The Great Wealth Transfer

Data suggests over 90% of ‘Generational Wealth’ returns back to poverty within the 3rd generation.

Are you ready for the largest wealth transfer in human history?

The Curse

The Scottish proverb “shirtsleeves to shirtsleeves in three generations” describes families who start with little, build wealth through consistent hard work, but lose it all by the time the great-grandchildren are in charge.

This highlights the challenge of not necessary building wealth, but the difficulties of maintaining wealth across generations and the need for financial education and planning.

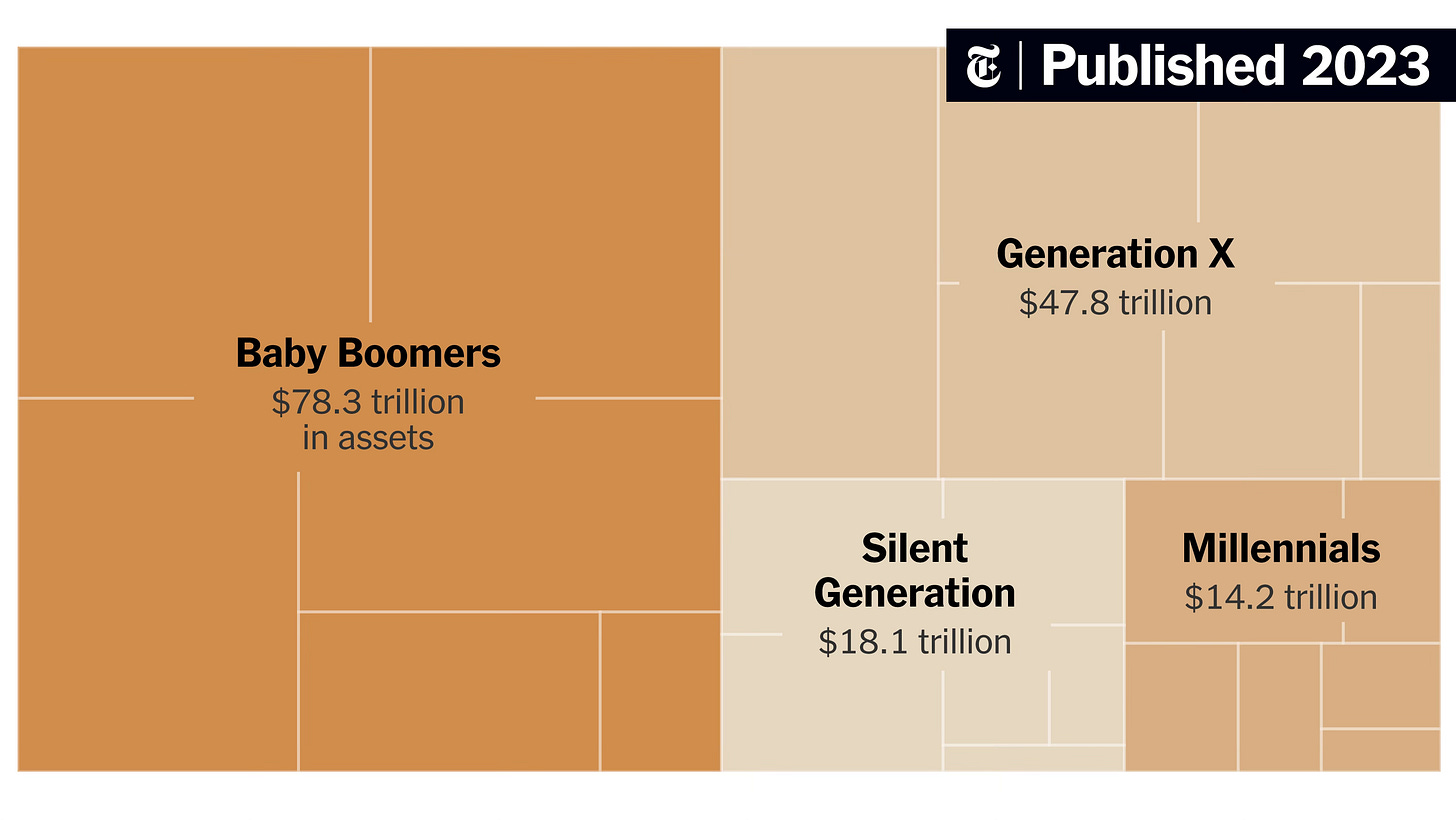

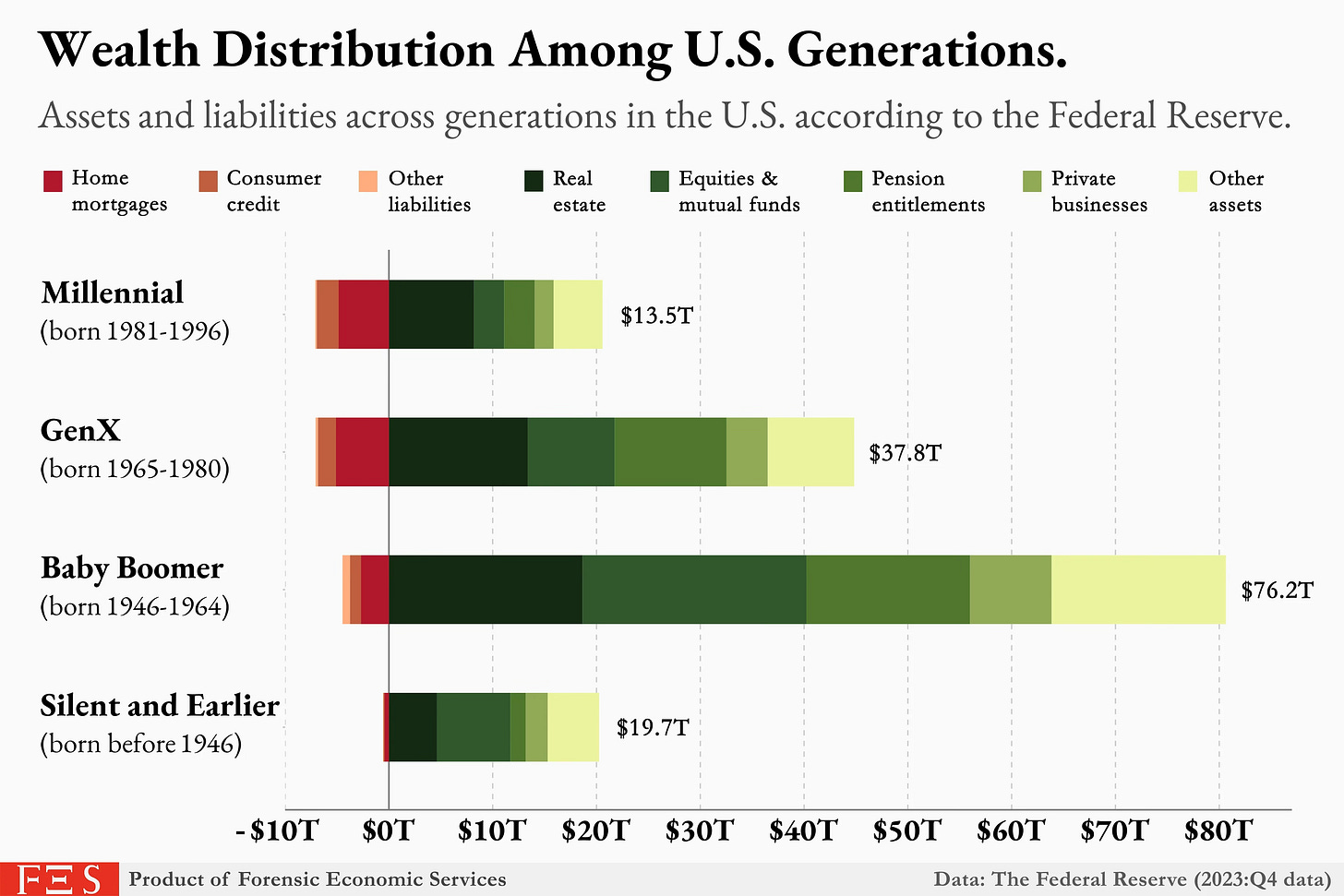

As of recent data, Baby Boomers (ages 57-75 years old) control a significant portion of the wealth in the United States. Specifically, they hold approximately $78.1 trillion in assets, which accounts for about 50% of the nation's total wealth. This includes assets such as real estate, equities, mutual funds, pensions, and private businesses (Nasdaq) (Visual Capitalist).

Despite being a smaller demographic group, Baby Boomers' wealth is substantial due to decades of accumulation and investment. Their wealth is primarily concentrated in financial assets like equities and mutual funds, which constitute a significant portion of their total assets (Visual Capitalist) (Marketing Charts).

In contrast, younger generations such as Gen X and Millennials are seeing their wealth increase, but they still hold significantly less in comparison. Generation X controls about 29.5% of the nation's wealth, while Millennials hold around 8.5% (Marketing Charts).

This large disparity highlights the significant impact Baby Boomers have on the economic landscape and the importance of the upcoming intergenerational wealth transfer.

If proper education, determination and planning is not executed on behalf of their heirs — a majority of the Baby Boomers will have spent a lifetime doing it

All For Nothing.

The Cycle

Whether you aim to seize and unlock upcoming opportunities or are determined to break the cycle of returning your family legacy to poverty, consider these key factors.

Financial Education & Planning

Financial Management: Heirs may lack the knowledge and skills to manage inherited wealth effectively.

Lifestyle: Without understanding budgeting and financial planning, heirs might overspend, leading to financial decline. Abundance, with no merit, makes humans soft.

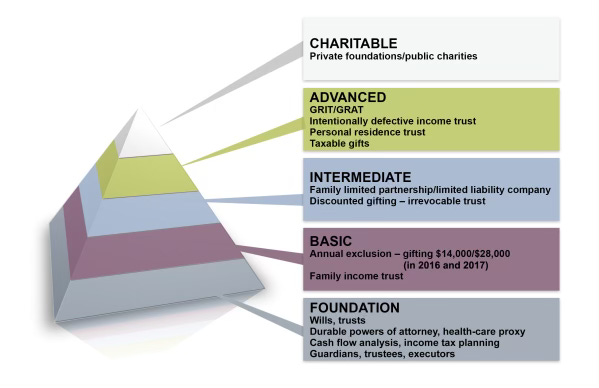

Estate Planning & Strategy: Failure to set up wills, trusts, and other financial instruments can lead to mismanagement and disputes over assets.

Governance: Hiring mentors, advisors and counsel to strategically establish legal instruments and resources to protect & transfer assets to heirs. Consistently meet and discuss on the family’s legacy: mission, vision and management of wealth.

Tax Liabilities: High tax burdens can erode wealth if not planned for properly. Leverage loopholes to avoid major capital gains or other tax obligations when assets are being transferred or sold.

Economic & Market Fluctuations

Market Downturns (Recessions): Poor investment decisions or economic downturns can significantly reduce the value of inherited assets. Or, simply not capitalizing during these times to purchase discounted assets or launch new ventures. Many successful businesses were established during economic downturns, leveraging the unique opportunities presented by challenging times.

Here are a few notable examples of businesses launched during economic Recessions: Microsoft, AirBnB, Uber, Netflix, Slack, and many other successful companies you and I both use on a day to day basis for their products & services.

Inflation: The silent killer of wealth! It is the decreasing value of money over time can erode purchasing power and wealth. As of 2020, the USD has lost over 25% of its purchasing power due to the FEDS printing off over 25% of its money supply & injecting it into the markets.

Evolution: Not evolving into future, growth oriented type of investments, such as: technology, cryptocurrencies, artificial intelligence, algorithmic trading, etc.

Documentation & Communication

Family businesses & investments may fail due to lack of interest, skills, systems, processes or poor management by successors. Most problems in our lives could be resolved or prevented with proactive, assertive communication. Keep accessible documentation & paper trails of important aspects of the family’s financial wealth & estate plans.

Philanthropy & Giving Back

Charitable Trusts: Establish charitable trusts to give back to the community while managing tax liabilities.

Family Foundations: Create family foundations to instill a culture of giving and social responsibility.

By implementing these key strategies, families can better protect and grow their wealth across generations, reducing the risk of returning to poverty.

Why do you do, what you do?

Generational Wealth can buy you a lot of things:

Food, but not Health

House, but not a Home or Family

Sex, but not Love

Positions, but not Respect

Entertainment, but not Joy

Bed, but not Rest

Power, but not Peace

My main mission in building & breaking the cursed ‘generational wealth’ cycle, is to ensure I do not do it All For Nothing.

Text me your mission!

+1 (614)-660-5921