There’s 2 type of people in this world.

Always has been, always will be.

📐The Wealth Reset

The ones who build wealth.

And the ones who watch it being built.

Since the dawn of civilization, power and prosperity have revolved around just three things: Capital. Land. Labor.

Capital (credit): centralized system which governs access & leverage—it’s the money, now evolving into a peer-to-peer decentralized system.

Land (real estate): stores & multiplies wealth—it’s the law, the foundation of control.

Labor (human effort/jobs): fuels production & solves problems—it’s the tax, created, extracted & regulated.

From the Egyptian dynasties to the Roman Empire to the Rockefellers, the elite didn’t just participate in these systems—they created, owned & manipulated them. That is, until the cycle gets broken: by revolution, collapse, or a technological leap.

And today, we’re living through one of the most profound shifts in modern history, one that’s rapidly reshaping capital, land, & labor faster than most can even recognize.

The catalyst?

AI.

🤖 Artificial Intelligence

It’s rewriting the wealth rules — at a fast pace than ever imagined, or seems to be even understood.

What started as niche automation has become an inevitable seismic force.

AI is now growing more capable by the hour—and with it, our economic foundations are shifting:

Labor? AI is replacing human input at every level—from coders to copywriters, architects to analysts.

Land? With less need for office space, we’re seeing major metro buildings auctioned off or converted to housing—while tokenization creeps in to digitize property ownership.

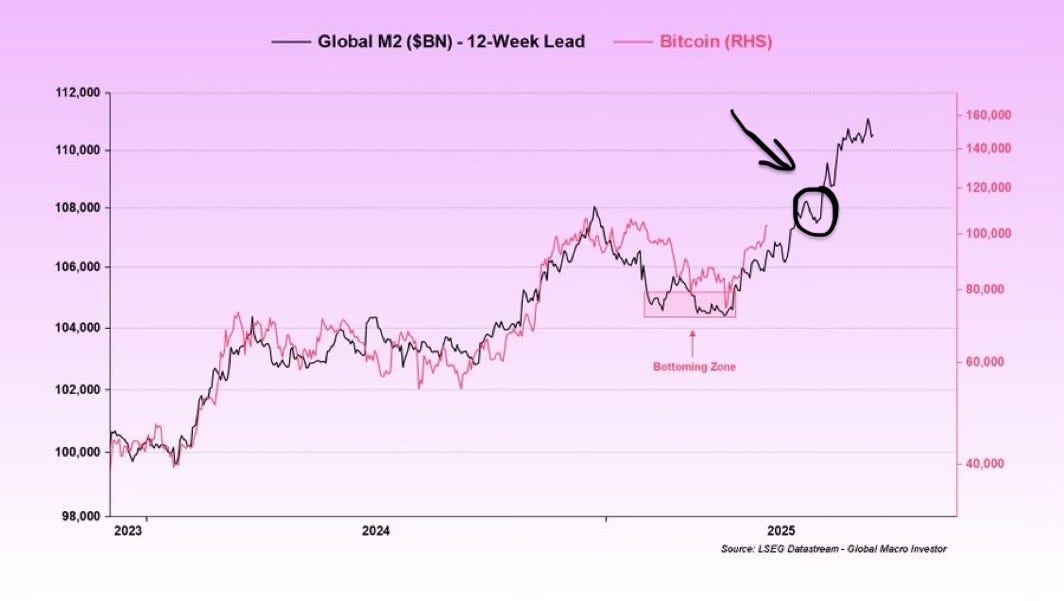

Capital? Bitcoin and digital assets are increasingly bypassing centralized banking systems—and the dollar’s purchasing power is in terminal decline.

🪙 Want more of Poppy’s 2 cents?

The U.S. penny now costs more to mint than it’s worth—a fitting metaphor for the decline of fiat currency.

It’s a clear sign: money is becoming more symbolic than practical. And it’s happening right in front of us.

Further proof that the wealth shift is underway and at the heart of it is capital.

Just like the Rockefellers shaped the modern banking world during the last Great Reset, we’re now facing a similar inflection point.

But this time, you have the chance to leverage both systems—the traditional & the emerging. Credit, funding, and digital finance offer everyday people a shot at becoming their own bank… if they act before it becomes harder, more competitive, and tightly regulated.

After all...

Who controls the food supply controls the people (labor).

Who controls the energy can control whole continents (land).

Who controls the money can control the world (capital).

The question is: Will you control it—or be controlled by it?

🏚️ Real Estate’s Echo of 2008 (But With a New Twist)

The U.S. housing market in 2025 feels eerily familiar—like a modern-day replay of 2008. But this time, it's not just subprime loans or reckless speculation. It’s a perfect storm of high interest rates, record-setting home prices, inventory surges, and an economy weighed down by uncertainty.

⚠️ Market Data & Pain Points

Why capital access matters more than ever in 2025 for buyers, investors, realtors, and anyone trying to scale or survive in real estate:

📉 Home Sales at a 15-Year Low

In April 2025, existing home sales dropped to 4 million units (SAAR)—the slowest April since 2009. That’s a 0.5% MoM and 2% YoY decline, signaling broad buyer hesitation.

📈 Affordability Squeeze

The median home price hit $414,000 (+1.8% YoY), while mortgage payments are now 26% higher than in 2020, adding over $18,000/year in carrying costs. First-time buyers are increasingly locked out.

🏦 Rate Lock-In Trap

Over 80% of homeowners have sub-4% mortgage rates, and they’re not moving. Freddie Mac estimates a $47,800 lock-in effect per household, keeping resale inventory tight and demand bottled up.

⏳ Inventory Is Rising, But Not Moving

Listings are up 21% YoY, but homes are now sitting 29 days on market, up from 26 last year. Unsold new homes hit 117,000 in April—the highest since 2009—especially in oversaturated Sun Belt markets (FL, TX).

📉 Mortgage Application Activity Is Tanking

Q1 2025 shows purchase applications down 13% and refinance activity down 8% YoY, as rate shock and hesitation keep borrowers frozen.

🧱 Builders Are Offering Deep Discounts

D.R. Horton reports lagging spring sales, KB Home is slashing prices & Lennar is offering up to $52,000 off $400K homes to move stagnant inventory. Insane!

🌀 Economic Uncertainty = Fear

2025 has delivered nonstop confusion: daily-changing tariffs, legal ambiguity, and shifting policy tone.

This environment has led to:

Consumer hesitation

Corporate spending cuts

Mass layoffs: 56% of CEOs expect workforce reductions in Q2 2025

🔐 Lending Standards Keep Tightening

According to Fannie Mae, 62% of lenders raised DTI thresholds in Q1, limiting financing options for everyday buyers and sidelining credit-constrained investors.

📉 Transaction Volume Is Down, Margins Are Thinner

Realtors, Mortgage Lenders, Wholesalers & well… basically anyone in the industry are under pressure.

Deal volume is down 15% YoY, & with rising lead gen and ad costs, it’s never been more expensive, or more critical, to close quality transactions efficiently.

💰 The Underrated Wealth Weapon

This isn’t 2008—but it rhymes.

While sentiment feels familiar, the mechanics are different: affordability compression, inventory dislocation, & policy volatility.

Deals haven’t disappeared—they’ve just become more complex.

Those who understand how to access capital creatively will be positioned to win while others wait, hope, or retreat.

🏦 Creating Capital

Becoming your own bank isn’t a theory—it’s a strategy the wealthy have mastered for generations.

By leveraging credit, borrowing against investment vehicles (like insurance policies, retirement accounts, or brokerage portfolios), and using other people’s money strategically, they’ve built empires with good debt.

The kind that produces income—not the kind that drains it.

It’s no coincidence that the wealthiest people often carry the most debt. It’s just not bad debt. It’s productive capital—money working harder than they do.

Want to get ahead?

Use tax-free money to generate more money.

Over the years, we’ve helped thousands of clients secure over $300 million in funding. Most of it at 0% APR (or very low interest) for personal, business, & investment ventures.

→ Often without:

❌ Collateral

❌ Extensive experience required

❌ Large cash reserves

❌ Even those with challenged credit

🏀 Pivot or Perish

In basketball, the pivot foot changed the game forever. Even the slowest big man could outsmart elite defenders with one solid pivot—just ask Dirk Nowitzki, who torched LeBron’s Heat with it in 2011.

Like in basketball, the most successful people, businesses, and investors don’t always sprint—they pivot, because in an evolving world, the smartest move isn’t speed… it’s adaptability.

🏠 5 Major Pivots in Real Estate Right Now:

From Traditional Loans to Creative Financing

Seller financing, subject-to, lease options, Equity advancements vs Traditional Cash-out or HELOC refinances, and DSCR loans, & the list goes on.

It is evident investors are moving away from traditional bank financing & toward deals that require strategy, relationships and creativity.

From Ownership to Control

Master leases, arbitrage models, and partnerships are letting people profit from properties they don’t technically own.

From Short-Term Rentals → Mid-Term & Long-Term Plays

As Airbnb gets saturated and regulated, investors are shifting to travel nurses, insurance housing, and co-living solutions.

From Appreciation Betting to Cash Flow First

Investors are trading speculation for stability, buying based on proven and market rental income—not "hope" appreciation or overpaying like it’s the Covid home buying era.

From Physical to Digital Assets Backed by Real Estate

Tokenization, fractional ownership, & real estate funds are opening doors for passive investors & global capital.

AI Tools: Market analysis, virtual property tours, & automated lead generation.

💰 Now ask yourself: what would $100,000—or more—do for you?

For your client?

Your business?

Your private investor?

Even your portfolio?

Better yet—what could hundreds of thousands (or even millions) do in the hands of someone who knows how to adapt & deploy it with precision?

Because the game has changed.

It’s no longer about being the biggest, fastest, or flashiest. Never has been.

It’s about being smart enough to pivot, like Dirk—calm, calculated, and cashing in.

P.S. Poppy said LeBron is still the 🐐 No debate!

🤿 Deep Dive!

Here are real-world methods our clients are using to acquire deals or scale their current real estate operations:

1. Equity Advances vs. Traditional Cash-Out or HELOC

✅ 10-Year Equity Advance (No Monthly Payment)

Great for landlords, Airbnbs, or investors with 30%+ in equity, who need capital now without touching monthly cash flow

No immediate impact on DTI (debt-to-income)

Often non-reporting to credit bureaus

⚠️ VS. Traditional Cash-Out Refi or HELOC

Immediate payments begin

Rate-sensitive + stricter borrower profile needed: income, assets & credit requirements

Usually shows up on credit reports

Key Takeaway: With equity advances, you buy time and cash flow, which is the most valuable thing in an uncertain economy.

The Verdict? Use equity advances when you want to keep liquidity & avoid over-leverage in a high-rate market.

2. 100% Financed Deals with 0% or Low-Interest Credit

We’ve helped clients:

Many of our clients secure on average $100K–$300K+ in unsecured capital

0% interest options for 12–18 months

Can be used for down payments, rehab costs, or acquisitions

Also perfect for realtors, wholesalers, and flippers needing marketing capital or team expansion

Imagine 100% financed deals, without touching your own cash. 👍

Even with bad or average credit, we’ve helped clients get qualified for funding to do whatever they need to do!

✌️The Two Types of People

We’re at a pivotal moment.

AI is automating labor.

Land is being tokenized.

Capital is going peer-to-peer.

There are two types of people:

Those who act & those who watch.

Will you leverage AI, secure funding, & acquire assets to become your own bank?

Or sit on the sidelines as jobs vanish, real estate transforms, & capital slips away?

Office buildings are being auctioned or converted to housing.

Bitcoin & digital assets are bypassing banks entirely.

Labor & Land needs are shrinking & shifting.

But controlling capital remains king. 👑

📖 Bible Verse

"Precious treasure and oil are in a wise man's dwelling, but a foolish man devours it." — Proverbs 21:20

Reflection: True wealth isn't just about what you gain, it's about what you preserve & how you position it. In a world full of consumption, those who think long-term, steward wisely, pivot at critical moments & invest strategically will always be ahead.