OnlyFans has over 190 million users.

😶 Digital Dopamine

Over 70% of them are men, mostly aged 25 to 34. But here’s the kicker: a significant portion of them aren’t lonely bachelors… they’re in relationships or what Poppy would maybe refer to as a more so ‘situationships’.

One study found 82% of subscribers were in a relationship, & the majority of male subscribers are married. So we’re not talking about isolated men seeking connection, we’re talking about men in partnerships chasing digital intimacy on the side.

✍️ Let’s do some quick math.

The average OnlyFans user spends estimated between $250 to $500 per month on subscriptions.

→ What if, instead, they invested that money?

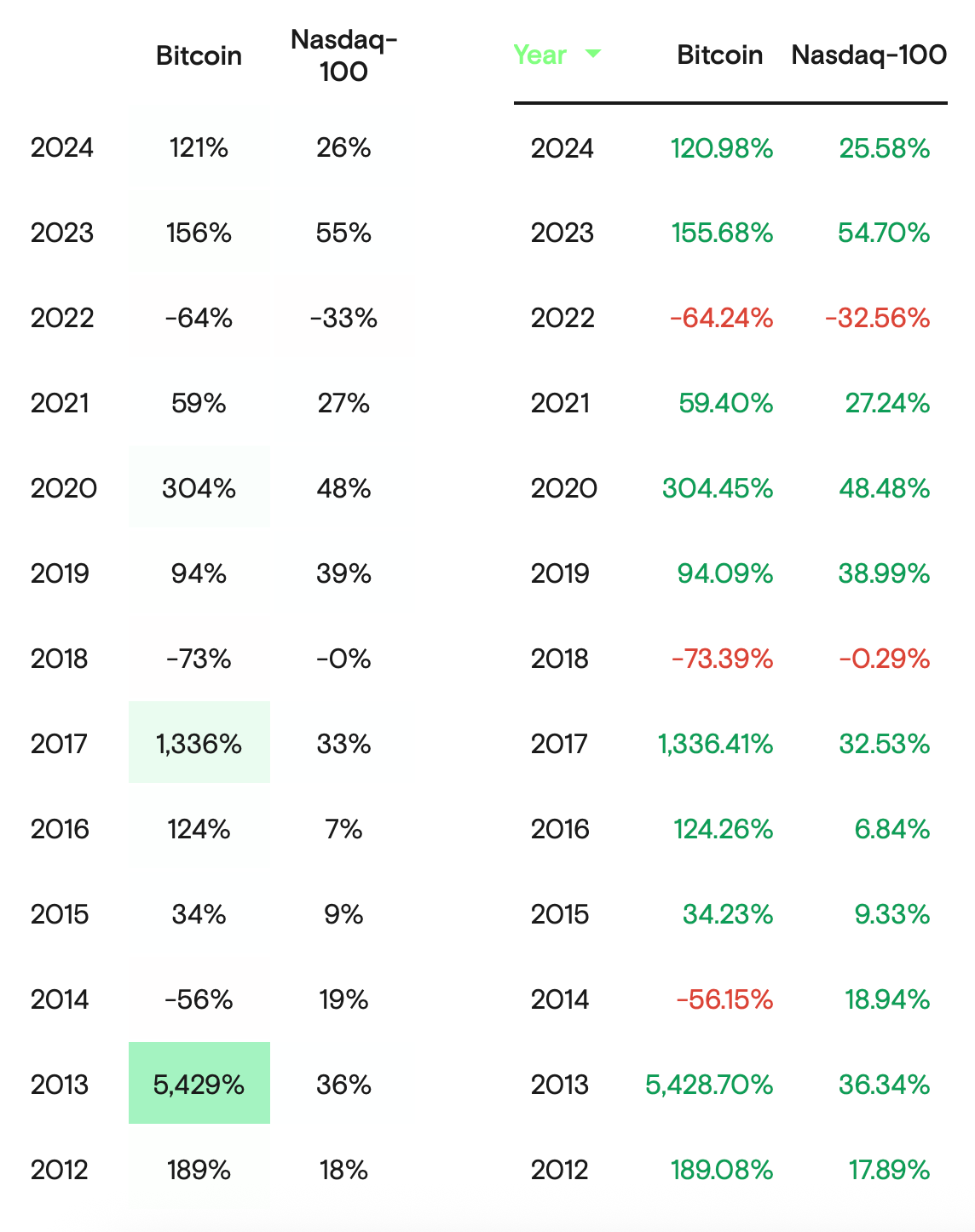

📈 10% annually in the S&P 500 (since 1970 with dividends reinvested)

₿ 25% annually in Bitcoin (realistically trimmed from historical averages as it’s performed over 250% in past 10 years)

Let that sink in. And ask yourself:

$500/month toward digital fantasy... or a multi-million dollar portfolio for your future?

A decision that feels small today compounds into financial legacy, or regret, tomorrow.

✝️ Money & Meaning | Illusion & Truth

The point isn’t to judge—it’s to reflect.

Why is fantasy outpacing reality? What does that say about our culture, our connection, and what we truly value?

Your name is your real currency.

Your reputation is your greatest asset.

And in 2025? It’s like a glass house in a world of stone throwers.

It can take 20 years to build… & 20 seconds to break.

But you don’t lose your name through failure.

You lose it by hiding.

By letting others write your story.

By letting comfort override conviction.

The Cross isn’t just a symbol of sacrifice.

It’s a call to clarity in chaos.

A call to stand for something real—when everything else is noise.

And that’s why we need to talk about money.

Because the greatest illusion? The system itself.

The Fed prints from thin air 🎩

Banks repackage and relend 🏦

Debt-fueled bubbles get sold as “growth” 📈

Meanwhile, the asset once mocked—Bitcoin—is now:

• On balance sheets 🧾

• Backing real estate 🏘️

• Powering new financial rails ⚙️

In a world built on deception, truth is the rebellion.

Faith over fear. Value over illusion.

That’s the real Cross roads we face.

🚨 4 Big Market Shifts… You Shouldn't Ignore

1. Real Estate x Crypto

Yes, you can now use crypto as collateral to buy real estate.

🔥 Why it matters:

Avoids liquidation & taxable events

Unlocks capital quickly

Forces traditional banks to adapt

Confirms digital assets are real wealth

⛈️ But is real estate storm not just ahead, but already here?

🏚️ Property taxes in previously ‘hot’ markets (TX, FL, AZ) have doubled or tripled, making it even more unaffordable to buy in these markets.

💸 Insurance premiums? Skyrocketing—or impossible to get

⌛ Homes are sitting 40+ days on the market (on average), remember when it would sell in 0.069 seconds?

📉 National home prices are cooling off

📊 Freddie Mac reports a 30-year mortgage rate at 6.77%, still high despite a slight drop

🏗️ New Home Builders are adapting:

Slashing new home prices by 5%

Offering aggressive incentives (rate buydowns, closing credits)

Cutting costs (removing walk-in closets, flex space, etc.)

This is housing shrinkflation: smaller spaces, bigger prices.

Top 4 national builders have seen stock drops of 20–40%, with revenue sliding.

📉 Major corrections underway in:

Austin, TX – down 22% from peak

Florida and similar markets – hit hard by property taxes, insurance, inflated prices, etc.

Meanwhile, the Northeast is thriving:

Strong labor markets

Low inventory

Limited land supply

If the Fed cuts rates in September (as expected), it may reignite demand or further damage affordability, as prices could then begin going back up.

But waiting until September might be too late… peep the correlation between interest rate drops = recession? 😳

🧨 And the silent killer?

The U.S. Dollar Index (DXY) dropped from nearly 110 → 97.08 this year — down 11.8%.

➡️ So even if home prices look stable on paper, real value is eroding when adjusted for a weaker dollar.

✅ Crypto-Backed Mortgages: How It Works

Use Bitcoin or Ethereum as collateral instead of a cash down payment.

Process (Simplified):

Lender holds your crypto.

You get fiat to buy the property.

You repay the loan.

Crypto is returned once paid in full.

Benefits:

💸 Avoid selling = No capital gains taxes

🚀 Retain upside potential

⏱️ Faster approvals (based on crypto balance, not credit score)

Risks:

⚠️ Volatility → Margin calls or liquidation

🧾 Regulatory grey areas

Platforms like Milo offer up to 100% financing with zero cash down—just enough crypto to back the deal.

2. 😃 Golden Cross vs ☠️ Death Cross

Let’s break this down:

Golden Cross = 50-day SMA 🟢 crosses above 200-day SMA

→ Bullish. Signals strength and momentum.

Death Cross = 50-day SMA 🔴 drops below 200-day SMA

→ Bearish. Often followed by fake rallies and real pain.

3. 📈 The Bitcoin Correlation

The Nasdaq, S&P 500 & major Stocks are back near peak levels! And Bitcoin?

Riding shotgun, ready for it’s next ATH shot. 🚀

More correlation: 30-day correlation to tech stocks is now over 70%, tracking macro trends like liquidity, earnings, & rate bets.

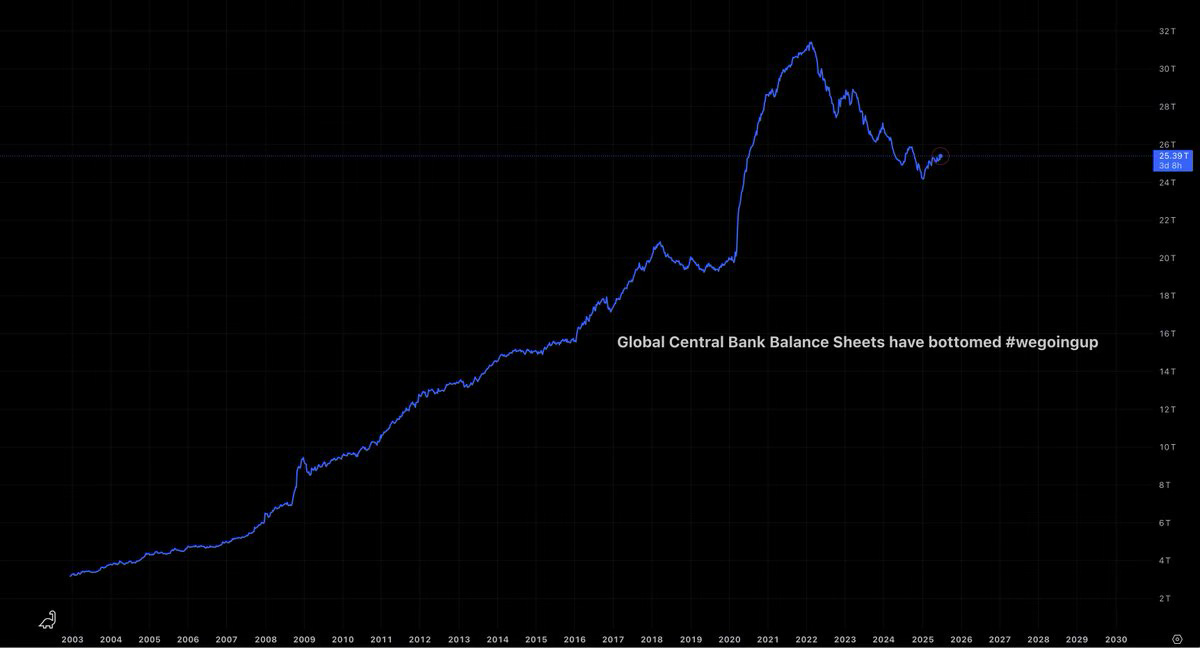

And to make it all look better (hopefully so that is), Global Central Banks seemed to have bottomed & liquidity is ready to flood in. 🌊

What a roller coaster it has been this year. 😅

But these correlations don’t last forever. And whales & market manipulators (major exchanges like Binance, Coinbase, etc) know the script… well… because they help write & influence it:

💥 Force liquidations

🧊 Stage fake breakdowns

🚀 Trigger explosive rallies

Still, the bold Poppy prediction remains: $120K BTC by end of July.

June is usually slow… but Q3 tends to deliver fireworks.

⚠️ But be careful: when everyone’s yelling “bull run,” it often means they’re preparing to wreck over leveraged positions. Watch what they do, not what they say.

🐾 Poppy’s Take: Better to move slow in the right direction than to sprint off into the wrong one.

4. 🏦 Federal Reserve Leverage Rule Changes

The Federal Reserve laid out a plan to cut U.S. bank capital requirements that were implemented after the 2008 financial crisis, allowing major banks to carry higher leverage levels.

💼 What’s changing?

The Supplementary Leverage Ratio (SLR)—originally implemented to ensure banks held adequate capital—is being reduced

This change will free up approximately $13 billion across the 8 largest U.S. banks

📈 What it means:

Banks will have more flexibility to expand credit & deploy capital

Increased leverage = more liquidity in the markets

Critics warn of potential financial instability, but markets tend to love easy money

🔥 More liquidity = rocket fuel for Bitcoin and risk-on assets

This regulatory shift adds to the already-unfolding liquidity story—and could flood both traditional & digital markets with fresh capital.

But… let’s not forget how it ended last time.

🪨 This is The Cross We Carry:

Between indulgence & discipline

Between fantasy & freedom

Between comfort & calling

Your name is your legacy. Your money is your magnifier. Your choices? They’re the real message.

Whether it’s relationships, wealth, or reputation—carry it with honor.

📖 Bible Verse

"A good name is more desirable than great riches; to be esteemed is better than silver or gold." — Proverbs 22:1

Reflection: A strong reputation outlives income. When the dust settles, your name echoes louder than your net worth. Build wealth—but build character firs

I did not expect this story to take this turn. Interesting! Where did you get the numbers for the average OF subscriber spend?