It's All In Your Head

Your mind is directly connected to your pockets.

Let’s start with your brain.

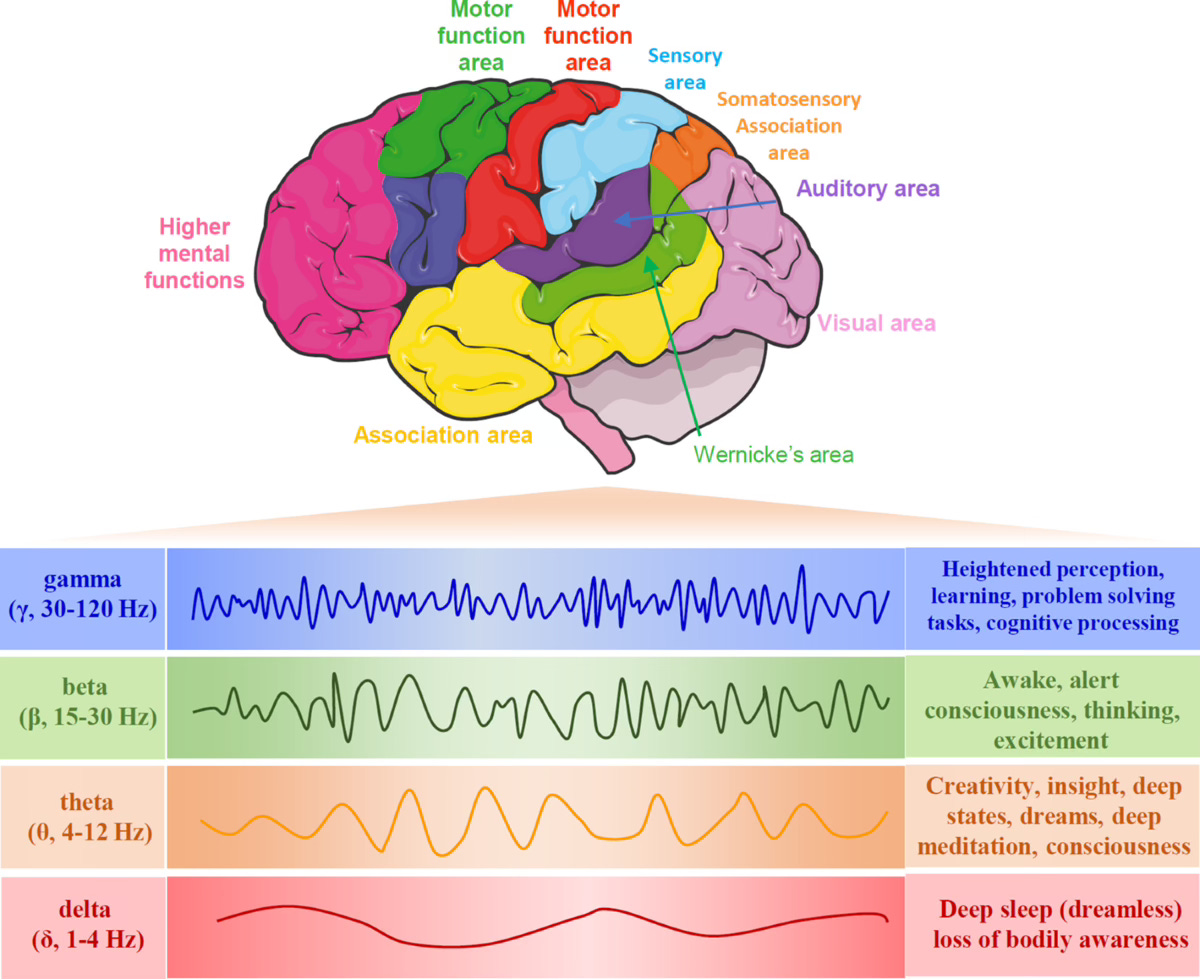

Every thought you’ve ever had... every decision you’ll ever make... they’re all transmitted via oscillating frequencies known as brain waves.

Delta. Theta. Alpha. Beta. Gamma.

These electric pulses, measured in hertz, dictate your state of awareness:

Delta (0.1-3 Hz): Deep sleep, unconsciousness

Theta (4-8 Hz): Creativity, dreams, meditative states

Alpha (8-12 Hz): Calm, focus, presence

Beta (13-30 Hz): Alert, analytical, solving

Gamma (30+ Hz): High-level cognition, insight, peak consciousness

Your mind is a live wire. It processes trillions of data points. It builds stories. Beliefs. Realities.

And in this reality—the markets, the economy, investing—all of it, too, is just a collection of signals.

Which brings us to the real signal emerging: the entire world is moving on-chain.

From Atoms to Bits to Blocks

For centuries & still to this day, wealth was measured in atoms: gold, land, buildings.

Then came bits: digital records, online banking, electronic trading.

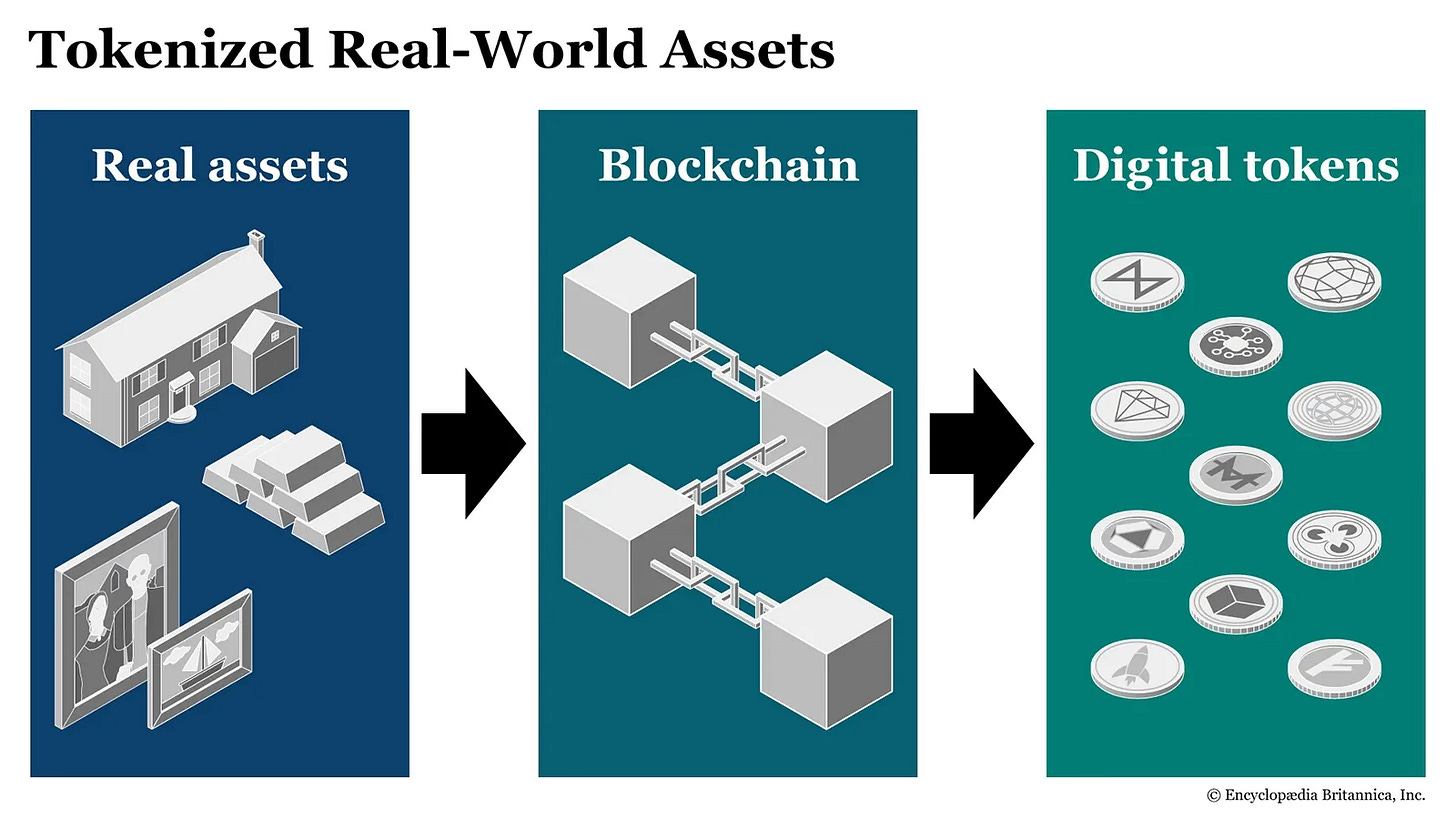

Now? We’re transitioning to blocks: blockchain-powered, verifiable, programmable ownership of everything.

What’s happening isn’t just crypto—it’s the tokenization and digitization of all asset classes.

Stocks

Bonds

Real estate

Intellectual property

Carbon credits

Music royalties

Private companies

And yes... even YOU (via data tokens, identity, reputation scores, etc.)

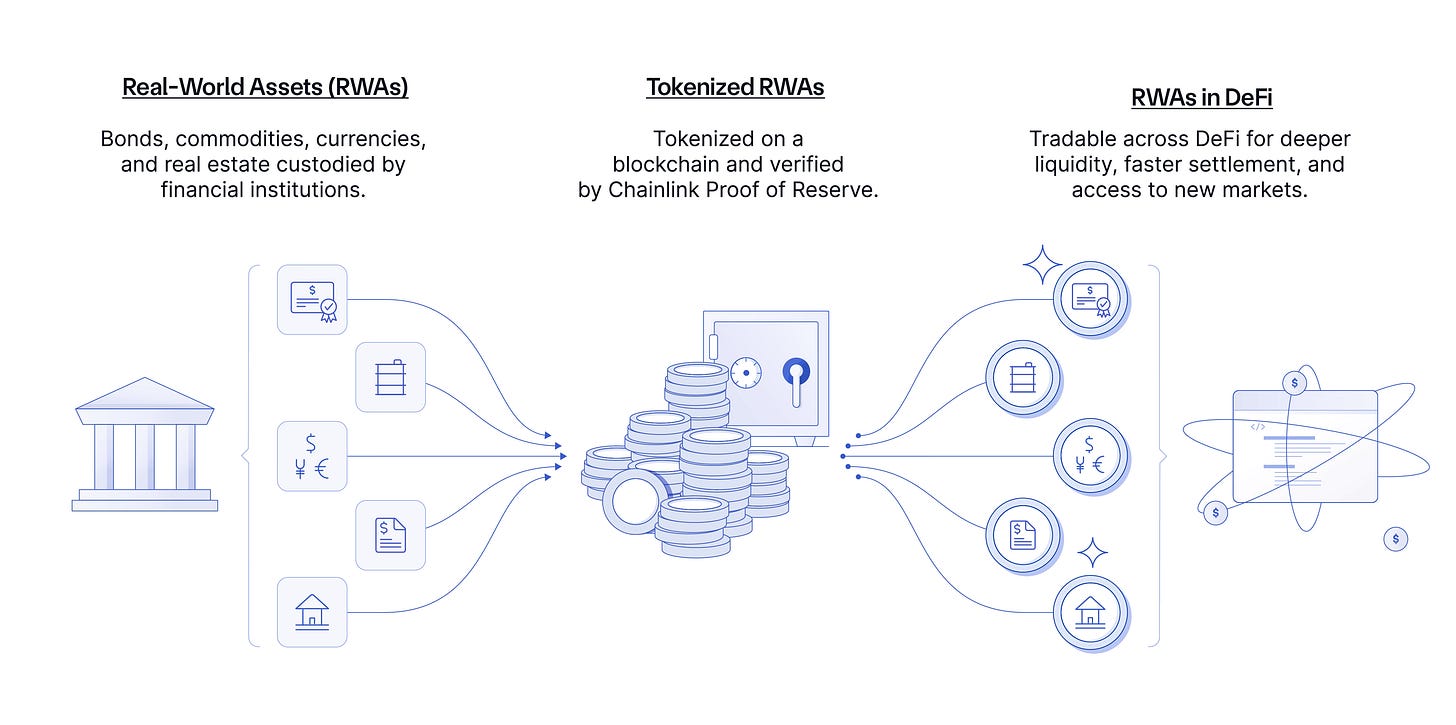

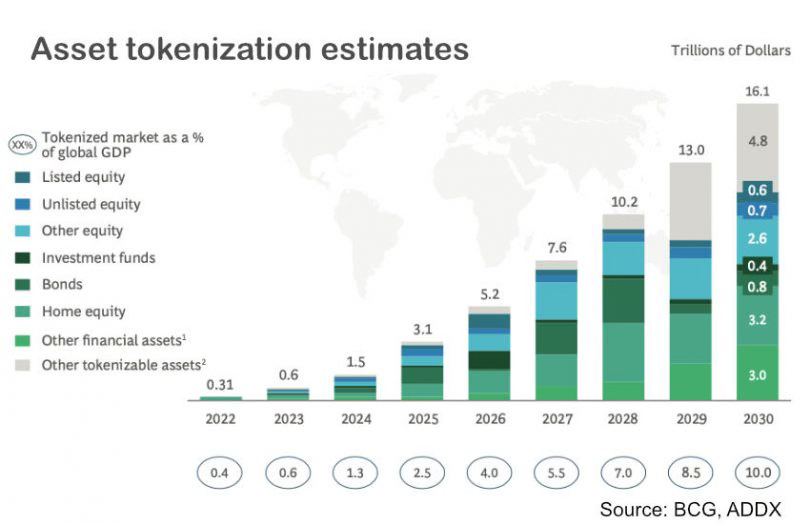

Tokenization is revolutionizing finance by cutting inefficiencies like slow transaction settlements & high costs. It could save $15–20B annually & reach a $2T market cap by 2030, unlocking liquidity & access across global markets.

This is not a hypothetical future. It’s here. And the pace is accelerating.

🤔 What Does “Everything Moving On-Chain” Mean?

“Everything moving on-chain” refers to the shift of financial and operational activities—such as payments, asset trading, corporate governance, and record-keeping—from traditional systems to blockchain networks. This transition enables transparent, secure, and decentralized operations.

Key Concepts:

On-Chain: Activities recorded directly on a blockchain, ensuring transparency and immutability.

Off-Chain: Processes occurring outside the blockchain, often in traditional systems.

Implications Across Sectors:

Cryptocurrencies: Stablecoins like USDC operate entirely on-chain, facilitating seamless digital transactions.

Stocks & Corporations: Tokenization allows for the representation of stocks and corporate assets on the blockchain, enabling fractional ownership and real-time settlement.

Institutions: Financial institutions are exploring blockchain for efficient settlement systems and transparent record-keeping.

🧠 Syncing Minds & Markets

Just as brain waves align during social interactions, tokenization synchronizes global markets.

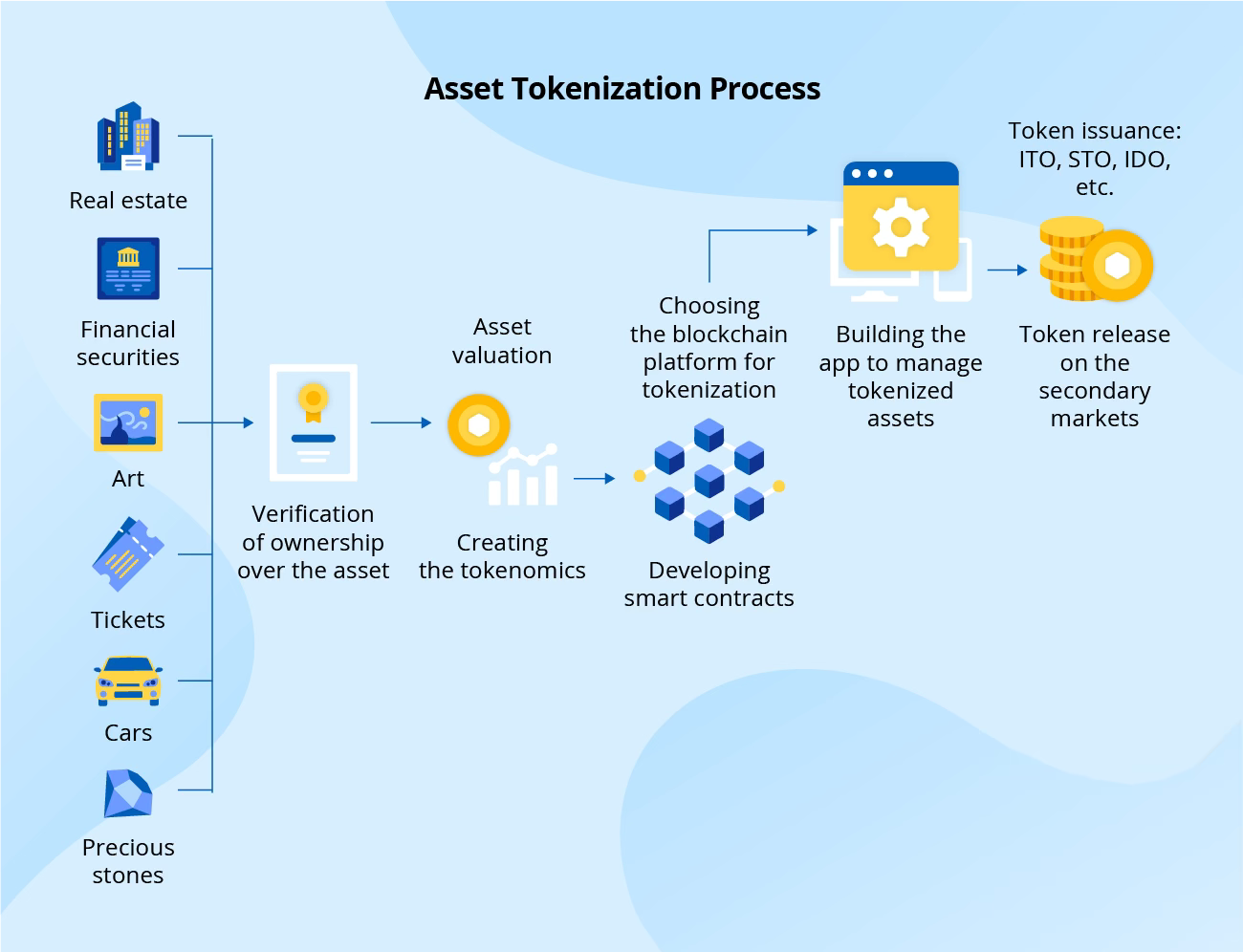

Blockchain technology acts like a neural network, creating a shared ledger where assets—stocks, bonds, real estate, even rare collectibles—are digitized into tokens.

These tokens, secured by smart contracts, flow across borders with the fluidity of theta waves in a meditative state. This isn’t just a technological shift; it’s a psychological one. Investors, corporations, & regulators are rewiring their mental models to embrace a world where ownership is fractional, transparent, & instantaneous.

The result?

A financial system that’s as responsive and interconnected as the human brain during a moment of collective clarity.

Tokenization is the process of converting real-world assets (RWAs) into digital tokens on a blockchain.

Imagine a $10 million Manhattan penthouse tokenized into 10,000 shares, each worth $1,000. Suddenly, a high-net-worth asset becomes accessible to retail investors, much like alpha waves democratize calm focus across the brain. This transformation is already underway, with traditional finance giants and crypto natives converging to bring everything on-chain.

The On-Chain Opportunity Map 🧭

Here are the key trends unfolding:

1. Wall Street is Coming (eh… jk it is already here)

BlackRock, Fidelity, Franklin Templeton are already issuing tokenized funds and ETFs on Ethereum.

JP Morgan launched its own on-chain platform for tokenized collateral settlement.

The DTCC (which clears $2+ quadrillion annually) just piloted tokenized settlements with Chainlink.

2. The Numbers Are Getting Yuuuge

Tokenized assets could hit $10T+ by 2030 (this is 3X bigger than crypto market cap now)

On-chain RWAs (real-world assets) already passed $4B in TVL (total value locked).

Ethereum dominates, securing over 65% of tokenized asset activity.

3. Programmable Assets = New Asset Classes

🤔 Imagine this:

Stocks that pay dividends in real time.

Bonds that auto-adjust yields based on inflation.

Real estate that fractionalizes globally.

Art that streams royalties to its original creator forever.

This isn’t just a modernization of old systems. It’s a complete rewrite.

💰 Placing Your Bets 💰

Investing is entering a new frequency.

Just like your brain shifts into high gear during moments of focus or creativity, markets are now firing on new wavelengths—where assets are digitized, fractionalized, & globally accessible 24/7.

🖼️ Fractional Ownership of Illiquid Assets

Platforms like Securitize and Ondo Finance are tokenizing U.S. Treasuries and real estate, enabling retail investors to own fractions of high-value assets. A $500,000 painting can be split into 500 tradable tokens.

📈 Tokenized Equities & Corporate Shares

Companies are exploring native on-chain equity. BackedFi and Kraken's xStocks are launching tokenized U.S. equities on Solana, embedding dividends and governance into smart contracts.

🔄 New Asset Classes & DeFi Integration

Protocols like Aave, Sky, and Frax Finance are using tokenized RWAs as collateral, creating hybrid assets that blend TradFi yields with DeFi composability.

🌍 Emerging Markets & Financial Inclusion

Countries like Thailand and Philippines are issuing tokenized bonds for low-ticket investors, making capital markets accessible to the masses.

🚘 Luxury Goods & Collectibles

MCQ Markets is tokenizing rare Ferraris on Solana, linking each vehicle to an NFT. This is the evolution of high-end NFTs into authenticated, real-world-backed collectibles.

So, Which Chains Win? 📈

Poppy is closely watching these top contenders:

🔷 Ethereum (ETH)

🏦 Institutional Favorite: Used by BlackRock (BUIDL fund) and Securitize for security tokens

🔗 Token Standards: ERC-20 & ERC-3643 dominate RWA tokenization

🌉 Layer 2 Growth: Arbitrum & Optimism are scaling ETH with cheaper/faster transactions

💧 Liquidity & Trust: Deep liquidity, most battle-tested chain

📈 Poppy Projection: $10K–$15K by end of 2026 with continued adoption

⚡ Solana (SOL)

💰 High-Speed & Low-Cost: ~2,400 transactions per second, fees under $0.001

🧠 Use Cases: Tokenized equities, U.S. Treasuries, gaming, and DePIN

📊 Real Impact: Posts show ~10% of NASDAQ's daily volume now mirrored on Solana

📈 Poppy Projection: $500–$800 if ETF + RWA momentum continues

💧 Sui (SUI)

🧬 Built for Digital Ownership: Designed to handle complex, customizable digital assets like real-world assets (RWAs), identity tokens, and NFTs

🔐 Soulbound RWAs: Enables non-transferable, identity-verified assets (like diplomas, licenses, or compliance-locked investments) via niche projects like OMG_Assembly

🚀 Developer-Friendly & Fast: Prioritizes speed and smooth user experience with object-based architecture—ideal for apps needing real-time, secure transactions

🌀 Emerging Use Cases: Could power tokenized property records, legal contracts, or reputation-based financial products

📈 Poppy Projection: High-risk, high-reward—potential $10–$20 if adoption for identity + asset-linked protocols grows

⚙️ Other Notables

Aptos: Powering tokenized funds like Hamilton Lane's Credit Opportunities Fund

Avalanche: Building modular, enterprise-ready DeFi ecosystems

The Tokenized World

In this world, everything becomes traceable, programmable, & tradable. Is that freedom or control? As assets go on-chain, the line between financial innovation & digital surveillance gets dangerously thin.

✅ Pros

Liquidity – Trade assets 24/7.

Accessibility – Fractional ownership opens doors for everyday investors.

Efficiency – Smart contracts enable instant settlements.

Transparency – Auditability and trust via blockchain.

Innovation – New financial instruments and funding models.

❌ Cons

Regulatory Risks – Inconsistent frameworks across jurisdictions.

Security Concerns – Hacks, smart contract bugs.

Scalability Bottlenecks – Some chains still face throughput issues.

User Education – Mass adoption needs better UX.

Infrastructure Costs – Parallel systems require resources to build and maintain.

🌀 The Future of Finance: Fractal, Fluid, & Fully On-Chain

The question isn’t if we’ll tokenize everything. It’s when and how fast.

Just like your brain transitions from Alpha to Gamma waves when you're locked into deep focus... the global economy is shifting from analog to digital to on-chain consciousness.

What This Means:

New sectors will emerge. The on-chain equivalent of the NYSE, Nasdaq, and S&P 500 are being built now.

Entirely new asset classes will be invented—powered by data, governed by smart contracts, and priced in crypto.

Digital identity, soulbound tokens, and data marketplaces will redefine how we verify credit, credentials, and reputation.

🔮 Poppy’s Perception

The Financial Rewiring Has Begun

The institutions are moving—quietly, deliberately, and on-chain. These aren’t “retail signals.” These are billion-dollar plays revealing where the next financial battleground is forming.

Here’s what Poppy’s brainwaves are picking up:

SharpLink Gaming just launched a bold $425 million Ethereum-based corporate treasury strategy—and appointed Ethereum co-founder Joseph Lubin as chairman of the board. This isn't just a treasury play—it's a bet on ETH becoming institutional digital collateral, echoing Michael Saylor’s Bitcoin model.

ETH isn’t a speculation—it’s infrastructure.

When platforms, treasuries, and even BlackRock's tokenized assets are built on Ethereum… you don’t bet against the elite. 😬

Trump Media Group plans to raise $3 billion—with the purpose of acquiring Bitcoin and Ethereum. Again: this isn’t fundraising for operations. It’s digital asset accumulation, echoing MicroStrategy, but with political influence baked in.

Dubai has greenlit a $16 trillion real estate tokenization initiative, using XRP as the backbone for global property liquidity.

Circle, issuer of USDC, is heading to Wall Street.

If brain waves govern our thoughts… & thoughts govern our decisions… then the next financial frontier is a neural network of global capital flows.

It’s the rewiring of the world’s value system.

Your opportunity is simple:

Follow the signal before the masses wake up to the wave.

📖 Bible Verse

"Be transformed by the renewing of your mind. Then you will be able to test and approve what God's will is—his good, pleasing and perfect will." — Romans 12:2

Reflection: Just as our minds shift through brain waves to reach higher states of clarity, the financial world is undergoing a transformation → digitizing value and bringing it on-chain. Embracing this evolution requires mental renewal, discernment, and faith in the unseen foundations being laid today for the future economy.