That strange feeling like we’ve lived through this before — it’s not just in your head.

🔥 In This Edition 🔥

• Covid 2.0 is quietly unfolding: the global fiat printing press is warming up again.

• Why Bitcoin still makes sense: even above $100K, it’s far from "too late."

• The 8 most important indicators: to track Bitcoin and crypto’s performance in this next cycle.

• Trump Lifts Crypto Ban on 401(k)s: As of May 28, 2025, the Trump administration reversed Biden-era guidance that discouraged Bitcoin in retirement plans. This clears the path for employers to include crypto in 401(k)s under standard fiduciary rules. While not a mandate, it removes a key barrier — potentially opening access to a slice of the $9 trillion sitting in U.S. retirement accounts.

• Poppy’s portfolio if starting today: how a crypto newbie (or expert) could position themselves right now.

• The next big beautiful crypto narrative is starting now: don’t miss the hype!

🦠 Covid 2.0?

Fear is the ultimate motivator. It rewires logic & it doesn’t just drive headlines → it challenges your beliefs, tests your discipline, & reorders priorities in real time.

Poppy isn’t sold on the "new Covid variant scare", but he sees the pattern forming… again.

During Covid 2020, the global economy panicked. So central banks did the only thing they know: print money.

Today?

The global debt crisis panic has arrived and the central banks have began doing what they do best: print money like they have never done before.

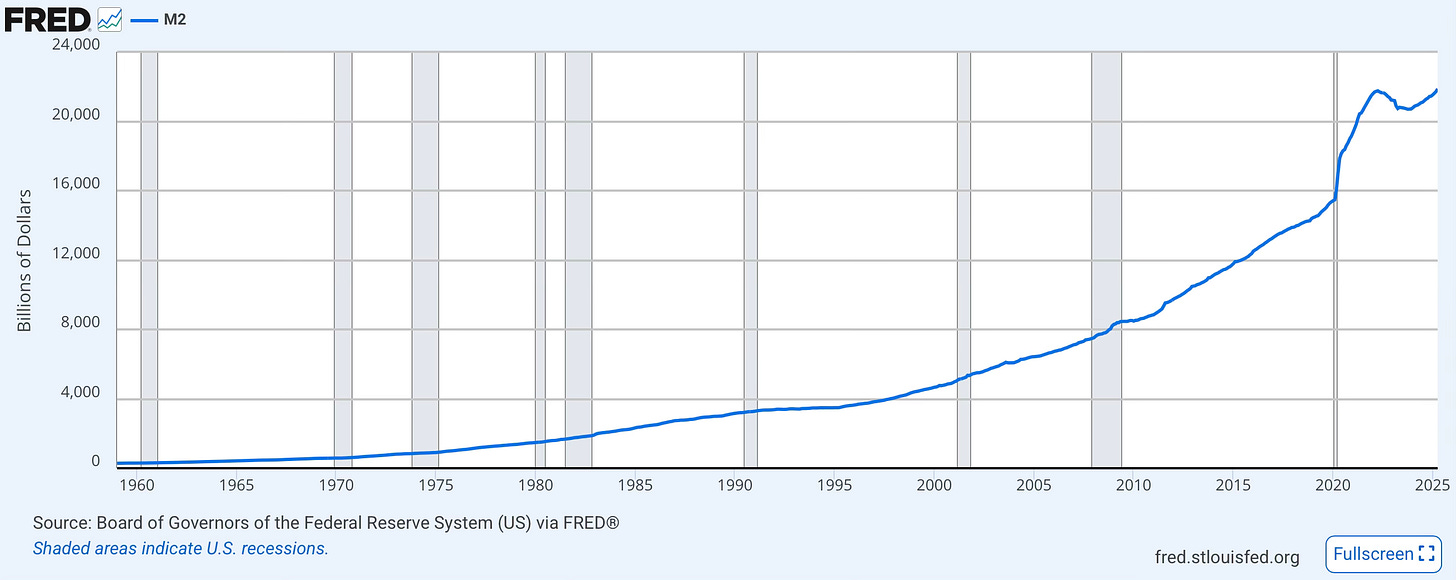

📈 From 2020 to 2022, the U.S. alone increased the M2 money supply by over 40% in under 2 years.

Here’s what followed:

Asset prices exploded.

BTC went from $5K to $69K.

Inflation? Well, that came shortly after & owning eggs became a luxury.

Now? M2 has been ticking up again… and with it comes a delayed wave of asset price increases. Historically, we see a 2–3 month lag from M2 growth to higher BTC prices.

Translation: We're in the early innings of a repeat performance… China virus or not.

🟠 Why Bitcoin Is (Still) the Smart Bet

“Why would I buy Bitcoin now? It’s already over $100K. What’s the upside—just a 2X?”

Poppy hears this a lot. And respectfully… that’s not smart investor thinking. That’s short-term gambler logic.

Let’s be real—if a global, decentralized, censorship-resistant asset with a decade-long track record of outpacing inflation, surviving every macroeconomic storm, and consistently outperforming every major index still has a conservative 2X runway… why would you ignore it?

Meanwhile, your fiat is melting like ice in a microwave—quietly losing value, taxed by inflation, and diluted by nonstop money printing.

This isn’t about timing the top or hoping for 10X moonshots.

It’s about owning the foundation of the future financial system. Ironically, the asset people once called “too volatile” is now becoming the most stable long-term wealth preserver we have.

The so-called “boring” choice → Bitcoin, might just end up being the best-performing asset of your lifetime.

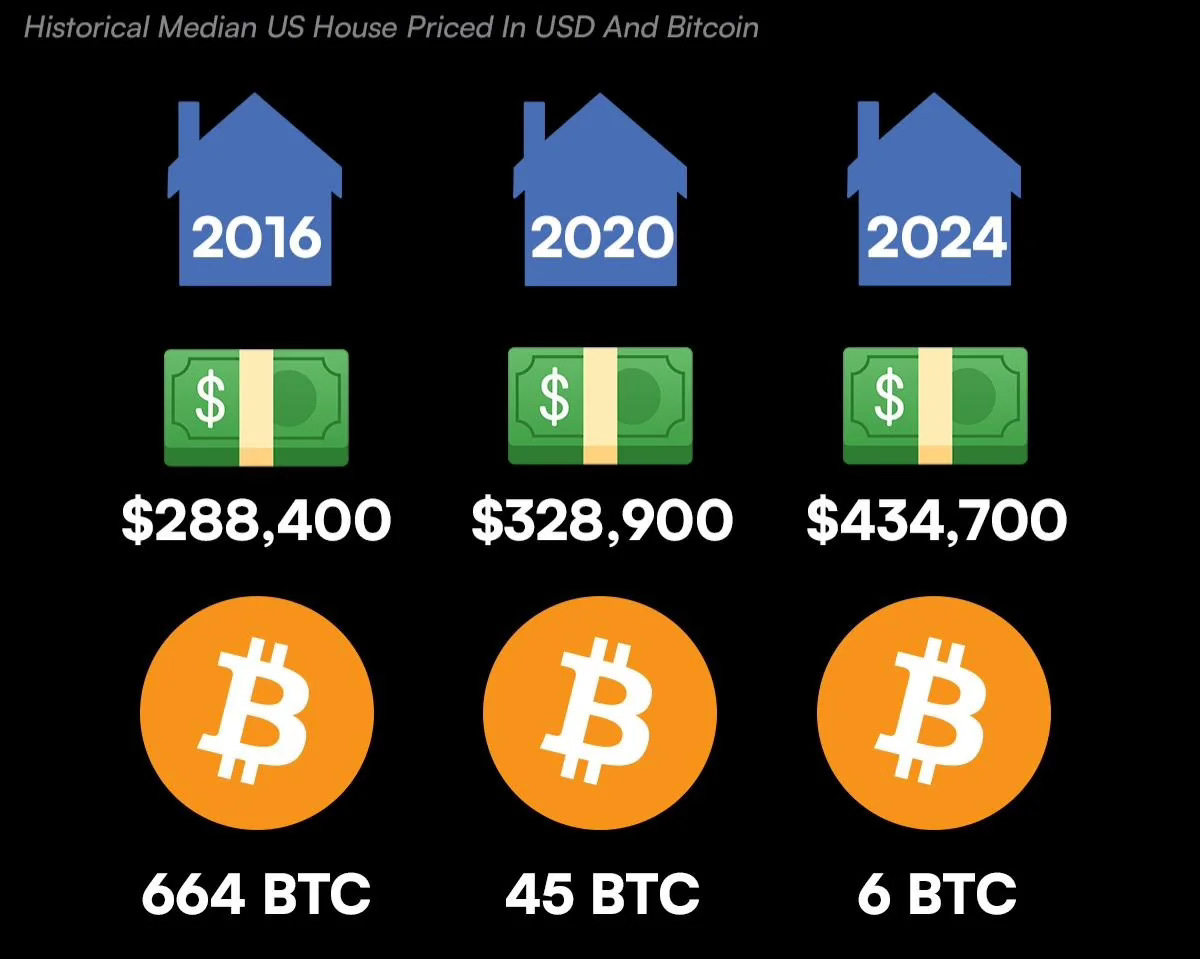

It’s like your grandparents buying a house for pocket change 50 years ago… and now it’s worth millions.

Remember:

Savers = losers.

Investors = winners. Nearly 50% of Americans own no appreciating assets. And almost 100% of their wealth is trapped in a melting currency (dollars)

📊 The 8 Core Crypto Indicators

Recessions are being outlawed.

Central banks & governments are doing everything they can to avoid economic collapse. Tariffs, job loss, global deficits, soul crushing inflation, high interest rates… all just symptoms of a broken & outdated model.

Here’s what actually matters:

Tracks the total supply of money in circulation. More liquidity = more fuel for risk assets = crypto rallies.

Just hit an all-time high. More money in circulation than there’s even been.

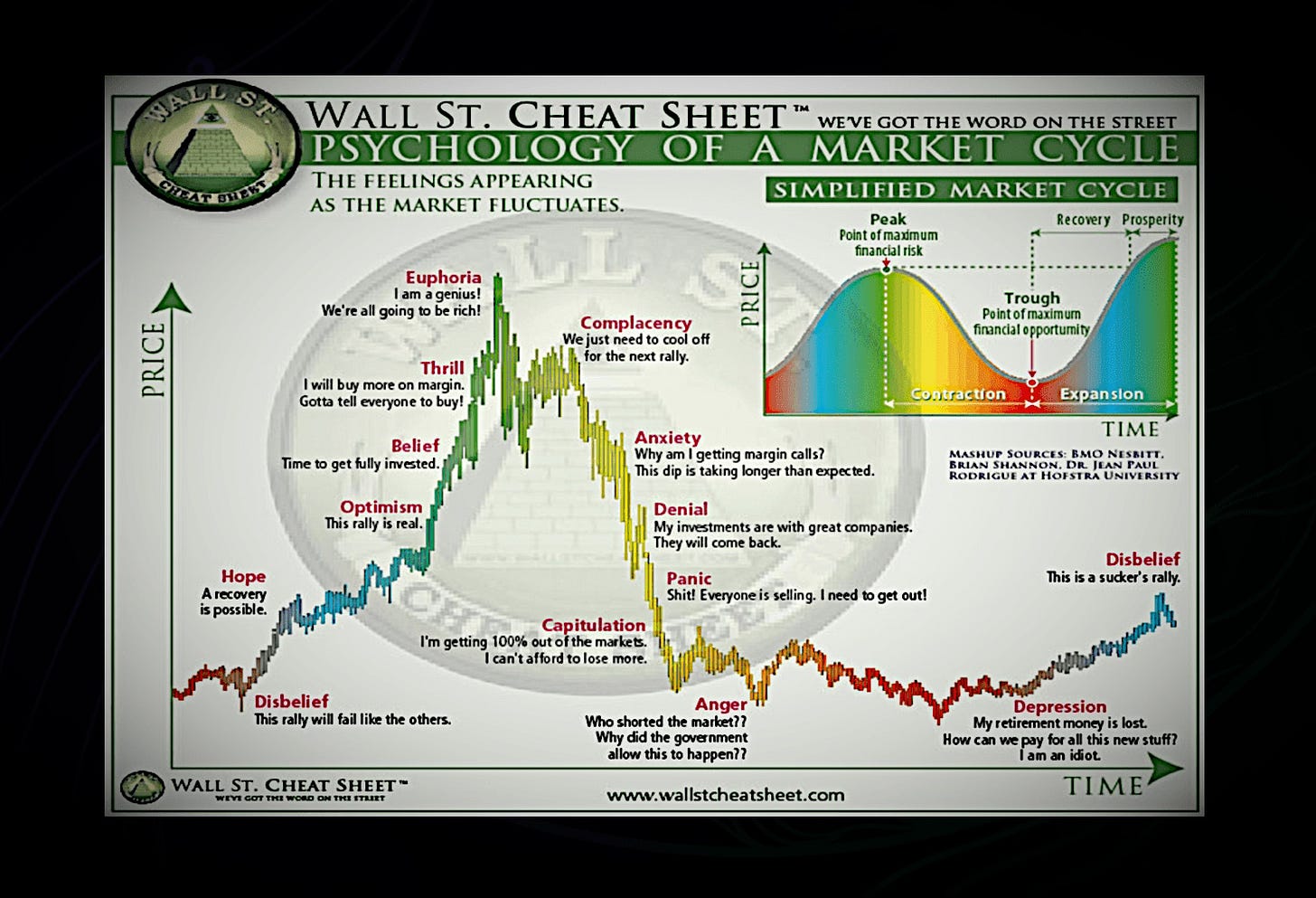

Measures sentiment aka emotions (how to make or loss money investing)

Below 25 = extreme fear (buy zone).

Above 75 = extreme greed (take profits).

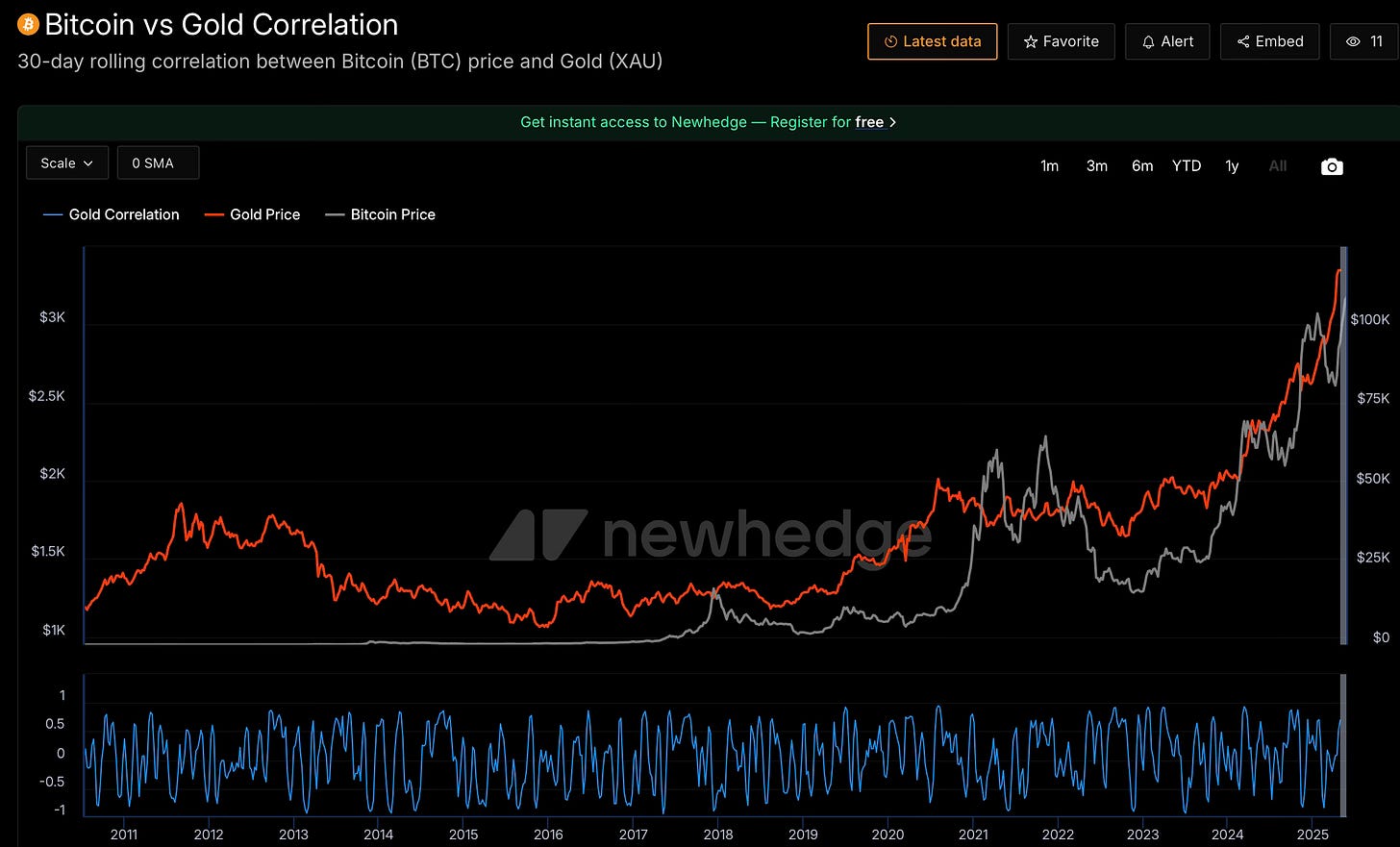

BTC is moving like digital gold. If gold rallies, Bitcoin follows.

The traditional & modern ‘safe haven’ assets.

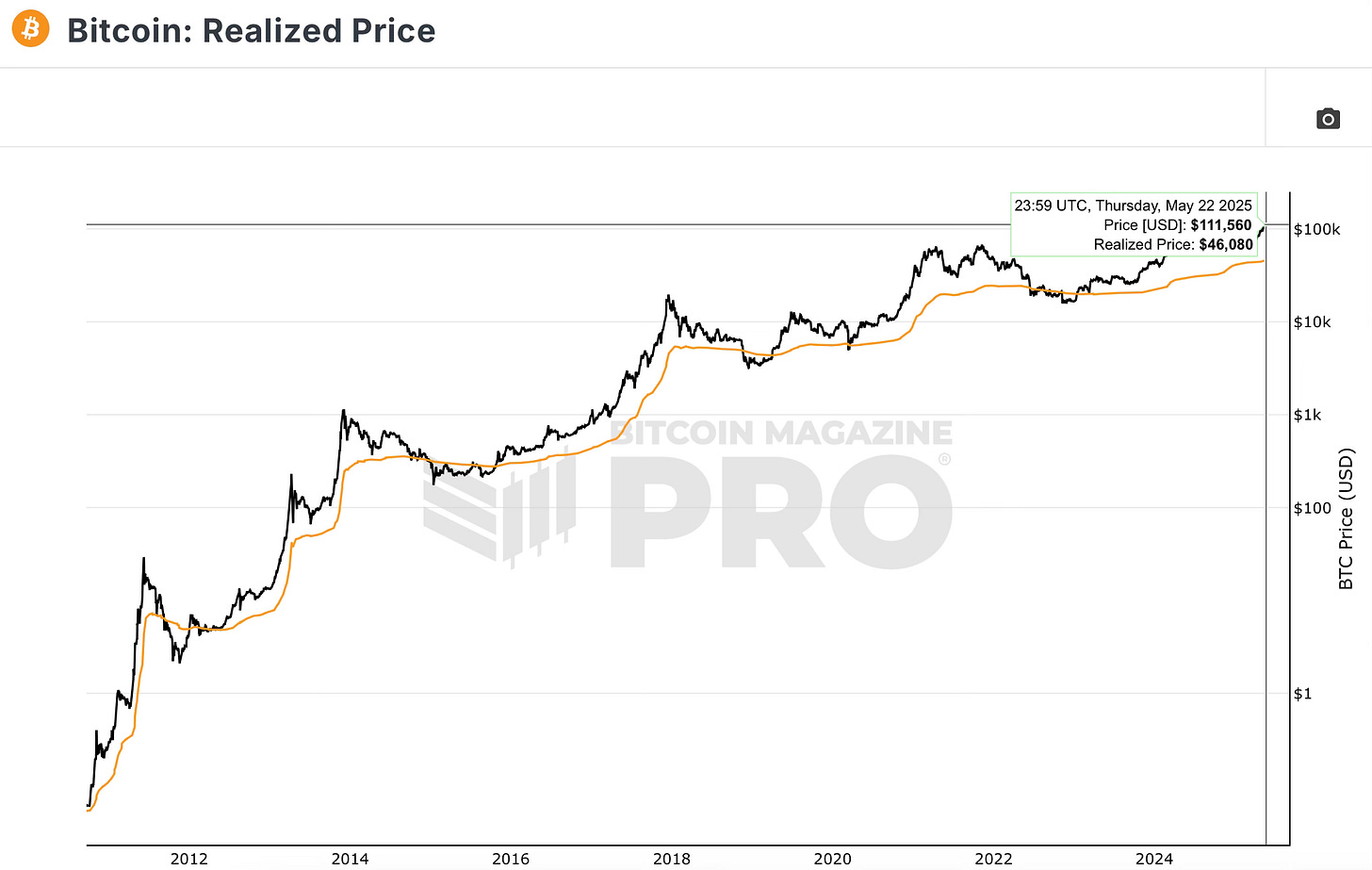

The average price when each BTC last moved.

Above = market in profit.

Below = accumulation zone.

🔄 SOPR (Spent Output Profit Ratio)

Tracks if coins are sold at profit (>1) or loss (<1).

Dips below 1 are strong reversal signals.

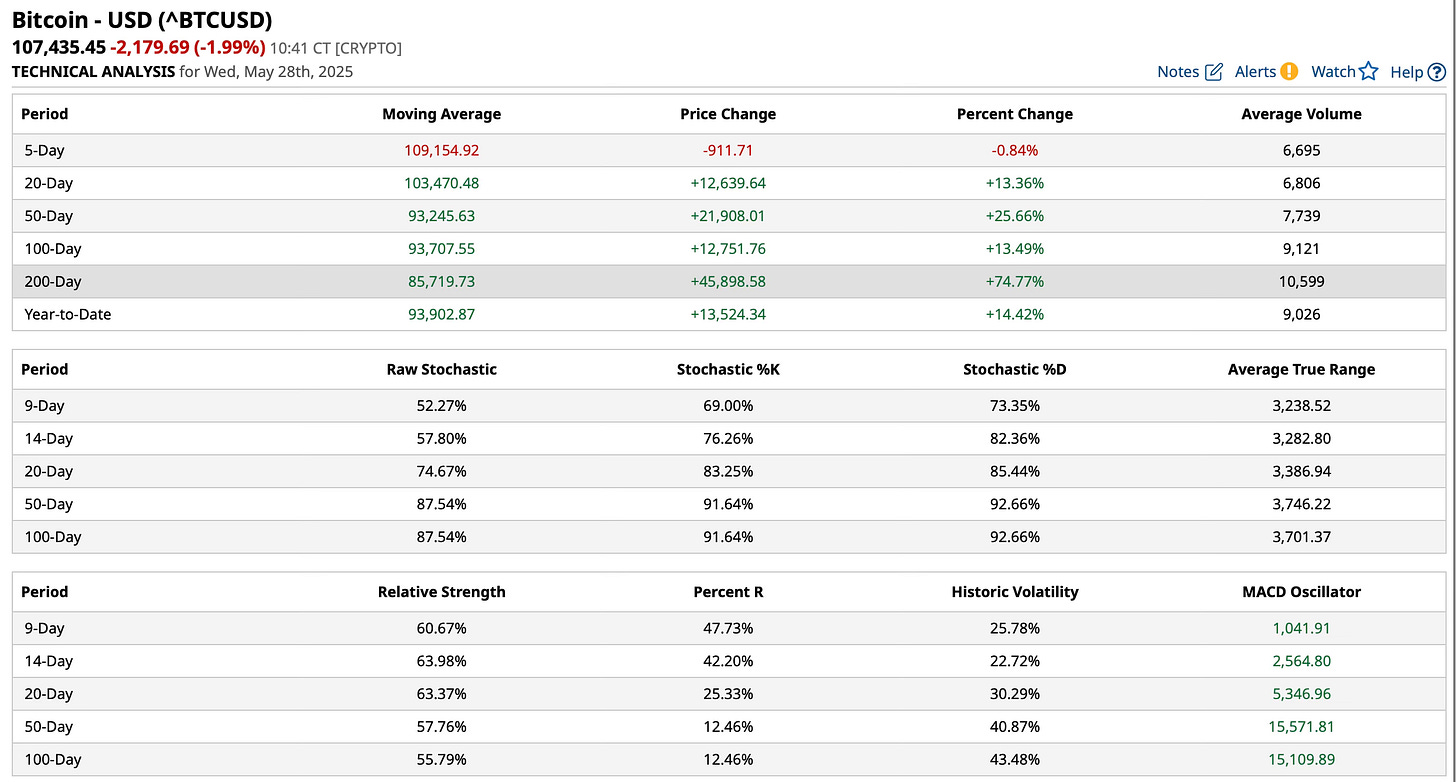

The most classic trend signal.

BTC above 200-DMA = bull trend. Below = caution.

Monitors BTC balances on exchanges.

Outflows = accumulation.

Inflows = potential sell pressure.

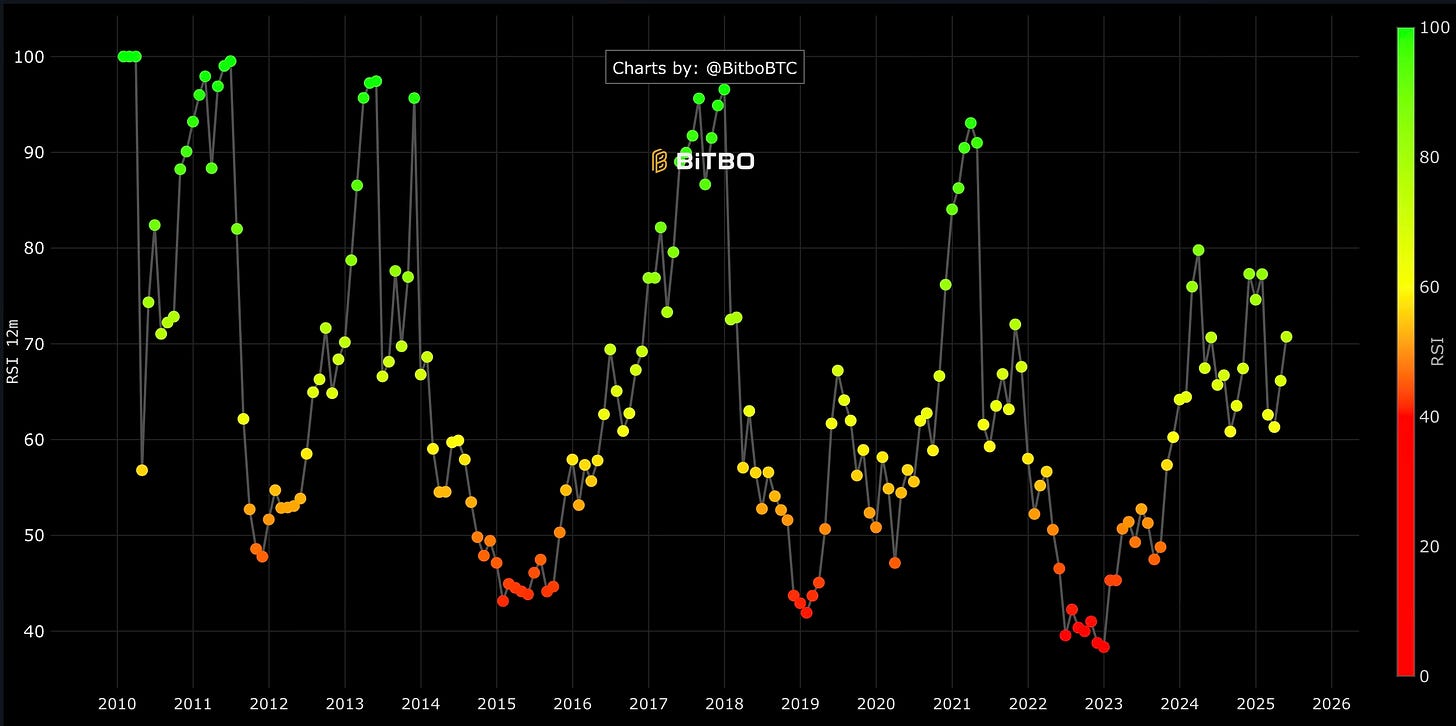

⚡ Relative Strength Index (RSI)

Measures if BTC is overbought or oversold.

RSI > 70 = overbought.

RSI < 30 = potential buy signal.

🎢 The faster the drop, the faster the rebound.

Volatility isn’t bad. It’s the price of admission for generational wealth.

Print money = higher asset prices + cost of living.

Higher inflation = savers lose, investors win.

⚠️ Poppy’s #1 indicator for a crypto bear market is deleveraging.

In other words, the institutions, major corporations & so forth borrowing or raising money to deploy into digital assets to copy & paste Michael Saylor’s strategy.

Leverage = pumps markets 📈

Deleverage = rekts markets 📉

💼 Poppy’s Portfolio: (18-Month Hold)

Here’s how Poppy would invest in crypto if he were starting fresh in May 2025:

*not financial advice

🟧 Large Caps (70%)

Focused on top 25 assets with a proven track record, strong fundamentals, deep liquidity, and growing institutional interest. These are high-conviction, lower-risk plays in an otherwise volatile market.

Current Poppy Picks:

Bitcoin (BTC) – The foundation of digital assets. Store of value, inflation hedge, & reserve asset for the new financial system.

Ethereum (ETH) – The backbone of DeFi, NFTs, Tokenization & smart contracts. Transitioned to proof-of-stake with faster, more cost effective & deflationary supply model .

Solana (SOL) – Ultra-fast Layer 1 with low fees, built for scalability & real-world consumer apps. Tons of development & activity.

Sui (SUI) – High-performance Layer 1 optimized for speed & composability. Strong developer growth and early ecosystem traction. Poppy thinks this is ‘this cycle’s Solana’ pick.

HYPE – Narrative-driven token with strong community momentum and positioning as a culture-native large-cap play.

📈 Projection: 2–3X return potential over the next 18 months with lower downside risk compared to mid & small caps.

🟨 Mid Caps (20%)

Looking for the next Solana. Focused on Layer-1s, DeFi, AI, & strong emerging narratives w/ “real world” utility.

Current Poppy Picks:

SUI – High-performance L1 with early-stage growth potential.

TAO, RENDER, VIRTUALS – AI-focused projects leading the decentralized compute and virtual intelligence space.

ONDO – DeFi meets traditional finance; tokenized real-world assets gaining traction.

Monero (XMR) – Privacy-first crypto; the OG for anonymous transactions.

📈 Poppy’s Projection: 5-10X return potential over the next 18 months with higher downside risk compared to larger caps.

🟥 Small Caps (10%)

Degeneracy meets potential moonshots. Welcome to The Boys Club — where risk is high, but so is the upside.

This is basically the same success / failure rate as drafting a successful QB for the Cleveland Browns.

Memecoins:

Pepe – The OG meme coin with deep liquidity and massive community reach.

Brett – Cult favorite blending meme culture with purpose-driven branding.

Andy – Gaining traction as a cross-platform, community-backed token.

Landwolf – Fast-growing, Solana-based with strong meme appeal and quirky personality.

Bird Dog – Underdog energy with growing grassroots support. Keep an eye on it.

NFTs:

Pudgy Penguins – Family-friendly IP with expanding product lines and mass market appeal.

CryptoPunks – The original flex. Scarce, prestigious, and battle-tested.

📈 Poppy’s Projection: 10-50X return potential over the next 18 months with higher downside risk compared to mid caps.

🚨 The Next Big Beautiful Crypto Narrative

Poppy’s prediction for the next hype train of opportunity → Gaming & Betting

Immutable ($IMX): Infrastructure layer with strong partnerships.

SuperVerse: Play-to-earn ecosystem with gamified tokenomics.

BEAM: Scalable blockchain built for on-chain gaming.

🎮 eSports and betting platforms like FanDuel and DraftKings are booming—with over $136B wagered in the U.S. in 2024.

Digital assets are the next phase of integration into these rapidly growing industries.

🐾 Poppy’s Wisdom

The matrix we live in isn’t fiction—it’s rhythm → Frequency. Vibration. Currency is just one layer of control. But Bitcoin? It’s the tuning fork.

We are not entering the golden age of crypto. We are entering the globalization of digital assets as the foundation of global’s future finance.

This time, retail isn’t the firestarter. It’s the institutions & the gamblers fueling the next bull wave.

But volatility’s coming (& will never go away): tariffs, global debt, wars, regulation, & Wall Street’s manipulation game are intensifying.

Poppy predicts peak euphoria by summer 2025, with a potential rug-pull by year-end. Stay emotionally grounded; greed and fear can wreck even the sharpest traders.

The only question is:

Can’t beat it?

₿uy it.

📖 Bible Verse

"The prudent see danger and take refuge, but the simple keep going and pay the penalty." — Proverbs 27:12

Reflection: Wisdom isn’t about being fearless. It’s about preparing when others ignore the signs. Markets don’t reward the bold. They reward the disciplined.