deploy, and profit — without oversight, transparency, or accountability.

That’s not just deregulation.

That’s legislative surrender.

Whether you're a business owner, investor, or everyday American, understanding how this system is being shaped isn’t optional anymore — it’s survival.

📖 Bible Verse

“Woe to those who make unjust laws, to those who issue oppressive decrees, to deprive the poor of their rights and withhold justice from the oppressed.”

— Isaiah 10:1–2

Reflection: This verse is a sobering reminder that systems built on confusion, manipulation, and oppression are nothing new. Even in ancient times, people were exploited by unjust laws designed to serve the powerful and punish the unaware. It’s a call for discernment — to not just follow blindly, but to seek truth and protect justice, especially when the rules are designed to entrap.