Do you want the GOLDen ticket to financial freedom?

If you’re still tracking Bitcoin like a tech stock, it’s time to shift your lens. The true north of this next cycle isn’t Nasdaq correlations or macro tech trends—it’s gold.

Why? Because Bitcoin is becoming the world’s digital gold—a safe harbor when paper money feels like sinking sand. Forget chasing tweets or stock market tickers. The BTC/Gold ratio is your map to the next crypto surge.

✨ The Golden Ratio

Picture the Golden Ratio—that elegant spiral found in seashells, galaxies, and nature’s finest designs. It’s balance, harmony, and predictability in a chaotic world.

Now, imagine the BTC/Gold ratio as crypto’s Golden Ratio—a perfect signal guiding Bitcoin’s price through turbulent seas.

🏆 The #1 Bitcoin Indicator

Bitcoin is no longer moving in sync with the S&P 500, tech stocks, or the so-called “Mag 7.” The past correlations that once helped predict BTC price moves — Apple earnings, Fed rate decisions, NASDAQ tech trends — are losing their influence.

Instead, a new pattern has emerged:

Bitcoin is syncing with gold.

In 2022, Bitcoin and gold moved in near-perfect harmony, aligning 93% of the time. In 2025, this bond is stronger.

Why? Both thrive when trust in paper money falters—think inflation storms, government debt whirlpools, or global unrest. Gold’s ancient glow and Bitcoin’s digital spark are twin beacons against fiat’s fade.

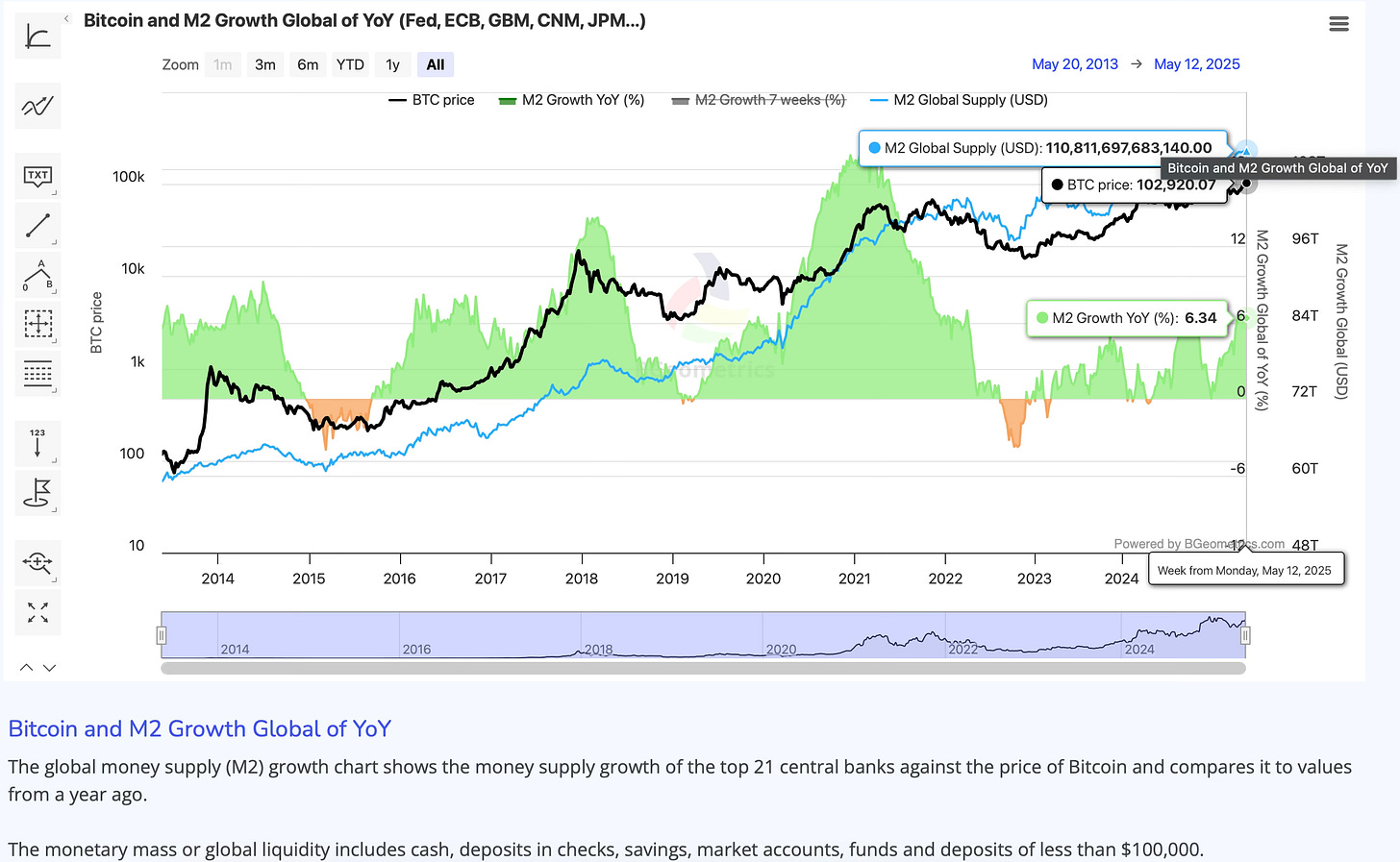

This ratio is now the #1 indicator because Bitcoin is decoupling from its old anchors—tech stocks and the Nasdaq. Where once it bobbed with Tesla or the S&P 500, Bitcoin now sails with macro currents: gold’s safe-haven surge and the swelling global M2 money supply ($1.5–$2.3+ trillion more cash is coming).

As gold climbs toward record highs, Bitcoin follows like a ship catching the wind—amplified by M2’s flood of liquidity. The Golden Ratio isn’t just a signal; it’s your compass for the next crypto wave.

🔭 The Macro Confluence: BTC/Gold + M2 Expansion

Think of BTC/Gold as your directional compass, and global M2 as the fuel gauge.

When gold breaks out → BTC tends to follow with more aggression (typically within 3–4 months).

When global M2 money supply expands → crypto markets swell, absorbing new liquidity rapidly.

⚠️ Old Maps Won’t Work Anymore

Tracking Tesla or the Nasdaq to predict Bitcoin? That’s like using a paper map in a GPS world.

Stocks like Coinbase or MicroStrategy might hint at Bitcoin’s moves, but they’re just echoes, not the source.

Bitcoin’s price now follows bigger tides: Wall Street ETF cash, pension fund buys, and global fears of money printing.

With over $1.5–$2.3 trillion in new M2 growth projected globally in the next 1–3 months, the setup is forming: Gold leads → Bitcoin follows.

Liquidity fuels the fire.

🏖️ The New Retirement Plan

Coinbase, the crypto world’s lighthouse, just docked in the S&P 500. This is yuuuge.

It’s like crypto sneaking into your grandma’s retirement fund. Every pension, 401(k), or index fund tracking the S&P 500 now has a crypto spark through Coinbase recent announcement in being listed in the S&P 500

What’s coming?

A flood of money into Bitcoin ETFs (like IBIT or GBTC).

More Coinbase stock (COIN) in boring portfolios, pushing the stock & crypto market cap even higher.

A boom in Bitcoin IRAs for everyday savers.

🔒 Crypto in Your Nest Egg

Retirement isn’t just bonds and blue-chip stocks anymore. Here’s how to sprinkle some crypto magic:

Bitcoin IRA — Swap part of your IRA into a crypto-friendly account (try BitcoinIRA.com).

Bitcoin ETFs — Safe, regulated, and easy to hold in your brokerage.

Small Bets, Big Wins — Add 3–5% crypto to your portfolio to outrun inflation without capsizing your ship.

PS: Poppy reiterates the not financial advice disclaimer.

🤮 Feeling Seasick Missing the Crypto Wave?

If you’re like most… FOMO (fear of missing out) leads to very bad money and investing decisions— especially in crypto!

🏴☠️ Like Aaron Rodgers said… R-E-L-A-X (Here’s your cure…)

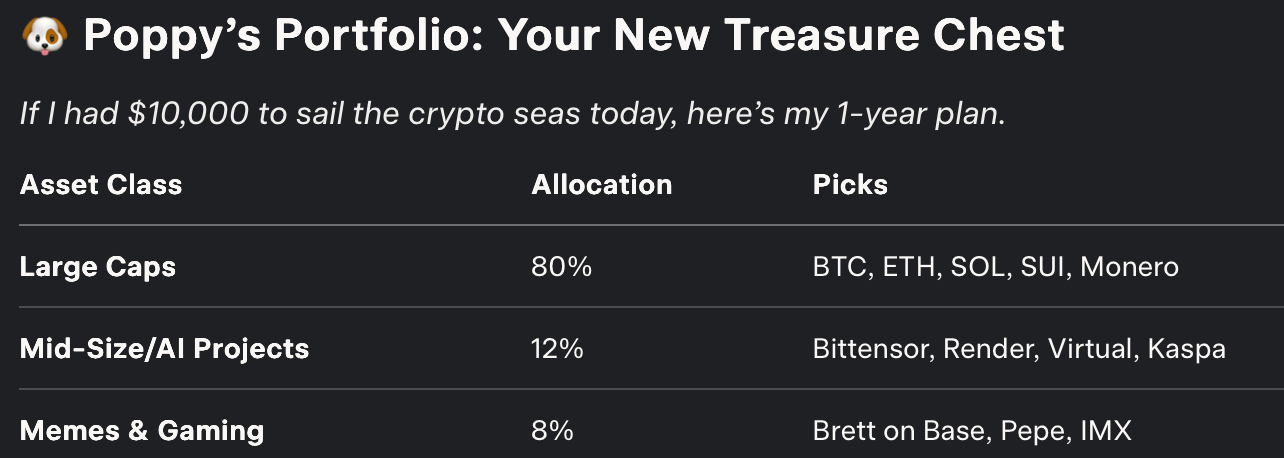

🧪 Why this mix?

Large Caps (80%) – The battleships of crypto. Bitcoin’s the king, Ethereum’s the queen, Solana’s the speedster, SUI’s the innovator, and Monero’s the stealthy pirate guarding privacy. These hold ~90% of the market’s gold and are your safest bet.

Mid-Size/AI (12%) – The merchant ships of tomorrow. Bittensor and Render power AI’s rise, Virtual builds digital worlds, and Kaspa’s blockchain is lightning-fast. These are your growth bets.

Memes & Gaming (8%) – The cannonballs of fun. Brett and Pepe are viral lottery tickets, while IMX fuels gaming’s blockchain future. Small bets, explosive potential.

📊 Top 10 Coins = Nearly 90% of Total Crypto Market Cap

Let’s simplify this even further.

✅ Even if you ONLY held those 10 assets—you would’ve outperformed traditional portfolios 5x over in the last 5 years.

✅ Simplicity wins. Time in the market beats timing the market.

✅ Simplicity scales.

🌐 Internet Capital Markets: The New Narrative

What’s an ICM? Imagine a global stock market that never sleeps, doesn’t need bankers, and lives on the blockchain. That’s Internet Capital Markets (ICMs)—the future of money.

Think: Wall Street turned into code.

No middlemen. Instant settlement. 24/7/365 liquidity.

Why it’s a big deal:

Solana and Ethereum are the highways of this new world.

Platforms like Jupiter (JUP) and Raydium (RAY) are the market stalls.

Everything—stocks, loans, derivatives—runs on code, not corporate suits.

Pros:

✅ Lower fees

✅ Transparency

✅ Global access

Cons:

⚠️ UI/UX still early

⚠️ High learning curve

⚠️ Subject to evolving regulation

Isn’t this what Blockchain is all about?!

🧨 Altcoin Season: Lost at Sea?

Here’s a splash of cold water:

The altcoin party might not happen like the old days.

Why? Too many hungry coins, not enough bread (yet) to go around.

2017 had ~1,300 coins. 2025? 2.6 million tokens and growing.

Money’s spread thinner than butter on toast.

Unless Bitcoin’s dominance (now 62.5%) dips below 50% and ETH/SOL take the helm, altcoins might stay adrift.

Track BTC Dominance:

🔗 https://www.tradingview.com/symbols/BTC.D/

🗺️ Your Weekly Treasure Map

✅ Chart BTC/Gold on TradingView to navigate the seas ahead.

✅ Build Poppy’s Portfolio with 80% large caps, 12% AI, 8% memes/gaming.

✅ Explore Bitcoin IRAs for your retirement (& COIN)

✅ Watch M2 growth for the next crypto wave.

✅ Monitor BTC Dominance for altcoin signals.

📖 Bible Verse

"Trust in the Lord with all your heart and lean not on your own understanding; in all your ways submit to him, and he will make your paths straight." Proverbs 3:5—6

Reflection: Like sailors navigating stormy crypto seas with the BTC/Gold ratio as their compass, this verse reminds us to trust God’s guidance over fleeting market signals. Submitting to His wisdom ensures our financial journey finds a steady course, even amidst turbulent waves.

Stay steady.

Stay ready.

The next 12 months could chart your financial future.