All For Nothing

It is better to disappoint in the truth, than to deceive in the lies.

🪄 The Narrative

The truth sounds crazy in a world built on lies.

While most people argue over politics, headlines, & narratives handed down from puppet masters to teleprompters… the game plan behind the curtain never changes.

Red hat or blue wave? Doesn’t seem to matter.

Right wing. Left wing → same bird. And it seems it’s being eaten alive from the inside… financially, spiritually, & structurally.

Meanwhile, most wake up anxious, in a never ending state of worry.

Maybe due to drowning in debt.

Maybe have a job (or business), that lost its inspiring spark.

Maybe doing well financially, but still clinging to routines + habits + people that no longer serve you.

Maybe you’ve done everything “right”… got the degree, got the job, started the business, made some decent investments, & followed all the rules… yet still feel like you’re running on a treadmill, & no matter how hard you run, you’re still in the same place.

That’s not a glitch.

It’s by design.

Because whether you wear a tinfoil hat or just occasionally ask hard questions, one thing becomes clear:

The three-letter agencies, central banks, billionaire class, and media machines have made truth nearly unrecognizable.

Or maybe even worse… the deceiving lies leads to the truth being so blatant, it becomes paralyzing. You start to see it through the mirage of deception… & the moment you try to challenge it, you’re hit with another spin, another distraction, another manipulated narrative.

Leading us to ask:

What can I even do about it?

(Poppy says he can attest firsthand.)

It no longer feels like we live in a world of facts.

We live in a marketplace of narratives. & the highest bidder gets to write reality…

Or at least, the perception of it.

Meanwhile, most Americans & people around the world, may feel stuck in controlled chaos, chasing stability inside a system designed to distract + extract, not empower.

Financial anxiety isn’t rare anymore.

It’s a chronic disease.

And the worst part?

It’s been marketed as normal.

🤥 They May Lie… But Stats Don’t

💰 Average Individual Income:

~$67,000/year → ~$5,583/month (pre-tax)

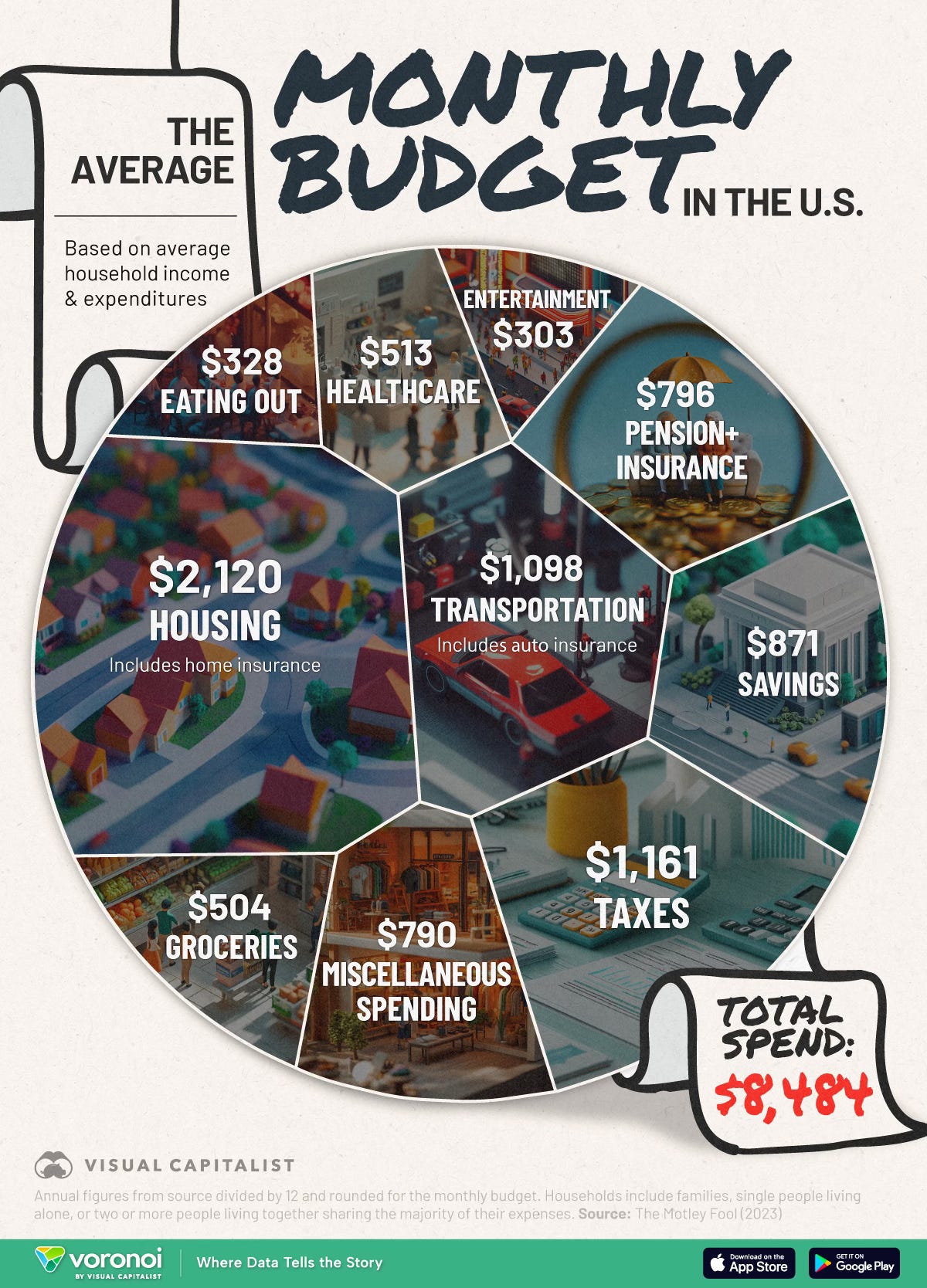

📝 Average Monthly Expenses:

• Housing (Rent/Mortgage): $2,000

• Car Payment: $700

• Auto Insurance: $170

• Student Loans: $500

• Credit Cards (interest only): $300

• Groceries: $500

• Utilities + Subscriptions: $400+

➡️ Total: $4,600+ per month. And that’s before life actually happens.

No emergencies. No dinners out. No concerts, sports games, or family trips.

Just survival.

And while you're barely keeping up… the U.S. dollar is quietly being debased & devalued → down over 10% YTD & with no slowdown in sight.

Simultaneously…

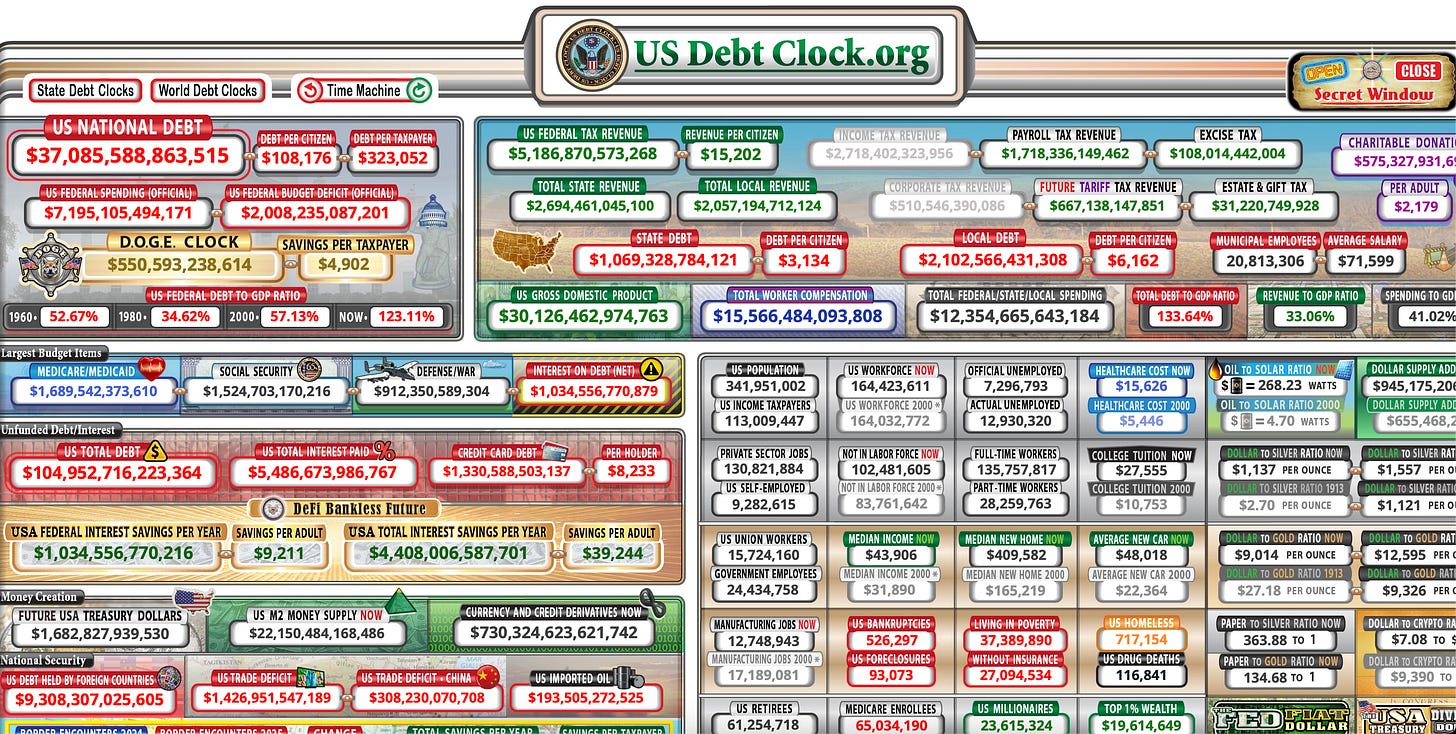

• U.S. national debt has crossed $37 trillion

• Annual deficits have more than doubled in just 5 years

• Interest rates are too high to service the debt, let alone reduce it

• More money printing is inevitable — & you pay for it

… through inflation, inflated asset prices, & dollars that keep buying less.

🤔 What does all that mean in plain English?

It’s like when you ran out of dish soap growing up, so you added water to the bottle to make it last longer. Sure, it looked full, but it didn’t clean worth a damn.

That’s exactly what money printing does.

You might see more dollars in your account, but each one is weaker.

So everything… from Biden’s eggs to Luigi’s insurance… costs more.

Not because it’s more valuable, but because the currency is diluted.

Maybe that’s just a small-town Ohio analogy… but even Poppy knows a watered-down dollar when he sees one. 💸

Printing gives the illusion of abundance, but the cost always circles back to the middle class.

Same playbook. Every time:

• Campaign to cut spending? Never happens

• Run bigger deficits? Every year

• Pass the cost? Straight to you

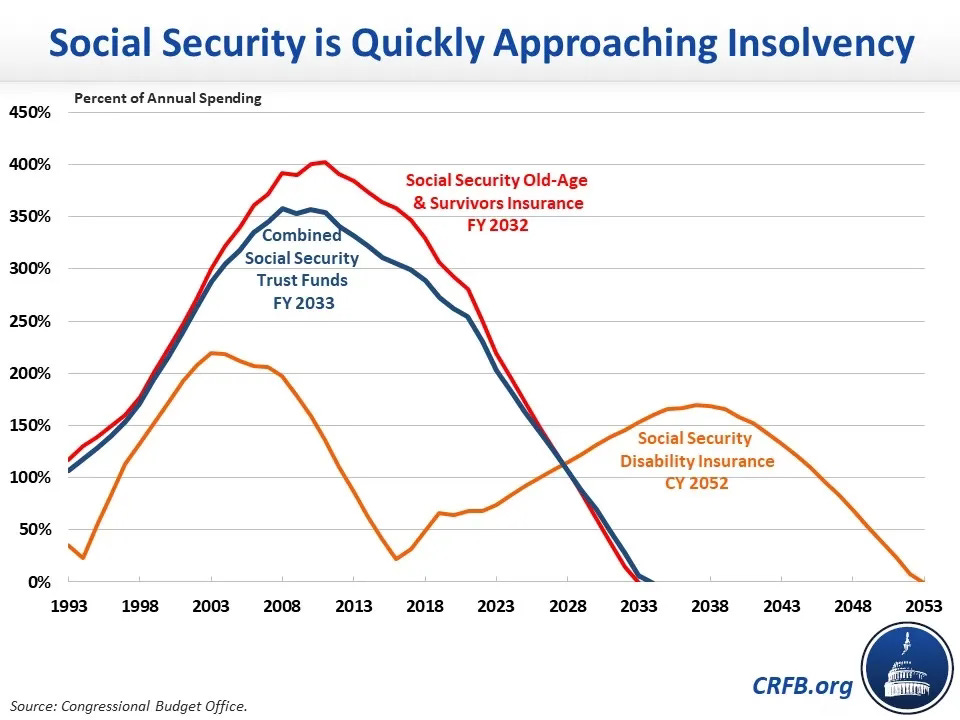

& the “safety nets”? They’re fraying fast:

• Social Security projected to run dry by 2033

• Medicare by 2031

So after 40 years of labor, taxes, & delayed gratification… maybe you retire.

Stuck in a house paid for in devalued dollars.

That’s not the American Dream. That’s a financial trap.

For too many today… it really does feel like working All For Nothing.

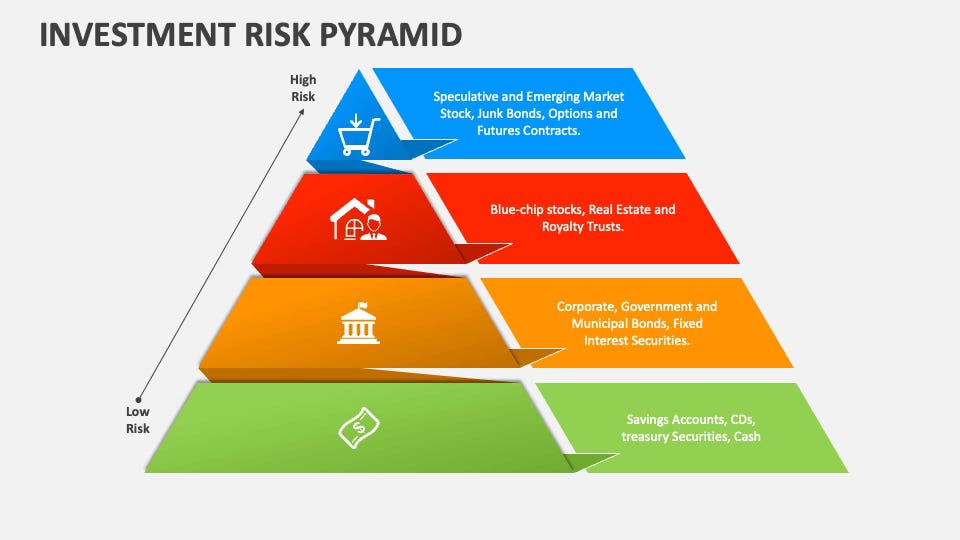

📈 Risk-On Assets

History’s rhyming again.

The currency debases → liquidity floods in → risk assets soar.

Sure, tariffs may stir the pot. A 10% correction wouldn’t surprise Poppy.

But structurally? We’re living in a risk-on regime.

📊 A Hidden Signal for Risk-On Assets

The ISM Manufacturing Index measures how U.S. factories are doing → tracking new orders, production, hiring, & inventories. It’s like checking the pulse of the economy’s “build & buy” engine.

✅ When the ISM is above 50 → manufacturing is growing

❌ When it’s below 50 → contraction, slowdown, or recession

So why does it matter for investors?

🔁 Historically, when ISM bottoms out & begins to rise, risk-on assets like stocks, crypto, & small caps rally hard.

It’s a leading indicator. It often turns up before the markets explode upward because Wall Street knows what Main Street is just starting to feel.

🧠 Poppy Insight:

Almost every major bull market of the last 50 years began when the ISM bounced off a low point — often while fear & doubt were still dominant headlines.

The best rallies don’t start when things are perfect.

They start when things are quietly turning the corner.

Think of the ISM like a factory's thermostat.

When it hits a cold low (below 50) & starts rising, it means someone just turned up the economic heat.

That warmth? And risk-on assets? They start cooking, as the cool kids would say.

🔺 Poppy’s Picks: Risk-On Assets 1️⃣ Bitcoin 🟠

The anchor of digital assets, store-of-value narrative

Increasing institutional adoption (ETFs, family offices, pension funds)

Backed by governments, insurance giants & Fortune 500 treasuries

The ultra-wealthy are deploying… because the risk/reward is beyond worth it

2️⃣ Altcoins & Memecoins 🧨

Where chaos meets asymmetric upside

→ ETH, SOL, The Boy’s Club Memes (pure degen gambling), & projects reshaping finance through DeFi, AI, RWA, & Gaming

Historically outperform BTC during bull cycles

But lately? BTC dominance has been… well, dominant

Poppy still sees an alt szn coming, but warns:

→ Over-diversifying = watering down your potential (like putting water in the soap bottle — looks full, but doesn’t clean a damn thing)

🔍 Focus on emerging narratives:

DeFi = disrupting traditional finance

RWA = tokenizing the real world

AI & Gaming = sticky user adoption & future infrastructure

💥 Memes = pure speculation × 1000

→ Only the top memes on each chain is Poppy’s prediction of ones which will be worth considering…

3️⃣ Small-Cap Growth Stocks (Russell 2000 Index) 📈

Undervalued U.S. companies with high growth potential

Higher beta to economic trends = amplified returns in recovery

Historically lead early bull market cycles for risk on asset environments

Less institutional exposure = more alpha when the tide turns

4️⃣ Innovative Stocks 🧠

The kings of scalable disruption of control → from semiconductors, chips & AI to blockchain & digital finance

→ Includes mega-cap dominance like Nvidia, Apple, Tesla, plus the “end of the world tech squad” — Palantir, Snowflake, Datadog

→ Now add in the next wave: crypto-native tech stocks like Robinhood, Coinbase, & other digital infrastructure players riding the Web3 boom

→ These thrive in low-rate, high-liquidity environments where capital chases exponential growth stories

📊 For broader exposure, ETFs like ETH ETFs, ARKK, GBTC offer:

Packaged upside in innovation & digital infrastructure

Lower volatility than individual names or pure crypto plays

Easy on-ramps for boomers, institutions, & retirement accounts

Whether you're trading tickers or stacking ETFs, this category gives you a front-row seat to the next financial & technological revolution.

5️⃣ Algorithmic Trading Bots 🤖

Everyone wants passive income → this is as close as it gets

Strong YTD returns, momentum building into Q3

Fully automated, hands-off systems tied to real strategy

On pace for record 2025, with bigger ROI potential in 2026

(User screenshots below — past performance ≠ future results. No investment is guaranteed 😉)

🗺️ The Way Out

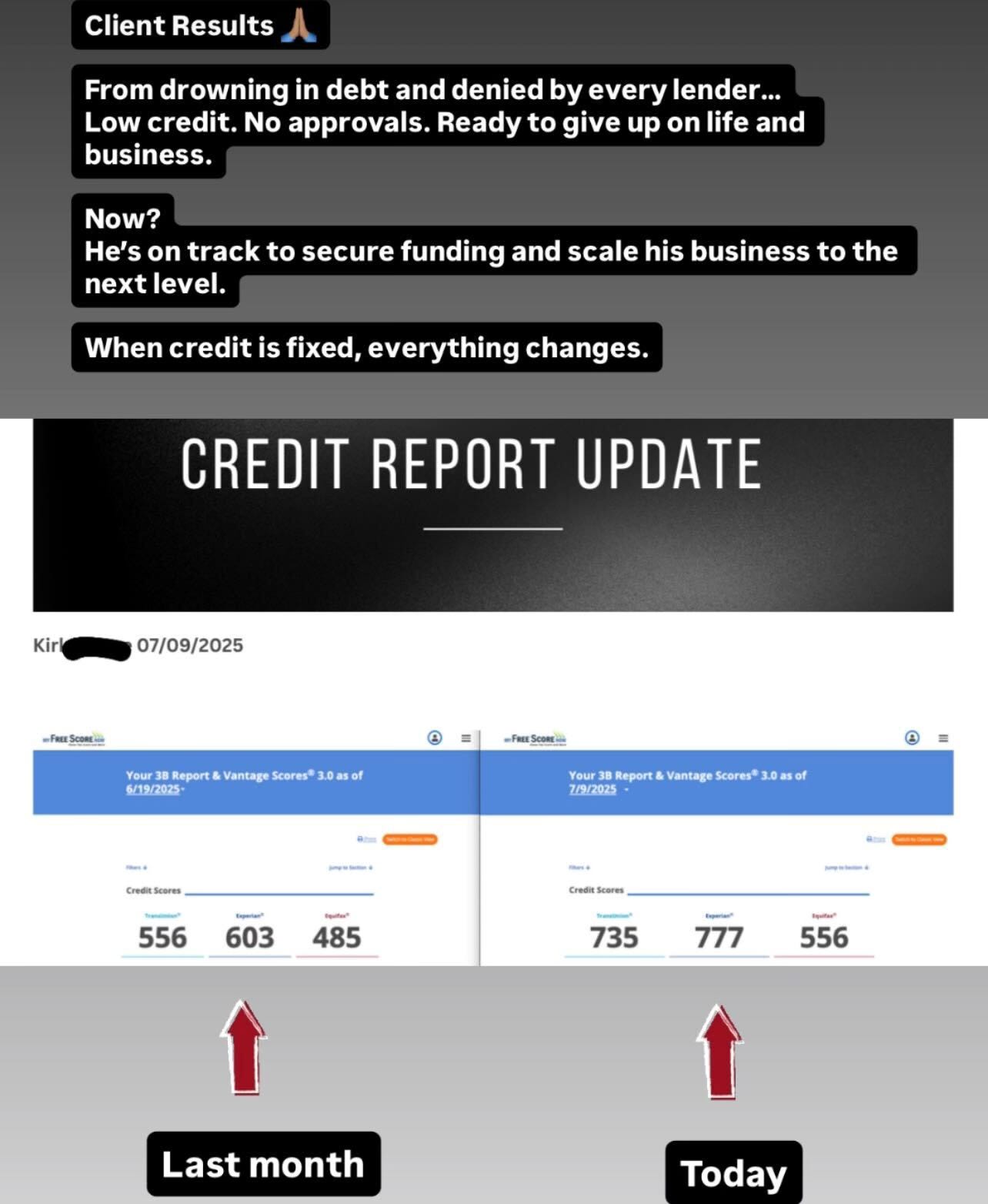

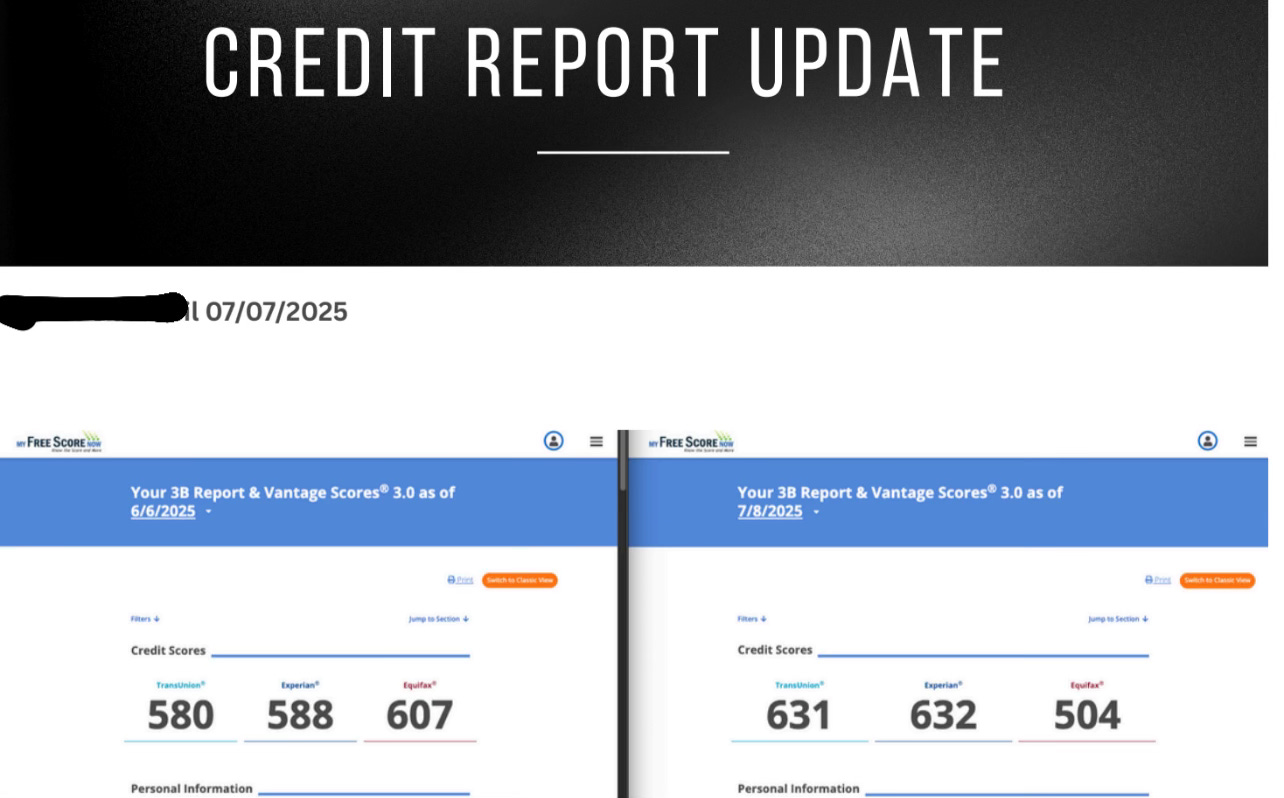

Fix your foundation → Credit.

Exchange Credit → Capital

Stack ‘risk-on’ digital assets → Bitcoin + Tech Stocks + Generate Automated Income

Fix bad credit + eliminate toxic, high-interest debt

Secure capital

Deploy it into income-producing opportunities

The winning formula hasn’t changed:

Turn credit into capital.

Turn capital into cash-flow.

Automate + duplicate what you can.

Just don’t fall for the “100% passive” income myth.

👀 Because if you can check Instagram 74 times before noon… you can at the very least… glance at your investment accounts or tune into an algo trading bot at least once a day (even if you’re a newbie).

We’re not in a normal cycle — we’re in a capital migration.

Bitcoin and crypto are the fastest-adopted assets in human history, with active wallets projected to hit 1.1 billion by end of 2025.

Even ETFs, pension funds, & nations are rotating in.

Why?

Because liquidity drives everything, & global M2 leads crypto like clockwork.

90%+ of the NASDAQ is fueled by monetary debasement.

90%+ of price action is just following the flow of global capital.

🧮 Fed Net Liquidity vs U.S. Debt as % of GDP = flashing red

🪙 Gold = real-time stress signal from the global system

This isn’t just a cycle reset — it’s a full-blown capital reallocation.

You’re either positioned… or you’re exposed.

✅ Fix your credit

💰 Secure capital

🏗️ Own real assets

Otherwise?

You’ll grind away for decades…

All For Nothing.

📖 Bible Verse

“Even though I walk through the darkest valley, I will fear no evil, for you are with me; your rod and your staff, they comfort me.” — Psalm 23:4

Reflection: Financial stress can feel like walking through a shadowed valley…uncertain, heavy, & lonely. But God’s presence provides guidance & peace. His protection isn't just symbolic, it’s practical. Even in chaos, you are covered. Keep walking… one step, one day & one right decision at a time.