Tax-Free Money

What do you really own?

Let’s say you earn $10,000 a month.

Sounds solid, right? But here’s how the system actually works:

Your employer pays payroll taxes before you even get paid

The office building? Taxed (property tax)

Your paycheck? Taxed again — federal, state, Social Security, Medicare

📍(In Ohio, that’s 30–35% gone before you even touch it)You spend what’s left? Taxed (sales tax)

The business you paid? Taxed on profits… blah blah blah…

Then you’re responsible for filing to prove you paid enough

“How much do I owe?”

“We don’t know. You figure it out.”

Still think you own your income?

Or does it own you?

🤔 What if you could...

Borrow without selling

Invest without triggering taxes

Grow assets tax-deferred—or even tax-free

Spoiler → You can.

There are legal, proven, IRS-compliant ways to protect, grow, and multiply wealth while minimizing taxes.

And the rise of digital assets like Bitcoin, stablecoins, and tokenized stocks is making that easier than ever.

From Section 351 tax strategies to Bitcoin-backed loans, crypto-preferred equity, and retirement accounts powered by BTC—we’re entering a new era:

Tax-optimized. Borderless. Automated. On-chain.

Let’s break it down—starting with the foundation for it all:

👉 the Stablecoin Genius Act and why it matters more than most people realize.

(Oh, and obviously: Poppy is not a tax advisor. So do your own research & consult your own counsel. 🤓)

1. 🏦 The Genius Act vs. Fractional Reserve Banking

Imagine digital assets (like Bitcoin) as a high-speed train carrying wealth across borders… & Stablecoins (like USDC) as the rails that make it possible. 🚂

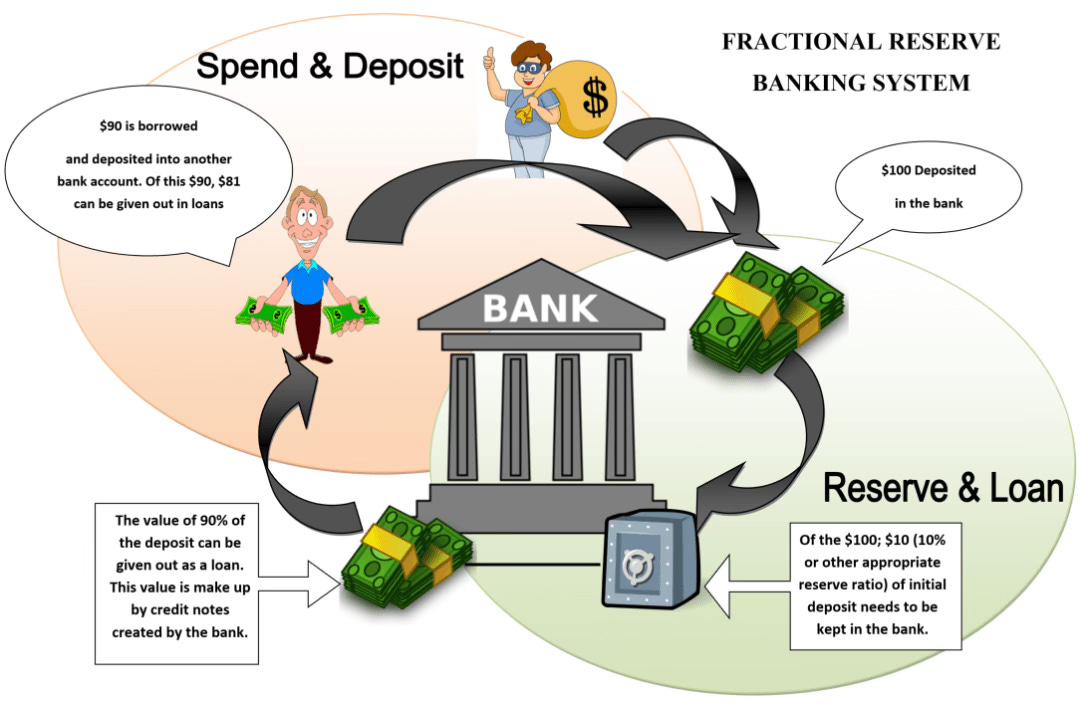

The Old System:

Built on fractional reserve banking—banks hold only a fraction (~10%) of your money & loan out the rest.

→ Slow. Opaque. Fragile.

→ Inflation, fees, bailouts... you pay the cost.

The New System:

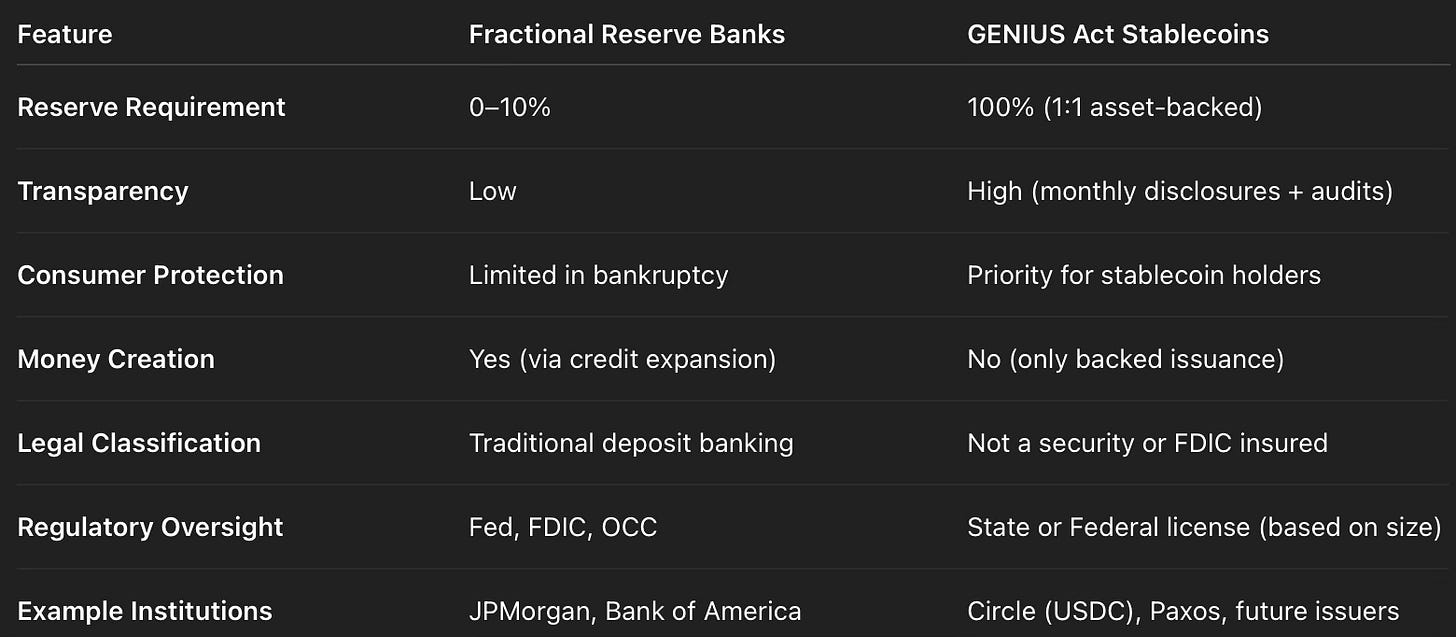

🔹 Stablecoins + The GENIUS Act — legislation introduced in 2025 to modernize digital dollars with:

🧾 1:1 reserve backing (no games)

📊 Monthly disclosures + third-party audits

🛡️ Bankruptcy protections for holders

🧩 Legal clarity: stablecoins ≠ securities

🌍 Global regulatory alignment

💡 Why it matters:

Stablecoins are the transaction layer for tokenized stocks, real estate, treasuries, and more. Regulation unlocks access for banks, institutions, and governments to build on crypto rails—creating programmable, auditable digital dollars.

🌐 It’s Bretton Woods 2.0

1944: USD backed by gold → global reserve

2025: USDC backed by Bitcoin → digital reserve

2. 🪄 The Magical Money Machine (Tokenization)

Tokenization = a vending machine for modern finance.

Buy fractional shares of Tesla, Apple, or real estate

All on-chain, no brokers, no banks

Just a phone, stablecoins, and internet

A teacher in Ghana can buy $25 of Tesla stock.

A shopkeeper in Argentina can own tokenized U.S. real estate.

✅ 24/7 access

✅ Fractional ownership

✅ Instant global liquidity

✅ Lower fees

Tokenization democratizes investing & stablecoins are the fuel.

3. 🏛️ The Corporate Express: Bitcoin as Treasury

This is the next major wealth train.

Bitcoin Treasury companies are reshaping finance—holding BTC on balance sheets instead of cash.

🎯 Core Objectives:

Hedge fiat debasement

Raise capital to buy BTC

Give shareholders BTC exposure without wallet risk

🧠 MicroStrategy & Michael Saylor

Buys BTC using corporate cash & convertible debt

Turns the company into a leveraged Bitcoin ETF

💸 $STRK: Bitcoin via Preferred Stock

Issues preferred shares to buy BTC

Gives investors exposure without custody hassle

🧬 21.co & Crypto-First Firms

Build tokenized ETPs backed by BTC

Merge fintech, equities, and crypto infrastructure

⚡ Why It Matters:

This model is driving institutional adoption, tightening supply, and forcing a treasury rethink. And yes—you can structure similar tax-optimized strategies personally or as a business.

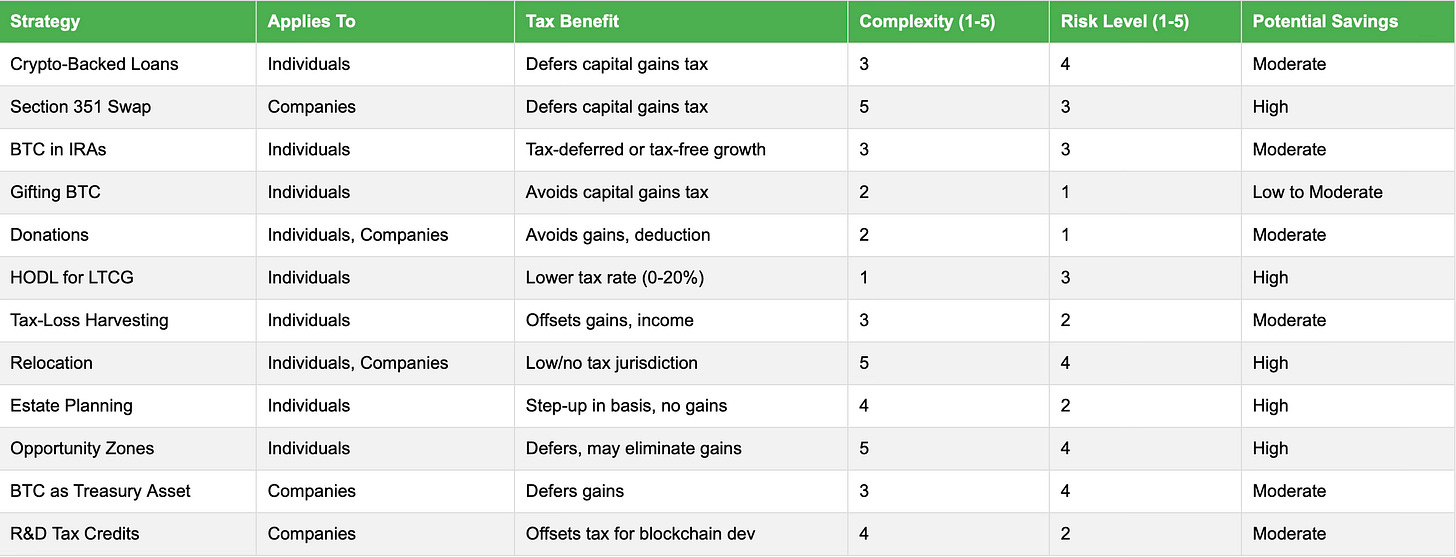

🔁💰 Bitcoin Tax-Advantaged Strategies (Simplified)

For Individuals

🏦 Crypto-Backed Loans: Borrow against BTC → no sale = no capital gains

🧾 Section 351 Transfer: Move BTC into your corp → defer tax

🏛️ BTC in IRAs: Roth or Traditional = tax-deferred or tax-free growth

🎁 Gifting/Donations: Gift $19K tax-free or donate BTC to skip capital gains

⏳ HODL: Hold >12 months → long-term capital gains (0–20%)

For Businesses

💰 BTC Treasury Strategy: Hold BTC long-term on balance sheet

🔁 Reinvest via 1031 Exchange: Shift post-tax BTC into real assets

🧪 R&D Credits: Build BTC tech = tax credits

🌎 Relocate: Crypto-friendly states/countries = lower tax

❤️ Donate Corporate BTC: Reduce income + gain goodwill

💥 The Bitcoin Supply (& Price) Shock

BTC’s supply is capped at 21 million. Post-2024 halving = 450 BTC/day (~164K/year).

In 2028? 225 BTC/day.

Meanwhile…

🏦 BlackRock + MicroStrategy now hold 1M+ BTC

MicroStrategy: 439K

BlackRock: 567K

= 6+ years’ worth of mining supply already absorbed

📈 May 22, 2025:

ETFs absorbed 13,940 BTC in one day—that’s 30x daily mining output.

📉 Exchange Reserves Are Dropping:

From 2.75M → 2.35M BTC in under 2 years

Institutions are not selling—they’re locking BTC into ETFs & treasuries

🔁 Bitcoin is being integrated into:

Corporate Treasuries

Tokenized Stocks ($STRK, $STRD)

Stablecoin Networks

Governments (Federal & State) + Sovereign reserves (speculated, emerging)

🚂 The New Financial System

Stablecoins are laying the tracks.

Tokenized assets are loading the treasury cargo.

Bitcoin is the engine pulling a new financial system into motion.

📖 Bible Verse

"You shall remember the Lord your God, for it is He who gives you power to get wealth, that He may confirm His covenant that He swore to your fathers, as it is this day." —Deuteronomy 8:18

Reflection: True wealth begins with gratitude and God. In a world of shifting systems, those who keep God first will be entrusted with resources that endure. This verse reminds us that prosperity is not self-made, but covenant-backed and God-given.