Give a mile to see if they will take an inch.

Because if they take an inch, they will take anything.

You may have heard the old saying, “give an inch & they will take a mile”.

This old saying is wrong.

Relationships are the foundation of living a prosperous life.

Trust is the foundation of prosperous relationships.

Think of relationships as a bridge.

These bridges are designed to provide a mutual exchange of value. If built correctly, it can become an unbreakable bond. And The bridges you decide to build determine the value you receive.

When Etruscan engineers migrated to Rome, they shared their knowledge of bridge-building techniques.

The Romans improved on their shared skills, by developing & enhancing methods of their own. Such as designing arches & keystones. Eventually utilizing stronger building materials such as concrete, iron & volcanic rock.

The act of Etruscan engineers exchanging their knowledge is what bridged the gap for Rome to expand their empire.

The value of a relationship is merely the exchange of information.

If applied, the information can transform into knowledge.

Knowledge is power.

Power is control.

Trust is required when maintaining & expanding prosperous relationships.

'Relationship Capital’ can eventually become more valuable than fiat capital in your bank account.

But, you can’t take an inch, when given a mile.

You must continue to nurture & attend the valuable bridges in your life.

If not, these bridges will decay & become a liability.

Please do understand there serves no purpose of burning these decayed bridges.

Just leave them unattended.

A truss provides a framework upon which other elements can rely.

Similarly, in a relationship, the Truss symbolizes the strength to endure challenges & difficulties that will arise.

A framework for designing valuable relationships is built on shared values, mutual respect, & understanding, as those elements are essential for its sustainability.

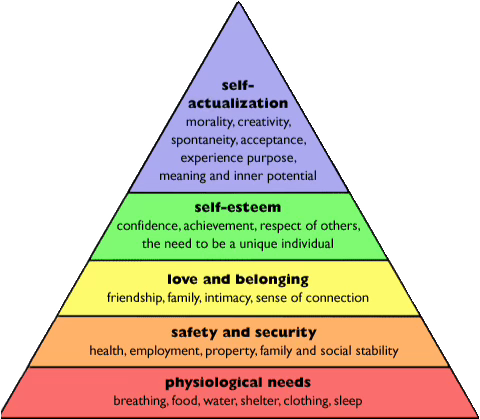

Trust is one of the fundamentals of basic human needs — safe & security.

It is estimated that 70% of wealthy families will lose their wealth by the second generation and 90% will lose it by the third.

A proven strategy to avoid this statistic?

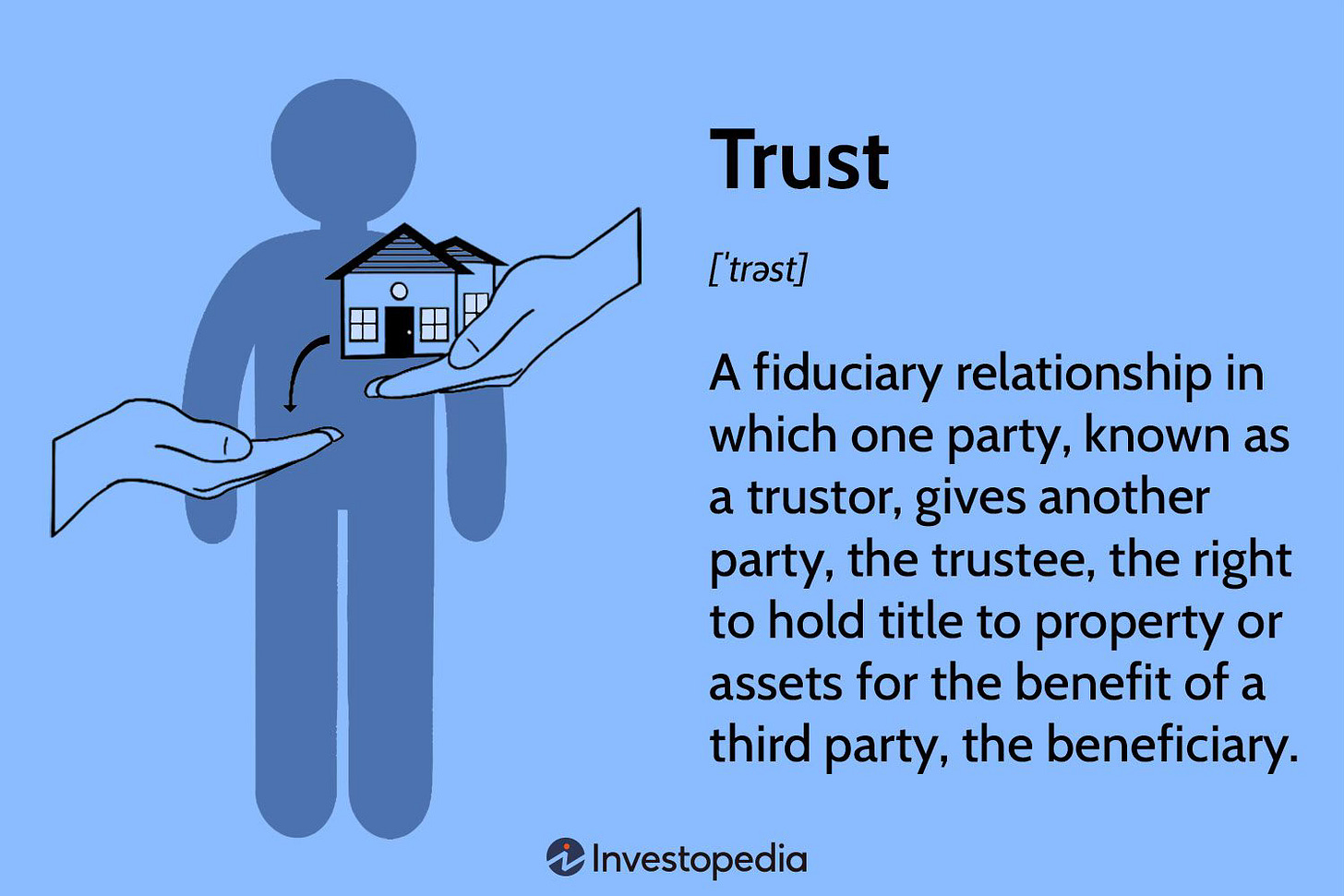

Trust(s).

The wealthiest people & empires leverage trusts to protect their power.

Implementing this tool is to ensure they do not build an empire All For Nothing.

Since the beginning of time, humans have an endless desire of control & power.

Power is accumulating information & transforming the information into knowledge through action. Protecting that knowledge is what allows people & empires to remain in control. Ultimately, growing their empire by conquering other’s land.

Wealth returns back to poverty by the 2nd generation not necessarily due to bad investments, taxes, or poor probate planning… but rather a victim, entitled mentality.

Trust(s) can assist in preventing a cancerous mentality of spreading & ultimately, collapsing an empire.

As you are building or exiting your empire, it is crucial to design a plan in protecting yourself & future generations.

It is not how much money you make, but rather, how much money you keep.

If you are a business owner or director of an organization, how do you own your shares of the company? Determining how you own your company shares, will determine how you are taxed. Whether it be as an individual or maybe through a discretionary trust.

Why is this important?

Taxes are the largest expenses one will have in their lifetime.

A Trust owning your shares in the company & other potential assets, can be beneficial for a couple of reasons.

***Benefit #1: TAXES

A trust can determine how much Tax you are paying as an individual.

You could give yourself an annual Salary. Then the company pays the shareholders, the owners of the shares in the company, a portion of the profits, referred to as a dividend. If you would personally own your shares, you would also earn those dividends as a shareholder on top of the annual salary. As a result, you would be taxed at your individual marginal tax rate, which will likely be paying higher taxes than owning the shares in your trust vs individually.

If you own the shares of the company through the trust, the dividends would be paid through the trust. As the trustee (controller of the trust’s assets), you could distribute the money back to yourself, or other people, such as family. The trust doesn’t pay taxes; only you would pay taxes on the amount of money distributed to you personally. Maybe you could consider distributing the money to partners, advisors, counsel & other expenses to assist in further mitigating your tax liability and growth of the company.

***Benefit #2: BASIC HUMAN NEEDS

A Trust can protect & secure your shares if something goes wrong with the company or maybe other shareholders within the organization.

Let’s assume you personally own your company shares rather than owning the shares through a trust. And like all business owners and/or directors, you need capital to operate your business & cover contractual expenses, such as: inventory, rent/mortgage, salaries, etc.

Now, let’s assume one of the parties in a mutually executed contractual agreements does not fulfill their responsibilities. A few simple examples would be not having enough personal funds to pay an expense/invoice. Or maybe a supplier for the company’s product does not deliver the entire inventory, resulting in the need for refunding the clientele, but yet you personally do not have the funds due to reinvestments/other expenses within the organization. You are in breach of a contractual agreement. There can be many more details & variables in this example of course, but you personally are now on the hook for this company debt & potentially subject to losing your personal assets (ie - house, car, personal money).

A trust would protect your company shares & personal assets. Considering you would not personally own the shares or assets, rather it is owned by the trust, in which you control the trust.

Own nothing, control everything.

1. Taxes are the largest expenses one will ever have in their lifetime.

It is not how much money you make, it is how much you keep.

2. Safe & security are basic human needs not only to survive, but design a life to thrive.

Removing risks & personal liability in business ventures, while mitigating tax liabilities, can help in ensuring you & future generations are not doing it

All For Nothing.

In the Bible, the Gospel of John opens with a poem, “In the beginning was the word…”

This seems to be a reiteration of Genesis 1, when God created everything with his word.

Here is how I personally interpret this scripture:

The word of a man is a reflection of their mind.

The mind of a man is a reflection of their creator.

Sharing your word, is a reflection of one’s knowledge.

Keeping your word, is a reflection of one’s trust.

You can’t have any positive relationship without trust.

***P.S. — If you enjoyed this post or other Substack posts, send me a text to connect & share your feedback :)

My cell phone number is: +1 (614)-660-5921

Disclaimer: My Substack posts are not written for financial, tax or legal advice.

I am strictly sharing my personal experiences & opinions.

Consult with your own advisors & counsel.