The old saying is true… it takes money to make money.

It just doesn’t have to be yours.

You need more money.

To eliminate bad debt, start or grow a business venture, purchase your 1st or next investment property, invest into the market or whatever you desire.

What would you do with $50,000 to $200,000 (or more)?

Over the years, I’ve helped thousands of people secure millions of dollars at 0% APR to accomplish their personal, professional & financial goals. More importantly, saving them 1-3+ years of their life not having to exchange their time in their job to get the cash, considering the average annual income is ~$60K per year.

Keep reading… because most of these clients paid ~$10,000 or more for the information I am sharing with you below, in effort to secure creative funding.

~$50K-$200K (or more) is pointless if you do not have intentional purpose in utilizing the funds. Sure, it is best to stay ready than to get ready, especially if there is a major market collapse or even life/business emergency.

Why use your money, when you can utilize the system’s money?

Since 2020, the USD has lost over 25% of its purchasing power & projected to be on-track for losing nearly 10% of its value year-after-year.

They say cash is king. Maybe in the short term.

But, in the long term, it seems to me that cash is trash. Not investing money (even if it is not yours), is the fastest path to inflation stealing your money.

Interest Rates & Asset prices have sky rocketed over the years.

Whether it be real estate, stocks, crypto, or really any other asset class for that matter. So, not only is your money losing its value, but everything you are purchasing is significantly appreciating in value and price.

This has created a huge problem.

It has become more & more difficult for people to not spend their entire day to just pay bills, but to actually get ahead in life, increase their net worth & overall standard of living.

Learning and implementing the tips below could potentially be the end of this recipe of financial disaster for you.

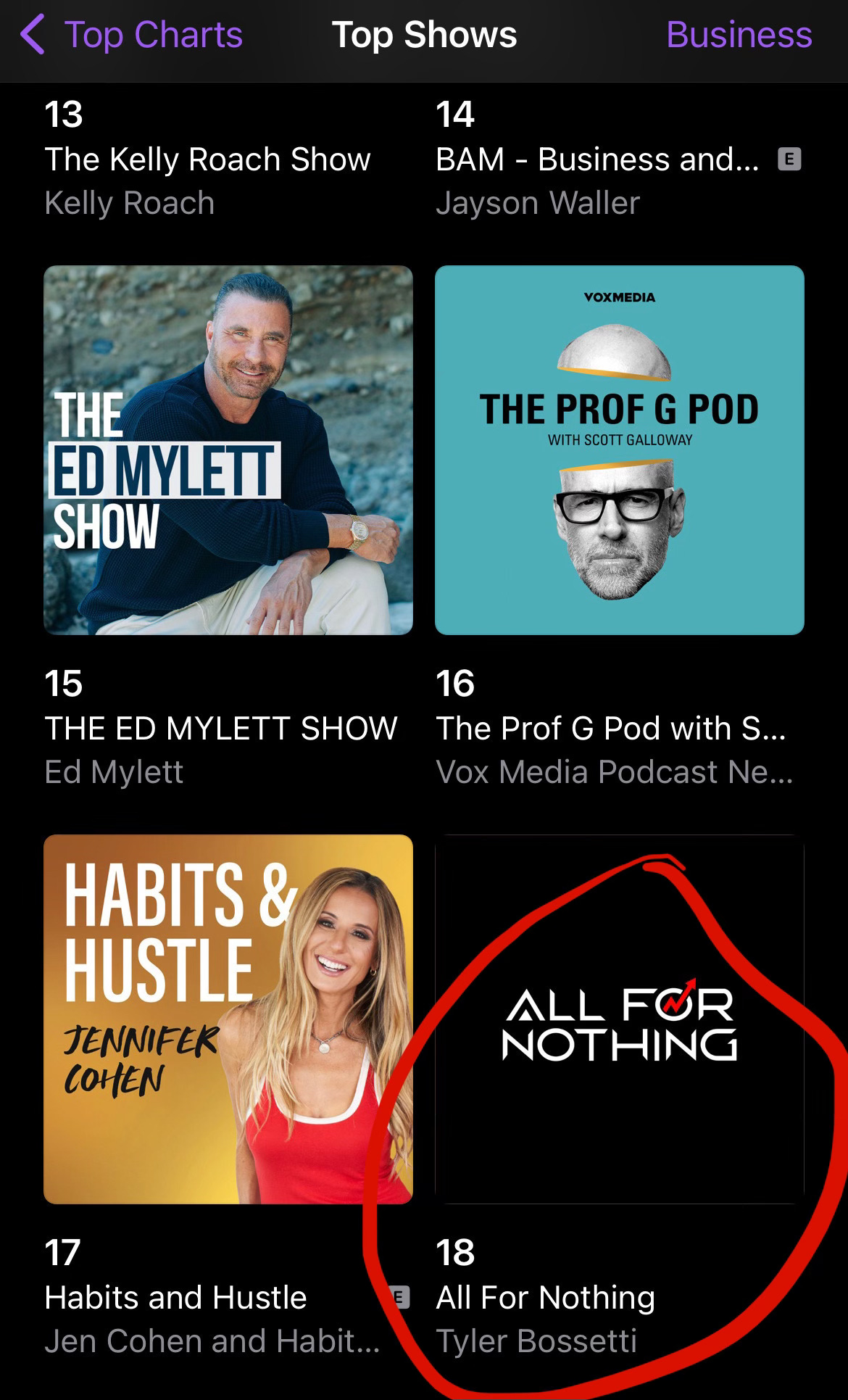

My lifelong mission has been to help people enhance their personal, professional, and financial well-being. This is why I created and host a top performing podcast show, All For Nothing.

Statistics & data suggest if you are not increasing your income over 10% each year, you will not make it out alive.

Overwhelmed by debt — stranded in deep waters, weighed down by anchors of stress & liabilities. A life of which most are in a fear state of being to survive, not thrive.

Enough of the fluff, let’s dive into the action steps to securing creative funding.

***Creative Funding — Action Steps

Funding for your business or investment ventures:

1. File an entity, such as an LLC, in the state where your business operates.

2. Wait for your business name to be approved and receive your business documents (e.g., articles of organization) from the Secretary of State where you filed.

3. Visit the IRS EIN website to secure your Employee Identification Number, which acts as your business's social security number.

4. Open a business bank account, preferably with larger banks like Chase, Bank of America, or US Bank. Then, secure relationships overtime with regional and local banks.

5. Deposit funds into these accounts if possible, and allow the accounts to 'season' for at least one bank statement period (30 days).

6. Begin submitting your funding applications after the bank accounts have seasoned, you meet the credit requirements & read the important notes listed below.

Now, the priceless & FREE information you have been waiting for…

***Personal Credit Requirements

1. Purchase a real 3 Bureau FICO 8 credit report.

→ A vantage score from credit karma or another resource is not your real FICO scores taken into consideration from creditors, banks or lenders. Personally, I prefer using the “advanced” package from www.myfico.com for consistently monitoring my personal credit scores & confidential information.

2. Credit scores to be 680 or higher for each major bureau: Experian, TransUnion & Equifax.

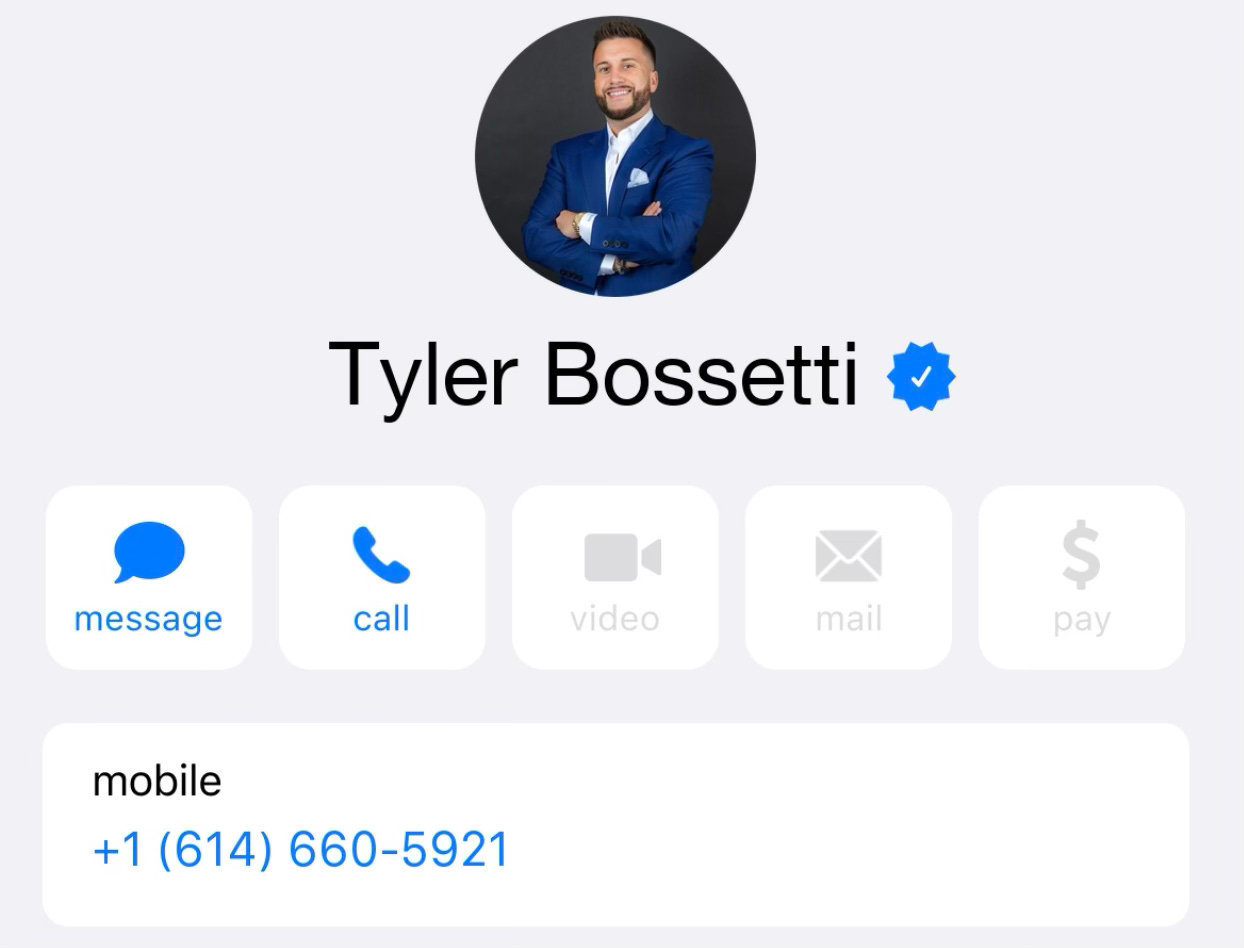

3. Less than 3 hard inquiries on each major bureau. If you have many credit pulls recently for a mortgage or auto loan, oftentimes you can contact that creditor or the major bureau to get some or all of them removed. Text me if you need help with this process.

4. No derogatory items: collections, judgements, late payments, charge offs, etc.

→ if you need resources for fixing your credit, text me and I will share them with you.

5. Confirm you have at least 3 personal credit cards, ideally with limits above $5K each before applying for business 0% credit cards.

→ If you do not, I would encourage applying for at least 1 or 2 personal 0% APR credit cards, waiting a month or two, then applying for the business accounts.

6. Credit utilization for EACH personal revolving credit card account reporting below 30% utilization.

→ People get confused here because the credit reports usually reflect the total utilize for all accounts taken into consideration, but the balance to limit ratios (credit utilization), must be below 30% for each personal revolving credit card account. The utilization is reported on the statement date, NOT the due date, so you may need to pay down or wait until that date for it to reflect accordingly on your report.

Not sure what 0% APR products to apply for?

Text Me for additional resources & information.

***Important Notes:

→ Although this is obvious, everyone’s situation is different. Use this information at your own risk & consult with your own counsel. Although you may meet all of the above requirements, it does not guarantee you will be approved. The provided ‘credit requirement factors’ is information I have compiled over the years in assisting thousands of people secure millions of dollars of capital.

→ Avoid this type of funding for “risky” type of businesses. Usually, it is best to have your entity/LLC set up as a “consulting” or “e-commerce” type business rather than risky businesses, such as: restaurants. Having the proper NAICS code filing increases the likelihood of being approved.

→ Projected Income: Creditors/Banks will consider approving credit limits upwards of 10-25% of the stated projected business revenue and/or projected personal income on the application.

- Projected Business Revenue: Less than $500,000.00

- Projected Personal Income: Less than $250,000.00

If you put $500K projected revenue or $250K projected income, you will likely be required to verify via financials (tax returns, bank statements, etc). Unless you can proof it, it’s best, in my personal opinion, to state a slightly lower amount than those two figures. To be clear, I am not telling you to lie or disclose inaccurate false information on your applications. You will clearly most, if not all applications, require you to state the projected amount. Regardless if your business is brand new or if you are potentially not going to gross that amount of revenue/income. It is strictly projected estimates.

→ If you do not apply directly for the applications in person, then be sure to apply from your home or business address stated on the application. Or, if you are traveling, then consider setting up a VPN location for the address stated on your applications.

→ If your application is immediately denied or in pending status, you must pick up the phone and call the phone number they provide in effort to get your application approved. Oftentimes, people can be automatically denied or placed into a pending status of approval because of several reasons. Majority of the time, the creditor/bank wants to verify you are in fact the individual applying and it is not fraudulent. Therefore, calling to confirm your identity and explain

→ You will be personally guaranteeing this type of 0% APR funding debt, until you have established a real business credit score.

→ This is for United States citizens. I am aware of a legal process of securing credit/capital if you are not a US citizen.

*Welcome to text me for questions, suggestions or feedback :)

Now what?

To reiterate, if you do not have intentions of utilizing money to create more money, then it essentially doesn’t serve much of a purpose.

Oftentimes, my clients utilize the funds to save money or make more money.

→ Pay off bad debt or balance transfers

→ Deployed into their current or new business ventures

→ Invest in 100% financed real estate deals, stocks, cryptocurrency or have additional capital set aside for upcoming opportunities or emergencies.

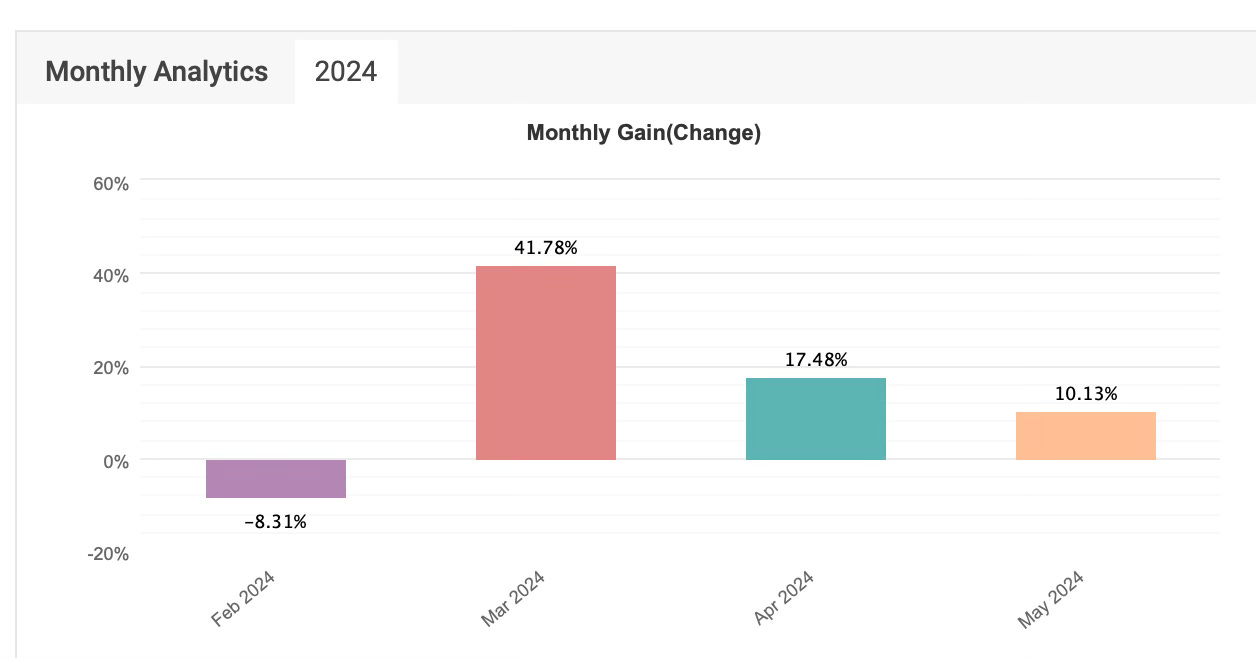

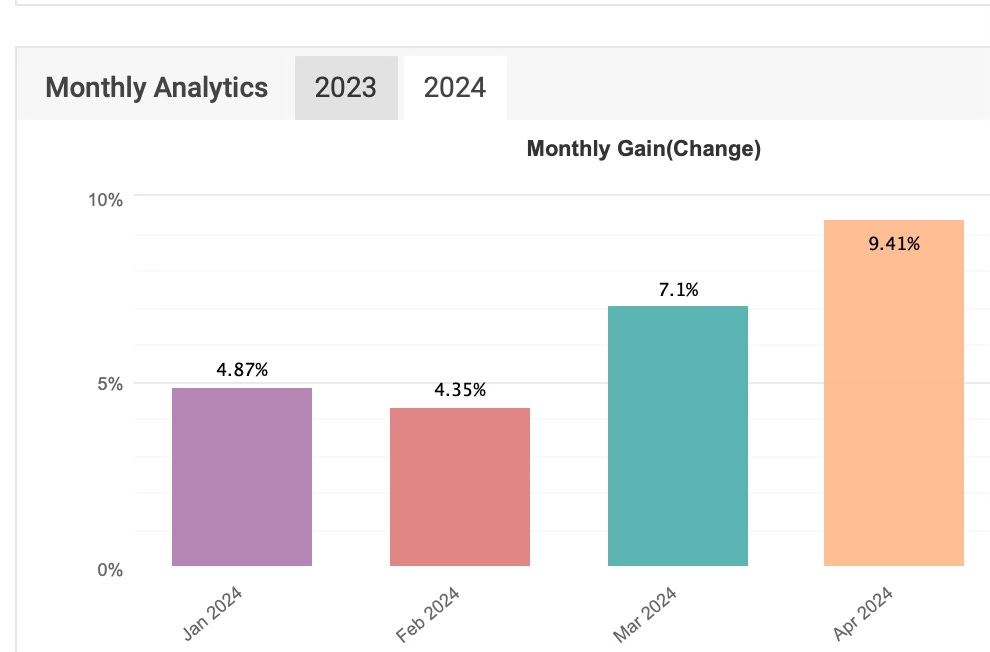

In the past year, arguably the most effective & profitable has been my company’s algorithm trading bots.

Although past performance does not indicate or guarantee future returns —

This year, my two algorithm trading bots are producing 10% returns per month!

Yes… per month.

Don’t believe me?

In short, if you secured $100,000 at 0% APR for 12 months.

Hypothetically, you could be passively earning ~$10,000 or more, per month!

Oh yeah — without using your own money.

Wise leverage.

This is the secret of the rich & wealthy.

Expert investors & savvy business owners would be thrilled if they earned 10% more per year, let alone per month. Not too mention the ability of having full control of their funds in their Broker account versus sending funds to an advisor, investment firm or other scenario in which they do not have access to day-to-day decision making. These same experienced individuals would likely have to exchange a majority of their time, anchored down at a specific office location to consistently produce these type of returns.

Whereas the two (2) algorithm trading bots - The Legacy & The Fortuna, are designed to be more of a hands off, passive approach for my community.

The intention of the Algo Bots are to help everyday people not only stay afloat in their life, but to get ahead. That said, I do not believe or ‘promote’ anything to be truly passive. If you have an investment (time, money or both), you MUST pay attention to it.

All investments require risk and nothing is guaranteed. What is also guaranteed, is if you do nothing, your money will be losing its value year after year. This is not a debate.

Will you work hard day in and day out, All For Nothing?

Or, will you equip yourself with the right information and take action on empower yourself?

Remember, it takes money to make money — it just doesn’t have to be yours!

Want to connect?

Text Me: +1 (614)-660-5921