N#MBERS DON'T LIE

Beating The Casino's Outdated Odds

Emotions.

The #1 reason why people lose money.

March Madness is in full effect.

At this point of the NCAA college basketball tournament, brackets & bank accounts are busted; people are willing to bet their hard earned money on a Cinderella Story, rather than invest it for themselves.

This is how most people decide to invest their money.

Gambling, not investing.

Buy high, sell low.

Their lack of controlling emotions — fear & greed, or simply getting screwed over by not having experience or enough capital to overcome the adversity, ultimately lead to them losing money.

What if there was a solution for you to remove emotions?

Not stock dividends or real estate — which require more hands on attention than most prefer.

From anywhere in the world (as long as you have access to internet connection), you can earn consistent returns on your hard earned money.

And with full control of your funds.

Nowadays, there’s even algorithms designed by people & artificial intelligence to consistently win against the casino’s outdated odds.

What if you could create your own Cinderella Story?

If you ask me, that’s the best bet.

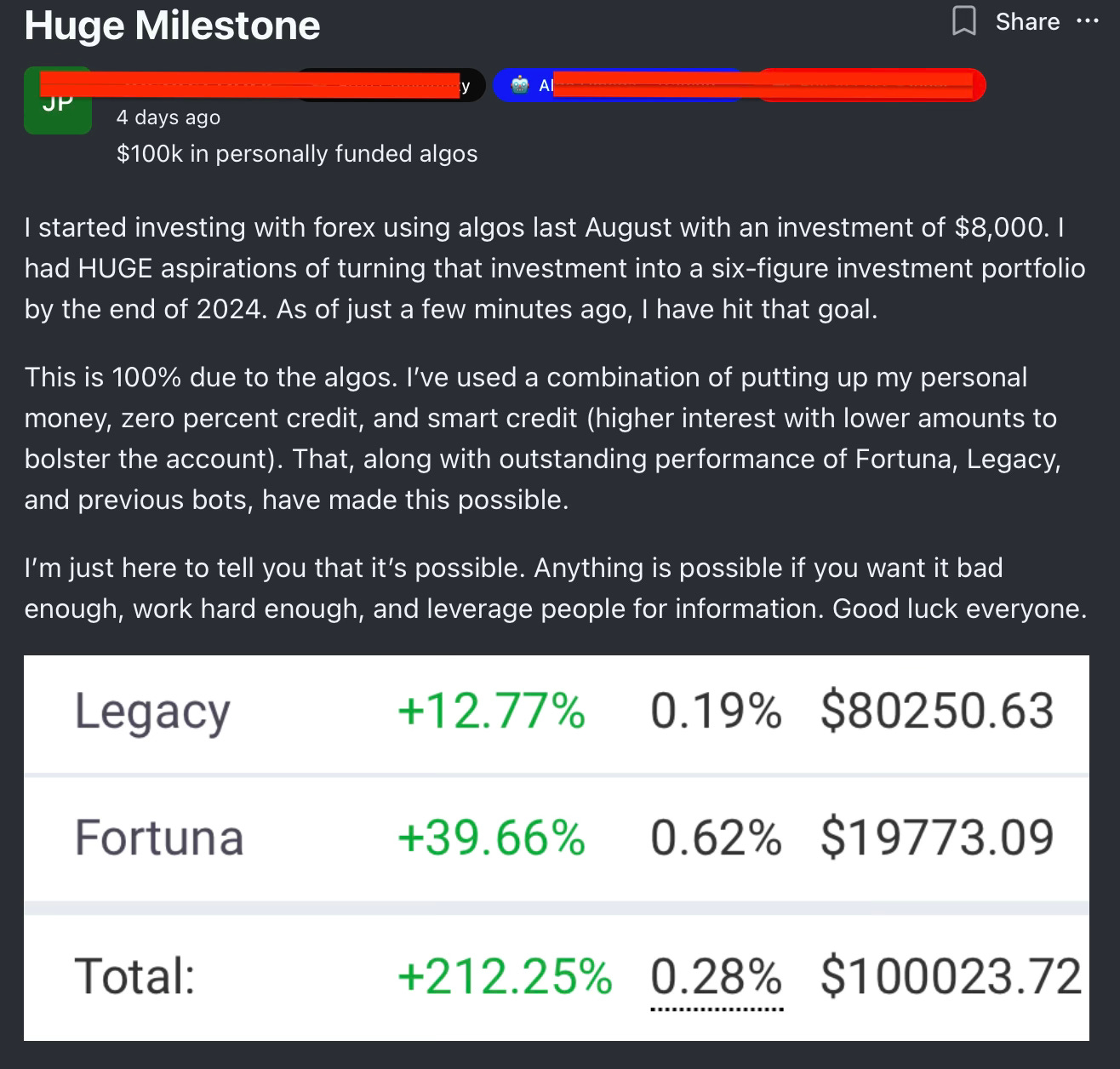

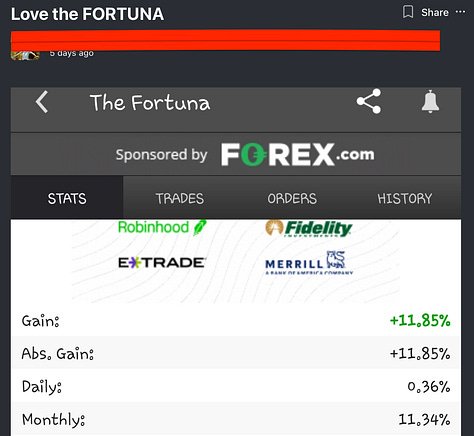

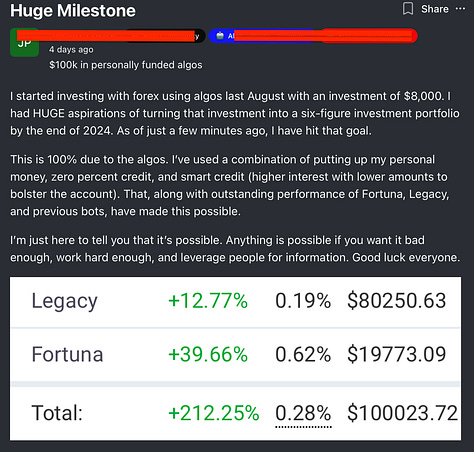

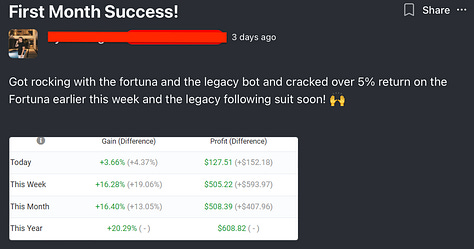

***Here are some of my clients creating their own Cinderella story.

They are earning 5% to over 20% per month licensing my algorithm trading bots.

There’s three (3) simple concepts for Money.

1. How-to Make it

2. How-to Keep it

3. How-to Expand it

Over 70% of people are not making enough money to keep up in life.

Drowning in the deep end due to high-interest/bad debt, student loans, soaring cost of living — paycheck to paycheck.

Brainwashed to save your money & remove meaningless expenses. Although important, it is not the formula for beating the odds.

People have an income problem, not a spending problem. (most of the time)

That said, until you are disciplined in the art of saving money, you will not become disciplined in the art of investing & expanding it.

Think of your expenses as your fingernails — it is healthy to monitor & trim them as needed.

A dollar saved, is a dollar earned.

The most simple & effective financial strategy to implement & evaluate is a budget.

The 50/30/20 budget.

50% Needs: This portion of your income should cover all of your essential expenses. These are the bills and costs you must pay to live and work, including rent or mortgage, utilities, groceries, insurance, healthcare, and minimum debt payments. If your necessary expenses exceed 50% of your income, you may need to reassess and adjust your spending in this category.

30% Wants: This segment is for discretionary spending or non-essential items that enhance your lifestyle. This includes things like dining out, entertainment, hobbies, travel, and luxury items.

20% Savings & Debt Repayment: The final 20% is dedicated to your financial future. This includes savings, investments, and extra payments on any debts beyond minimum payments (such as paying off credit card debt, student loans, extra payments on your mortgage, or other debts)

Real Life Example:

Monthly Income: $8,000 (pre-tax)

50% Needs: $4,000

30% Wants: $2,400

20% Savings & Debts: $1,600

Saving money over your lifetime is gambling & the odds are not in your favor.

At any given moment, our Government & The FEDs can increase our country’s money supply by “printing” more fiat USD into the economy, ultimately reducing the value of our currency & it’s purchasing power.

This is inflation.

In fact, your $1 is losing nearly 10% of its value, year-after-year.

Like all fiat currency, the USD is on the verge of collapse. Each day that goes by, the odds in favor of your fiat USD becoming worthless.

This means if your traditional investments: retirement accounts, stocks/bonds, mutual funds, commodities, or even real estate, and the list goes on… is not earning 10% or more, it is likely not an asset, but rather a potential liability.

A common referred to investment strategy from ‘professionals’ is the often cited "60/40" portfolio, which allocates 60% to stocks and 40% to bonds, though this can be adjusted to suit individual needs.

Although saving money & implementing the “60/40” portfolio is better than nothing; these odds are also not in your favor.

It is a fast path strategy to ensure you are doing it All For Nothing.

In fact, most retired people are not on the beach sipping margaritas, they are rather using their decades of hard earned money (from saving & traditional investments) to pay for their health expenses.

Or, their generational wealth is lost within the 2nd generation due to entitlement or victim mentality.

Most people never enjoy their own money, let alone getting it to work for them.

They spend their entire life accumulating it, never enjoying it, let alone expand it.

My mission is to help people ensure they are not doing it All For Nothing.

Decades ago, to beat the odds of financial success, it was rather simple:

- Get a job.

- Save money.

- Buy a house.

- Invest into traditional 60/40 retirement account.

Times have changed.

Today, this path is the best bet for losing.

With the chips stacked against us — how do we defy the odds?

Innovate.

The best coaches of all time created winning formulas.

They innovated the game by implementing a specific strategy their opponents may have never experienced or witnessed — creating a competitive edge against their competitors for victory.

Investing is no different.

“If you want something you never had, you have to do something you’ve never done.”

– Thomas Jefferson

This formula is simple:

1. Beat Inflation

2. Make, Keep & Invest Money

Verified by economical data, one must make at least 10% or more income each year to stay ahead of inflation, let alone getting ahead & enjoying the fruits of their labor.

Then, you need to integrate strategies & loopholes to mitigate tax liabilities.

Eventually, investing your money, so you do not spend your entire life attempting to earn it, while it is simultaneously losing it’s value.

Easier said than done, right?

It may not be easy, but it can be simple.

After consulting thousands of people over the years, the #1 reason why people & their business ventures do not grow or ultimately fail, is due to lack of capital $$$.

Capital they need for marketing, sales, operations — with the intention of generating more cash-flow.

Takes money to make money.

Just doesn’t have to be yours.

Providing a personalized blueprint, has helped clients secure hundreds of millions of dollars (at 0% APR or low interest) to eliminate bad debts (credit cards or student loans) & generate more active & passive cash-flow.

If your personal FICO credit is 680 or higher, there’s a good chance you can secure tens of thousands, if not hundreds of thousands of dollars at 0% APR or low interest. Even on a brand new business venture. If your credit is bad, outside of following a budget, this is by far the upmost importance as it is the foundation of your finances.

Check out other Substack posts or Text Me for help.

My number is: +1 (614)-660-5921

Now, let’s say you have at least $10,000 and you’re looking for the next move to make.

Maybe you have dabbled in the markets, purchased an investment property, or simply want to generate larger returns, with minimal risk & time.

You’re likely busy enough & most traditional investments are unable to outpace inflation — not to mention, take minimal time.

What if you could make 5-15% a month on the $10,000 investment?

What would $500 to $1,500 extra a month do for you?

In less than a year — my client transformed $8K to over $100,000 by licensing two (2) of my proven algorithm trading bots.

They had full control of their funds in their own broker account.

The Bot is designed to beat the #1 reason why people lose money = emotions!

Absolutely life changing.

***Disclaimer: Past performance does not indicate future results. Although this is not an investment opportunity, please understand investing money does require risk. I am simply sharing a client testimonial on behalf of licensing my company’s trading bot — not an investment opportunity. Consult with your own counsel.

March Madness is all about the Cinderella Story.

When the stakes are the highest, who is going to rise to the occasion?

The underdog defying the odds, under the brightest lights & intense pressure.

They are magician’s on the court.

After midnight, everything Cinderella’s fairy godmother had done for her, became undone. Her carriage turned back into a pumpkin, the footmen turned back into lizards, the coachman turned back into a rat, and her gorgeous dress turned back into rags.

The magic wore off.

Cinderella likely felt as most people do in real life — she had done it All For Nothing.

In your lifetime — there is usually only 1 major opportunity or “black swan” event for you to be prepared & decide to capitalize.

A magical opportunity for you to decide your financial fate & defy the odds.

Rather than gambling your money away, betting on someone else’s Cinderella Story, consider creating your own.

The numbers don’t lie.

Text Me if you have at least $10K and want to see if you qualify for licensing the algorithm trading bots.

***Disclaimer: This post and my Substack page is not sharing financial, tax, legal advice or investment opportunities. Consult with your own advisors & counsel.