A Tale of Two Cities

"It was the best of times, it was the worst of times..." — Charles Dickens

This isn't just literature— it feels like our economy today. But when you read it, which side do you resonate with? Are you seeing opportunity... or overwhelmed by uncertainty?

Poppy thinks this question cuts to the core of people’s mindset — whether you lean pessimistic or optimistic. Emotions aside, let’s get grounded in reality.

You might be asking yourself:

Will I ever pay off these student loans?

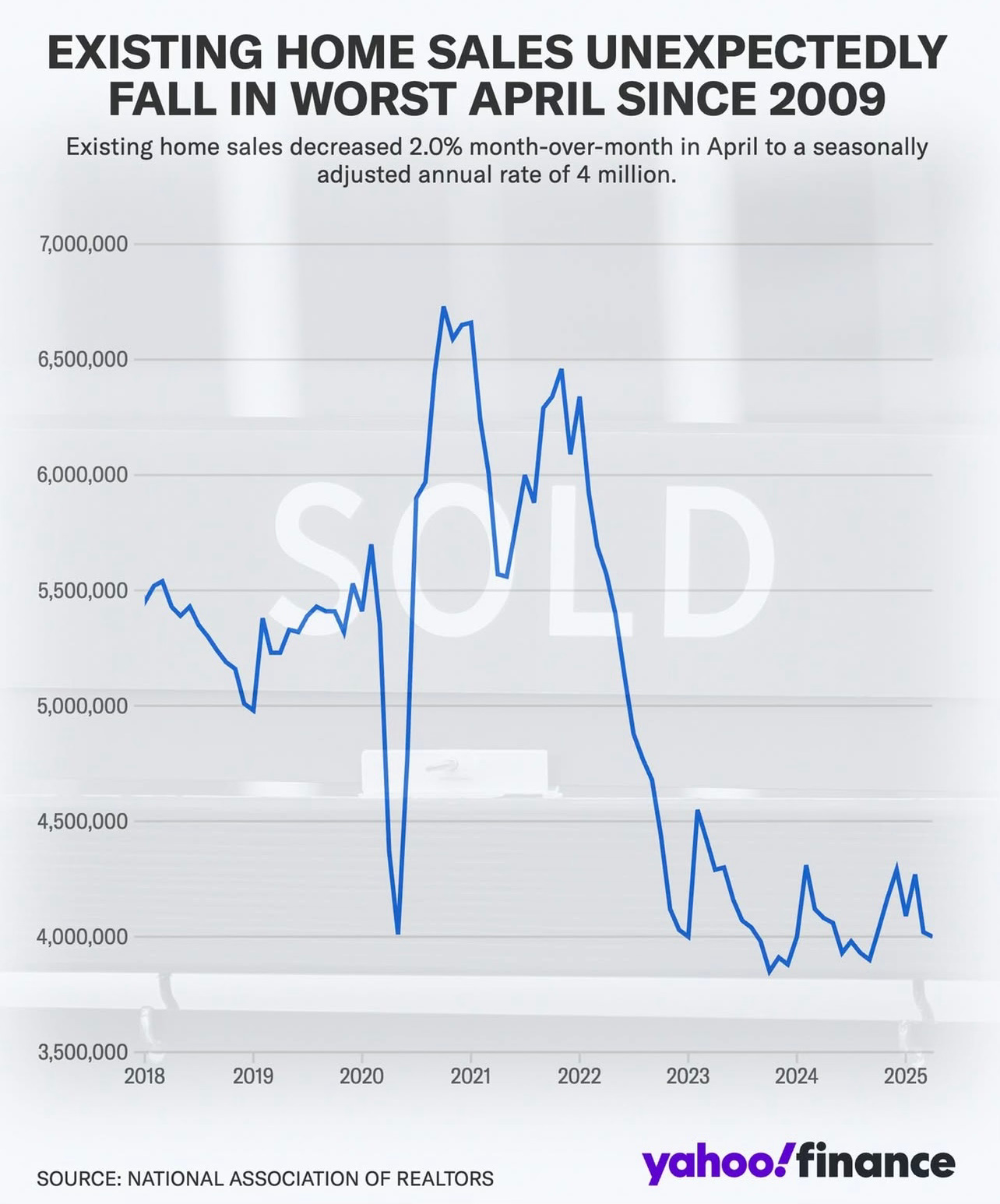

Is the American Dream of owning a home dead?

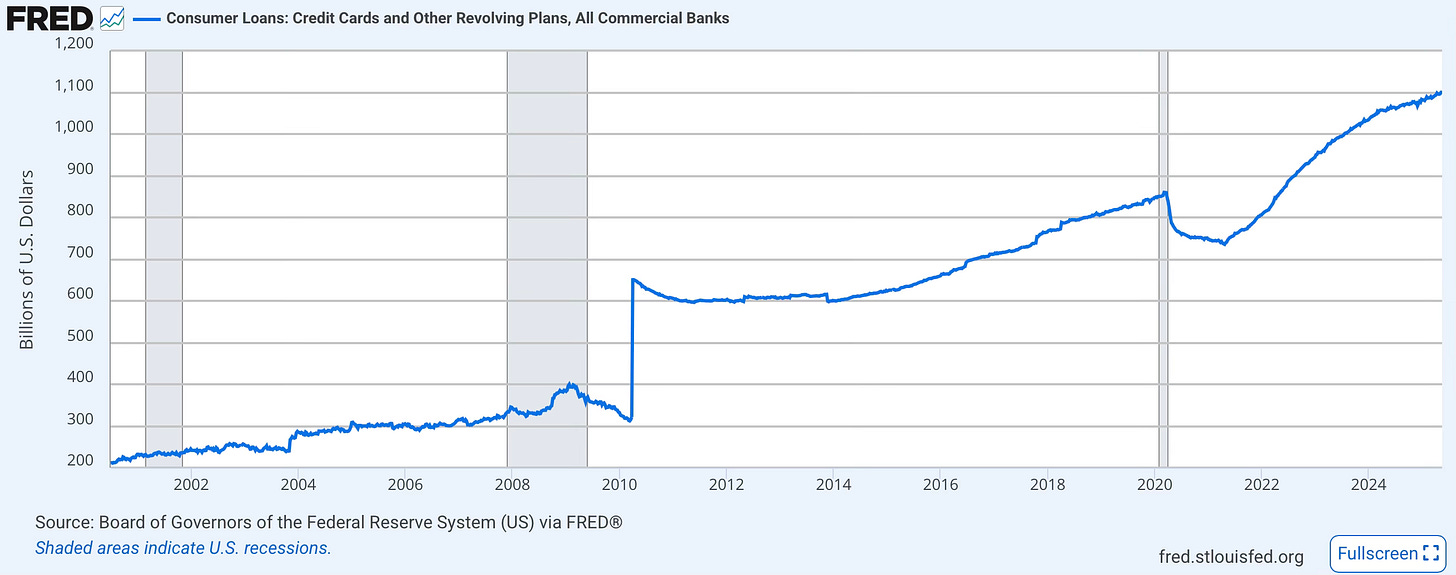

Can I ever escape this cycle of credit card debt?

How do I grow a business or invest when I’m barely affording life?

The answer lies in one word: funding.

When used correctly, funding isn't a liability—it's a ladder. A lifeline. A launchpad. The wealthy have long understood this. They don't hustle more when times get hard. They leverage. They become their own bank. And they use capital to buy time, compound wealth, and expand opportunity.

🩸The Lifeblood of the Economy

Credit & Debt (not Adrenochrome), is the circulatory system of our economy. When it flows freely and responsibly, it powers innovation, business creation, homeownership, and prosperity. But when it clogs—when bad debt builds and servicing costs exceed income—it becomes economic cancer.

"One man's debt is another man's asset."

This isn't just a quote—it's the bedrock of the financial system & economic machine. Debt instruments like bonds and loans are assets to lenders.

Your student loans, mortgages, and credit cards? A financial institution or even a part of someone else’s investment portfolio.

📊 The Financial State

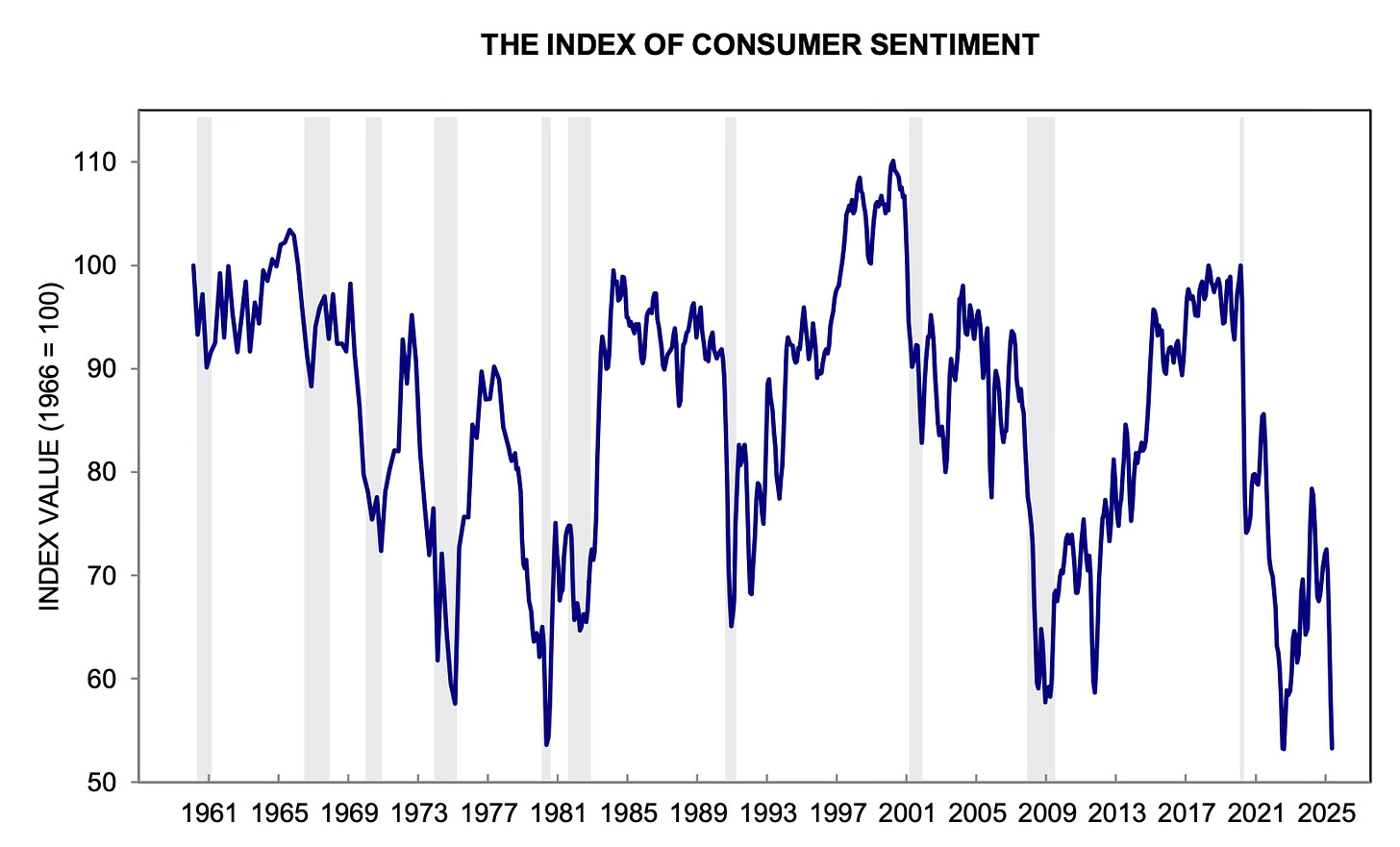

Financial anxiety is rising.

Consumer sentiment? Declining at Usain Bolt speed. ⚡️

Here’s what the data is screaming:

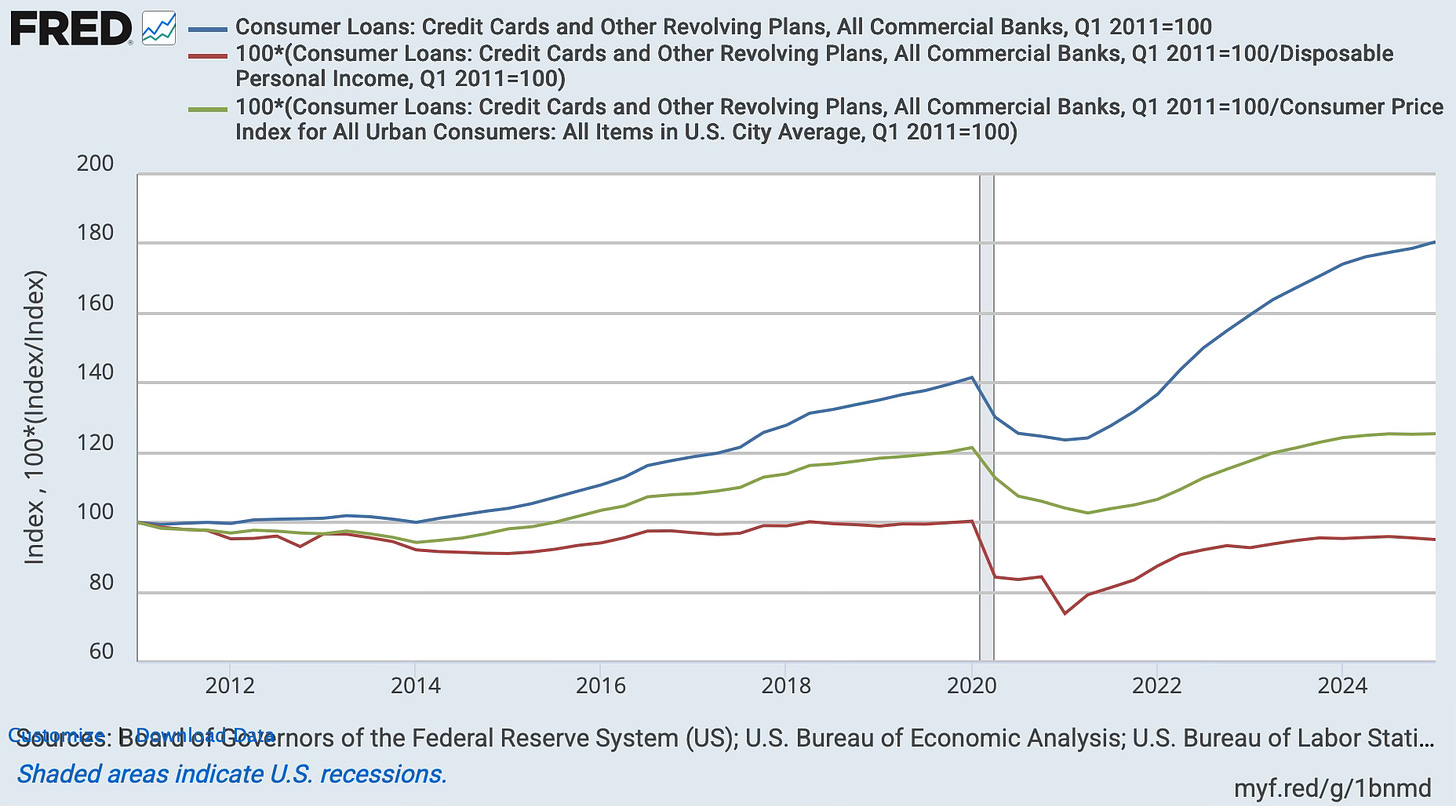

🔺 Consumer Defaults Are Surging

90-day delinquencies: Highest since Q1 2011

Serious delinquencies: Up 52% YoY

Credit card write-offs: Hit $46B in the first 9 months of 2024 — highest since 2010

Student loan delinquencies: Now 7.74%, up from <1%

Mortgage delinquencies: Ticked up to 4.04%

🧾 Buy Now, Pay Later (BNPL)

40% of BNPL users made late payments in the past year (up from 33%) — LendingTree, April 2025

Klarna: Reported a $99M net loss in Q1 2025, due to $136M in credit losses (up 17% YoY)

Affirm: 90+ day delinquency rate at 0.7% vs. 7.2% for credit cards as of Dec 2024

BNPL is especially popular among the youth:

37% of users are 18–24

34% are 25–33

Too many financed Chipotle burritos. 🌯

Bad Credit? Buried in Debt? Need Funding or Extra Income Streams?

→ Whether you're stuck with:

❌ Damaged credit

💸 High-interest debt

🏦 No or limited access to funding

📉 No passive or additional income streams

We’ve got real solutions to help you level up:

✅ Credit repair & debt cleanup

✅ Business & personal funding

✅ Automated income streams

🎁 Exclusive for Substack subscribers — get major discounts on all services!

👇 Tap below to get started and take control of your financial future.

🚩 Macro Economic Red Flags

$1.9T U.S. federal deficit for 2025.

$9.2T in Treasuries maturing this year — will need to be refinanced.

Interest on U.S. debt: now $952B/year, higher than both Medicare & Defense.

Bond market instability: 10-year Treasury >4%, 30-year >6%.

This means: The government borrows debt to pay off other debt. It's like paying your MasterCard with your Visa. The show goes on… 🔄 (but for how long).

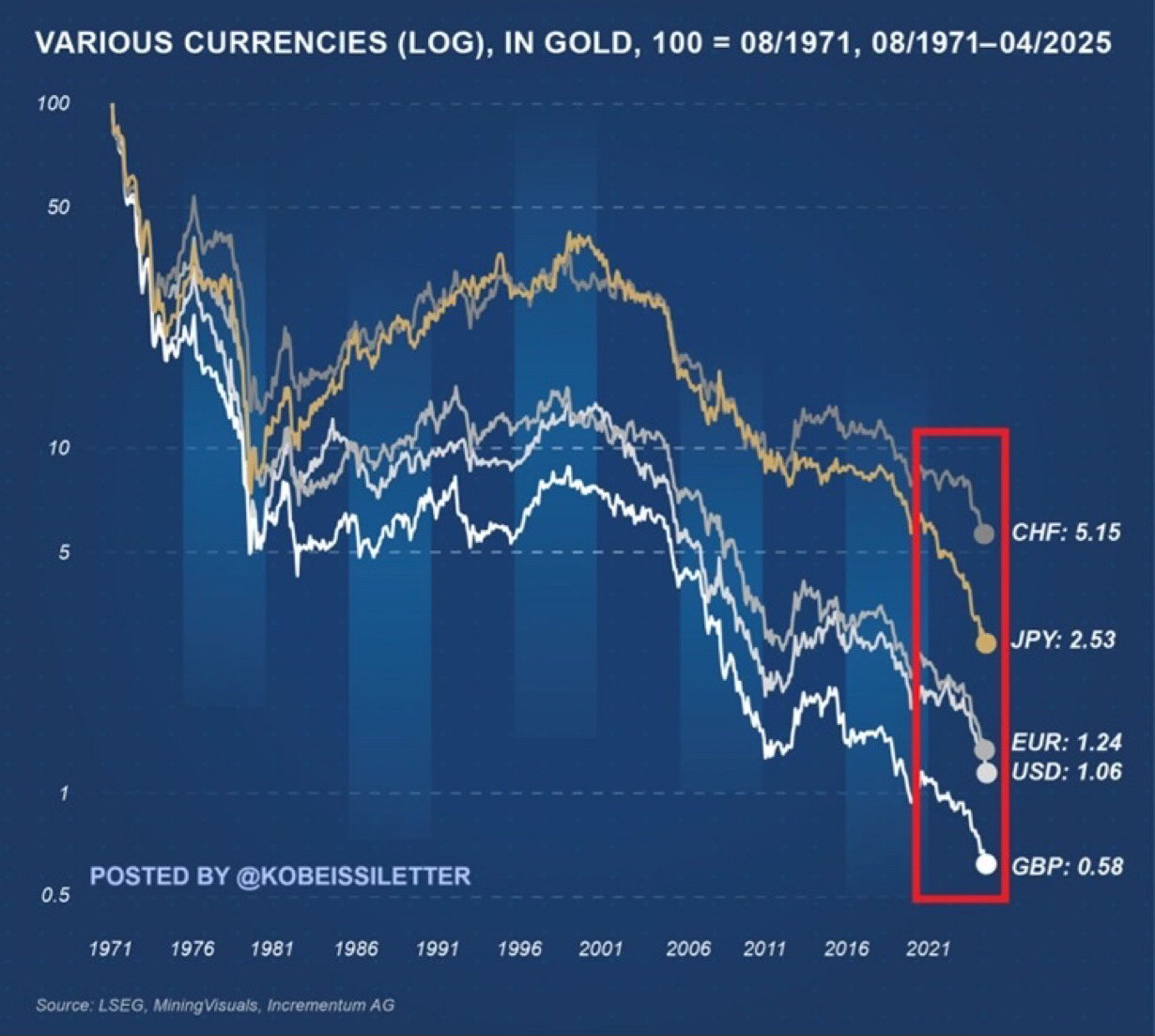

Inflation Reality

CPI says ~22% since COVID. But the Everyday Man Index (used cars, groceries, rent) says 35%+.

Bottom 50% of Americans feel inflation more directly.

Consumer Sentiment

Has declined 5 months straight.

Americans are increasingly worried about inflation, debt, and economic decline.

🇺🇸 Trump’s 3-Legged MAGA Stool

The U.S. is facing a historic deficit—simply put, it’s spending far more than it earns. The Trump administration’s proposed strategy rests on three pillars:

1. Deleverage the Government

This means reducing the deficit by cutting government spending, streamlining departments, & trimming excess labor (e.g. IRS), while loosening some banking and financial regulations.

Why it matters: Less government overhead & red tape = more room for entrepreneurs, investors, and small businesses to grow. The goal is for those displaced from public jobs to be absorbed into a stronger private sector.

2. Reorder Trade Through Tariffs

The recently proposed 50% tariff on European imports & threats to Tim Cook, CEO of Apple for production of products & iPhones, signals a new protectionist push to incentivize manufacturing in the U.S.

Why it matters: Tariffs act as leverage. Companies that bring production to America may benefit from reduced taxes, deregulation, and energy incentives. Short term = market volatility. Long term = potential surge in domestic growth and jobs.

3. Revamp the Tax Code

Dubbed the “Big Beautiful Tax Bill,” this aims to extend the 2017 tax cuts, eliminate taxes on tips and overtime, and raise the standard deduction.

Why it matters: If it doesn’t pass, the U.S. could see the largest tax hike in recent history. While some aspects may raise the deficit, proponents argue it could boost consumer spending, business growth, and economic confidence.

⭕️ The Cycle Circle

One of my biggest mentors, Ray Dalio—founder of Bridgewater, the world’s largest hedge fund, breaks it down simply:

Debt Cycles: We're in the late stage of a long-term debt cycle.

Internal Conflicts: Rich vs. poor. Left vs. right. Truth vs. trust.

Global Conflict: A rising power (China) challenging the existing power (USA).

Acts of Nature: Pandemics, floods, and growing climate instability.

Technology: Disrupting jobs, industries, & reshaping global influence.

This isn’t just a typical recession—it’s a historic restructuring of both domestic & global economic systems.

And in times like these, your inner circle means everything.

These are the people who’ll pull you through the hard times and celebrate with you in the good.

Show me your friends, and I’ll show you your future.

💰 Securing Funding Now Is Crucial

Despite everything: funding is & will always be available—but in times of high interest rates, volatility, fear & uncertainty, it becomes more difficult (for most): window is narrowing:

Banks are tightening.

Underwriting is more selective: high scores, low debt & usually zero negative marks (e.g. late payments, collections, charge offs, etc)

Your ZIP code, credit mix, income, and even LLC industry code affect approval.

But for those positioned properly?

0% APR credit cards (12–18 months)

SBA Loans (small business loans: 7a, 504, etc)

Traditional mortgage loans, Cash-out mortgage refinance or HELOCs

Margin loans against crypto or equities

IRA/401(k) rollovers into self-directed accounts

This is just to name a few funding options. Then you can finally buy assets, consolidate debt, fund your business, pay those brutal student loans, invest without draining liquidity, secure real estate deals in a frozen market conditions, or just be prepared for opportunities & emergencies.

⏰ Time Arbitrage

How long would it take you to save $100,000? A year? 16 months? Two years? More?

Now consider that capital is available right now—cheap or even interest-free—and that inflation will erode your savings as you wait.

This is time arbitrage: borrow today's money to buy tomorrow's asset at yesterday's price.

→ The Secret of the Wealthy

They don’t work harder. They leverage smarter. They:

Use Other People’s Money (OPM)

Buy cash-flowing assets

Recycle debt for tax efficiency & secure more cash-flowing assets

They become their own bank, without usually using their own cash.

🛡️ The Golden Dome

We’re not here to be alarmist—we’re here to be realists. If the events of recent years have taught us anything, it's that the next “arms race” won’t just be nuclear—it’ll be digital, invisible, and possibly already in motion.

From cyber attacks targeting America’s three fragile electrical grids, to AI-enabled drone warfare launched from thousands of miles—or even space—the battlefield is no longer boots on the ground. It’s code in the cloud.

The "Golden Dome" isn't just a metaphor for national defense—it’s a wake-up call that protection is no longer physical alone. It’s economic, digital, ideological, and increasingly spiritual.

Here’s what’s unfolding:

Domestic Conflict: Cultural divide, state vs. federal clashes, & a concerning rise in antisemitism. Harvard University situation is interesting situation too.

International Conflict: Currency devaluation, trade weaponization, and a breakdown of global alliances.

Technological & Spiritual Conflict: Global connectivity is at an all-time high. But trust in institutions? At an all-time low.

History shows every empire eventually faces a reckoning. The smart ones? They prepare—not out of fear, but out of wisdom.

And just like a nation needs a defense system, individuals need one too.

Poppy believes that knowing how to use the bloodline of your finances → credit & debt ← is no different. It’s your shield against a flawed but opportunity-filled financial system.

Because in this world — not just sports?

The best defense is a great offense.

💰 Need Money? 💰

You are either playing the game or getting played by it. The next 6–12 months will shape the next 6–12 years of your life.

Progress creates happiness. And funding creates opportunities. Opportunity creates progress.

➡️ If you want or need to:

Eliminate bad debt

Secure capital to grow your business

100% finance your 1st or next real estate deal

Invest in Bitcoin, Gold or other opportunities

Then it's time to stop thinking it is the worst of times, but rather the best of times and book a free consultation.

Let’s build your Funding Blueprint. One that works in this new world.

📖 Bible Verse

"Through wisdom a house is built, and by understanding it is established; by knowledge the rooms are filled with all precious & pleasant riches." —Proverbs 24:3–4

Reflection: Lasting wealth isn't built on hustle alone—it’s built on wisdom, understanding, & strategic stewardship. In uncertain times, it’s not just about having more money, but knowing how to multiply what you already have through wise decisions & divine guidance.