Blood started streaming down my back as the pain sharpened with each second. Panic set in.

Mentally paralyzed on what to do, I froze.

What do I do? Should I scream? Should I run?

Every second felt like an eternity as my mind wrestled with the chaos. The heat of the sun, the sting of the bite, and the sheer terror of the unknown overwhelmed me.

Thankfully, my sister was there to save the day. Instead of freezing like I did, she acted. She rushed over and pulled me off the ground, away from the neighbor’s massive Rottweiler, preventing what could have been an even worse situation. Without hesitation, she helped me inside, grabbed a bottle of peroxide, and poured it over the deep wound where the dog’s teeth had sunk into my shoulder. The sting of the peroxide was sharp, but nothing compared to the fear that had gripped me moments earlier.

Looking back, that day wasn’t just about a dog bite—it was a moment that taught me how fear can paralyze us and how crucial it is to have someone or something to break through that paralysis. For years after, I remained terrified of dogs, avoiding them at all costs, convinced they were all a threat.

But here’s the thing: today, I love dogs. The creature I once feared has become one of my greatest companions. And that shift taught me something profound about fear: it’s often just false evidence appearing real. It blinds us to reality, makes us feel powerless, and stops us from seeing opportunities or solutions.

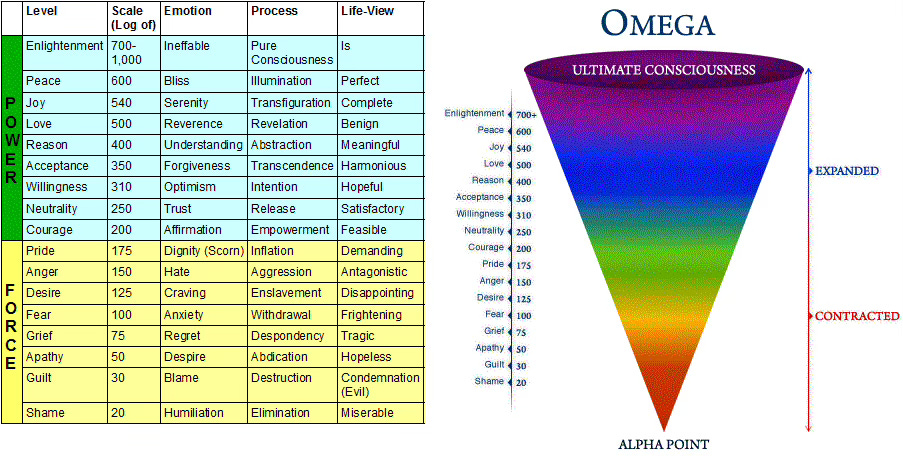

Just as I once froze in fear of that dog, many of us let fear dominate our lives—whether it’s fear of drones in the sky, investing in volatile markets, or navigating relationships. But what if, like my sister that day, we learned to act despite our fear? What if we reframed fear as a signal to grow, instead of a reason to shrink?

Let’s explore how fear controls us, why it’s so effective, and how we can reclaim our power.

The Fear Agenda

The parallels between the movie Don’t Look Up and our current reality are eerie. In the film, humanity is distracted by politics, media manipulation, and trivial arguments while an apocalyptic event looms over the planet. Today, we see fear-based narratives dominating headlines, with drones becoming a focal point of concern. Are they tools of surveillance disguised as a safety measure? Could these drones represent the "new virus"—a metaphorical bird flu of paranoia, used to monitor and control society under the guise of security?

This isn't a stretch of the imagination. Reports suggest the government might be hiding critical information, such as the existence of a lost nuclear bomb off the East Coast or potential spy operations reminiscent of the Chinese spy balloon incident. Are these narratives part of a larger agenda to distract and control? History tells us that when fear is weaponized, it often serves as a means to centralize authority. As the saying goes, “If you want more freedom, expect less support in safety and security—and vice versa.”

Although it is great to be aware of what is going on around you, you have to be careful of what it is doing inside of you.

This is one of my favorite quotes— “Never let a good crisis go to waste.”

This phrase has been attributed to various leaders and thinkers, including Winston Churchill during World War II and more recently Rahm Emanuel. It reflects the idea that challenging times often present unique opportunities for growth, innovation, and positive change if we are willing to see and seize them.

Fear <> Financials

While we may not have the insider knowledge of someone like Pelosi, we can still zoom out, identify patterns, and position ourselves to capitalize on unique opportunities.

The key? Follow the money.

When news broke about the drones in the Northeast, I decided to do some digging. A few critical questions guided my research:

Who manufactured the drones?

What are they looking for?

Who owns the company behind them?

How was it funded?

Although I do not claim to have the correct answers for the above questions….

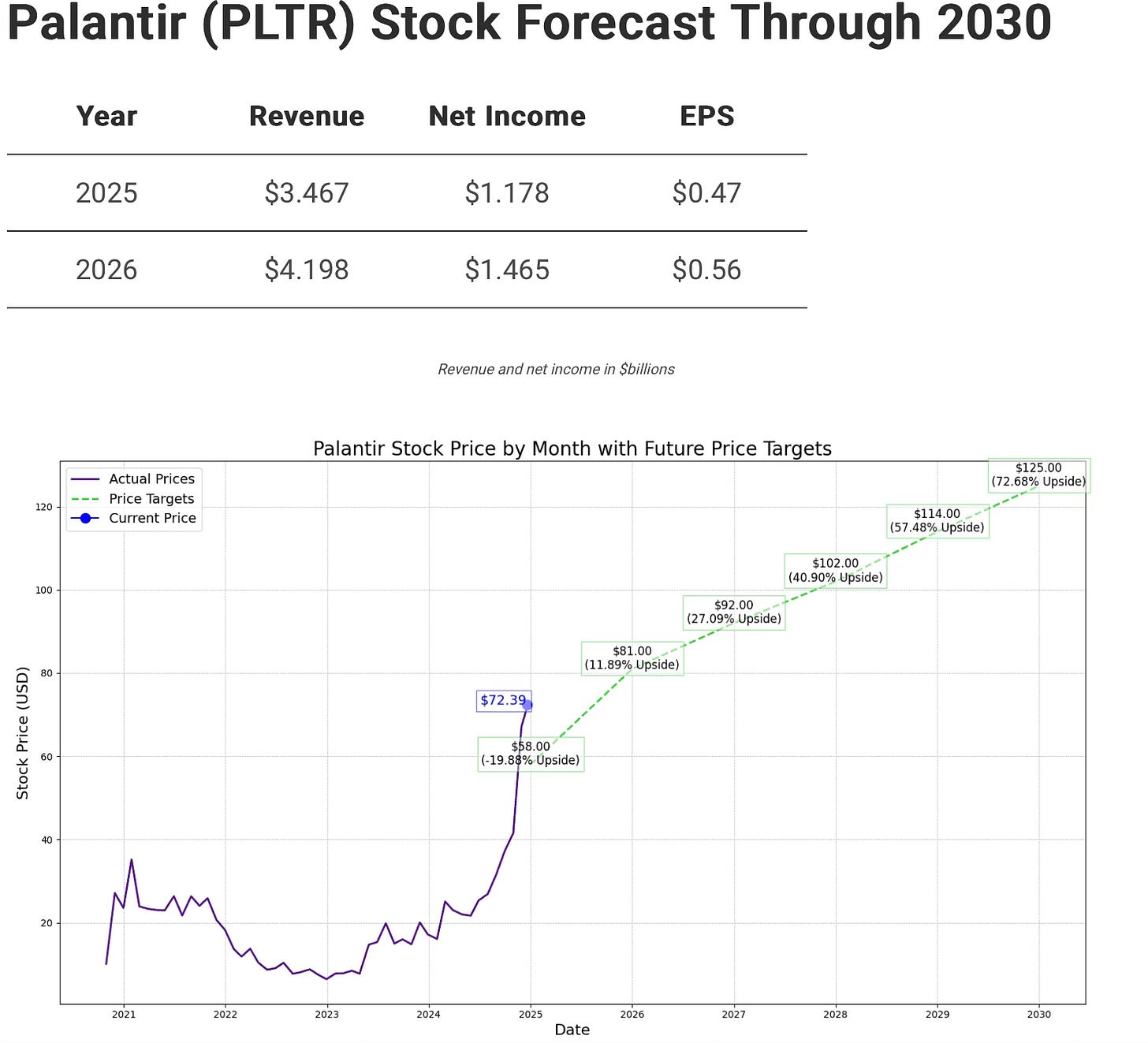

This research trail led me to Palantir Technologies, a company deeply intertwined with data analytics and defense technologies, including collaborations in drone innovation. Palantir’s expertise in large-scale data integration and analytics makes it a cornerstone of modern defense and intelligence efforts, with increasing relevance as nations prioritize security and surveillance.

From an investment perspective, Palantir presents a compelling long-term opportunity. Their consistent involvement in cutting-edge technologies and government contracts suggests strong revenue potential, especially as global demand for data-driven solutions continues to rise. Projections indicate steady stock growth, driven by increasing reliance on their platforms across industries, from defense to healthcare to finance.

Success Leaves Clues

Success often leaves behind a trail of clues for those who are willing to pay attention. While we may not have access to insider tips, simply following the flow of capital and understanding key market trends can provide invaluable insights.

Arguably, the most critical clue is understanding the "Who." Palantir Technologies was co-founded by Peter Thiel, a visionary entrepreneur with a proven track record of success, from co-founding PayPal to being an early investor in Facebook. With Thiel's history of building and backing transformative companies, it’s reasonable to believe that Palantir’s stock price has a strong probability of increasing over time.

What’s also worth noting is Palantir’s reported contributions to Trump’s campaign—a strategic alignment that could further position the company for lucrative government contracts, particularly in defense and data analytics.

Battles Are Won Before They Begin

This past weekend, during the Army vs. Navy college football game—a stage where tradition meets strategy—Palantir aired a commercial that captured the attention of many, including notable attendees Donald Trump and Elon Musk. You can [Click Here] to watch.

Coincidence or strategy?

Consider Elon Musk’s statement in an interview: “The future wars are really going to be drone wars. If your drones are better than their drones, then you win.” Is it merely a coincidence that Palantir, a leader in data-driven defense technologies, showcased its brand during this high-profile event? Or is it a calculated move to align with the growing relevance of autonomous systems and military innovation?

And then there’s Musk’s recent tweet on X, which adds another layer of intrigue.

As the saying goes, fortune favors the bold—and those who follow the trail of clues left behind.

2025 Recession?

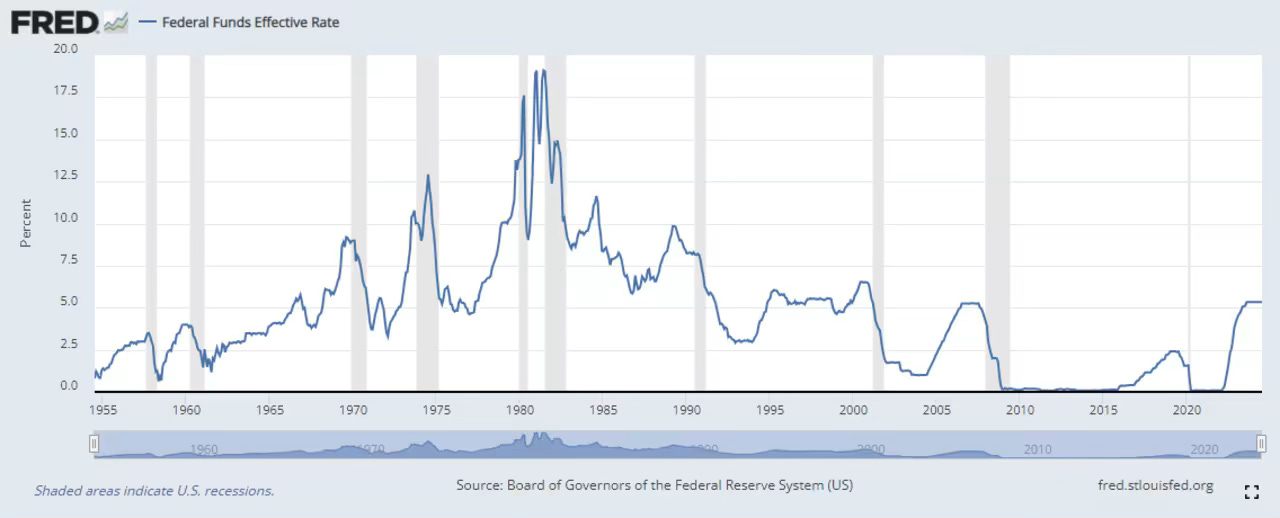

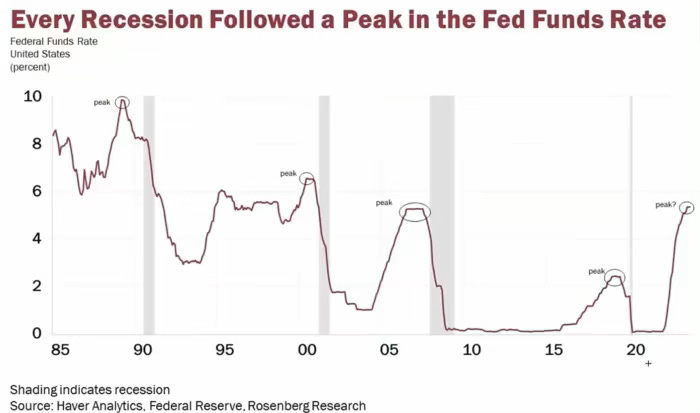

Weeks ago, I shared how falling interest rates often signal market declines. This was validated less than 72 hours ago when Jerome Powell reduced interest rates by 25 basis points to curb inflation. While some fear this as a precursor to economic collapse, it’s crucial to focus on preparation, not panic.

With rapid advancements in technology, AI, chips, and digital assets, headlines scream of volatility. But the data tells a different story. Historically, investors with a long-term horizon who stay consistent outperform those who try to time the market. If your horizon is 10+ years, doing nothing during fear-driven downturns might actually be your best move.

Adjusting During Fear: Lessons From Crypto

Cryptocurrency offers a fascinating lens into fear and opportunity. The narrative has shifted; once dismissed as fringe, crypto is now mainstream. Yet, some still say, “It’s too late.”

I usually just respond: “Is it?”

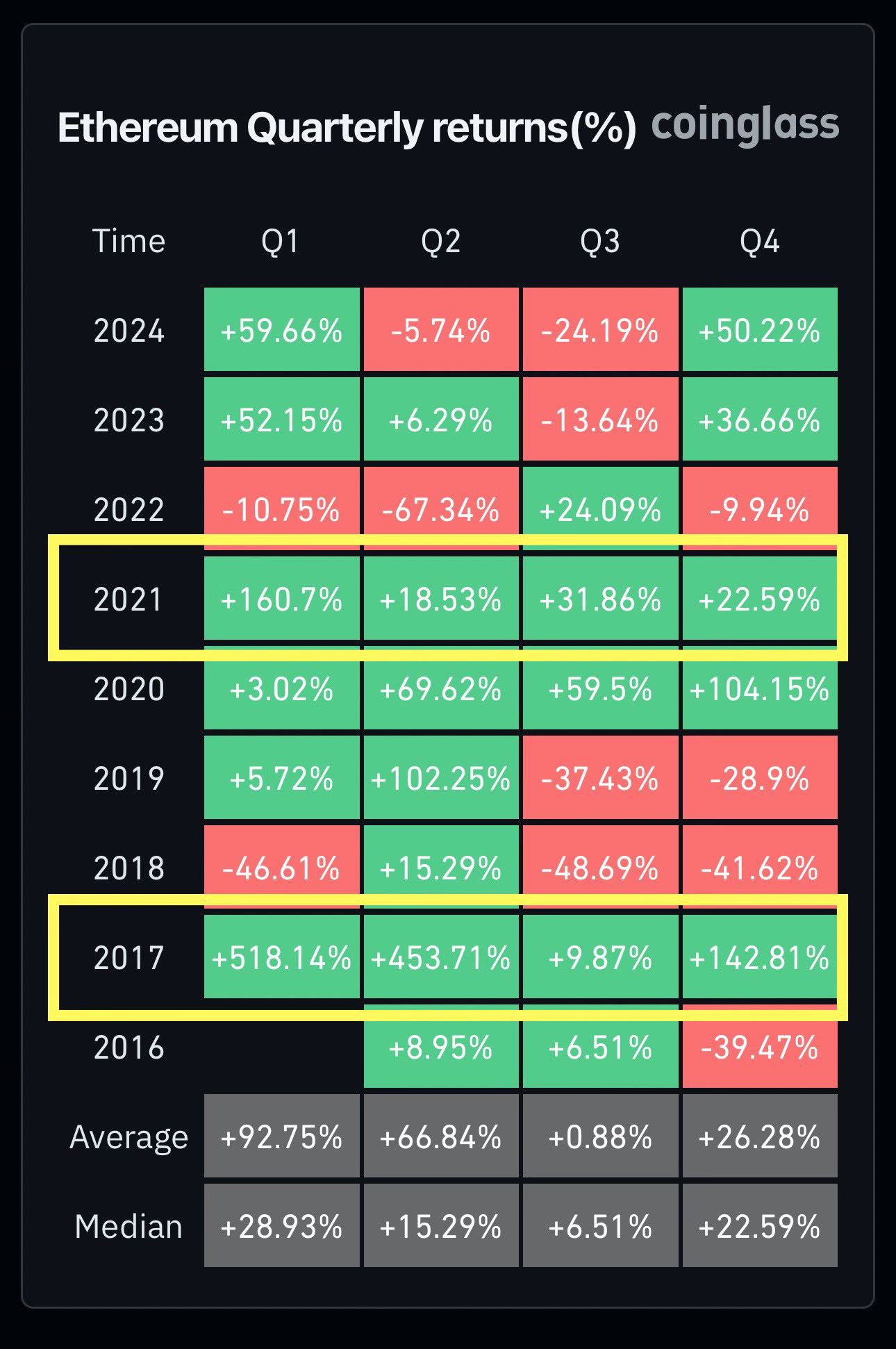

During a bull run, Bitcoin often corrects 20-30%—sometimes even 50%—multiple times. Altcoins can drop 30-50% or even 80%. These corrections, driven by fear, cause many to sell at the worst times, missing the chance to capitalize on the subsequent recovery. History doesn’t always repeat, but it often rhymes. Smart investors know these corrections are part of the process and in fact healthy considering the volatility.

We’re likely heading out of halftime and catapulting into the second half of this crypto bull market cycle. And like in sports, the best coaches, players and teams make necessary adjustments at halftime to win the game.

Ethereum (ETH) has historically surged past its previous all-time highs in Q1 following a Bitcoin halving cycle—most recently occurring in the spring of 2024. Similarly, altcoins are poised for explosive growth during "altcoin season," with the potential for 2-10x returns within a matter of months. Historically, the year following a Bitcoin halving has offered massive opportunities for growth, often creating life-changing financial gains for those who stay the course.

However, fear often leads investors to panic and sell prematurely during inevitable market corrections, leaving them with empty bags of regret instead of realized profits. Or, what is potentially worse, is being greedy and not taking profits along the way resulting in losing a majority, if not all your money.

As I always say to my consulting clients — Ask yourself: “Are you content with where you are personally, professionally, and financially?”

If not, now is the time to prepare, position yourself, and act with faith and discipline. Sometimes, the wisest move is simply staying the course—trusting in God’s timing and allowing your efforts to compound over time.

Fear, Faith, and Financial Wisdom

Fear is not just an emotional response—it’s often the enemy’s most effective tool to paralyze us. But the Bible offers guidance to counteract this.

Proverbs 3:5-6:

"Trust in the Lord with all your heart and lean not on your own understanding; in all your ways submit to him, and he will make your paths straight."

This verse reminds us to replace fear with trust. Financially, it teaches us to make wise, faith-driven decisions rather than reacting to fear or greed. Here’s how:

Plan with purpose: Align your investments and financial goals with your values and long-term vision.

Stay steady during storms: Just as faith calls us to trust God during life’s trials, staying committed to a sound financial plan during market volatility is crucial.

Give generously: The Bible encourages stewardship. Using your wealth to bless others not only brings peace but also counters the fear-driven mindset of scarcity.

When grounded in faith and armed with knowledge, you can face fear head-on and find opportunities even in the chaos.

Stay ready. Stay faithful. And don’t let fear dictate your decisions. Instead, let it sharpen your focus on what truly matters—both in life and in eternity.

P.S. If you’re looking for guidance navigating the markets or just want to connect, feel free to follow me on Instagram and send me a DM!

Let’s grow and build together. 📈

Stay Blessed,

Tyler Bossetti

info@tylerbossetti.com

www.tylerbossetti.com