Will you ride the wave or sink with the ship?

We’re not witnessing a crash.

We’re witnessing a transition—into a new system. This is monetary history in motion.

The Great Monetary Reset

They mocked it.

They banned it.

They called it a scam, a bubble, a threat to the system.

And now?

They're building the system around it.

From JPMorgan to BlackRock, the same institutions that once slammed the door on crypto are now quietly becoming its architects.

Flipping the script while the world wasn’t watching.

Welcome to The Great Monetary Reset.

🐾 Poppy’s Predictions 🐶

Our favorite four-legged forecaster is back with bold calls—and the charts are barking in agreement:

Bitcoin to reach $118K–$120K by end of June, with strong support holding around $84K

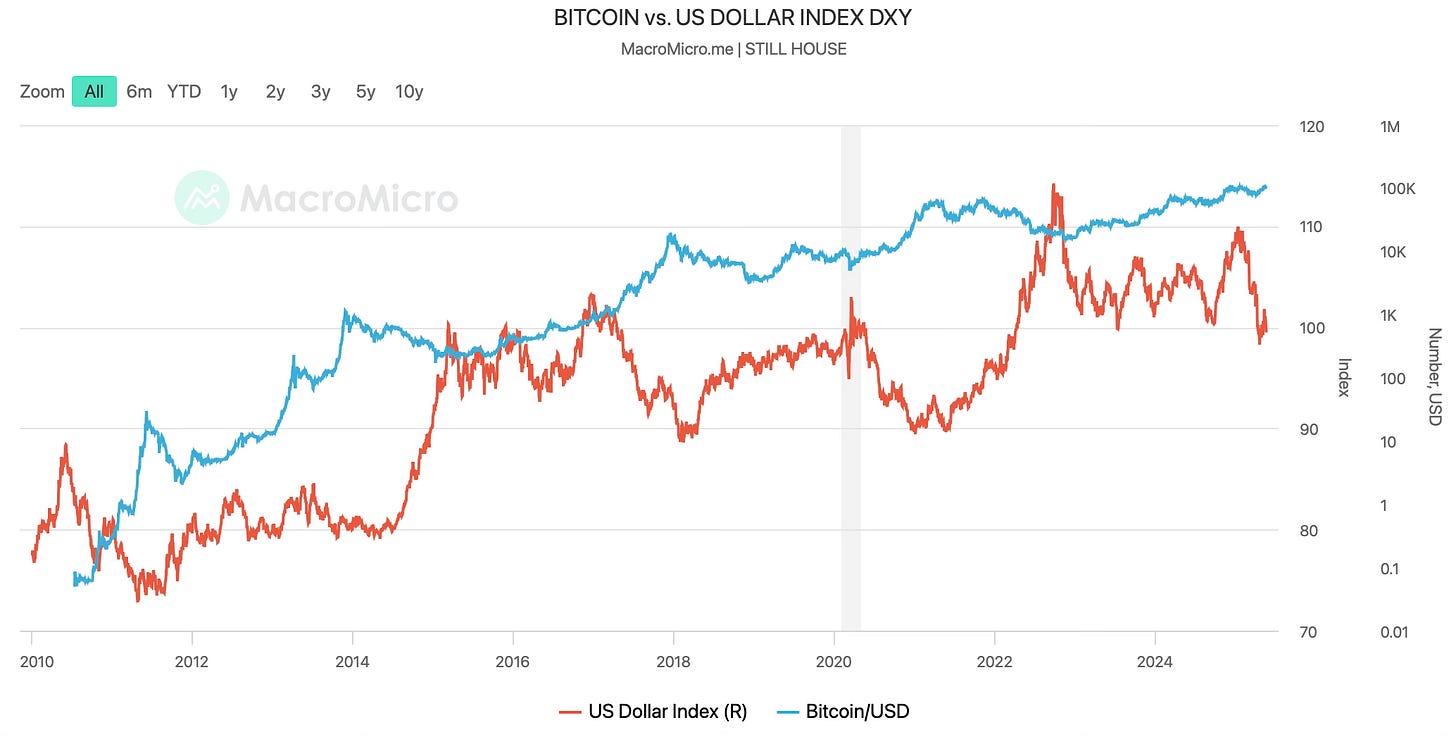

As the U.S. Dollar Index (DXY) weakens (uh… any day now 😥), expect a parabolic move in Bitcoin and crypto markets, potentially triggering a 2–4x price surge based on historical inverse correlations of DXY vs Bitcoin.

In other words →USD = up/down in value, Bitcoin price goes down/up.

Oh yeah… Poppy reiterates patience & prudence, this could take through end of the year to see 2-4X BTC price increases as we see global liquidity increase & other major macro variables unfold in the coming months.

Gold and Bitcoin decoupling is underway—watch for Bitcoin to break free from traditional asset correlations and lead as the primary store of value in the new digital system

🌍 The 1st Global Domino Has Fallen

Most people slept on Japan. But what’s unraveling over there is being referred to as worse than Greece, and it could slam into the global financial system like a tsunami wave.

For decades, Japan basically gave money away for free. 🤑

Seriously, they had 0% (even negative) interest rates—meaning you were literally paid to borrow their money. That birthed the infamous carry trade: investors would borrow in yen at dirt-cheap rates and dump it into U.S. tech stocks, Treasuries, or anything yielding 2–4%.

Easy money.

But here’s the kicker: 📉

Now that Japan’s finally raising rates, that gravy train is over. And the unwind? It’s already started. When Japan hikes, global investors pull their cash, triggering what’s called a carry trade unwind—aka the financial equivalent of yanking the tablecloth and watching everything crash to the floor.

What’s Happening? 🤷♂️

And it’s not just theory—it’s most certainly unwinding:

💣 Bond Markets Are Breaking

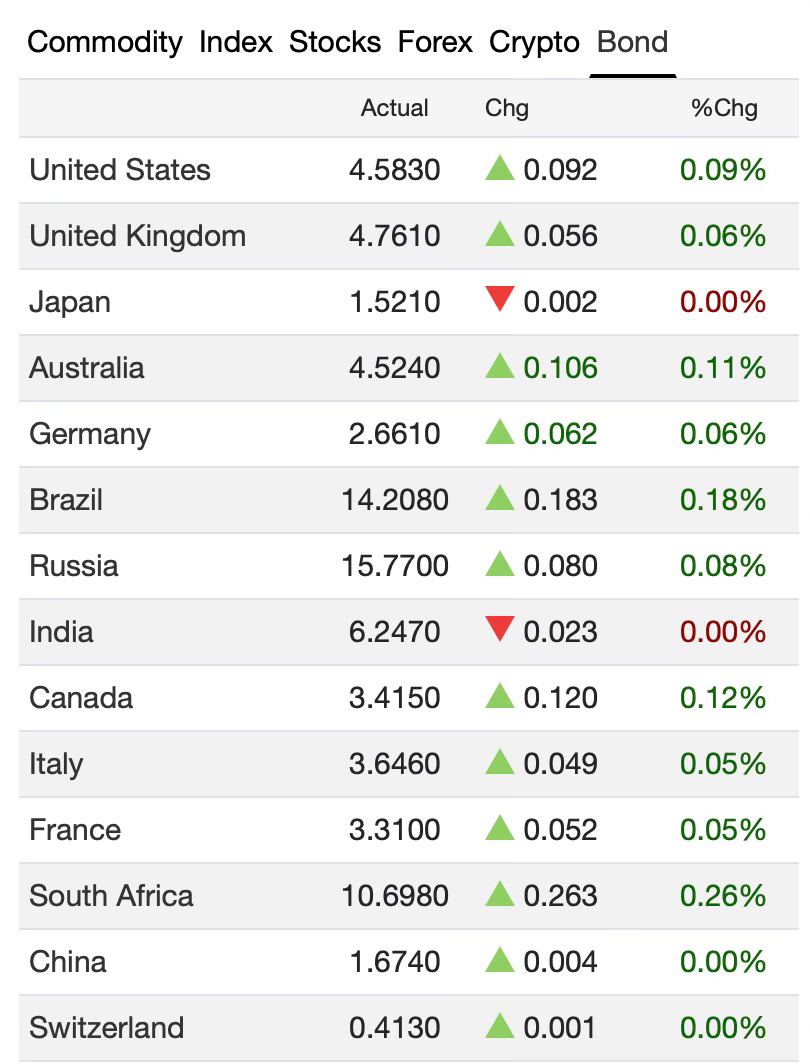

Japan’s 10-year bonds just hit yield levels not seen in a generation. 30- and 40-year JGB yields are exploding, which means investors are bailing hard. That’s not inflation talking... that’s systemic distrust.

U.S. 30-year Treasuries? Cracked 5%.

Moody’s just slapped the U.S. with a downgrade. Why? Because there's no plan (or ability) to repay $37 trillion at current interest rates.

Global bond funds are hemorrhaging. China and Japan, the two biggest foreign holders, are dumping U.S. Treasuries.

The global bond market isn’t “tightening.” It’s spiraling. Rates are rejecting the entire idea of government solvency.

💀 Japan’s Insolvency & The Carry Trade Collapse

The Bank of Japan’s own internal docs admit it—they’re insolvent.

That carry trade? It was the duct tape holding together trillions in global risk assets.

As it collapses, we’re facing forced liquidations, margin calls, and potentially multi-quadrillion-dollar derivative exposure.

→ This isn’t Lehman 2.0 aka 2008 financial crisis. It’s on the brink of nation-states breaking. 😅

📉 Is This Worse Than 2008?

In 2008, banks failed & governments bailed them out.

In 2025, government’s + traditional financial systems are failing & there’s no one left to bail them out.

Treasuries are no longer “risk-free.”

States like Texas and Florida have better credit than D.C.

Global investors are fleeing.

And the almighty dollar? Being replaced quietly… but rapidly.

🎭 It’s Not Chaos—It’s a Controlled Reset

Let’s not pretend this is accidental.

Jamie Dimon is onboarding high net worth clients into Bitcoin 🟠

Trump has repeatedly said he wants to weaken the USDollar (btw: very good for BTC price) 💵

BlackRock is building crypto rails on the back end & their ETF’s are scooping up BTC & ETH like the Cleveland Browns do Quarterbacks.

Coinbase data breach… ehh, who cares right? They are on track for onboarding 1Billion users sooner than later.

This is a planned demolition of the old system—and they’re quietly setting up the next one behind the curtain.

The Future of Finance is here, folks.

Don’t be FOMO, FUD or insert other crypto catchphrase… be aware & stay ready. 📈

🧊 The Dollar’s Iceberg Moment

The dollar is no longer the “safe haven.” It’s the Titanic iceberg.

Inflation is rotting it from the inside

Global trust is evaporating. Why put cash into treasuries (aka government debt) when you can’t trust it can be paid, while interest rates made their surge back upwards, while inflation doesn’t seem to be going anywhere if you ask Poppy about the cost of his dog treats 😝

PS: thank you to everyone who reads, share & have donated some tasty treats to Poppy. ❤️

The USD is too strong to help U.S. exports, but too weak to buy trust back for manufacturing. Hence Trump’s tariffs fiasco.

And when the middle class goes down with the dollar? That’s when things get real.

🧩 Here’s What’s Unfolding Now (Step-by-Step)

Think dominoes, but with economies (the game, not the beloved midwesterner pizza):

Bond collapse → Credit panic → Treasuries dumped

Capital flight → Gold, Silver, Bitcoin, Real Estate

Wealth divide → Middle class crushed

Digital Financial Revolution & AI → Surveillance capitalism

Institutional Crypto → Global rollout

State-level unrest → Fragmentation possible

Welcome to the blueprint for The Monetary Reset 2.0—digitally tracked, blockchain-verified, & sold to the public as “safety.”

The money is flooding into Gold & Bitcoin… but, not all tides raise all ships.

🔥 What To Do NOW (Before the Curtain Falls)

This isn’t just prepping for volatility—it’s prepping for system failure.

✅ Stack Bitcoin, gold, silver, real & limited assets (ie - real estate)

✅ Monitor liquidity cycles—not media soundbites

✅ Protect your privacy, mobility, & digital autonomy

🚨 This Isn’t Doom Porn → It’s Simple Math:

Japan’s debt-to-GDP = 260%

U.S. is adding another $2T in debt this year with no repayment plan (interest rates making it impossible to refinance current $37 trillion in US debt)

Trust in traditional institutions? Collapsing daily. They’re all shifting to the digital era. With or without you.

Timing? This isn’t a 10-year grind—this is a 2025 detonation window

🚨 Inflation Is Rising

Real-time data shows these 3 key culprits:

1️⃣ 🏠 Rents – Construction slowdown + strong urban demand = rising rental prices again heading into mid-2025.2️⃣ ⛽ Gas – U.S.-Iran sanctions, OPEC cuts, and revived U.S.–China trade = tighter supply + stronger demand = higher prices.

3️⃣ 🚗 Used Cars – Demand surge, tariff fears, and rising trade-in equity = used vehicle prices climbing again.

📖 Bible Verse

"Woe to you, teachers of the law and Pharisees, you hypocrites! You shut the door of the kingdom of heaven in people's faces. You yourselves do not enter, nor will you let those enter who are trying to." — Matthew 23:13

Reflection: Like the Pharisees of old, the financial elites once mocked and rejected crypto—only to quietly build the infrastructure behind closed doors. Their public dismissal and private adoption reveal not ignorance, but orchestration. No coincidence… just control dressed as caution.