It’s not how much money you make, but rather how much you keep.

Disclaimer: This post, like all others, is for informational purposes only and does not constitute financial, tax, or legal advice. Please consult with your own financial advisor, tax professional, or legal counsel for advice tailored to your specific situation.

Taxes: The Biggest Expense of Your Lifetime

For most people, taxes are the single largest expense they'll ever face. Over your lifetime, you could easily pay millions in taxes—income tax, sales tax, property tax, capital gains tax, and many more.

As we rapidly approach the end of the 2024 year, one of the best strategies to consider implementing is Tax-Loss Harvesting.

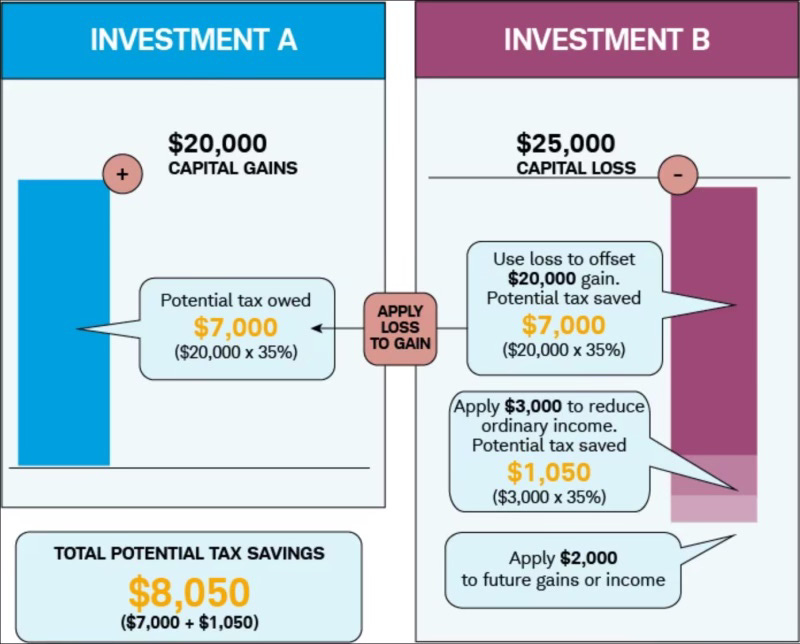

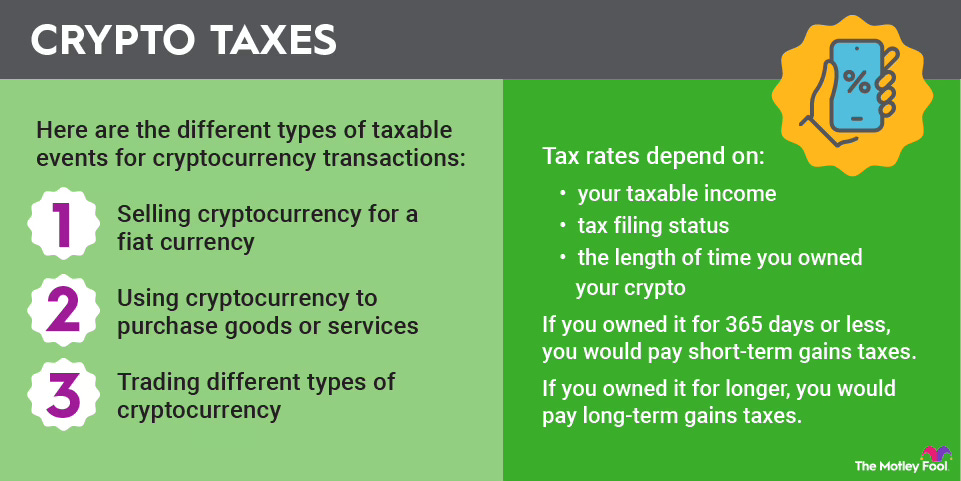

This strategy involves selling digital assets at a loss to offset capital gains from other investments, thereby reducing your overall taxable income.

As we approach the end of the year and considering where we are in the current cryptocurrency bull run market cycle, I firmly believe that tax-loss harvesting is one of the most lucrative strategies to implement. This approach can position your portfolio for maximum upward potential while effectively mitigating your tax liability.

Lose money, to save money…

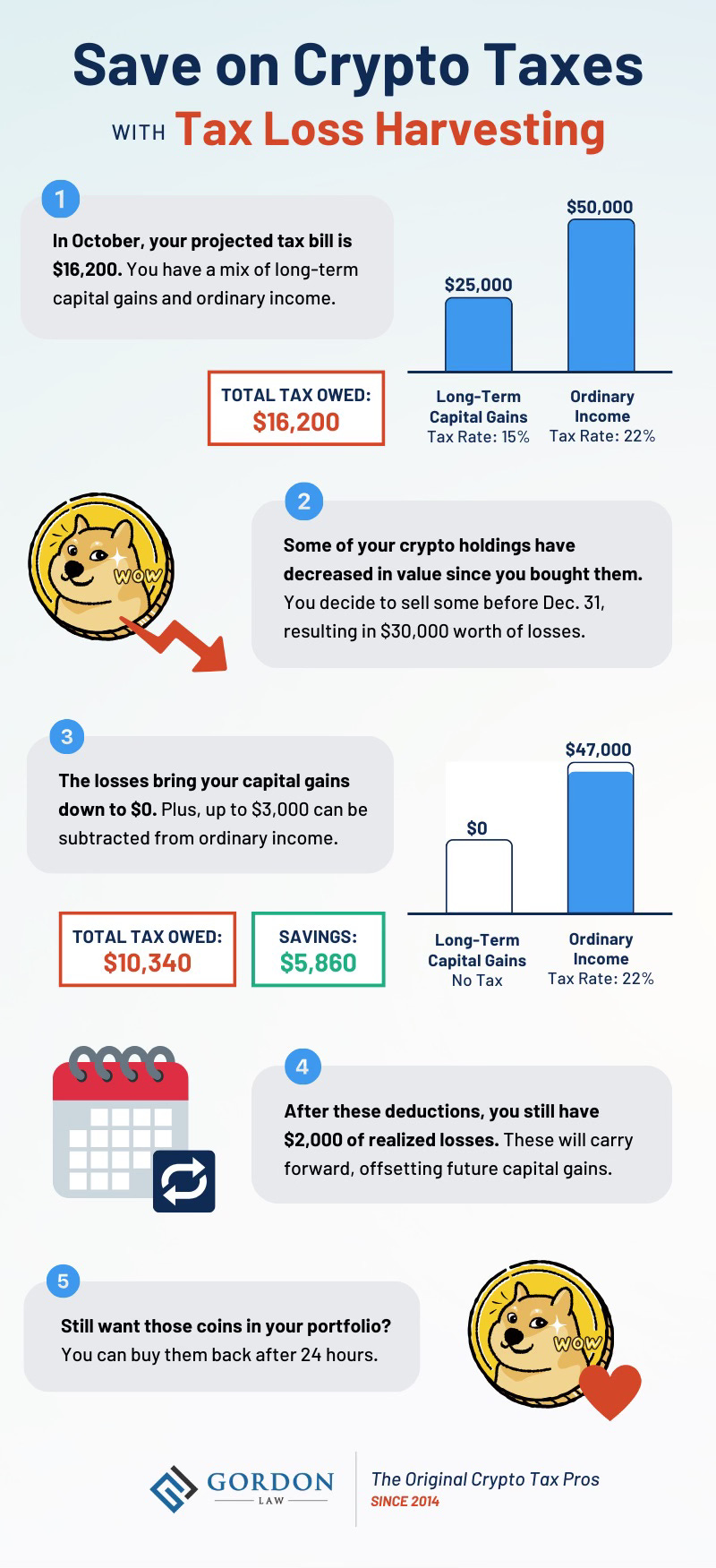

How It Works:

Identify Underperforming Assets: Review your cryptocurrency portfolio to pinpoint assets that have declined in value since purchase.

Sell to Realize Losses: Sell these underperforming assets to realize the capital losses.

Offset Gains: Use the realized losses to offset capital gains from other investments. If your losses exceed your gains, you can offset up to $3,000 of ordinary income per year and carry forward any remaining losses to future tax years.

Considerations:

Wash Sale Rule: Unlike Stocks, Bonds and Mutual Funds—Currently, the IRS does not apply the wash sale rule to cryptocurrencies, allowing you to sell a crypto asset at a loss and repurchase it immediately without disqualifying the loss for tax purposes. However, this may change in the future, so it's important to stay informed about regulatory updates.

Record Keeping: This can be a pain, considering the potentially high volume of trades. Maintain detailed records of all transactions, including dates, amounts, and transaction fees, to accurately report gains and losses. Save tons of time by considering a useful tax software tool, such as: CoinLedger and save 10% using code: CRYPTOTAX10

Consult a Tax Professional: Given the complexities of cryptocurrency taxation, it's advisable to consult with a tax professional to ensure compliance and optimize your tax strategy.

By strategically implementing tax-loss harvesting in your cryptocurrency investments, you can potentially reduce your tax liability and improve your portfolio's after-tax returns.

Leverage Letting Go

If tax-loss harvesting isn’t the right strategy for you, consider stepping away from traditional investment approaches, which nowadays hardly keep up with real inflation, or complementing them by embracing the new digital economy. Leverage tax-advantaged accounts such as IRAs, Roth IRAs, SEP-IRAs, traditional 401(k)s, Solo 401(k)s, HSAs, and more to maximize your tax benefits while positioning yourself for growth opportunities.

It’s clear from recent regulatory actions and market trends that governments (pioneered by El Salvador), large institutions, and hedge funds are positioning their portfolios for both short- and long-term growth. They are doing so by allocating funds into high-potential assets while employing the same lucrative tax-saving strategies.

Matthew 22:21

"So they gave Him a denarius, and He asked, 'Whose image is this? And whose inscription?' 'Caesar's,' they replied. Then He said to them, 'So give back to Caesar what is Caesar's, and to God what is God's.' "

Reflection:

This verse reflects Jesus' wisdom in addressing the tension between earthly and divine responsibilities. It teaches:

Honoring Obligations: Fulfill your duty to the government by paying taxes or following laws while maintaining integrity in your faith.

Divine Stewardship: Recognize that while material wealth and obligations are part of life, your ultimate responsibility is to God and His purposes.

Application for Finances and Taxes:

Be faithful and ethical in managing your taxes and investments.

Use your wealth to support causes aligned with your spiritual values.

Balance financial strategies with a heart of gratitude and generosity, recognizing everything ultimately belongs to God.

This verse challenges us to navigate both worldly and spiritual stewardship wisely.

After all, the IRS tax code spans over 80,000 pages and is one of the most complex systems ever created—yet it’s also full of opportunities for those who know how to navigate it.

It’s not about how much money you make, but how much you KEEP that truly matters!

Stay Blessed

— Tyler Bossetti