Debt can feel like you're drowning—like the weight is too heavy to bear.

2025 Credit Crisis 🧨

The pressure is suffocating. Millions of Americans are getting squeezed from every direction— relatively high rates, steady inflation, student loan collections back in action, and volatile markets that feel like a wild roller coaster. And through it all, the debt trap just keeps tightening.

You wake up, grind through the day, pay bills—and somehow still fall further behind. That isn’t living. That’s financial survival. And it’s quietly draining your freedom, your options, and your future.

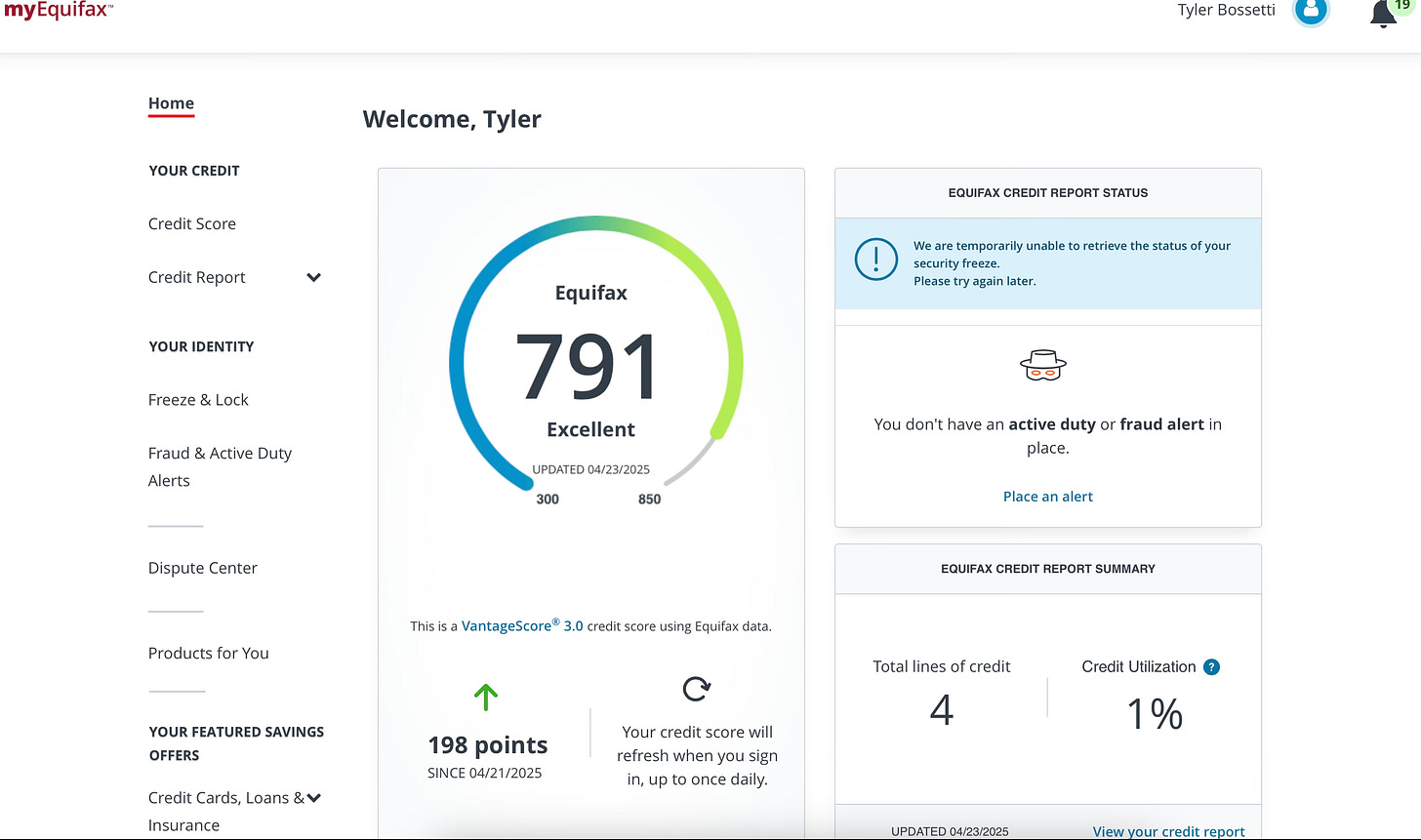

Even I got hit with a credit curveball recently (keep reading & see real results to see how fast we fixed it). A few unexpected negative marks tanked my personal scores—but by using the same strategies we apply for our clients, we turned it around fast.

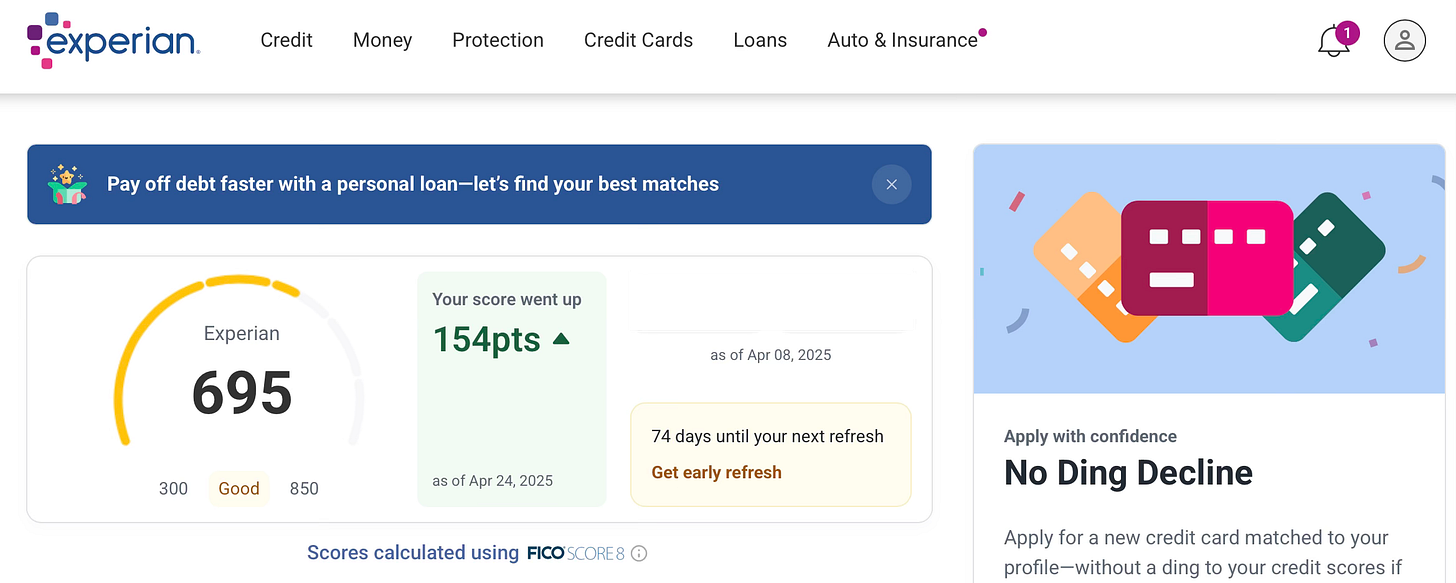

The results speak for themselves:

📉 My scores took a huge hit.

📈 Jumped from 593 → 791 on Equifax in under 30 days

📈 Went from 541 → 695 on Experian, with another 80+ point boost on the way this week.

👀 And TransUnion? Showing the same dramatic rebound in the next 24 hours.

This isn’t luck.

This isn’t theory.

This is a system— fast, repeatable, & built to win.

Just look at the numbers:

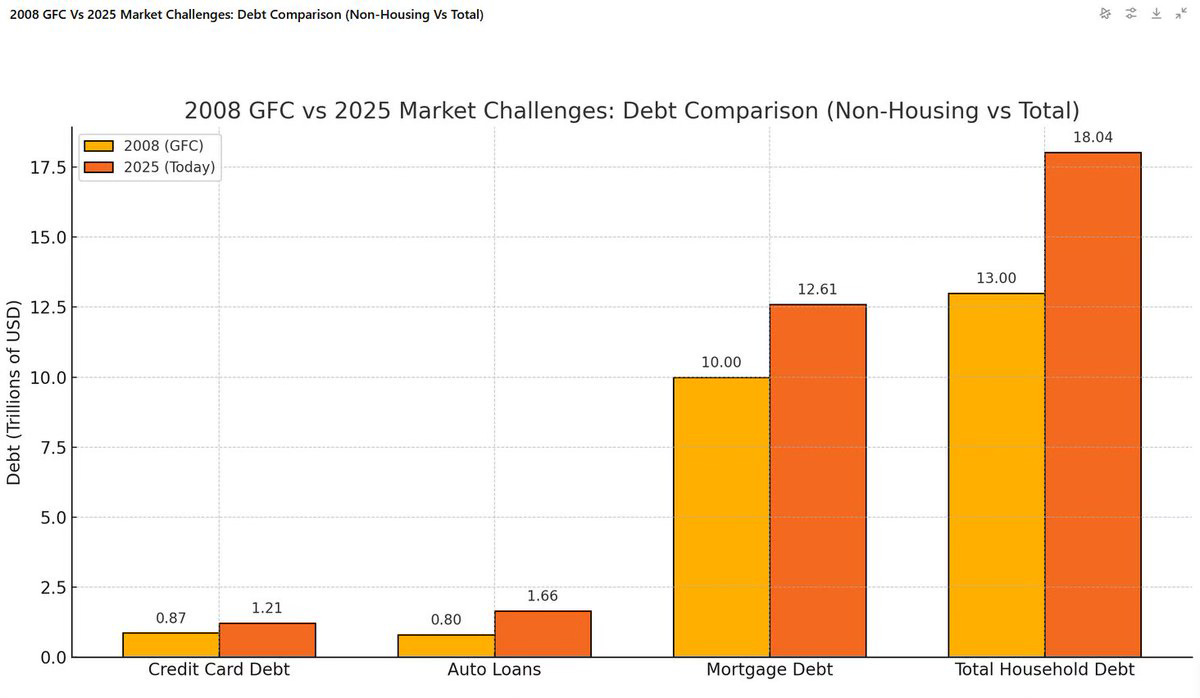

💳 Record Credit Card Debt: Balances hit $1.21 trillion in Q4 2024—a 57% jump since 2021.

🔥 Average APRs at 21.37%—some new card offers are now over 24.23%.

🛒 Essentials still expensive: Food, gas, and housing are still nowhere near pre-pandemic prices.

🚨 Delinquency Surge: Over 7.18% of balances are now late, the highest in years.

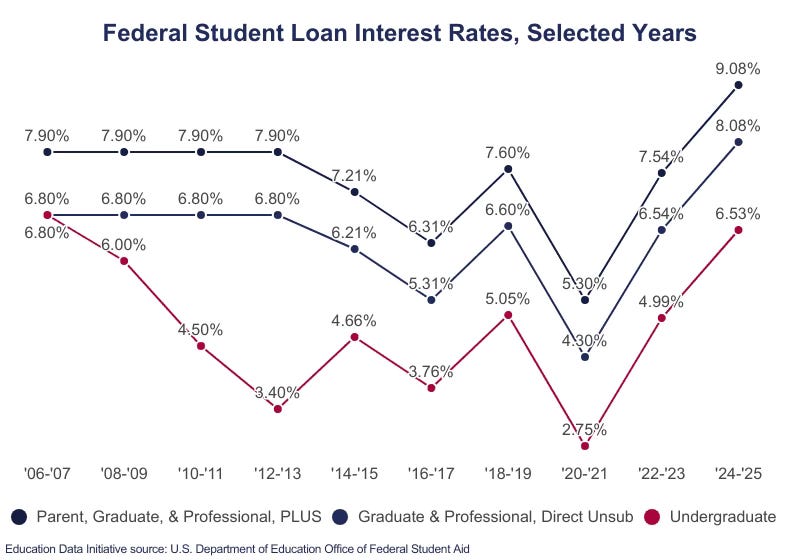

🎓 Student Loan Collections are back, with garnishments and legal actions hitting struggling borrowers hard.

📉 Debt.com 2025 Survey Highlights:

32% of Americans have maxed out their credit cards

37% use credit cards just to make ends meet

44% say inflation has forced them to carry larger monthly balances

Of those maxed out:

→ 80% would rely on cards in an emergency

→ 23% owe over $20,000 in credit card debt

🏛️ FED Pressure & Uncertainty: Despite recent rate cuts, APRs remain high, and political pressure from Trump on Jerome Powell adds more instability.

And then there’s the U.S. debt crisis—where high interest rates are ballooning government borrowing costs, crowding out the economy, and putting even more pressure on everyday Americans.

If you’re paying 20–30%+ in interest, you’re not just paying a bill—you’re funding the bank’s bonus check.

💰 The Roadmap to Securing $100K+ in Funding

✅ Step 1: Optimize Your Personal Credit (FICO 8 Required)

Before any personal or business funding happens, your personal credit must be lender-ready. That means a strong FICO 8 profile—the exact scoring model of top lenders use.

Here’s the baseline to qualify:

700+ Credit Score

→ Across all three bureaus: Experian, TransUnion, Equifax.<25% Utilization

→ On each revolving credit card account, not just overall. Start making payments on your accounts 3 business days prior to the statement date, not the due date!<3 Hard Inquiries (Past 6 Months)

→ Too many recent loan applications = red flag to lenders, even if your credit scores are sky high!0 Negative Marks

→ No late payments, collections, or charge-offs. (We help remove these fast and legally — 90 days or sooner guaranteed.)3+ Total Revolving Accounts (ideal structure before applying for business accounts)

→ At least 2 accounts with $5K+ limits

→ Average account age: 2+ years

→ No more than 2 new personal credit cards in the last 6 months

→ We can help you secure large trade lines to help boost the strength of your profile.

⚠️ Most people think it takes years to fix credit—wrong. With the right strategy (which the laws & regulations change all the time), we’ve helped clients jump 100+ points in under 90 days.

🔗 [Schedule A Consultation Meeting Here]

What if you could wipe out your student loan stress with the right funding strategy?

We’ve helped clients raise their scores by 100+ points in 30–90 days and secure over $100K in funding—even during market chaos.

✅ Step 2: The Business Funding Application Blueprint

Once your personal credit is in position, the next step is building a fundable business structure. This is where most people get stuck—but when done correctly, it opens the door to infinite funds in 0% or very low APR interest.

→ Here’s the foundation:

Business Setup Checklist:

Form your LLC & get an EIN (ideally it is at least 60–90 days old before applying)

Use a low-risk NAICS code (e.g., Consulting, Marketing, eCom)

Set up business essentials (not required, but suggested):

Business email (GoDaddy)

Business phone (Kall8)

Business address + registered agent (Regus or virtual office)

Revenue & Income Projections (for applications):

Projected Business Revenue: Less than $500,000

Projected Personal Income: Less than $250,000

⚠️ Important Note:

Your projected business revenue & personal income are just that—projections, even for brand new entities. Some applicants make the mistake of entering very low estimates, not realizing this can lead to instant denials or low-limit approvals.

On the flip side, reporting higher projections may trigger requests for supporting financial documents, depending on the lender and the product.

🏦 Bank Setup Strategy

To position your business for funding, start by establishing relationships with banks—both big & small:

Open business checking accounts at Tier 1 banks

→ Chase, US Bank, Bank of America, and so forth.

→ Fund the account with $500 to $5,000+ to show legitimate activity & begin building trust. After all, banks are relationship driven.This applies to regional & credit union banks as well

Wait 2–4 weeks (or at least 1 full statement cycle) before applying for credit products

→ This allows the account to "season" & strengthens approval oddsMatch the bank to your strongest credit bureau

→ Each lender pulls from one or two different bureau (Experian, TransUnion, or Equifax). Some lenders (e.g. Capital One can pull all 3 bureaus)

→ Check where banks pull from at: www.creditboards.com

📧 Or email info@tylerbossetti.com us for a personalized strategy & get access to our Free Lenders List

💳 Business Credit Benefits:

0% APR for 12–18 months on revolving business cards

Doesn’t report to personal credit (you can utilize without tanking your FICO)

Use like cash to invest in growth, real estate, marketing, etc.

Low minimum payments (~1% of balance; e.g., $100/mo on $10K)

Leverage balance transfers to eliminate high-interest personal debt

⚠️ Disclaimer:

This is a proven framework—but the exact steps can vary based on your personal and business profile. For the most accurate, customized funding strategy, we strongly recommend booking a consultation call with our team.

🔗 [Schedule A Consultation Meeting Here]

Your Action Plan Starts Now

👉 Tired of drowning in high-interest debt?

👉 Ready to unlock 6 figures (or more) in funding—fast?

Book a free consultation to see if you qualify. We'll help you:

✅ Eliminate crippling high-interest debt

✅ Rebuild your credit quickly

✅ Unlock capital to fund your business, invest in opportunities, or create a safety net for your future

You don’t need to stay stuck. You just need the right strategy.

🔗 [Schedule A Consultation Meeting Here]

📖 Bible Verse:

Isaiah 43:2 – “When you pass through the waters, I will be with you; and when you pass through the rivers, they will not sweep over you.”

Reflection: This verse is a reminder that even in overwhelming waters, you are not alone. God doesn’t promise we won’t face deep currents, but He does promise that they won’t consume us—and that breakthrough is always on the other side of faith and action.

Great strategy!!