It’s the fire that forges.

The deepest trials become the greatest teachers—while critics spectate, never risk, and never build, the faithful endure, create, help, and multiply.

The Oracle of Omaha 🐐

Every generation crowns its own investing GOAT.

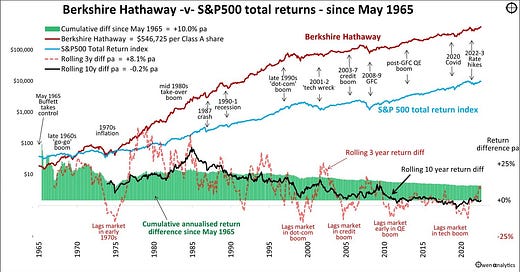

For the 20th century, that icon is Warren Buffett, the Oracle of Omaha, whose unparalleled track record with Berkshire Hathaway has set the gold standard for investors worldwide.

Since taking the reins of a struggling textile company in 1965, Buffett has delivered a staggering 5,502,284% return for Berkshire Hathaway shareholders, transforming it into a $1 trillion conglomerate.

To put this in perspective, from 1965 to 2024, Berkshire’s stock soared while the S&P 500, including dividends, returned a comparatively modest 39,054%. Buffett’s compound annual growth rate of 19.9% nearly doubled the S&P 500’s 10.4%, showcasing his extraordinary ability to outpace the market over six decades.

Buffett’s value investing philosophy—snapping up undervalued, cash-generating businesses—remains a masterclass in patience, discipline, and foresight, cementing his legacy as the greatest investor of all time.

What if I told you there’s a new GOAT on the horizon?

While Buffett mastered the art of traditional investing, a bold visionary is emerging to dominate the 21st century, harnessing the power of digital assets to rewrite the rules of wealth creation.

📈 From Software to Satoshi

Michael Saylor, the founder and Executive Chairman of MicroStrategy (recent rebranded as Strategy), took an enterprise software company & turned it into a Bitcoin holding juggernaut.

Since 2020, he’s executed one of the boldest capital allocation strategies in modern history:

Accumulated 555,000+ Bitcoin (as of May 2025) worth over $57.11 Billion. Go check out the → Saylor Tracker ← 👀

Leveraged convertible debt, equity, and strategic financing

Rebranded the company from a tech firm to a Bitcoin development and holding company

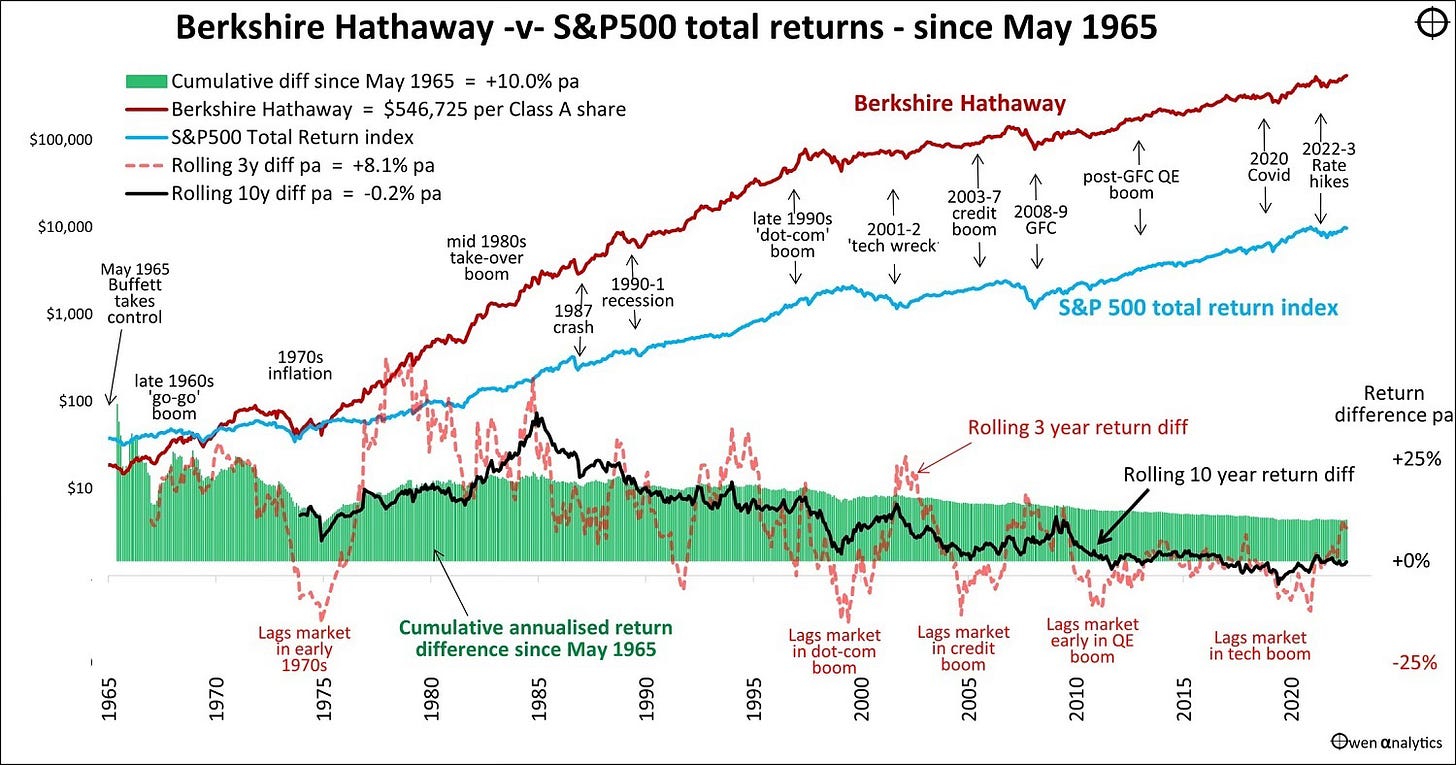

Turned MSTR into a proxy Bitcoin ETF—one that outperformed most tech stocks, including Apple and Nvidia during multiple cycles

The result?

Strategy’s stock has surged 2,295% since August 2020, dwarfing Berkshire Hathaway’s 36% gain in the same period. For context, this performance outpaces even Bitcoin’s own 1,000% growth and the S&P 500’s 71.31% risesince Strategy’s first Bitcoin purchase.

Strategy stock has become the ultimate Trojan horse for Bitcoin exposure, and Saylor is publicly encouraging other CEOs to follow suit. He’s even pitched it to Microsoft, stating that any company holding excessive cash and strong equity has a fiduciary opportunity to transform their balance sheet.

21/21 Plan ₿

Saylor’s strategy is a masterstroke of financial engineering. By issuing convertible debt and equity—referred to as the “21/21 Plan” to raise capital over three years—Strategy has created a self-sustaining cycle of Bitcoin accumulation.

This approach has turned Strategy into a leveraged Bitcoin powerhouse, with daily trading volumes rivaling the Magnificent 7 tech giants (Meta, Apple, Alphabet, Microsoft, Amazon, Tesla, and Nvidia) despite its modest $496 million annual revenue. Saylor’s mantra, “cash is trash,” reflects his belief that fiat currencies are devalued by inflation, while Bitcoin is a scarce, appreciating asset poised to dominate the digital age.

🏈 The Saylor Playbook

Imitation is the sincerest form of flattery—and Michael Saylor’s blueprint is going global.

By using corporate balance sheets, convertible debt, and equity to buy Bitcoin, Saylor transformed Strategy into a Bitcoin buying machine. Others are following fast:

🇯🇵 Metaplanet adopted Bitcoin as a reserve asset (May 2024)

💼 Solidon committed 60% of excess cash to Bitcoin (Jan 2025)

⚡ MARA, Riot, Bitdeer issued billions in convertible bonds to stack BTC

🧱 Block (8,027 BTC) and Tesla (10,000 BTC) are already on board

🏢 Microsoft—with $80B in cash—was pitched by Saylor to allocate just 5% to Bitcoin

The Financial Accounting Standards Board (FASB)’s January 2025 rule, allowing mark-to-market accounting for crypto holdings, has supercharged this trend.

Companies can now report Bitcoin’s gains, making it a compelling asset. This could propel Strategy into the S&P 500, triggering passive fund buying and boosting its stock, which has already soared 515% year-to-date in 2025.

Secret Sauce 🤌🏽

The table below illustrates how Michael Saylor’s Strategy leverages convertible debt to fuel its Bitcoin acquisition strategy, using the $2 billion zero-coupon convertible bond issued in February 2025 as a case study.

🌊 Trillion-Dollar Ripple Effect

The paradigm shift begins…

📈 Stock Valuations

• Bitcoin-holding companies will see share prices surge

• “Bitcoin yield” may emerge as a key financial metric, as seen in Strategy’s meteoric rise

🪙 Bitcoin Price Surge

• Institutional buying will trigger a supply shock

• Bitcoin’s fixed 21M supply creates explosive upside potential

🏦 Financial Innovation

• Expect Bitcoin-backed bonds, ETFs, and DeFi platforms

• Banks like Bank of America may offer BTC custody and lending

• Fintechs will create tokenized stock-BTC hybrids and crypto notes

🌐 Economic Shift

• Trillions flowing into digital assets will reshape global markets

• Bitcoin could become a core settlement layer for AI-driven economies

🚀 Corporate Adoption is Just Beginning

• Apple and Google could allocate 5–10% of their cash reserves to BTC

• Startups may issue equity or debt to acquire Bitcoin

• Private equity will tokenize funds and deploy crypto capital

• Pension funds and governments may follow—or be forced to

Saylor predicts, this could spark a $250 trillion digital asset boom by 2045.

Bitcoin: THE Greatest (Asset) of All Time 🌰

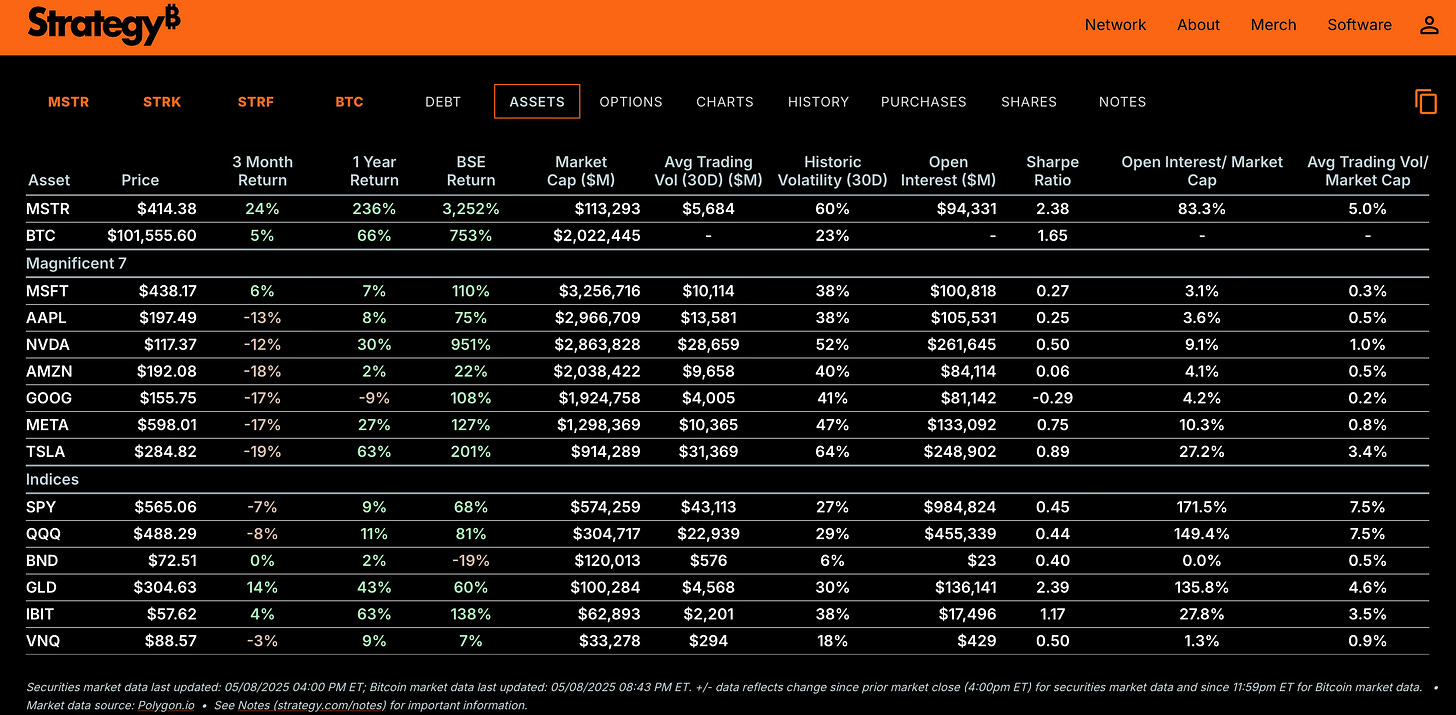

Bitcoin’s Performance Highlights

Since Inception (2009–2025):

🚀 Price Surge: From ~$0 to ~$109,000, yielding a multi-million percent return.

📈 CAGR: ~98.6% over 13 years, unmatched by any asset class.

Past 10 Years (2015–2025):

📈 Price Growth: From ~$230 to ~$109,000

💰 Returns: ~44,500% total gain (~60% annualized)

📊 Outperformance:

Gold: ~40% (~4% annualized)

S&P 500: ~160%

Nasdaq: ~300%

✅ Why Bitcoin Excels

🌍 Unrivaled Returns: Multi-million percent gains since 2009 make it the best-performing asset ever.

⚖️ Risk-Adjusted: Sharpe ratio ~0.82, balancing high volatility (std. dev. ~152%) with exceptional returns.

→ Recent Performance:

5-Day: +6.12%

1-Month: +22.79%

3-Month: +7.50%

1-Year: +69.78%

♟️ 4D Chess

There are no coincidences. Michael Saylor—an MIT-trained rocket scientist with highest honors in aeronautics—doesn’t just believe in Bitcoin, he’s architecting a new financial paradigm around it. He calls Bitcoin “digital energy,” a mathematically perfect asset.

In 2020, while most doubted, Saylor bet the future of Strategy on Bitcoin. Today, that decision mirrors the kind of legendary, contrarian conviction Warren Buffett was known for. His mantra?

“You don’t sell your Bitcoin; you borrow against it.”

Saylor urges us to upgrade our balance sheets with digital assets and play the long game. And while I’m not a rocket scientist (shocking, I know), I think it’s safe to say:

Bitcoin is going to the moon. 🌕

🚀 Seize the Digital Wealth Revolution

Don’t wanna miss the rocket ship? My consulting services are built to help you thrive in this new digital era:

• Eliminate High-Interest Debt

Secure funding to crush bad debt and free up capital for higher-return assets like Bitcoin.

• Launch or Scale Your Venture

Get access to capital and proven strategies to grow your business in the evolving digital economy.

• Tailored Wealth Strategies

1-on-1 consulting to align your personal, professional, and financial goals with the rise of digital assets.

👉 Schedule your free consultation today or email me directly at info@tylerbossetti.com

Don’t just watch the next Warren Buffett in real-time—build your own financial empire in the Bitcoin age.

📖 Bible Verse

"So we fix our eyes not on what is seen, but on what is unseen. For what is seen is temporary, but what is unseen is eternal." — 2 Corinthians 4:18

Reflection: Big vision often looks like madness to small minds. Stay focused on your purpose, not the opinions of those who’ve never risked anything— let me say it again… critics never build anything, but the faithful endure, create, help & multiply.