The Best Budget

Discipline is the foundation of financial success.

Disciplined Dough 🍕

Budgeting isn't just about limiting what you spend. It's about creating discipline to secure your freedom.

There is a lot of online hustler talk: “Who cares about expenses, I only focus on growing my income because it can be infinite” — and sure, you can only cut expenses so far to where you are eating Ramen in a cold, dark room without Wi-Fi. That is not the point here.

Think of managing money like maintaining good hygiene. While it’s essential to focus on healthy habits to grow your income, managing your expenses is like trimming your fingernails—they require regular attention to keep everything in order.

(weird way to think about it, I know)

Math is the path.

Tracking what comes in and what goes out. A solid budget isn’t about deprivation; it’s about control, clarity, and confidence to kick financial stress to the curb.

Who doesn’t want that?

Top 3 Money Mistakes 🚧

1. The Victim Mentality Trap 😢

“They didn’t teach me about money in school!”

The Mistake: Newsflash—nobody got a “Money 101” class with their diploma. Whining about it? That’s just handing your power over to excuses. The real crime? Not having a budget at all. It’s like trying to navigate a road trip with the old school MapQuest printed off directions, or in reality no map and a blindfold.

Why It Hurts: Money doesn’t care about your sob story—it’s out the door while you’re still blaming “they.” Everyone’s got excuses; winners ditch ‘em and take control.

The Fix: Start simple and smart with a budget that doesn’t allow likely your biggest expenses, housing to eat up more than 30% of your income.

Here’s a quick breakdown for a simple budget to consider:Housing: 30% max (rent, mortgage—keep it tight).

Essentials: 30% (food, utilities, gas—not avocado toast splurges).

Debt/Savings: 30% (pay down or stack up).

Fun: 10% (because life’s not all spreadsheets and hate to admit it, but it can lead to building stronger network— and as a result your net worth).

Free Resource: Download Mint, EveryDollar or RocketMoney—apps that track your cash like a hawk so you don’t have to. Check out other benefits to eliminate unnecessary expenses, monitor your credit, protect your identity and more.

No more “where’d my money go?” mysteries disguised as excuses.

2. High-Interest Debt & Fees 💳

Buying bling to flex & impress for strangers & people you do not even like? Oof.

The Mistake: High-interest debt (think 20%+ APR credit cards) and sneaky fees keep you paycheck-to-paycheck. It’s lifestyle inflation in disguise—new car, designer drip, all to impress people you don’t even vibe with or know.

Why It Hurts: That $150 payment barely dents the principal while interest feasts on your funds. Bank fees? Late fees? They’re the cherry on top of this broke sundae.

The Fix:

Call Your Creditors: Negotiate lower rates (sometimes drop it to 0% APR temporarily)—yep, just ask. They might budge.

Bank Fees or Late Fees: Spot a random charge? Or, that annoying monthly service fee. Call and request a refund or you will consider your banking relationship elsewhere. Be polite, but firm. Maybe they will do it for the year or worst case a couple of months! 🤷♂️

0% APR Hack: Balance transfer that high-interest debt to a 0% card (12-18 months, usually). Pay it down fast without the interest vampire biting. I can help you snag one—hit me up and fill out this form!

Insurance Check: Shop around quarterly or at least yearly—better rates are out there.

Reality Check: You’ll check your Instagram likes 10x a day (or scroll for hours) but not your money? Flip that script—log in at least ONE time a day to your bank accounts and other investment resources to SEE where it’s going.

3. Ignoring Small Wins & Losses 🎯

$500 a month might not feel like much, but stick with me—this gets good.

The Mistake: Brushing off small savings or tiny overspends because “it’s not a big deal.” Wrong—those little moves compound into massive wins or losses over time. Kinda like that person you know, and they’re super nice, but for some reason they can’t seem to brush their teeth— it leaves an impression.

Why It Hurts: You’re missing the math magic. Let’s run the numbers:

Save $500/month for a year: That’s $6,000 in your pocket. Pretty sweet, right?

Invest It at 9% APR: The S&P 500’s averaged about 9% over past couple decades. If you stashed that $6,000 and let it ride for 10 years, compounding annually, it’d grow to ~$14,242. Wait 20 years? ~$33,616. That’s a legit full or partial down payment on a house or an investment property, a dream vacation, or the initial investment for your passion-driven business venture—all from $500 a month!

Flip Side: Spend that $500 instead? It’s gone, and you’re still double-tapping pics of someone else’s yacht to fall into a deeper pit of social media comparison despair.

The Fix: Turn your fiat trash cash into BTC, toss it in a low-cost index fund (like an S&P 500), finally start up your business, or purchase that first investment property!

Little choices today = big bucks tomorrow.

Sorta like when you have to hit an NBA range three to confirm you play great defense and the ball was out on them… the math doesn’t lie, it is the path! 📈

The Government’s Budget 🇺🇸

Every successful person & business has a budget. The U.S. government? It’s supposed to do the same—generating revenue from taxes (income, corporate, etc.) and other streams (like loan fees, weapon sales, Treasury bond sales and so forth) which funds the good stuff: highways & infrastructure, educational, military defense.

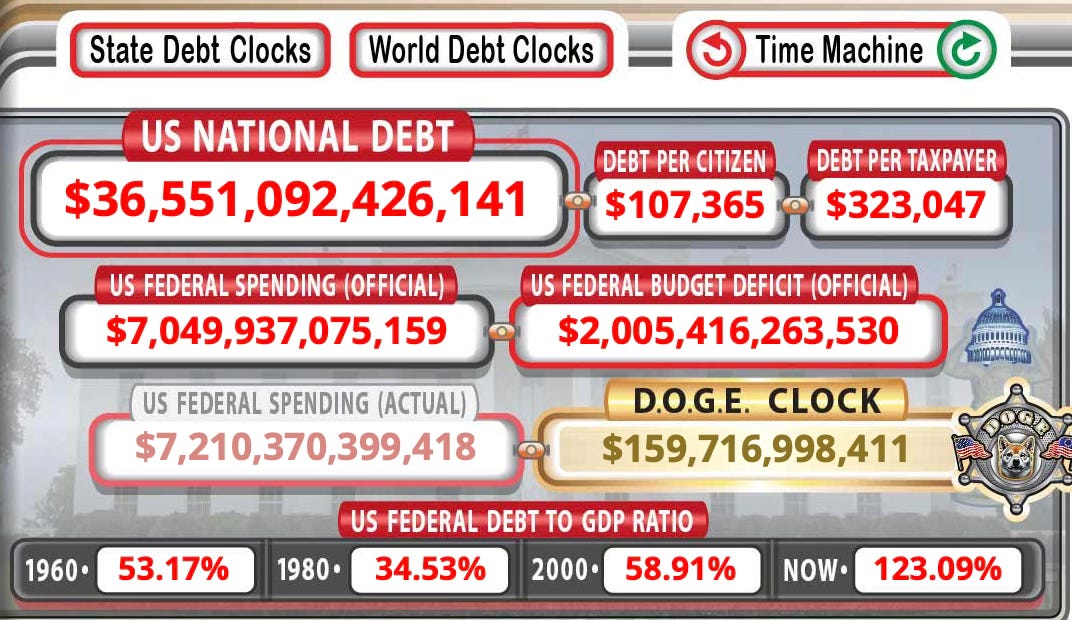

But that U.S. National Debt Clock says they’re spending like it’s Black Friday shopping every day—ticking past $36 trillion as of early 2025—and it’s clear the swamp’s budgeting skills are more “YOLO” than “zero-based.”

Revenue Reality: In 2024, the feds pulled in about $4.9 trillion (mostly taxes), per the Treasury. Solid haul, right?

Expense Explosion: They spent $6.7 trillion—think Social Security, Medicare, military, and interest on that debt pile. That’s a $1.8 trillion deficit in one year alone.

Debt Clock Drama: At $36 trillion+, the national debt’s growing faster than a TikTok trend—about 130% of GDP. Interest payments? Over $1 trillion annually now, and climbing.

The government’s a business with a budget, but it’s acting like a shopaholic with maxed-out credit cards.

D.C Drama ✂️ 💳

The latest move: on February 25, 2025, the House narrowly passed a budget resolution (217-215, party lines, one GOP holdout) to kickstart Trump’s agenda.

It’s not law yet—just a blueprint for the “reconciliation” process, letting them dodge a Senate filibuster and push it through with a simple majority. Think of it as the government’s New Year’s resolution, but with more zeros.

Here’s the scoop:

Tax Cuts Galore: $4.5 trillion over 10 years—extending Trump’s 2017 cuts (set to expire end of ’25) and adding perks like no taxes on tips, overtime, or Social Security. The next big question is: will we see an eventual elimination or at least decrease in federal income taxes? Maybe if they just fire all the IRS agents. 🤷♂️

Spending Cuts Showdown: Aims for $2 trillion in cuts over a decade. Where? Committees are tasked to find it—think $880 billion from health (Medicaid’s sweating like a …. in…. well, never mind we will keep it classy), $230 billion from agriculture (SNAP’s on the chopping block), and more. Details TBD, but it’s got folks nervous. 😬

Border & Defense Boost: $300 billion for border security, deportations & military muscle. Trump’s “America First” flex is loud & clear. And allegedly some cities have canned soup ready for their families.🛡️

Debt Ceiling Hike: Oh, and they’re jacking up the borrowing limit by $4 trillion because that $36 trillion debt wasn’t spicy enough. TURN ON THE U$D PRINTER PRESS BABY! Critics are screaming “deficit balloon!” while the GOP bets on growth to offset it. This is exactly what we need for digital assets like Bitcoin and other cryptocurrencies to see their next leg up = more liquidity! 🎈

The Catch: If they can’t hit that $2 trillion in cuts, tax breaks shrink to match. It’s a high-stakes balancing act—House Speaker Mike Johnson’s walking a tightrope with a razor-thin majority (one defection max!)

Bible Verse

Proverbs 21:5 "The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty."

Reflection: This verse shares the importance of careful planning and diligence in managing our finances. A thoughtful and consistent approach to budgeting not only prevents wasteful spending but also paves the way to financial abundance. By setting clear goals and being disciplined to a well-structured budget, we honor God's principles of stewardship and wisdom.